With just a week or two to spare before Treasury hits the debt ceiling "x date" when it will no longer be able to finance all federal obligations, President Biden and House Speaker Kevin McCarthy (R-CA) reached a deal, introduced as the Fiscal Responsibility Act (FRA).

Among its provisions, the FRA would suspend the debt ceiling through January 1, 2025, implement restraints on certain discretionary spending, rescind unspent funds enacted during the pandemic, and claw back some of the Inflation Reduction Act’s boost to the Internal Revenue Service.

The bill would also help spur lawmakers to pass the annual appropriations bills on time. For 2024 and 2025, discretionary spending would be limited to one percent below FY 2023 levels in the event that all twelve regular appropriations bills are not enacted before the start of the calendar year.

The Congressional Budget Office's (CBO) cost estimate finds that the FRA would save $1.528 trillion over the next ten years, including $1.332 trillion from the FY 2024 and 2025 statutory caps and their impact on future discretionary spending. CBO also notes:

If future appropriations were provided at the amounts of the caps as specified, budget … outlays would be $553 billion lower over the 2026–2033 period than the amounts CBO would project based on the caps specified in section 101(a) for 2024 and 2025.

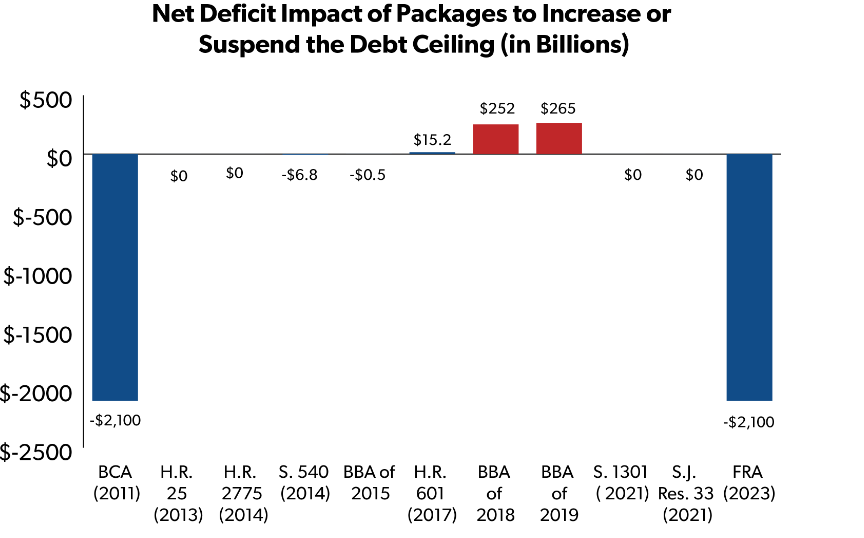

In the time since the BCA was enacted, the debt ceiling was increased or suspended nine times. Of those debt ceiling increase bills, four included no reforms, three actually increased spending, and just two were scored as savings upon passage.

Note: Based on CBO scores and the time of passage, and the new CBO score for the FRA including additional savings If future appropriations were provided at the amounts of the caps as specified.

Recent Debt Ceiling Increases

Below is an overview of the BCA and nine debt ceiling increases or suspensions since then. The CBO scores are those available at the time of passage. Some scores may have been revised by CBO in budget outlook updates following passage of each of these laws. For example, shortly after the passage of the Bipartisan Budget Act of 2019, discussed below, CBO’s budget update incorporated the law’s discretionary spending levels into the ten-year baseline and found that it would increase deficits by $1.5 trillion.

2011: The BCA increased the debt ceiling by $2.4 trillion, and was scored by CBO as leading to deficit reduction of "at least $2.1 trillion over the 2012-2021 period."

2013: On February 4, 2013, H.R. 325, the No Budget, No Pay Act of 2013, suspended the debt ceiling through May 18, 2013 along with a provision that would delay Members’ salaries if Congress had not agreed to a budget resolution.

2014: H.R. 2775, the Continuing Appropriations Act, 2014, ended a 16-day government shutdown and effectively suspended the debt limit through February 7, 2014 subject to a congressional resolution of disapproval, which was passed in the House but failed in the Senate.

2014: The Temporary Debt Limit Extension Act, S. 540, enacted on February 15, 2014, suspended the debt limit through March 15, 2015. The law also provided $2.4 billion for Medicare and extended BCA sequestration, scoring $8 billion in savings in 2024 for a net deficit reduction of $6.847 billion. It should be noted that originally, S. 540 also included a provision to repeal a scheduled reduction in cost-of-living adjustment (COLA) for military retirees costing $6.813 billion. Although that was left out of the debt ceiling extension, the COLA reduction was later repealed in S. 25, enacted on the same day. Combined, the two laws reduced spending by $34 million over ten years.

2015: The Bipartisan Budget Act (BBA) of 2015, signed into law on November 2, 2015, suspended the debt ceiling through March 15, 2017, increased FY 2016 and 2017 BCA spending caps by a total of $79.4 billion, and included other provisions totaling $79.9 billion in deficit reduction.

2017: On September 8, 2017, H.R. 601, the Continuing Appropriations Act, 2018 and Supplemental Appropriations for Disaster Relief Requirements Act, 2017 extended the debt ceiling through December 8, 2017, provided regular appropriations through that date, and also added $15.2 billion to the deficit for emergency supplemental appropriations.

2018: On February 9, 2018 the BBA of 2018 suspended the debt ceiling until March 1, 2019. It also increased FY 2018 and 2019 BCA spending caps by a total of $290.3 billion and included $38.3 billion in deficit reduction.

2019: On August 2, 2019, the BBA of 2019 suspended the debt limit through July 31, 2021, increased FY 2020 and 2021 BCA caps by total of $319.4 billion, and was scored by CBO as resulting in deficit reduction of $54.5 billion in fiscal years 2027-2029 for extending customs user fees and BCA sequestration.

2021: On October 14, 2021 the enactment of S. 1301 increased the debt ceiling by $480 billion.

2021: On December 16, 2021, S.J. Res 33 enacted a debt ceiling increase of $2.5 trillion with no reforms included.

The Fiscal Responsibility Act of 2023 Compared to Laws to Increase or Suspend the Debt Ceiling since 2011 | ||

Debt Ceiling Provision | Net Deficit Impact of Packages to Increase or Suspend the Debt Ceiling (in Billions) | |

BCA (2011) | $2.4 trillion increase | -$2,100 |

H.R. 325 (2013) | Suspended through May 18, 2013 | (none included) |

H.R. 2775 (2014) | Suspended through February 7, 2014 | (none included) |

S. 540 (2014) | Suspended through March 15, 2015 | -$6.8 |

BBA of 2015 | Suspended through March 15, 2017 | -$0.5 |

H.R. 601 (2017) | Suspended through December 8, 2017 | +$15.2 |

BBA of 2018 | Suspended through March 1, 2019 | +$252.1 |

BBA of 2019 | Suspended through July 31, 2021 | +$264.9 |

S. 1301 ( 2021) | $480 billion increase | (none included) |

S.J. Res. 33 (2021) | $2.5 trillion increase | (none included) |

FRA (2023) | Suspended until January 1, 2025 | -$2,100 |

Conclusion

Earlier in May, House Republicans enacted the Limit, Save, Grow Act which included over $4.1 trillion in deficit reduction reforms and a $1.5 trillion hike in the debt ceiling. President Biden and many congressional Democrats had wanted a “clean” debt ceiling increase, with no strings attached.

While not perfect, the FRA moves in the direction of resetting discretionary spending on a lower trajectory. Lawmakers should build on the bipartisan spirit of this proposal and continue to implement additional pro-growth economic policies and mandatory spending reforms so that the debt ceiling is no longer an issue.