(pdf)

As the country closes in on half a year dealing with the novel coronavirus, Congress is preparing its Phase Four legislative relief proposal. This will likely include extensions to federally-boosted unemployment benefits, continued funding for the Paycheck Protection Program, and another round of economic impact payments. Yet if the Health, Economic Assistance, Liability Protection and Schools (HEALS) Act is any indication, it will unfortunately also include a great deal of spending above and beyond previous appropriations.

The National Taxpayers Union Foundation categorized programmatic spending in the HEALS Act that piles on top of previous expenditures or extends beyond pandemic response. To get a better picture of how this funding relates to normal appropriations and what has already been spent on COVID relief, we placed each appropriation under one of four headings:

New Spending: Appropriations for programs that did not receive any funding under normal FY 2020 appropriations or the Coronavirus Aid, Relief, and Economic Security (CARES) Act.

Normal Appropriations Plus-Ups: Additional appropriations for programs that received funding under the normal FY 2020 appropriations process, but not the CARES Act.

CARES Act Plus-Ups: Additional appropriations for programs that received funding under the CARES Act, but not the normal FY 2020 appropriations process.

Double-Dips: Additional appropriations for programs that received funding under the CARES Act as well as the normal FY 2020 appropriations process.

In total, more than $311 billion in the HEALS Act represents spending on ordinary appropriations items, which is more appropriately dealt with in the course of normal Congressional business, or expenditure increases on items that Congress has already addressed in previous legislation responding to the pandemic.

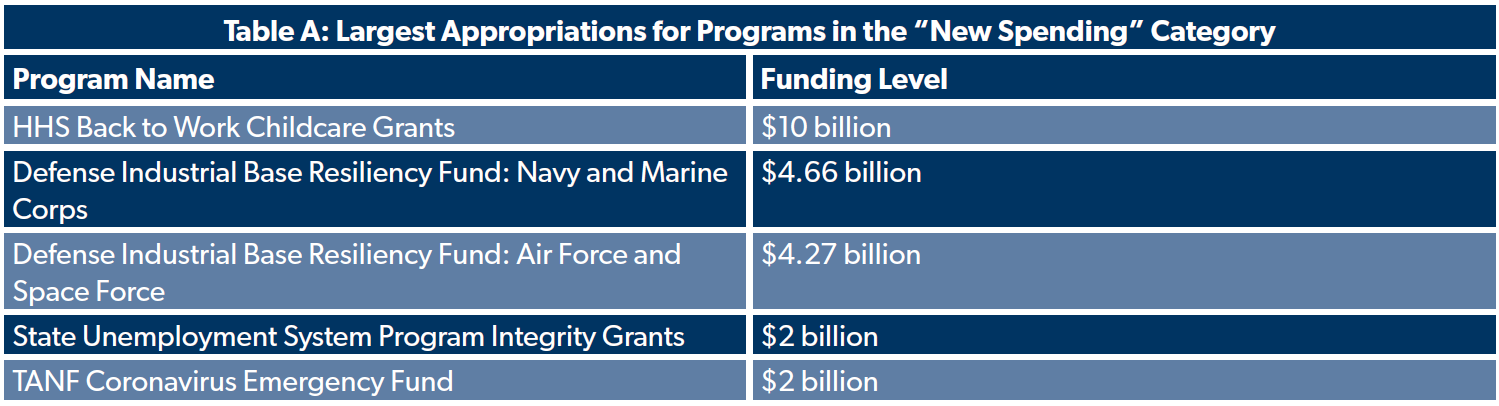

New Spending: $24.9 billion

Spending that has not appeared in either the CARES Act or FY 2020 appropriations makes up the smallest category, at just under $25 billion. The next most significant appropriation in this category is $10 billion for “Back to Work Childcare Grants” intended to reopen childcare centers to enable parents to return to work.

Also included in this category is a $2 billion appropriation for modernizing state unemployment systems. This upfront cost could save money over the long-run by bolstering program integrity efforts to reduce fraud. For example, a related proposal in President Trump's FY 2020 budget was estimated to save taxpayers $2.5 billion over a decade.

Additional provisions would add just under $11 billion in total for Defense Industrial Base Resiliency Funds for the Army, Navy, Air Force/Space Force, and Special Operations/Missile Defense, and a $2 billion appropriation for a Temporary Assistance for Needy Families Coronavirus Emergency Fund.

Though it is a tax break and not a spending item, this section also includes a proposal to allow full deductibility of business meals through 2020. While Congress is wise to consider additional tax relief, the effectiveness of this proposal is questionable at a time when declining restaurant sales is far more a matter of consumer fear of the coronavirus, not price.

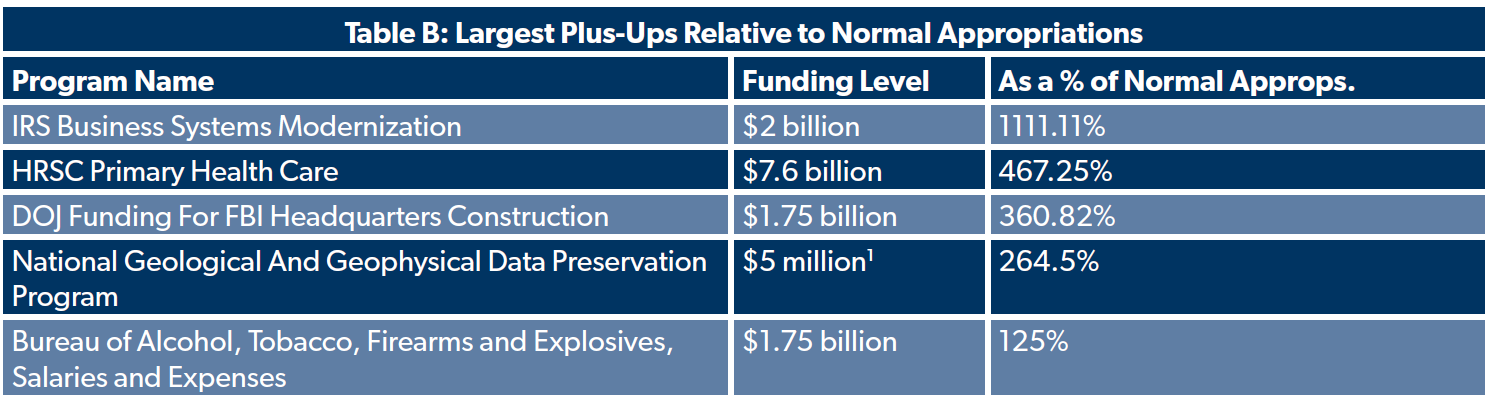

Normal Appropriations Plus-Ups: $29.7 billion

The second-smallest category of appropriations in the HEALS Act is funding increases to programs funded under normal FY 2020 appropriations. This amount is driven primarily by $7.6 billion in primary healthcare funding for the Health Resources and Services Administration (HRSA), as well as $3 billion for Department of State global health programs.

The $7.6 billion in funding for HRSA also represents the second most significant funding increase relative to CARES Act funding, at 467.3 percent of normal appropriations. The most significant funding increase is a 1,111 percent increase to funding for Internal Revenue Service modernization programs — funded at $2 billion in HEALS as opposed to $180 million in general funding.

Other significant boosts in funding include a 360.8 percent increase for a new FBI headquarters in Washington D.C. This project received $485 million in funding under previous appropriations, but would be increased to $1.75 billion under HEALS — funding that has next to no place in emergency relief legislation.

CARES Plus-Ups: $105.5 billion

In a category nearly of its own is the Educational Stabilization Fund. This program, intended to provide relief for state education spending, received $30.8 billion in funding under the CARES Act, but did not receive any funding under normal appropriations. Notably, this number is far lower than the well over $1 trillion in aid to state and local governments that House Democrats proposed back in May.

The only other appropriation in this category is far smaller — a $500 million appropriation for Fisheries Disaster Assistance. This line item received a $300 million appropriation under the CARES Act.

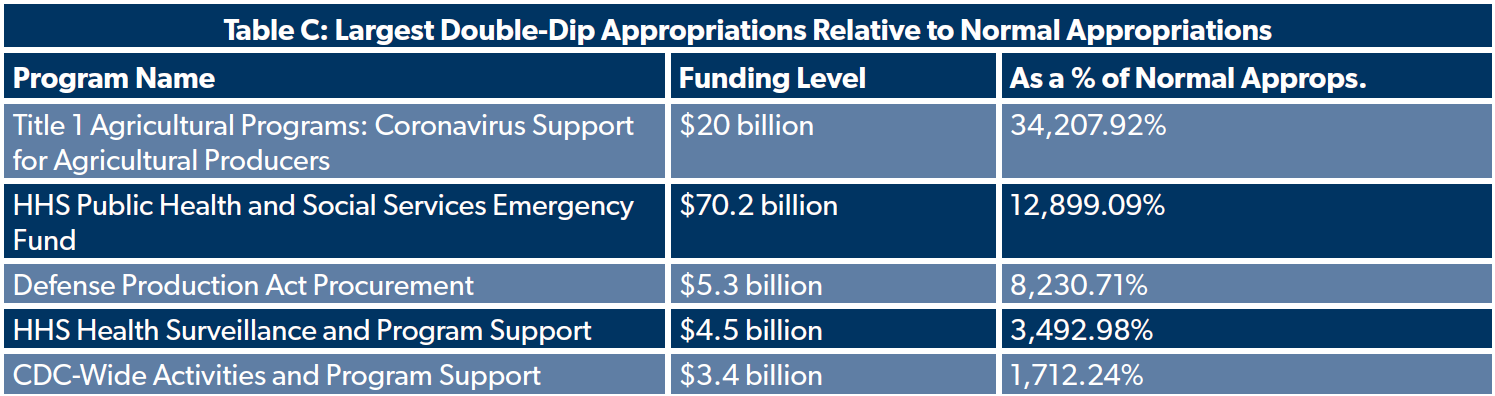

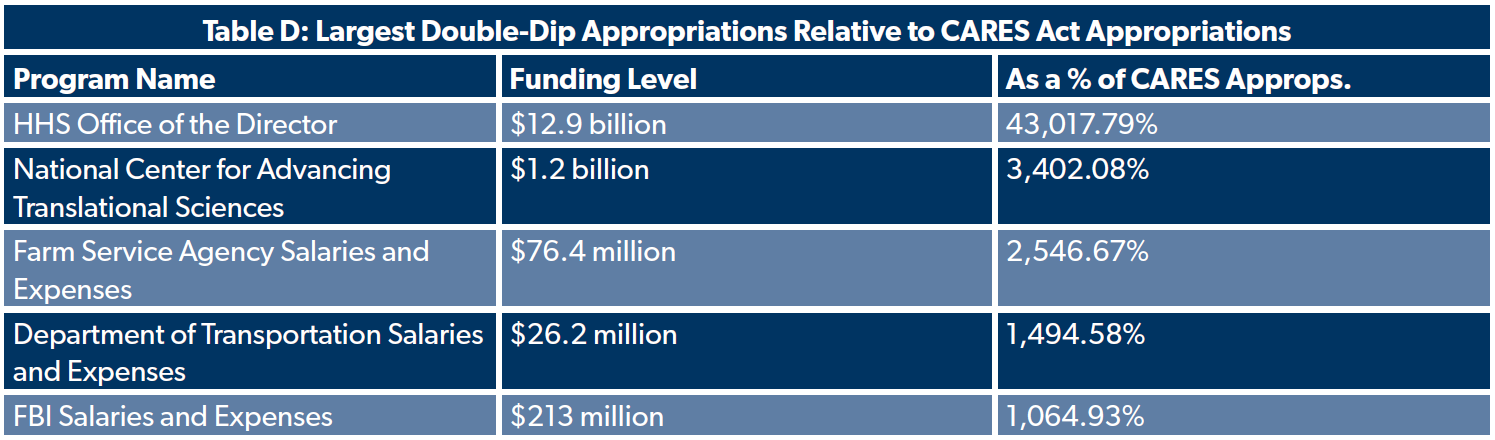

Double-Dips: $151.6 billion

The last and largest category of funding is appropriations that appear in some form in both normal FY 2020 appropriations and the CARES Act. In total, the category includes $151.6 billion in appropriations.

The largest hike relative to normal appropriations is the increase to support for agricultural producers. This line-item received just $58.5 million under FY 2020 appropriations, but would receive $20 billion under HEALS — an increase of over 32,000 percent. Agricultural producers did also receive $9.5 billion in the CARES Act.

Conservation programs would also receive a massive increase in supplemental funding, a $76.4 million appropriation relative to $3 million appropriated in the CARES Act. The Department of Health and Human Services’s Director’s Office would receive the largest boost, however — from $30 million in the CARES Act to $12.9 billion under HEALS.

Conclusion

The HEALS Act includes many positive provisions, from protection for remote workers to an initiative to maintain the solvency of U.S. trust funds. But the unfortunate Congressional instinct to continually create new spending and expand past appropriations reveals itself in this legislation nonetheless.

Even in cases where national crises justify increased spending levels, the importance of protecting taxpayers by ensuring responsible spending remains. As Phase Four legislation moves closer to the finish line, Congress should aim to weed out spending that serves little purpose related to the crisis at hand.