(pdf)

All throughout 2021, President Biden repeatedly called on wealthy individuals to “step up” and “pay your fair share.” The “fair share” claim is repeated like a mantra to justify higher tax rates and enforcement. This message spurred congressional Democrats to include an $80 billion funding boost to the Internal Revenue Service (IRS) as part of the Inflation Reduction Act (IRA). Over half of this amount, $46 billion, is dedicated to boost tax enforcement by hiring new agents and conducting more audits.

This argument cropped up in a recent opinion piece by James B. Steele of the Center for Public Integrity which claimed, “Republicans — with some assists from Democrats — have worked to dismantle a system where the wealthiest people pay substantially higher rates.”

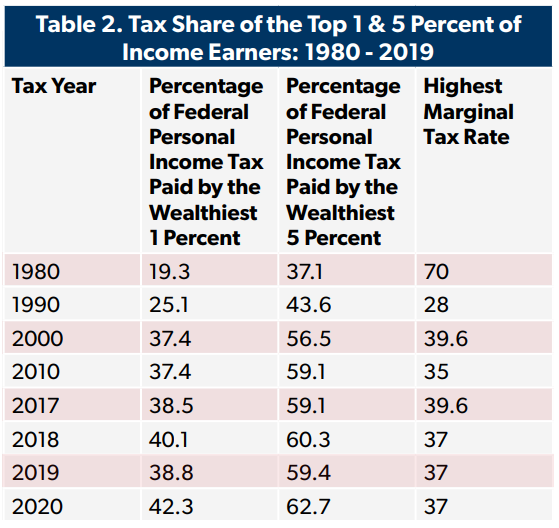

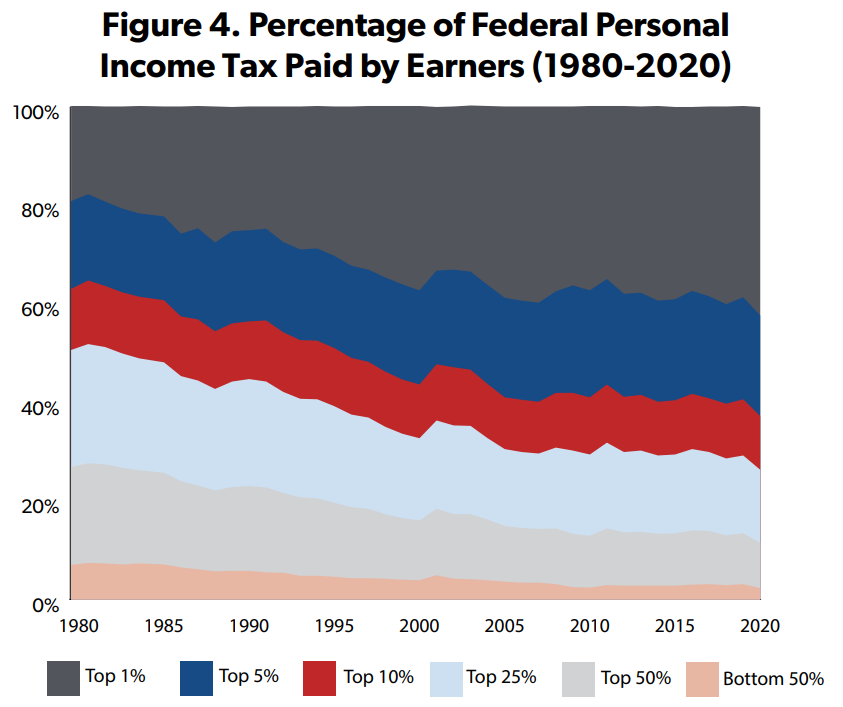

However, the “fair share” crowd tends to overlook the fact that our income tax code is highly progressive. New data from the IRS find that the top 25 percent of earners paid nearly 89 percent of all income taxes in 2020. This is the highest share of income taxes paid seen in the tax data available going back to 1980. Lower income earners carry little of the overall income tax burden, with the bottom 50 percent of earners owing 2.3 percent of the national share.

Lawmakers have made the income tax code increasingly progressive over time even as the top marginal tax rates were significantly reduced from 70 percent in 1980 to 37 percent in 2020. The top 25 percent of earners paid 73 percent of all income taxes in 1980 while the bottom 50 percent paid 7 percent.

Tax Shares in Tax Year 2020

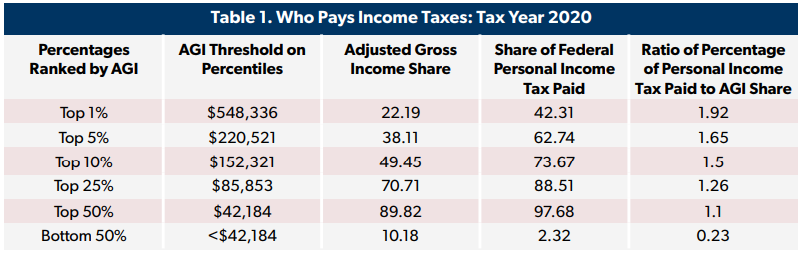

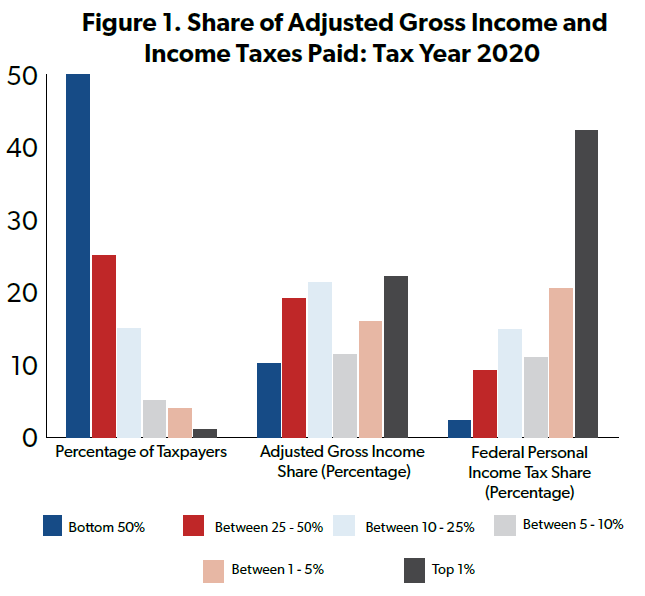

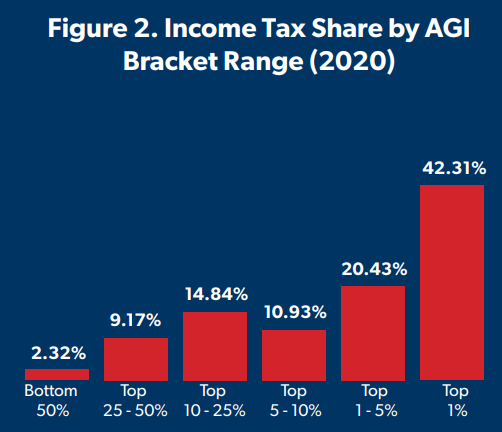

The IRS’s Statistics of Income division publishes annual data showing the share of income taxes paid by taxpayers across ranges of Adjusted Gross Income (AGI). The newly released report covers Tax Year 2020 (for tax forms filed in 2021). The newest data shows that the top 1 percent of earners (with incomes over $548,336) paid nearly 42 percent of all income taxes. The amount of income taxes paid in this percentile is nearly twice as much as their AGI share.

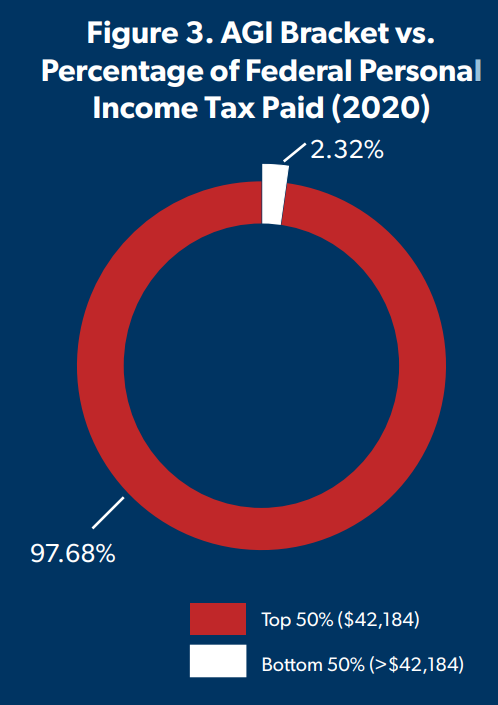

The top 10 percent of earners paid 74 percent of all income taxes and the top 25 percent paid 89 percent. Altogether, the top fifty percent of filers earned 89 percent of all income and were responsible for 97.7 percent of all income taxes paid in 2020.

The other half of earners (those with incomes below $42,184) owed 2.3 percent of all income taxes in 2020. Among this group are many filers with no income tax liability either because their earnings were below the taxable threshold or due to eligibility for tax credits that reduce income tax liability. Separate IRS data shows that there were over 61 million tax returns in 2020 with no income tax liability. Among these returns, 94 percent were filed by those with incomes less than $50,000.

Historical Tax Share Data

NTUF has compiled historical IRS data that tracks the distribution of the federal income tax burden since 1980. This was the first year of tax data impacted by the coronavirus pandemic which led to the shutdown of major parts of the economy. The record spike in unemployment contributed greatly to shifting a larger share of the income tax burden to wealthier individuals and reversed the wage gains for middle and lower-income earners that NTUF noted in the 2019 tax share data.

Back in 1980, the top marginal income tax rate stood at 70 percent and the wealthiest one percent of earners’ share of income taxes was 19 percent. Over the next decades, their share of income taxes has increased even as the top tax rates were reduced. By 2020 the top rate had fallen to 37 percent, yet the income tax share of the wealthiest one percent had doubled to 42 percent – the highest share reported in the decades of data.

Since 1980, the income tax share of the bottom half of earners has fallen from 7 percent to less than 3 percent in 2020. Analysis from the Congressional Budget Office (CBO) shows that individuals in the lowest income quintiles receive means-tested transfers through government benefits that lift their income in 2019 by $15,100 (or 64 percent), on average, to $38,900. Final data is not yet available on means-tested transfers for 2020 but pandemic relief legislation that year provided $414 billion in “refundable” credits, payable above and beyond a filer’s income tax liability.

This new IRS data should help inform the debate in Congress about the fairness of the tax system as the President and the IRS report on their plans for spending the $80 billion funding hike in IRA – the largest single infusion of funding ever provided to the tax collection agency.

Even counting payroll and other taxes, the top income earners pay a substantial portion of taxes. The CBO finds that the highest income quintiles’ average total federal tax rate (including other assessments such as payroll and excise taxes) was 24 percent in both 2018 and 2019 (the most recent years of analysis available). By comparison the lowest quintile’s average rate was less than 0.1 percent.

Conclusion

The claim that certain filers are not paying their fair share of taxes has led to tax hikes and to boost tax enforcement by vastly increasing the size of the IRS by hiring upwards of 87,000 new agents over the decade. These policies will further concentrate the income tax burden to fewer taxpayers over the coming years.