(pdf)

Introduction

Inflation remains arguably the top economic policy concern for Congress and the Biden administration as the summer of 2022 wanes and the fall approaches.

As of this writing, the most common measure of inflation – the consumer price index for all urban consumers (CPI-U), as measured by the U.S. Bureau of Labor Statistics (BLS) – had increased 8.5 percent from August 2021 through July 2022, the highest year-over-year rate in more than 40 years. An alternative measure of inflation – personal consumption expenditures (PCE), measured by the U.S. Bureau of Economic Analysis (BEA) – had increased 6.8 percent from July 2021 through June 2022, also the largest year-over-year increase in 40-plus years.

Even so-called “core” measures of CPI-U and PCE, which exclude food and energy prices because those can be particularly volatile from month to month, identified inflation of 5.9 percent and 4.8 percent respectively, over the course of a year. These also were the highest year-of-year rates in nearly 40 years.

Forward-looking expectations of inflation – which can play an important (if indirect) role in how inflation actually accelerates or decelerates over time – are slowing relative to earlier in the summer of 2022, but more than a year of significant price increases have taken their toll on American consumers, businesses, and taxpayers.

Pundits and politicians have blamed this inflation surge on a variety of individuals and factors. Alleged sources of runaway inflation range from President Joe Biden to Russian President Vladimir Putin to corporate greed to the Federal Reserve – whose dual mandate is “maximum employment” and “stable prices.”

As with many things in Washington, D.C., the truth is both simpler and more complicated.

Rising prices are affected by a confluence of factors, including but not limited to the consumption, labor, and supply chain effects of the COVID-19 pandemic; the food and energy effects of Russia’s invasion of Ukraine; lax monetary policy by the Federal Reserve; and excessive U.S. government spending in response to the economic effects of the pandemic. All these factors and more have contributed to too much money chasing too few goods and services.

The negative effects of inflation have been less hotly debated. Households’ purchasing power has eroded, with low-income families hurt by inflation the most. Businesses large and small have faced higher costs in labor, production, distribution, and more. Inflation also generally has led to less productive and efficient economic activity (an effect noted by the non-partisan Congressional Research Service), and, of special interest to NTU Foundation, higher costs for taxpayers in servicing the nation’s large debt load.

Given these pernicious effects, lawmakers in Congress and officials in the Biden administration are naturally proposing many different fixes to the nation’s current inflation woes.

President Biden pointed out in a May 2022 op-ed for The Wall Street Journal that “the Federal Reserve has a primary responsibility to control inflation.” While true, this cannot possibly absolve President Biden or Members of Congress for the role that their expansionary fiscal policy likely played in fueling inflation, nor does it mean policymakers in the executive and legislative branches are powerless to address rising prices.

Despite its politically enticing title, the “Inflation Reduction Act” – significant tax and spending legislation just passed by a Democratic Congress and signed by President Biden – will likely have no meaningful effects on near-term inflation, according to the Congressional Budget Office, the Penn Wharton Budget Model, and NTU Foundation. Other various proposals to increase taxpayer-funded subsidies, impose “profits” taxes on businesses, or more than double the federal minimum wage also won’t reduce inflation.

NTU Foundation presents an agenda that could make modest and near-term contributions to reducing inflation, even though monetary policy at the Federal Reserve will still have the largest role to play. Our agenda includes:

Making it easier and less expensive for energy producers in America to quickly increase domestic energy production and supply, including the permitting reform proposal expected to be considered by Congress this fall;

Establishing incentives for consumers to save now for the long term, such as in tax-advantaged retirement accounts, rather than spend in the short term;

Providing an inflationary update to a number of provisions in the tax code, as a means of mitigating the effects of inflation for middle-class households;

Resuming the payment of federal student loans sooner than January 2023, which may have small direct effects on reducing inflation but larger indirect effects in terms of signaling a slowdown in consumer spending;

Repealing or suspending protectionist policies that restrict supply chains and increase costs for consumers and taxpayers, including the Jones Act and “Buy American” restrictions;

Repealing or suspending tariffs, especially the large-scale tariffs placed on goods from China by the Trump administration and maintained by the Biden administration;

Rescinding tens of billions of dollars in unobligated funds from the COVID-19 relief bills of 2020 and 2021; and

Reaching a significant, short-term deficit reduction agreement that actually decreases deficits by tens of billions of dollars in the next one or two fiscal years, rather than playing the classic Washington game of promising deficit reduction years from now.

Such an agenda, in the aggregate, could have meaningful direct and indirect effects on addressing inflation, including a) reducing aggregate demand for goods, b) increasing aggregate supply of goods facing the highest price inflation, especially energy, and c) sending indirect but palpable signals to the Federal Reserve, consumers, and businesses that policymakers are serious about stopping inflation in its tracks without inflicting serious long-term damage on the economy.

It would reinforce monetary efforts rather than be at odds with them, and perhaps scale back how high interest rates need to go to control inflation. It would also potentially be the most comprehensive anti-inflation agenda to date that achieves the balancing act of respecting taxpayers, consumers, and businesses.

Fast Facts: Where Inflation Stands in Summer 2022

Inflation at Present

The Federal Reserve’s preferred measure of inflation is core PCE, which was 4.8 percent year-over-year in June 2022, has been above three percent since April 2021, and has been above four percent since October 2021. For sake of reference, the Fed’s goal is for inflation to average two percent over the longer run, meaning that year-over-year inflation has exceeded the Fed’s longer term target by at least 50 percent for over a year and has more than doubled the Fed’s target for almost a year.

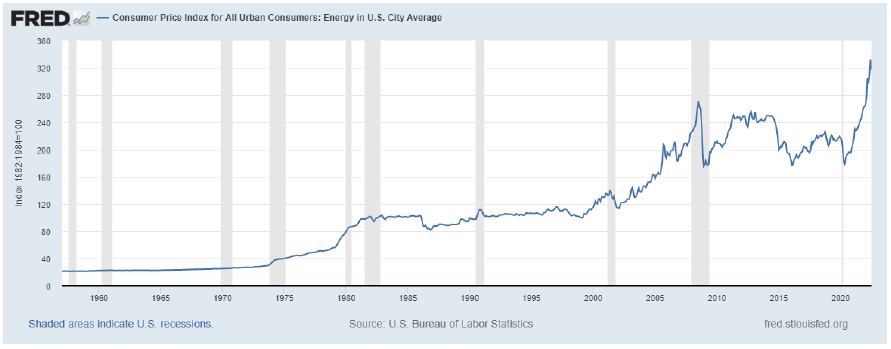

Overall CPI-U was 8.5 percent from August 2021 through July 2022. Energy costs have been a significant driver of inflation, with energy CPI-U a staggering 32.9 percent over the same time period. Fuel oil was up 75.6 percent from last year, gasoline of all types up 44.0 percent, natural gas was up 30.5 percent, and electricity 15.2 percent.

Food was also an inflation driver, with food inflation sitting at 10.9 percent in July 2022. Food at home (i.e., groceries; +13.1 percent) experienced higher price inflation than food away from home (i.e., restaurants; +7.6 percent). Grains (+15.0 percent), dairy products (+14.9 percent), and meat and fish (+10.9 percent) are all much more expensive at the grocery store than they were a year ago.

In the aggregate, goods and services outside of food and energy are experiencing lower inflation overall, but some distinct items outside of those two volatile categories are helping drive high inflation. New vehicle prices are up 10.4 percent, and transportation services are up 9.2 percent.

Goods and services experiencing inflation lower than the overall average of 8.5 percent include apparel (+5.1 percent), medical services (+5.1 percent), and medical goods (+3.7 percent), but it’s notable that even these items have experienced significant price inflation relative to pre-pandemic average inflation across the entire economy.

Inflation in the Future

Expectations at the Fed and among American consumers can play an important role in the direction of price increases going forward.

In June 2022, the median Fed projection for PCE inflation was 5.2 percent for 2022 – which would be the highest rate for one year since 1982. The median Fed projection for core PCE was 4.3 percent, which would be the highest rate for one year since 1983. Fed officials projected that inflation would cool in 2023 and 2024.

The Fed’s primary monetary policy tool for reducing inflation is to raise interest rates. When the Fed raises interest rates, it raises borrowing costs for consumers and businesses throughout the economy and also makes it more advantageous for those consumers and businesses to save their money rather than use it to consume (or borrow to consume). This can have the effect of slowing an economy that’s too hot, reducing some of the demand pressures that push price inflation upwards.

The economic risk for the Fed is that if it raises interest rates too much or too fast, it could slow the economy so much that a recession is precipitated. Cooling the economy without tipping it into a recession is sometimes colloquially referred to as achieving a “soft landing.

The Federal Reserve’s median expectations of future inflation and future interest rates can send important signals to financial markets, consumers, and policymakers. And the Fed’s latest projections suggest that it expects high inflation through at least 2022.

Consumer expectations can play an even more important role in future price inflation, given consumers expecting high inflation will demand higher wages from their employers, which in turn can lead to even higher prices. (This is commonly known as the “wage-price spiral”; more below.)

While the Philadelphia Fed surveys economic forecasters on a quarterly basis, the New York Fed surveys consumers about their inflation expectations on a bimonthly basis. While most consumers are not economic experts like officials at the Federal Reserve, their expectations for how much prices may increase in the months and years ahead are crucial to policymaking at both the Federal Reserve and in Congress.

The latest New York Fed survey, from July 2022, showed some encouraging results and some discouraging results when it comes to future inflation:

Consumers, on average, expect inflation to be 6.8 percent in the year ahead, up from 6.6 percent in May;

Consumers expect inflation in the next three years to be 3.6 percent, down from 3.9 percent in May; and

In the next five years, consumers expect inflation to be 2.8 percent, down from 2.9 percent near the beginning of the year.

As noted above, consumer expectations can play an important role in the future acceleration or deceleration of inflation. This can lead to the aforementioned “wage-price spiral,” where “rising wages increase disposable income raising the demand for goods and causing prices to rise” further.

If, on the other hand, consumers expect inflation to cool in the months or years ahead, that could signal to the Fed and to policymakers in Congress and the Biden administration that the factors and pressures pushing inflation upward right now will settle down in the near future. This in turn could lead to less drastic policy responses, such as fewer or less significant interest rate increases from the Fed.

What Caused Inflation?

Politicians are spreading plenty of blame around for the current inflation afflicting American businesses and households. Is it President Biden’s fault, or the fault of “greedy corporations”? Is it the fault of the Organization of the Petroleum Exporting Countries (OPEC) and their control of oil supply in the Middle East, or the fault of Russian President Vladimir Putin and his invasion of Ukraine? Is it the fault of lax monetary and fiscal policy?

The most basic, macroeconomic explanation of the nation’s current inflation woes is that too much money is chasing too few goods and services. The Congressional Research Service (CRS), a nonpartisan research institution of Congress, identifies two main causes of inflation (emphasis ours):

“Demand-pull inflation occurs when demand for goods and services within the economy exceeds the economy’s capacity to produce goods and services….

Cost-push inflation occurs when the price of input goods and services increases.”

Evidence suggests that both factors are at play in current, runaway levels of inflation in the U.S.

The COVID-19 pandemic has disrupted many aspects of life and business in America, and has certainly been a major contributor to the supply constraints that help fuel inflation. Or, as CRS puts it:

“Recently, supply has been constrained by disruptions to global supply chains, labor shortages, temporary business disruptions linked to COVID-19 outbreaks, and commodity shortages linked to the 2022 Russian invasion of Ukraine.”

Russia’s invasion of Ukraine has also played a role. Federal Reserve experts wrote in a May 2022 research note:

“Relative to a no-war counterfactual, the [researchers’ economic] model sees the war as reducing the level of global GDP about 1.5 percent and leading to a rise in global inflation of about 1.3 percentage points.”

Of particular concern to taxpayers, it also seems highly likely that excessive government spending – especially in 2021, with the passage of the American Rescue Plan Act (ARPA) – contributed to the high inflation America is experiencing today.

ARPA, passed in March of 2021, included provisions that:

Extended abnormally large unemployment benefits that the Congressional Budget Office (CBO) estimated (see Detailed Tables, Title 9) would increase government spending by more than $200 billion over just two fiscal years (2021-2022);

Sent $1,400 stimulus checks to tens of millions of households, which CBO estimated would increase government spending by $402 billion over two fiscal years (2021-2022); and

Temporarily expanded the Child Tax Credit (CTC), Earned Income Tax Credit (EITC), Premium Tax Credit (PTC), and COBRA subsidies, increasing government spending in the aggregate by $215 billion and mostly over the next two to three fiscal years (2021-2023).

In all, those provisions alone put roughly $800 billion in the hands of consumers either directly or indirectly.

A study from the San Francisco Fed, released in March 2022, estimated that “fiscal support measures” may have contributed as much as three percentage points to inflation:

“Estimates suggest that fiscal support measures designed to counteract the severity of the pandemic’s economic effect may have contributed to this divergence [between the U.S. and other industrialized wealthy nations] by raising inflation about 3 percentage points by the end of 2021.”

San Francisco Fed experts looked at U.S. inflation compared to other highly industrialized nations (in the Organisation for Economic Co-operation and Development, or OECD) and found that U.S. core CPI increased between two percent and four percent throughout 2021 while the OECD sample average increased only between one percent and 2.5 percent.

What Are Inflation’s Effects?

While the causes of inflation have been hotly debated, the negative effects are subject to less disagreement. Inflation has reduced the purchasing power of American households (with a disproportionately high impact on low-income households), made it more expensive to do business, led to a less productive economy, and raised costs for taxpayers.

The Penn Wharton Budget Model found in December 2021 that while “the average U.S. household [would have] to spend around $3,500 more in 2021 to achieve the same level of consumption of goods and services as in [2019 and 2020],” lower-income households would have to spend seven percent more while higher-income households would have to spend six percent more.

A Gallup survey in December 2021 found that nearly three in ten households making less than $40,000 per year reported “severe hardship” from inflation, with an additional 42 percent reporting “moderate hardship.” Only eight percent of households making between $40,000 and $100,000 reported severe hardship, while only two percent of six-figure households reported severe hardship.

And in February 2022, the Minneapolis Fed released a study on the “widely varied pain of inflation.” In addition to noting that “[h]ouseholds with more money have more options to preserve that money’s value in the face of inflation, they found that:

“...households with annual incomes below $20,000 experienced a median inflation rate 0.6 percentage points higher than households making more than $100,000.”

In other words, not only do low-income households have fewer resources to withstand higher prices, but they also experience inflation at higher levels than higher-income households.

Surveys conducted by the Richmond Fed suggest that businesses are also deeply affected by inflation. Businesses increasingly started incorporating inflation (and inflation expectations) into their decision-making over the second half of 2021 and into 2022:

In a 2022 Goldman Sachs small business survey, 73 percent of small business owners “said increasing energy costs are having negative impacts on their bottom lines.” The same proportion, 73 percent, said supply chain issues were “negatively [impacting] their bottom line.” And a CNBC survey for the second quarter of 2022 found that 75 percent of small business owners “ are currently experiencing a rise in the cost of their supplies.”

Despite these higher costs, there appears to be little evidence that businesses and corporations writ large are ‘greedily’ increasing their prices in order to reap huge profits – contrary to the claims of some policymakers.

The New York Fed looked into these claims in a July 2022 study. While experts there found that “for every one percent increase in prices, corporate gross margins increased by 24 basis points,” they also found that profits “are falling overall”:

“Looking back to the initial graph of the changes in profits in 2022, the change in gross profits in most industries (22 of 36) is negative. Profits are falling overall, and it’s just that companies in higher inflation industries have profits that are falling less quickly.”

The CNBC survey mentioned above also found that, in the second quarter of 2022, only 40 percent of small business owners were increasing their prices (even as 75 percent were experiencing price pressures from inflation). That was down from 47 percent of small business owners increasing prices in the first quarter of 2022.

And of particular importance to NTUF, the nonpartisan CBO has reported that inflation can contribute to higher costs for taxpayers, especially to the extent that the Federal Reserve raises interest rates to slow inflation growth.

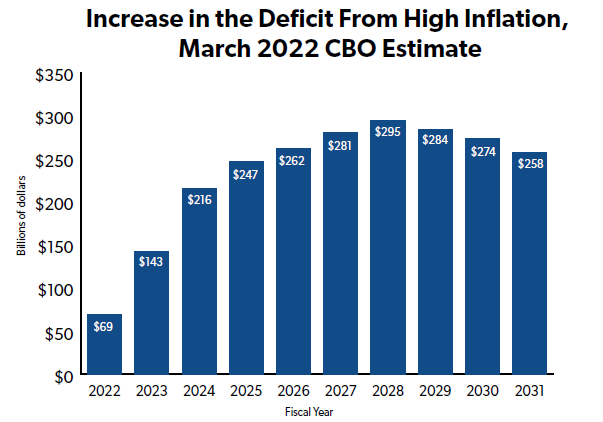

In March 2022, CBO wrote that under a “high-rate” scenario – which they calculated as 5.1 percent growth in the GDP price index (compared to CBO’s 1.9 percent baseline) and a 2.4-percent yield on 10-year Treasury notes (compared to 1.3 percent in CBO’s baseline) – net interest costs to taxpayers would be a staggering $2.3 trillion higher from fiscal year (FY) 2022 through FY 2031:

“The larger budget deficits would arise primarily because the government’s net interest costs would be higher, in CBO’s assessment, as the Treasury replaced maturing securities and issued more debt to finance new deficits— all at higher market interest rates.”

Notably, this estimate was conducted before ARPA added $1.9 trillion to 10-year deficit levels. However, this $2.3 trillion cost hike is more than CBO projects will be spent on the Affordable Care Act (ACA), Children’s Health Insurance Program (CHIP), Supplemental Nutrition Assistance Program (SNAP), and unemployment compensation combined over the next 10 years.

In a more recent update, from August 2022, CBO informed Congress that between February 2021 and May 2022 it had raised its projections of net interest spending by more than $2.5 trillion over 10 years. This is not the same as adding $2.5 trillion to deficits, because CBO has also adjusted its non-interest spending and revenue projections since then. These studies do demonstrate, though, that persistently high inflation can raise costs for America’s taxpayers – above and beyond the higher costs for consumers and businesses.

Who Can Fix Inflation?

President Biden was correct about one thing in his May 2022 Wall Street Journal op-ed about inflation: the Federal Reserve will play the primary role in combating inflation in the U.S.

The International Monetary Fund (IMF) notes that “central bank independence is indeed associated with lower and more stable inflation,” and that “most economists think monetary policy is best conducted by a central bank (or some similar agency) that is independent of the elected government.”

Theoretically, the legislative and executive branches of a government could enact legislation with a short-term and meaningful impact on inflation. But the fiscal policy choices required to make such an impact – likely, broad-based tax increases or spending cuts in the hundreds of billions of dollars over just a year or two, to take money out of consumers’ and businesses’ hands and put it into the Treasury – would be politically impractical and would inflict economic damage on their own.

But while we anticipate that monetary policy will reign supreme in the fight against inflation, Congress and the executive branch may yet have a role to play. Our agenda is centered around practical policy proposals with bipartisan potential that could have a meaningful short-term effect on inflation.

An Anti-Inflation Agenda That Respects U.S. Taxpayers, Workers, and Businesses

NTU believes that the following legislative or executive branch actions would have the greatest impact, in the aggregate, on inflation:

Making it easier and less expensive for energy producers in America to quickly increase domestic energy production and supply, including the permitting reform proposal expected to be considered by Congress this fall;

Establishing incentives for consumers to save for the long term, such as in tax-advantaged retirement accounts, rather than spend in the short term;

Providing an inflationary update to a number of provisions in the tax code, as means of inflation mitigation for middle-class households;

Resuming the repayment of federal student loans sooner than January 2023, which may have small direct effects on reducing inflation but larger indirect effects in terms of signaling a slowdown in consumer spending;

Repealing or suspending protectionist policies that restrict supply chains and increase costs for consumers and taxpayers, including the Jones Act and “Buy American” restrictions;

Repealing or suspending tariffs, especially the large-scale tariffs placed on goods by the Trump administration and maintained by the Biden administration;

Rescinding tens of billions of dollars in unobligated funds from the COVID-19 relief bills; and

Reaching a significant, short-term deficit reduction agreement that actually decreases deficits by tens of billions of dollars in the next one or two fiscal years, rather than playing the classic Washington game of promising deficit reduction years from now.

We review each proposal in turn below.

Enact Energy Regulatory Reform

Not only do higher energy costs affect consumers and businesses directly – raising the price of gasoline, electricity, heating, and other essential goods – but higher energy costs affect most Americans indirectly, since almost every good or service they consume requires energy to produce and distribute.

The price of gasoline has been settling down from early summer highs, but is still above levels regularly seen since 2012.

Energy prices broadly have yet to settle down from historic highs:

Part of the issue is that oil and gas extraction has yet to return to pre-pandemic highs. And industrial production for the energy sector in general has yet to return to pre-pandemic highs.

Of late, energy production and gas prices have been trending in the right direction, but policymakers can still do more to encourage oil and gas production in the short term and send gasoline, electricity, and heating oil prices more consistently downward.

While plenty of legislative and regulatory actions won’t have an immediate, significant impact on oil and gas production, they could send critically important signals to energy producers that give them the confidence to invest in new exploration and production.

As the U.S. Chamber of Commerce explained in May 2022:

“The exploration and production of oil and natural gas is extremely capital intensive and requires significant upfront investment and planning. Investors pay close attention to [legislative and regulatory] signals, and fear of regulatory hurdles impacting returns have held investment back.”

Or, as Republican staff on the Joint Economic Committee (JEC) observed in February:

“Investors and business leaders make business decisions based on policy actions as well as the political discussion that often precedes policy. The perceived political climate can directly influence forward-looking investment decisions, especially in heavily regulated industries.”

The Chamber and the JEC outline some commonsense steps for Congress and the Biden administration:

Hold leasing sales on federal lands and waters (policymakers could consider expanding these sales as well);

Adopt a new program to lease offshore for oil and gas development;

Build more pipelines; and

Abandon or avoid regulatory efforts that may chill investment activity.

Also on their lists is permitting reform, and it is encouraging to see Congress take two steps in the direction of permitting reform in recent weeks:

Overturning burdensome Biden administration rules enhancing permitting requirements under the National Environmental Policy Act (NEPA): the Senate voted, with 49 Republicans and Sen. Joe Manchin (D-WV), to disapprove of the Biden-era rules, but the legislation is likely dead on arrival in the House;

Enacting more comprehensive permitting reform under NEPA: Sen. Manchin extracted an agreement from President Biden, Speaker Nancy Pelosi (D-CA), and Senate Majority Leader Chuck Schumer (D-NY) to vote on legislation that would accelerate the approval and development of all sorts of energy projects.

The outline of the permitting reform agreement notes that it would:

Provide for a two-year maximum on NEPA reviews (and just one year for so-called “low impact” projects), plus develop categorical exclusions for NEPA reviews;

Require final actions on Clean Water Act reviews within one year of certification requests; and

Direct the President to designate and update a list of “at least 25 high-priority energy infrastructure projects and prioritize permitting” for those projects; the projects must be balanced among fossil fuels, renewables, and other types of energy initiatives.

Taken together, permitting reforms, leasing sales, pipeline infrastructure, and the removal of regulatory barriers would, to borrow from the Chamber of Commerce, “provide important signals to markets and help to limit the impact of energy on inflation.”

America’s short-term energy outlook is already improving – with energy consumption falling and production set to rise – but the above moves could push energy anti-inflation efforts over the top, and hedge against future price increases due to political instability in Russia, Ukraine, and the Middle East.

Establish Incentives for Consumer Saving

After hitting all-time high rates during the pandemic, in part due to government stimulus, personal savings among American households – measured by personal savings as a percentage of disposable personal income – have dropped to extremely low levels in 2022. Though never falling below 6.5 percent from 2015 through 2021, personal savings rates have been below six percent for each month of 2022.

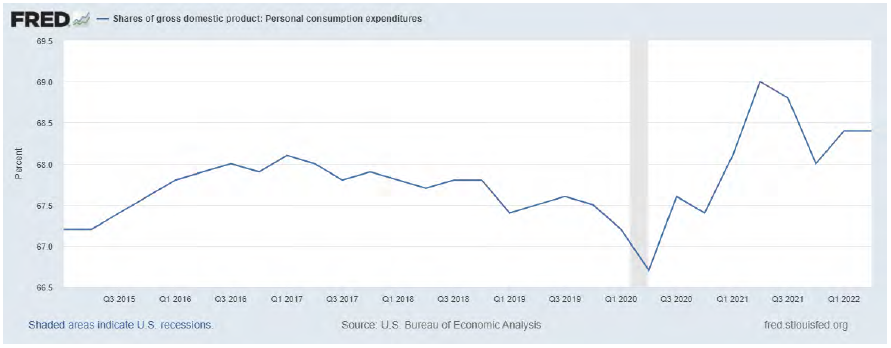

While there could be a bit of chicken-egg problem here – is inflation eroding personal savings, or are personal savings rates dropping because Americans are consuming too much, or both – personal consumption has been rising as a share of GDP over the same time period, suggesting that consumption levels are running too high in the American economy.

Personal consumption expenditures as a share of GDP have been above 68 percent for each quarter since Q1 2021 – notably, before inflation began running hot – after exceeding 68 percent in only one quarter from 2015 through 2020.

Meanwhile, recent data aggregated by major institutional investors suggests that Americans are not saving enough for long-term goals such as retirement.

Fidelity reported that in the first quarter of 2022 U.S. workers were contributing 14 percent of their paychecks to retirement accounts – the highest amount since 2010, but “below Fidelity’s recommended rate of 15 [percent].”

Vanguard reported that the median 401(k) balance in 2022 is just $35,345, that the median balance for individuals 25 to 34 is just $14,100, and that the median balance for individuals under 25 is a paltry $1,800. Vanguard, which similarly targets a 12-percent to 15-percent savings rate for retirement accounts, found that every age cohort 54 and under is contributing below their 12-percent recommended floor.

And the Federal Reserve found, in their May 2022 report on the Economic Well-Being of U.S. Households (SHED), that “only 40 percent of non-retirees thought their retirement saving was on track.”

Incentivizing Americans to save more for retirement was a central policy goal of the bipartisan Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019, which NTU supported and which easily passed both chambers of Congress. It is also the goal of lawmakers’ follow up legislation to the SECURE Act, called the Enhancing American Retirement Now (EARN) Act or the SECURE 2.0 Act.

Saving has become more important, though, in light of inflation and the trends described above. Congress needs to consider how it can incentivize American households to save for the future now rather than spend.

Reps. David Schweikert (R-AZ) and Byron Donalds (R-FL) have a thoughtful proposal to increase the contribution limits on tax-advantaged retirement accounts – including Roth and traditional IRAs and 401(k) accounts – by $4,000 for one year only. Such an effort could induce thousands or even millions of Americans to put extra money away into long-term retirement savings, money that they could otherwise spend on consumption now which – in the aggregate – fuels inflation.

The EARN Act has several provisions that could immediately pull money out of the consumption economy and into long-term savings:

One provision would immediately remove a prohibition on employers “providing any benefit that is conditioned on an employee’s decision to contribute or not contribute” to a retirement account, which could convince more workers to contribute to employer-sponsored retirement; and

Another provision would index the IRA catch-up limit (for individuals 50 years of age and older) to inflation, starting in 2023.

The SECURE 2.0 Act also has provisions that could increase savings rates in the short term:

One provision would allow employers to match an employee’s student loan payments with retirement contributions, effective 2023, incentivizing both enhanced saving through increased retirement account contributions from the employer and payment of debt over consumption from the worker; and

Another provision would expand the credit for small employer pension plan startup costs, effective 2022, further incentivizing employers to set up retirement savings for their workers.

In isolation, none of these proposals would likely have an immediate impact in significantly increasing savings rates. In the aggregate though, they could pull billions of dollars out of the consumption economy in the short term and put those dollars instead into long-term savings, reducing inflationary pressures and enhancing long-term financial security of households.

Update Indexing of the Tax Code to Mitigate Inflation Effects

Updating various provisions of the tax code that are either a) not indexed to inflation, or b) are indexed to some measure of inflation but not keeping up with record levels of inflation in 2022, is less about reducing inflation than mitigating its effects.

For example:

The standard deduction for taxpayers went up only 3.2 percent from 2021 to 2022, or from $12,550 to $12,950 for single taxpayers and $25,100 to $25,900 for married taxpayers filing jointly; if the standard deduction instead increased by the possible core inflation rate of 4.5 percent for 2022, the standard deduction would be $13,050 for single taxpayers and $26,250 for joint filers;

The Earned Income Tax Credit (EITC) maximum amount for childless workers, workers with one child, workers with two children, and workers with three or more children only went up between 3.1 percent and 3.2 percent from 2021 to 2022;

The health flexible spending arrangement (FSA) dollar limitation for workers went up only 3.6 percent from 2021 to 2022, from $2,750 to $2,850;

The income threshold for zero-percent long-term capital gains rates went up only 3.2 percent from 2021 to 2022; and

IRA contribution limits did not go up at all from 2021 to 2022.

And several provisions of the tax code are not indexed to inflation at all including:

The maximum Child Tax Credit (CTC) amount, currently $2,000 per child;

The maximum non-child dependent credit amount, currently $500 per child;

The tax deduction for student loan interest payments;

The American Opportunity Tax Credit (AOTC) for higher education;

The Lifetime Learning Credit for higher education; and

Dependent care assistance plan (DCAP) maximum contribution limits.

Sen. Chuck Grassley (R-IA) has offered several proposals to update indexing in the tax code, including:

Legislation NTU has endorsed to “[m]ore than [double] the size of the zero percent (lowest) tax bracket for long-term capital gains and qualified dividends, and [then index] the income thresholds to inflation,” and allow taxpayers to exclude $300 (single) or $600 (joint) of interest income from overall income subject to tax; and

Legislation to index the $2,000 CTC and $500 non-dependent credit to inflation, as well as the AOTC, Lifetime Learning Credit, the student loan interest deduction, and more.

And Rep. Cindy Axne (D-IA) has bipartisan legislation (Sen. Joni Ernst (R-IA) is leading in the Senate) to index the DCAP maximum contribution limits to inflation, because they have not been updated since the creation of the DCAP program in 1986.

Congress should consider all of these measures, taking a careful look at which provisions of the tax code may not be keeping up with record levels of inflation and may be in need of a one-time and/or permanent inflation adjustment. These provisions might not reduce inflation, but they can help taxpayers tread water with current levels of inflation and be made whole come tax filing season in April 2023.

Resume Federal Student Loan Repayments

In May 2022, the Federal Reserve estimated that the pause on federal student loan payments – which, as of this writing, had been ongoing for 2.5 years – was leading to roughly $2.8 billion in foregone payments each month, or about $84 billion in the 30 months from March 2020 through August 2022.

In June 2022, CBO came to an even larger estimate, reporting that “the student loan payment pause from February 2021 to August 2022 [alone] will cost roughly $85 billion.” (Prior pauses were authorized in law by the Trump administration and/or Congress and, presumably, already accounted for in previous CBO baselines or communications.)

There are mixed signals from the Biden administration over whether resuming federal student loan payments would have a meaningful direct impact on inflation. White House Council of Economic Advisers member Jared Bernstein told The New York Times in May 2022 that extending the federal student loan payment pause would have an “extremely negligible” effect on inflation, but then told the Times in June 2022 that the deflationary effects of restarting payments should neutralize the inflationary effects of canceling student loan debt.

The Times noted in that same June report that:

“Some economic advisers have made the case to Mr. Biden that the [debt cancelation] move might actually relieve inflation, at least a little, if he pairs debt forgiveness to a restart of the interest payments on student loans, which have been paused since early in the pandemic.”

While resuming federal student loan payments might not have a significant direct impact on inflation, a resumption could send indirect signals to the Federal Reserve and consumers that the federal government takes inflation seriously, which could reduce expectations of future inflation (at the Fed and among consumers and businesses) that can add fuel to the inflationary fire. President Biden has announced federal student loan payments will resume in January 2023, but we believe policymakers could resume payments more quickly, perhaps as early as October 2022.

One policy move that will likely send the opposite indirect signals to the Federal Reserve, consumers, and the market – and, in turn, contribute indirectly (or possibly directly) to inflation – is President Biden’s recent broad cancellation student loan debt.

Various estimates have put the cost of Biden’s debt cancellation action at between $360 billion and $500 billion.

While those “costs” to the federal government would not be immediately spent in the U.S. economy – and, for some borrowers, might not be spent at all, since the debt is for past rather than current or future consumption – the forgiveness of student loan debt could induce some borrowers to borrow again for current consumption (e.g., borrowing to buy a home, or borrowing to buy a card). If this happens en masse it could contribute to inflation for certain goods and services.

Repeal or Suspend Protectionist Policies

Unfortunately, some baked-in protectionist laws and policies throughout the U.S. government are raising costs for taxpayers in an already inflationary environment, and Congress could suspend these measures for the duration of elevated inflation or, better yet, repeal them entirely.

One law with a particularly negative impact on U.S. supply chains is the Jones Act. As NTUF’s Sophia Perez explained in July 2021:

“The Merchant Marine Act of 1920, also known as the Jones Act, requires that any cargo shipped between domestic ports must be aboard a U.S.-owned and built vessel with a 75 percent American crew. While the objective of the Act was to bolster American shipbuilding and protect maritime jobs, the Jones Act has done the opposite. In fact, the Act has proven to be an economic burden on the very sector it meant to improve and includes broader adverse impacts.”

Perez explained that U.S.-built merchant ships currently “cost 4–5 times as much as those built abroad,” and that an OECD study has estimated “repeal of the Jones Act would increase U.S. domestic output by $40 billion to $135 billion.”

The Jones Act can also make U.S. energy transportation more expensive, since U.S. energy producers cannot “ramp up oil transportation” as quickly as some foreign competitors.

NTUF’s Andrew Wilford noted in June of this year that there are only “93 Jones Act-compliant vessels” in the entire nation, adding that, as a result, only six percent of U.S. domestic freight is shipped via water (compared to 36 percent in the European Union).

Wilford added that the Jones Act is a particular issue “for gas supply, as there are no Jones Act-compliant tankers in the United States that can carry LNG.” (emphasis added)

A related set of laws that raise costs for taxpayers are “Buy American” requirements. These laws typically mandate that the federal government require a certain percentage of goods from domestic sources, sacrificing cost efficiency for narrow benefits targeted at certain industries and sectors.

The Peterson Institute estimated in August 2020 that U.S. domestic procurement requirements throughout the federal government cost U.S. taxpayers $94 billion in fiscal year 2017 alone.

Suspending or repealing the Jones Act and “Buy American” restrictions could reduce costs for taxpayers and prices for consumer goods, including the energy commodities that have been subject to the highest inflation rates over the past year. As a group of over 250 economists organized by NTU wrote to policymakers in 2020, “[d]iversifying supply sources and increasing inventories will be costly, but a broad Buy America regime will be more costly.”

Repeal or Suspend Tariffs

Even more impactful than suspending or repealing the Jones Act or Buy American restrictions would be to suspend or repeal tariffs, especially those imposed under the Trump administration and continued by the Biden administration on a wide array of imports.

NTUF’s Bryan Riley previously outlined several reasons why the Biden administration should allow Trump-era Section 301 tariffs – covering nearly two-thirds of imports from China – to expire:

“Section 301 tariffs are paid by Americans. Although Section 301 tariffs are often misleadingly called “China tariffs” for short, the tariffs are in fact taxes on Americans who import goods from China.”

“Tariffs are now higher in the United States than in China. Section 301 tariffs doubled the overall average U.S. tariff rate to the highest level in 27 years.”

“Extending Section 301 tariffs following a review of necessity by the Biden administration would be unprecedented. There has never been a case of an administration extending a Section 301 tariff following a review of necessity after their four-year lifespan has expired.”

“Extending Section 301 tariffs would require President Biden to break his tax pledge.”

“Removing Section 301 tariffs would boost U.S. exports.”

Another compelling reason to remove these tariffs is that they might modestly factor into reducing inflationary pressures in the U.S. economy.

The Peterson Institute estimated in June that:

“The direct effect of removing tariffs on imports from China could lower consumer price index (CPI) inflation by 0.26 percentage point—only marginally reducing inflation. But as US corporations trim their markups to compete with imports, the competitive impact of cutting the China tariffs could eventually lead to about a 1 percentage point reduction in inflation.”

Peterson Institute experts go on to estimate that a “2 percentage point tariff-equivalent reduction across a broad array of goods entering the US market could deliver an estimated one-time reduction of 1.3 percentage points in CPI inflation.”

Public reporting indicates the Biden administration was considering a tariff rollback to fight inflation earlier this summer, using Peterson Institute above as a key data point in favor of tariff reduction:

“Mr. [Larry] Summers and others have approvingly cited the March study on the issue from economists at the Peterson Institute for International Economics, who argued that a “feasible package” of tariff removal — which includes repealing a range of levies and trade programs, not just those applied to China — could cause a one-time reduction in the Consumer Price Index of 1.3 percentage points, amounting to a gain of $797 per American household.”

And American Action Forum (AAF) data from May 2022 indicates that the tariffs have increased annual American consumer costs by tens of billions of dollars and have decreased import volumes in the U.S. by tens of billions of dollars more.

The removal of tariffs, combined with the removal or suspension of protectionist policies throughout federal law, could combine to reduce costs for American consumers by tens of billions of dollars over the course of even one year, and could put some downward pressure on inflation at a time where economic actors are looking for more signs that price hikes are slowing.

Rescind Unobligated COVID-Era Federal Funding

While the Inflation Reduction Act doesn’t begin pulling tens of billions of dollars out of the economy (on net) until fiscal year 2026 or so, lawmakers do have the opportunity to pull tens of billions out of the economy by rescinding unobligated COVID-era federal funding.

A brief review of the differences between appropriations, obligations, and expenditures is in order:

Appropriations are funding amounts passed by Congress and signed into law by the President that are then directed to any number of federal agencies, contractors, grantees, individuals, businesses, or other recipients.;

Obligations, according to the nonpartisan Government Accountability Office (GAO), are “definite commitment[s] that [create] a legal liability of the U.S. government for the payment of goods and services ordered or received, or [legal duties] on the part of the U.S. government that could mature into [legal liabilities] by virtue of actions on the part of another party that are beyond the control of the U.S. government.”

Expenditures, according to the Department of Health and Human Services (HHS) are the “payment of funds.”

It is easier for Congress to rescind appropriations that have not been obligated or spent than it is to rescind appropriations that have not been spent but have been obligated, so for this recommendation NTUF focuses on unobligated COVID-era funds. We also focus on COVID-era funds that are not public health funds, given the COVID-19 virus still poses significant public health challenges across the U.S.

As of the end of February 2022 (the last date for which GAO has data available), there were at least $400 billion in COVID-era funds that had not been obligated. Major spending areas with unobligated funds included:

Coronavirus State and Local Fiscal Recovery Funds for state and local governments; $104.6 billion unobligated as of February 28 (out of $350 billion total);

Education Stabilization Fund for schools; $18.2 billion unobligated out of $278.1 billion total;

Transit Grants for states, municipalities, territories, and tribes; $9.6 billion unobligated out of $69.5 billion total;

Highway Infrastructure Grants for states, municipalities, territories, and tribes: $4.6 billion unobligated out of $10 billion total.

Congress could also rescind unobligated funds in ARPA’s pension bailout, the Special Financial Assistance (SFA) program. As of July 6, 2022, only $6.7 billion in funds for the SFA had been approved by the Pension Benefit Guaranty Corporation (PBGC), while PBGC expected a total of between $74 billion and $91 billion to be distributed. Lawmakers could theoretically save between $67 billion and $84 billion by rescinding unobligated funds.

These five accounts alone could add up to between $204 billion and $221 billion in unobligated funds as of February 28 (or July 6, in the case of the SFA). It’s quite possible that billions of dollars have been obligated since the February 28 and July 6 updates, but Congress should strongly consider pulling the remaining funds (likely tens of billions of dollars) out of the economy and back to Treasury coffers.

Such an effort could contribute meaningfully to a broader deficit reduction package (see below) and would represent almost as much deficit reduction as will occur in the first eight years of the IRA combined (FYs 2023 through 2030, $227 billion in combined deficit reduction).

Reach a Significant, Short-Term Deficit Reduction Package

Above and beyond achieving deficit reduction by rescinding tens of billions of dollars in unobligated COVID-era funds, lawmakers could further reduce inflationary pressures by reaching a significant deficit-fighting deal that actually reduces spending significantly in the short term.

The Biden administration has recently made deficit reduction a rhetorical focus of their anti-inflation efforts. Sadly, as noted above, the Inflation Reduction Act (IRA) is not likely to meaningfully reduce inflation in the near term.

The spending increases and tax cuts in the early years of the IRA are small when compared to the size of the economy, but they just about neutralize the spending decreases and tax increases in the early years of the legislation. On the contrary, a deficit reduction deal that reduced spending by hundreds of billions of dollars in the next year or two – while extremely politically difficult to achieve – would likely have a modest impact at reducing inflation.

NTUF honed in on two deficit reduction options from CBO that, together, would likely reduce deficits by almost $100 billion in fiscal year 2023 alone.

One would limit states’ abilities to reap additional Medicaid spending from federal taxpayers through gimmicky “provider” taxes, by removing a 1990s-era “safe-harbor” exception that allows states to use provider taxes to draw more money out of the federal government for their Medicaid programs; eliminating the safe-harbor could reduce federal spending on Medicaid by around $42 billion;

Another option would be to remove the 50-percent floor on the federal government’s share for state Medicaid services; this would have the practical effect of reducing the federal government’s share of Medicaid spending in around a dozen or so of the wealthiest states in the nation, and could reduce federal spending by around $56 billion in fiscal year 2023.

These reforms, either separately or in tandem, would reduce federal deficits but would not likely increase state deficits, even though states would increase spending on Medicaid as a result. This is because, unlike the federal government, most states are required by their own constitutions to balance their budgets each year (or, sometimes, over a longer period like two years). In the ideal, states would cut wasteful spending in their own governments in order to meet the increased spending needed under Medicaid.

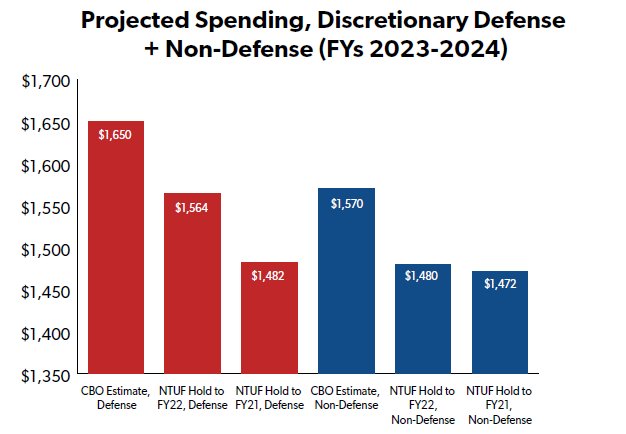

A final, major deficit reduction option would be to hold defense and non-defense discretionary spending fiscal years 2023 and 2024 to 2022 or 2021 levels, reducing spending and deficits relative to CBO’s budget baseline.

Holding FYs 2023 and 2024 discretionary spending to FY 2022 levels would save taxpayers $176 billion over two years, while holding FYs 2023 and 2024 spending to FY 2021 levels would save taxpayers $266 billion over two years.

Taken together with the COVID-era spending rescissions outlined above, NTUF’s deficit reduction plan could reduce deficits by around $478 billion in the lower bound scenario and by around $585 billion in the higher bound scenario, with much of the spending reductions occurring in the next fiscal year or two – when CBO, the Federal Reserve, consumers, and businesses expect inflation to be the highest. Unlike the IRA, our proposals would not delay meaningful spending reductions until four or five years from now.

Assessing Our Agenda’s Impact on Inflation

Taken together, NTUF’s anti-inflation agenda could:

Pull hundreds of billions of dollars in projected government spending out of the economy and back into Treasury coffers over the next few years alone;

Reduce consumer prices, increase goods imports, and even increase American exports – boosting the economy and jobs – by suspending or repealing tariffs and other protectionist measures;

Resume payments of federal student loans sooner than January 2023, which could send important, if indirect, signals to the Federal Reserve and consumers that fiscal policymakers are serious about reducing inflationary pressures;

Offer middle-class taxpayers relief from the effects of inflation by updating the indexing measures for several key provisions in the individual tax code;

Temporarily incentivize long-term consumer saving over near-term consumer spending; and

Send important signals to businesses that short-term exploration, production, and delivery of oil, gas, renewables, and other sources of energy will not be punished by U.S. lawmakers and regulators – and indeed could be rewarded under reformed and revamped regulatory processes.

While we are confident that this agenda, in the aggregate, could reduce inflationary pressures, it is important to acknowledge several caveats and limitations to the agenda above:

As noted earlier in the paper, we expect monetary policy will continue to play a much more important role than fiscal policy in reducing inflation in the near term;

As also noted above, at least one agenda item (updating indexing provisions in the tax code) is more centered around inflation mitigation than inflation reduction;

Some agenda items may have more powerful indirect effects on inflation – sending important signals to the Federal Reserve, consumers, businesses, and markets – than direct effects that either significantly reduce aggregate demand or significantly increase aggregate supply;

Some agenda items are more focused on mid-term (three to five years) or long-term (six to 10 years) inflation reduction, including permitting reform and energy deregulation; and

Arguably most important, many of the drivers of current inflation in the U.S. economy are in large part (but not completely) outside of the control of Congress or the Biden administration; this includes Russia’s invasion of Ukraine, the COVID-19 virus, future actions by the independent Federal Reserve, oil supply decisions made by OPEC, and future shocks that are difficult to anticipate like natural disasters (e.g., hurricanes that affect oil supply), pandemics or epidemics (e.g., monkeypox), or the ongoing effects of climate change.

Overall, though, we believe that our agenda respects U.S. taxpayers, workers, and businesses, and would represent a good-faith effort by Congress and the Biden administration to get a handle on runaway inflation. Meaningful deficit reduction in particular could also reduce long-term inflationary pressures, since we anticipate spending reductions in the federal budget will have compounding effects on spending and the budget going forward.

Some recently-enacted or -proposed policy alternatives in Congress, unfortunately, will either fail to fix inflation or make pricing problems even worse.

Why the “Inflation Reduction Act” Won’t Fix Short-Term Inflation

Sen. Joe Manchin (D-WV), other policymakers, and some policy experts have put a lot of stock in the notion that the “Inflation Reduction Act” (IRA) – massive reconciliation legislation which just passed Congress and was signed into law by President Biden – will actually reduce inflation.

Over 100 economists signed a letter to Congressional leaders urging them to pass the IRA, claiming that because the legislation “is deficit-reducing” it will put “downward pressure on inflation.” (A counter-letter warning the IRA would not reduce inflation was signed by over 230 economists.)

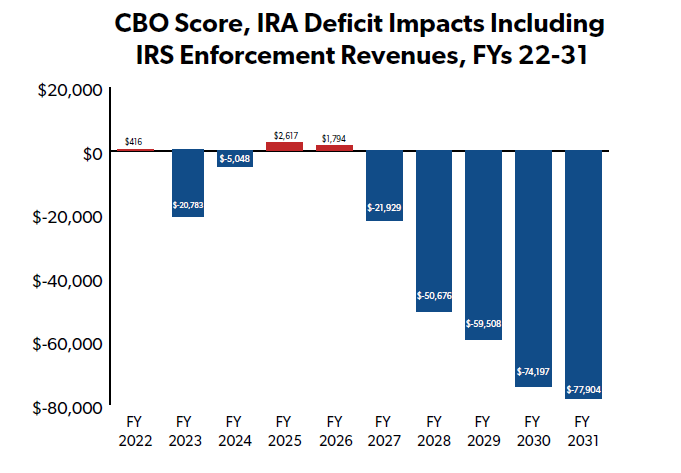

NTUF, the Congressional Budget Office, the Penn Wharton Budget Model, and others have pointed out that because the IRA actually doesn’t reduce deficits by a lot in the short term, the legislation likely won’t have a short-term effect on inflation. NTUF found that only seven percent of the bill’s net deficit reduction occurs in the next four years:

Most of the spending cuts or revenue/tax increases in the IRA – which economists in favor of the IRA have promised would put downward pressure on inflation – occur in fiscal year 2027 and beyond, years from now.

The few deficit-reducing provisions that do take effect in 2022, 2023, or 2024 could be deflationary, according to CBO’s estimates, but could also negatively impact business investment, in turn hurting economic growth.

Other Fiscal and Economic Policies That Won’t Fix Inflation

While the IRA is the largest piece of legislation to pass Congress this year that purports to fight inflation, lawmakers have had no shortage of additional proposals that they claim would reduce inflation and offer relief to consumers. As we share our own inflation agenda, it’s helpful to review some of these proposals and explain why they likely will not fix inflation in the short run.

Significant Expansions of Taxpayer-Funded Subsidies

Some policymakers have responded to high inflation by proposing taxpayer-funded subsidies that offset the cost – but, importantly, not the price – of goods and services. The ACA subsidies included in the IRA are one example. Another prominent example advanced by some members of Congress, some governors, and even President Biden as gas tax suspensions or rebates.

In March 2022, Tax Foundation’s Jared Walczak noted – in response to state gas tax holiday or rebate proposals – that one-time transfers to taxpayers “put even more [demand] pressure on the system.”

And in June 2022, after President Biden called for a three-month federal gas tax holiday that would run from July 2022 through September 2022, NTU wrote that:

“…a gas tax holiday may inflate gas prices once the tax holiday ends. This was the case in Maryland, according to another study conducted by the University of Pennsylvania Wharton Budget Model last week. Maryland enacted a state gas tax holiday between March 18 and April 16, waiving their state tax of 36.1 cents per gallon on gasoline and 36.85 cents per gallon of diesel. The Penn Wharton study shows the state gas tax holiday significantly decreased gasoline prices in the state of Maryland during the gas tax holiday period. However, once the holiday expired, gas prices in Maryland became higher than what they would have been without the tax holiday. So while a federal gas tax holiday may temporarily reduce gas prices, those prices will likely bounce right back after the holiday expires (assuming the level of energy production does not fluctuate heavily).”

Subsidies that increase aggregate demand without addressing aggregate supply are likely to throw more fuel on the inflation fire, and should be avoided.

Government Price Controls

There are no shortage of government price control proposals in good economic times, and that has been doubly the case in these rough economic conditions driven by high inflation.

The just-passed IRA includes new and significant price controls on prescription drugs in Medicare (though they do not take effect for several years). In May, the House of Representatives passed legislation that would empower the Federal Trade Commission to “enforce de facto price controls” on gas when prices increase at an ill-defined “unconscionably excessive” level. And progressive or left-leaning economists have increasingly entertained the idea that price caps or controls could combat inflation.

There are many problems with this approach, not the least of which that this was tried in the 1970s and economists widely agree those price controls failed.

CRS notes that:

“One of the largest attempts [to combat inflation] was the price control policy put in place by President Nixon during the early 1970s. These controls froze prices, rents, and earnings until 1974. While the controls were in place, inflation did fall but then spiked to double-digit rates after the controls were dismantled … as pent-up demand put further pressure on low supply.”

Credit controls put in place by former President Jimmy Carter in 1980 failed for similar reasons:

“The 1980 credit controls restrained the use of spending and investing via credit in an attempt to lower spending in the economy.

…As with price controls, once the credit controls were removed, pent-up demand resulted in an increase in spending, increasing inflationary pressures in the economy once more.”

These lessons of history invoke the famous saying, “The definition of insanity is doing the same thing over and over again and expecting different results.”

Indeed, St. Louis Fed Vice President Christopher Neely warned in March 2022 that “Price Controls Should Stay in the History Books,” arguing that price controls have five major costs to a domestic economy:

“A government bureaucracy and law enforcement must be funded to enforce the controls.

Goods and services are allocated inefficiently, both in consumption and production.

Competition shifts from production to political markets as firms attempt to influence price-setting decisions.

Widespread evasion of price controls promotes disrespect for the law.

Suppressed inflation appears when temporary controls are relaxed.”

In short, price controls have not worked in the recent past to combat inflation, and they will not work now.

“Profits” Taxes on Businesses

Pursuing the narrative that “greedy” corporations are to blame for high inflation, some policymakers have proposed assessing taxes on companies’ “windfall” profits in order to combat inflation. The thinking goes that if the government promises to tax a certain amount of a company’s profits, they will lower their prices to avoid the tax, providing consumers with relief.

Unfortunately, for many of the reasons cited above, “windfall” profits taxes would not curb inflation and could, in fact, reduce supply of key goods and services that consumers are demanding in the economy – which could have the effect of increasing inflation as demand continues to outstrip supply.

Or, as a coalition of 26 organizations led by NTU wrote to policymakers in August:

“History has shown that a windfall tax is bad policy that would have a devastating effect on the supply of oil in the United States. The US implemented a windfall tax on US oil from 1980 to 1988. According to a report by the Congressional Research Service, this tax reduced domestic oil production by at least 320 million barrels and at most 1.3 billion barrels. This drastic drop in domestic supply increased oil imports and made the US more reliant on foreign oil producers. Today, foreign oil cannot meet our current needs as globally demand has risen. Implementing this tax now would reduce supply and increase prices, the exact opposite of its desired outcome.”

Neither taxpayer-funded subsidies, nor price controls, nor “profits” taxes will work to combat inflation. NTUF has an agenda that could, in the aggregate, reduce inflationary pressures in the short run and long term.

Conclusion

NTUF’s anti-inflation attempts to strike a delicate and difficult balance:

Respecting taxpayers by reducing deficits in the near term without relying on budgetary gimmicks and games;

Respecting consumers by increasing their access to lower-cost goods and services, primarily by increasing imports, and offering them additional incentives to save for the long term rather than spend in the short term; and

Respecting businesses by providing an environment in which they can confidently increase supply of key commodities, especially in the energy sector, without fear of increased tax or regulatory burdens from the legislative and executive branches.

If Congress were to pass this agenda in the near term, we believe that in the aggregate it would reduce inflationary pressures, reducing taxpayer dollars circulating in the consumption economy, increasing access to more affordable goods from abroad, and alleviating pressures on supply chains.

However, the Federal Reserve will still play a primary role in reducing inflationary pressures by increasing interest rates in the near term. To the extent policymakers, markets, consumers, and businesses remain concerned about an ‘overcorrection’ from the Fed – increasing interest rates so much that it tips the economy into a recession – NTUF’s anti-inflation agenda could, above and beyond direct deflationary effects, send important indirect signals to Fed officials that Congress and the Biden administration are serious about tackling the most significant inflation America has experienced in 40 years.