The Congressional Budget Office (CBO) recently released a budget forecast that paints a grim picture of our fiscal future. The Budget and Economic Outlook projects annual deficits as far as the eye can see, adding $12.4 trillion to the debt over the next decade. As bad as this estimate looks, the reality is even worse. The CBO is required to project a “current law” baseline, which in general produces estimates based on what is written in law while ignoring frequent Congressional actions that extend policies that would otherwise expire. An alternative outlook that includes the expected extension of several policies and programs that are set to expire, and excludes several recently-enacted gimmicky “savings” that will likely never actually reduce spending, paints a more realistic view of the federal government’s fiscal challenges. This “current policy” baseline produced by the National Taxpayers Union Foundation (NTUF) is a more realistic assessment of what will actually happen.

CBO has, on occasion, produced a comprehensive estimate akin to a “current policy” baseline. However, the agency has not seen fit to produce one recently. As such, NTUF has endeavored to produce a current policy baseline using CBO’s outlook as its base. After correcting for budget gimmicks and employing more realistic assumptions of Congressional action, the fiscal picture shows another $3 trillion in deficits over the next decade – over two-thirds of which is due to higher spending.

The Adjusted Baseline

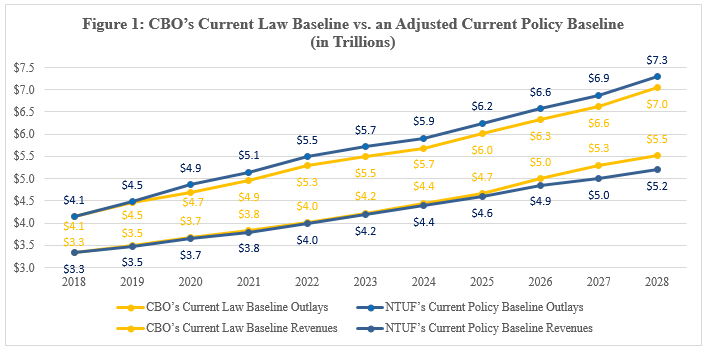

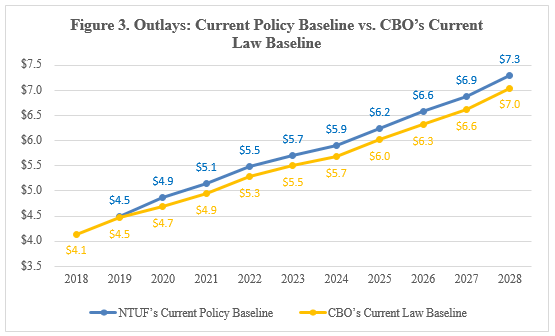

Figure 1, below, compares CBO’s projected baseline for outlays and revenues with the adjusted policy baselines for each as calculated by NTUF. Under the official baseline, annual spending will rise from $4.1 trillion this year to over $7 trillion in 2028. This year, outlays will comprise 20.6 percent of GDP, exceeding revenues by 4 percent. In 2028, under CBO’s current law baseline, outlays will climb to 23.6 percent of GDP, with the gap between spending and tax receipts expanding to 5.1 percent – and this includes $201 billion in 2028 just for the expiring income tax rate reductions. Under the revised baseline, total spending would be 3.5 percent higher over the decade (details on the alternative assumptions are below).

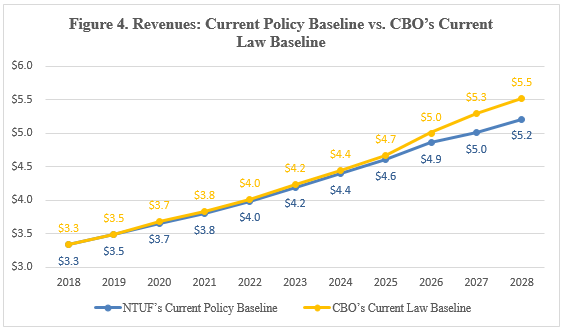

The CBO baseline projects that federal tax receipts will grow from $3.3 trillion in 2028 to $5.5 trillion in 2028. As a share of the economy, revenues will increase from 16.6 percent this year to 18.5 percent in 2028. Under CBO’s current law baseline, the expiring provisions of the Tax Cuts and Jobs Act (TCJA). Under NTUF’s revised baseline, which includes extension of the tax reform law, revenues would be 2.2 percent lower over the decade (additional details are provided below).

Deficit Impact

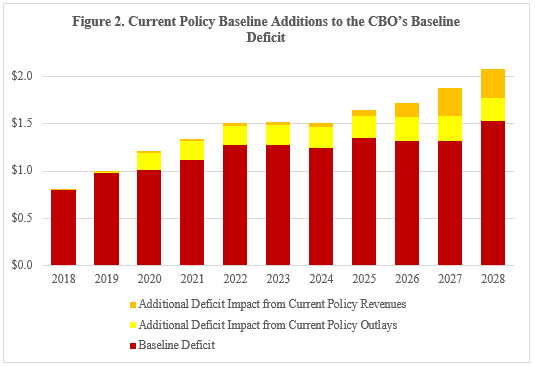

Figure 2, below, shows annual deficits as projected by CBO, and the deficit impacts from the NTUF-adjusted current policy baseline. In total, an additional $2.98 trillion would be added to the debt – 67 percent of which results from higher spending. Most of the revenue impact would occur from extension of the TCJA’s individual income tax provisions in Fiscal Years 2026 through 2028.

Without corrective action, higher deficits will also increase the burden of financing the debt. Thanks to Congress’s habit of spending far in excess of revenues, trillion-dollar deficits will make financing the debt one of the fastest-growing areas of spending. CBO projects that net annual interest payments on the national debt will rise from $213 billion this year to $915 billion in 2028. NTUF estimates that the increased debt load could add an additional $3 trillion in debt service costs over ten years, a figure that could run higher if interest rates rise.

Alternative Outlay Assumptions

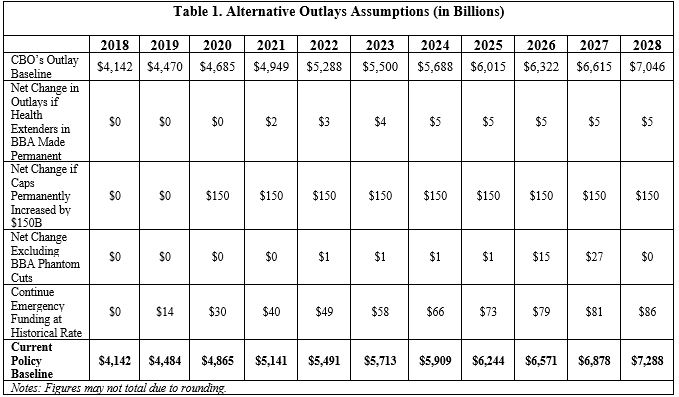

The table below shows the additional spending that would occur under alternative assumptions. These policies would lead to $2.01 trillion higher outlays over the decade, including:

- The Bipartisan Budget Act of 2018 (BBA) included another round of temporary extensions of several health care programs. Making these permanent would boost outlays $34 billion.

- The BBA increased spending caps by nearly $300 billion for Fiscal Years 2018 and 2019. If this funding boost is permanently added to the baseline in following years, as NTUF projects will occur, outlays would rise by an additional $1.35 trillion.

- In our analysis of the BBA, NTUF identified a number of “phantom savings” that, given their legislative history, are unlikely to ever result in actual spending reductions. Those still in the baseline include extension of sequestration provisions in FY 2026 and 2027, further postponement and increase of reductions in Medicaid Disproportionate Share Hospital Allotments, and reductions to the Physician Fee Schedule update.

- CBO provided an estimate of the cost of emergency spending over the next decade, boosting outlays by $562 billion over the baseline level.

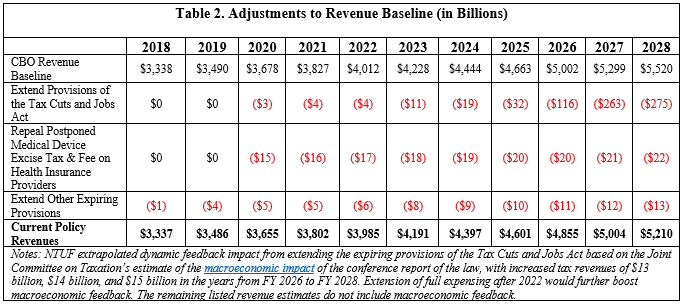

Alternative Revenue Assumptions

To its credit, CBO does produce projections of a few alternative fiscal scenarios, though budgetary rules prevent CBO from applying them to its official baseline that becomes the yardstick when it measures the impact of legislative policy changes. In addition to the emergency spending included above, CBO’s budget outlook provides a static cost estimate for:

- Extending the provisions of the TCJA that are scheduled to expire due Byrd Rule restrictions;

- Repealing the Affordable Care Act’s (ACA) medical device excise tax and fee on health insurance providers which have both regularly postponed before taking effect (yet are still included in the official baseline); and

- Extending several additional expiring tax provisions.

CBO’s alternative scenario estimate of repealing ACA taxes also included the revenue impact of from eliminating the high-premium excise tax, also known as the “Cadillac Tax.” NTUF excluded this from our adjusted baseline because CBO notes that there would be “largely offsetting effects” from savings in outlays: In the absence of the tax, more individuals would be able to get health insurance coverage from their employers rather than enrolling in Medicaid or the ACA healthcare insurance exchanges.

Although CBO did not provide an estimate of the macroeconomic impact that would result from this additional tax relief, NTUF calculated a partial impact for extending the TCJA. Last December, the Joint Committee on Taxation’s released its estimate of the macroeconomic impact of the enacted conference report of the TCJA. NTUF calculated that if the growth in revenues projected in the analysis continued at the pace after expiration 2025, revenues would be $42 billion higher from 2026 through 2028. This is a low-ball estimate: Extension of full expensing (which accounts for $122 billion of the ten-year total for extending TCJA’s expiring provisions) will unleash faster economic growth that would generate higher tax receipts.

Repeal of ACA taxes could also have a beneficial impact on taxable income in CBO’s projection. CBO notes that excise taxes and indirect business taxes “reduce the base of income and payroll taxes” such that higher indirect business taxes “lead to reductions in revenues from income and payroll taxes.” In one particular example included in a score of a proposal to replace an existing excise tax with a new alternative, CBO estimated that “revenues from the fees collected … would be partially offset in the federal budget by a loss of income and payroll tax receipts equal to about 26 percent of the fees each year.”

Continued Economic Growth Will Improve the Outlook

In addition to needed sorely spending restraint, policies such as the TCJA that encourage economic growth are key to improving the long-term budget outlook. There are numerous positive signs that the new tax reform law is helping to boost the economy, creating new jobs which generate tax revenues. CBO’s April budget review reported that incoming revenues for the month were “$30 billion to $40 billion larger than CBO expected when it prepared the estimates reported in The Budget and Economic Outlook: 2018 to 2028, which it issued on April 9.” The jump resulted from higher than expected income growth in 2017. The May report shows that receipts have risen 3 percent compared to a year ago.

If the economy grows faster than CBO expected in its baseline projection, higher revenues would help shrink deficits – assuming that the increased revenues aren’t plowed back into new spending instead of deficit reduction. Using CBO’s budget outlook data, NTUF calculated that a one percent boost in annual GDP could boost revenues by over $200 billion in 2018 alone, and by an average of $220 billion per year over the next five years. This in turn would reduce debt financing costs by approximately $500 billion over the decade.

Conclusion

The U.S. national debt has piled up through decades of overspending, and outlays will continue to grow faster than revenues over the next decade, even as tax and regulatory reform have boosted the economy. Worse is coming: red ink looms on the horizon with massive liabilities in entitlement programs. To improve the long-term picture, lawmakers need the continuation of pro-growth policies, the will to reform spending (the recently enacted caps secured $7,400 in savings per household before they were overridden), and a clear-eyed, realistic understanding of the fiscal challenges they face.