President Biden is likely to call for quadrupling the stock buyback tax in his 2023 State of the Union address on Tuesday. The stock buyback tax just went into effect on January 1, 2023 at a rate of one percent, and Biden will reportedly propose raising the new tax to four percent.

Readers may have questions about the stock buyback tax, including what it is, how much it raises taxes, and how it may affect everyday investors. We attempt to answer some of those questions below.

What is a stock buyback?

A corporation generally distributes profits to shareholders by issuing dividends, or cash payments. An alternative method is a stock buyback: increase the value of the company’s stock by reducing the supply of the stock. Companies do this by “pay[ing] shareholders the market value per share and re-absorb[ing] that portion of its ownership that was previously distributed among public and private investors.”

Stock buybacks, according to The Motley Fool, totaled $880 billion in 2021 on just one of the three major U.S. stock exchanges – the S&P 500 – and likely “exceed[ed] $1 trillion in 2022.” The volume of stock buybacks may decrease in the future as a result of the new tax, compared to an alternative scenario in which the tax never went into effect.

What is the current stock buyback tax?

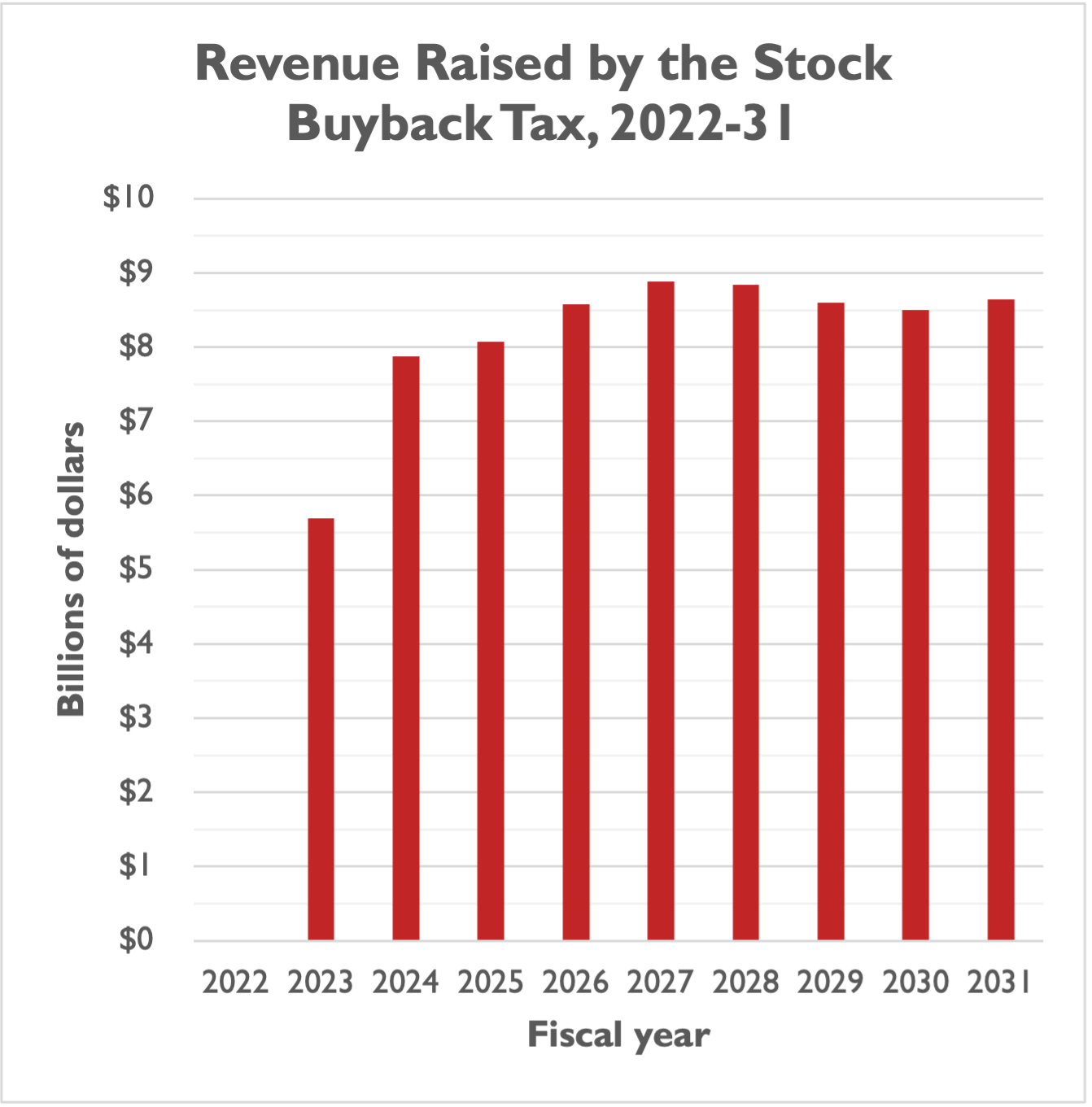

The stock buyback tax is a one percent excise tax on corporate stock repurchases included in the Inflation Reduction Act (IRA) of 2022. The IRA made the tax effective on all stock repurchases (i.e., stock buybacks) effective January 1, 2023. The non-partisan Congressional Budget Office (CBO) estimates that the one percent stock buyback tax will raise almost $74 billion over ten years from fiscal years (FYs) 2022 through 2031.

To put this number in context, the federal government is projected by CBO to raise $54.672 trillion in revenue over the same time period. This means the stock buyback tax represents less than one half of one percent of federal tax revenues.

Would President Biden’s four-percent stock buyback tax raise four times as much revenue?

No. The higher the tax rate on stock buybacks, the more the tax will discourage publicly-traded companies from engaging in stock buybacks. The more companies avoid stock buybacks, the less the federal government receives in buyback tax revenue.

What are the arguments in favor of stock buybacks?

NTU Foundation’s Andrew Wilford has previously written that stock buybacks are:

“...[close] to the corporate version of depositing money in the bank. … [A] business that buys back shares does more than improve its stock price. It also provides itself room to reissue these purchased shares at a later date when it does need to finance new investments.”

Some claim that stock buybacks benefit wealthy investors and shareholders at the expense of both workers and the broader U.S. economy. Regarding the latter argument, a Federal Reserve research note from 2017 found “little evidence that economies that have experienced larger shortfalls in corporate investment spending have experienced larger increases in share buybacks and/or dividend payments.”

What are the arguments against stock buybacks?

Sen. Elizabeth Warren (D-MA) is a long-time critic of stock buybacks, arguing on CNBC in 2021 that buybacks are “nothing but paper manipulation” to increase company stock prices, and the wealth of investors and executives at the top of a company. Senate Finance Committee Chair Ron Wyden (D-OR), the top tax-writing Democrat in the U.S. Senate, and Sen. Sherrod Brown (D-OH) have claimed that stock buybacks take money away from investments in workers.

As the non-partisan Congressional Research Service (CRS) has noted, though, there are several other reasons a company may choose to engage in stock buybacks, including:

- “[P]rovid[ing] financial flexibility” compared to compensating shareholders through dividends;

- “[O]ffset[ting] the increase in outstanding shares through exercise of employee stock options”; and

- “[Q]uickly adjust[ing] a firm’s capital structure.”

How might the stock buyback tax impact everyday investors?

NTU Foundation’s Andrew Wilford wrote in 2021:

“The latest Federal Reserve Survey of Consumer Finances (from 2019) shows that 53 percent of Americans hold publicly-traded stock in some form, with a median value of $40,000 in holdings. That roughly corresponds to the percentage of Americans who paid taxes that same year, 56 percent of Americans.”

…An excise tax would reduce that return not only by the [one] percent that would go to the Treasury Department instead of shareholders, but by reducing the incentive for corporations to perform buybacks in the first place.”

Consequently, a higher stock buyback tax would certainly have negative economic and financial effects that hit all investors, including middle-income families, workers, and retirees who are invested in the market.