(pdf)

In a recent paper, the National Taxpayers Union Foundation analyzed the impact wealth taxes could have on private charitable foundations. NTUF found that however a wealth tax would be ultimately administered, it would impose a substantial tax burden on those funding charitable foundations, as well as the foundations themselves — potentially depriving the country of a key source of altruism.

This paper looks at a different underreported consequence of a wealth tax: its impact on entrepreneurs and the successful companies many of them have founded. Entrepreneurs are vital for economic growth; they undertake risk and build the businesses of today and tomorrow. For those that are successful, their business and their personal situation become intertwined. Their personal wealth is often indistinguishable from the business’s. Under a wealth tax, their hard work is punished and the business they run can suffer the consequences.

With a wealth tax in place, significant net worth represents a tax liability, leaving entrepreneurs in a predicament. As wealth does not always translate to liquidity, founders may be forced to continually liquidate ownership in their companies in order to pay their tax bills. This would have the effect of discouraging entrepreneurship and limiting growth start-ups from raising the capital needed to thrive. In other words, businesses with the potential to transform the economy could be smothered in the crib.

Background: Wealth Taxes

Wealth taxes come from the premise that substantial revenue can be raised by taxing an individual’s entire wealth rather than a subset of it, such as income or consumption. However, there’s a good reason why policymakers generally target certain subsets of wealth: taxing some types of wealth slows economic growth less than others. Tax policy should be carefully crafted to minimize the harmful impacts caused by taxation on the economy.

Wealth taxes, on the other hand, toss aside the thoughtful policymaker’s scalpel in favor of a sledgehammer. Even that analogy may be too generous, as wealth taxes actually have the effect of targeting normal investment returns rather than unusual, windfall returns that are less sensitive to taxes.[1]

Our previous paper on this topic focused on one of the many administrative issues that wealth taxes pose to tax bureaucrats. This paper, on the other hand, will dive into some of the economic consequences that may arise from a national wealth tax.

Wealth Taxes and Entrepreneurship

Entrepreneurship is a crucial driver of economic growth. The relationship between the two may seem obvious, but it is indirect. Entrepreneurship drives innovation by introducing new ideas and products to the market, which forces established players in the market to either innovate or make way for younger, more innovative challengers. This innovation in turn leads to growth, resulting in job creation and wage increases.

Unfortunately, in recent years American entrepreneurship has decreased. While the number of new businesses has held relatively steady over the last 20 years, the number of jobs supported by businesses less than a year old has fallen, from 4.1 million in 1994 to 3 million in 2015. Though entrepreneurship rates have been growing in the last 10 years since the end of the Great Recession, the number of new businesses that opened in the recession’s wake is the lowest of any post-recession period.

The vast majority of entrepreneurs that stand to be affected by a wealth tax are not the founders of the megacorporations people often think of. There are nearly 6 million businesses in the United States. Eighty-nine percent employ fewer than 20 people, with 98 percent employing fewer than 100. Many of these businesses would be subject to a wealth tax, under the proposals from Senators Warren and Sanders.

At a time when new entrepreneurship should be fostered, a wealth tax would do the opposite. Any entrepreneurial activity, whether by established businesses or prospective ones, entails substantial risk that the investment will prove unproductive. A wealth tax adds one more negative factor to the cost-benefit calculation that potential entrepreneurs have to make, by potentially either subjecting them to a new wealth tax should their business’s expansion cause their assets to exceed the threshold, or by pushing them into a higher wealth tax bracket.

While the rhetoric surrounding wealth taxes suggests taxing ultra-successful entrepreneurs, wealth taxes actually are poorly targeted to hit above-average investment returns. Instead of targeting windfall investment returns and lightly taxing or exempting normal returns, wealth taxes do the opposite. An investor earning 5 percent is taxed at the same rate as someone earning 20 percent, meaning the effective tax rate for the lower-return investor is significantly higher.

Even the nearly 540,000 businesses between 20 and 99 employees have an average payroll below $2 million annually. While that is nowhere near high enough to be considered a large business, owners of businesses this size could still find themselves subjected to wealth tax liability.

Diluting Ownership

Under any wealth tax plan, business ownership would be considered part of an individual’s net worth. This could mean that an individual is wealthy on paper but lacking in cash on hand. Entrepreneurs would be put in a difficult position, where they could be forced to dilute their ownership interests just to satisfy their annual tax bills.[2]

This would be problematic for entrepreneurs who are household names, like Jeff Bezos of Amazon or Elon Musk of Tesla, but it’s also a problem for thousands of entrepreneurs who are not household names. Medium-size businesses could be forced to diversify their ownership as company founders liquidate their holdings in order to pay their tax bills, bringing new, potentially unwanted voices into the company’s management and structure. Founders, who have worked tirelessly to improve their business, would now be penalized for their success.

Additionally, entrepreneurs would be subject to taxation whether the business is profitable or not. It is easy to imagine a situation where the wealth tax would accelerate closure for struggling businesses, as the additional tax burden is too much for the owner to afford.

Such large tax bills for medium-sized businesses could also push them towards premature sales as entrepreneurs look for ways to lower their tax liability or eliminate it entirely.[3]It could limit competition as larger firms buy their smaller competitors.

Proponents of the wealth tax counter that these concerns are unjustified. Owners would have new options to mitigate liquidity constraints. One idea floated is to allow entrepreneurs to transfer shares of their closely-held business to the Internal Revenue Service (IRS), which would in turn auction the shares to the highest bidder. Putting the IRS, which already struggles to administer our exceedingly complex tax code, in the auction business is a scary thought. Such a system, even if administered well, could cause serious disruption. It would make it much easier for large firms to swoop in and buy up smaller competitors, thus eliminating potential competitive threats or allowing them to acquire valuable technology or facilities at fire-sale prices. Medium-sized companies could find themselves in the position of having part of their company owned by someone who they do not want as a business partner. Federal ownership and IRS auction of shares in companies is an unserious solution to a serious problem.

Entrepreneurs might want to escape the wealth tax by selling their company altogether, long before their desired sale date. The tax might also result in businesses deciding not to expand or grow. The proposals released by Senators Sanders and Warren would not affect all entrepreneurs, just those with sufficient net worth. However, that tax cliff would create a large incentive not to grow your business, and therefore, personal net worth, above the tax exemption.

Under a wealth tax such as those proposed by Warren or Sanders, the future Elon Musks or Steve Jobses of the early days of Tesla or Apple would have their stake in their businesses steadily chipped away at. Take a hypothetical founder who holds sole ownership of his business, valued at $100 million.[4]This founder would owe $1.2 million in wealth taxes under Sanders’s plan, and $1 million under Warren’s. This founder would have to sell between either 1.2 or 1 percent of his company in the first year alone just to raise the liquidity to pay a wealth tax bill.

All of these results are bad for entrepreneurs and bad for the economy. Risk-tasking is an essential part of economic growth.

Ownership Dilution Triggers Additional Tax Headaches

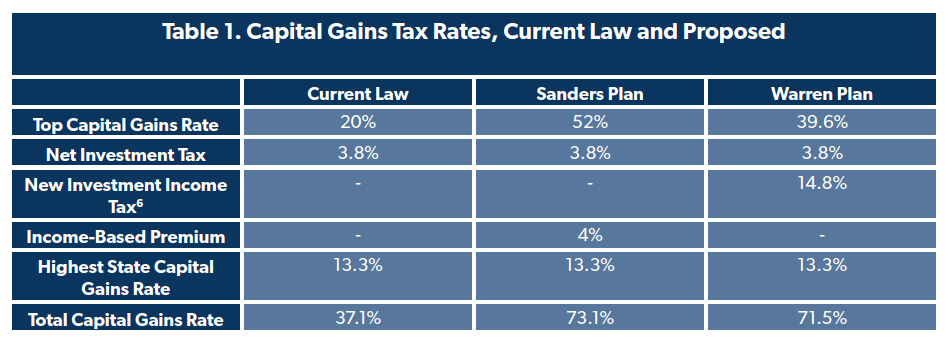

There is an additional downside to ownership dilution. Founders would also be forced to pay capital gains taxes on the assets that they sell — and both Sanders and Warren have proposed raising tax rates on capital gains. Both Sanders and Warren have proposed taxing long-term capital gains as ordinary income tax rates would significantly increase the top tax rate on capital gains.[5]Capital gains income would also be subject to multiple other taxes, including the net investment tax and state capital gains taxes. Senators Sanders and Warren are proposing tax increases which would impact capital gains rates as well. Table 1 lists the numerous taxes that founders would pay upon sale of their ownership interests.

Because of these astronomical capital gains tax rates, founders would have to sell far more of their assets to pay their wealth tax bills than they otherwise would. When factoring in capital gains taxes and the candidates’ proposed changes to them, the aforementioned founder could have to sell as much as $3.5 million in equity in his business just to pay his wealth tax bill under Warren’s plan, representing a significant chunk of ownership stake in the business — this number could rise to an even higher $4.5 million under Sanders’s plan.[7]

Needless to say, business founders forced to sell this amount of equity on an annual basis would soon see their stake in the company reduced to a minority position.

Business Consolidation

Such large tax bills for small-to-medium businesses could also push them towards premature sales. Wealth taxes could lead to less market competition and increase corporate consolidation as small businesses either cash in to avoid high wealth tax bills or stunt their growth to stay below certain wealth tax thresholds.

This could have tremendous consequences for innovation. Consider the famous case where Netflix’s founders offered to sell to Blockbuster for $50 million back in 2000, or roughly $75 million in 2019 dollars. Netflix was laughed out of the room, a move that ultimately sunk Blockbuster but likely accelerated the shift from brick-and-mortar movie stores to streaming video. It’s hard to imagine that Blockbuster would have been so keen to bail on its nearly ten thousand brick-and-mortar locations had it not been forced to by competitive pressure from Netflix. This would have meant the switch to streaming video, which Americans voted for with their dollars, would likely have been a slower and less committed process.

It’s purely speculative, but not unreasonable to think that Netflix ownership’s willingness to sell would have been greater had its members been incurring a wealth tax bill at the time— after all, Netflix’s financial position at the time of the Blockbuster meeting was so dire that it had to think twice about ponying up $20,000 for the private flight to make the meeting on time.

Alternatively, had Netflix’s owners not wanted to sell, would it have changed the calculus behind the company’s ensuing flood of investment in its streaming platform? Businesses do not avoid productive investments because of tax bills, but high tax bills can make productive investments unproductive.

The streaming platform was not subjected to this counterfactual, of course, but future entrepreneurs and industry disruptors could face a very different landscape under a wealth tax. At the very least, they may think twice before making investments that could shoot them up into a new tax bracket, comparing the potential increase in revenue against both the usual investment risk but alsoa higher tax bill.

Would a Lookback Period Be a Solution?

Wealth tax advocates may counter that liquidity issues can be solved by allowing for a lookback period in any wealth tax legislation. While this would work to alleviate some of the liquidity issues that wealth taxes face, it is not a cure-all.

It is not clear that a lookback period provision would make its way into final wealth tax legislation. However, even if one assumes that wealth tax advocates would be sensitive to the problems faced by entrepreneurs, it would face many of the structural issues that the wealth tax itself would.

Lookback periods essentially allow cash-poor taxpayers to defer tax payments until such time as they have the liquidity to pay their tax bill. Taxpayers would still accrue tax liability, but would be able to hold off on actually paying their tax bill until such time as their assets mature.

For example, Senator Wyden (D-OR) included a lookback period in his proposal for mark-to-market taxation, or taxes on unrealized capital gains. While the lookback period hopes to solve one issue, liquidity, it causes several others.

Under a lookback period, individuals who are unable to satisfy their annual tax burden can delay their tax liability to a future date. The federal government, however, would ideally like its revenue in the year it is due. To ensure that only those investors that need the lookback period take advantage, proposals assume the addition of a deferral charge. But adding any delayed tax payment raises the effective tax rate on entrepreneurs.

A lookback period could also struggle to handle situations in which assets suddenly lose value. Consider a case where a start-up grows rapidly, accruing a substantial wealth tax liability, for several years before suffering a catastrophic collapse and going out of business. The business’s owner would be left with a near-worthless business, but still could be stuck with the deferred wealth tax bills from the days where the business was successful. Balancing the need for a lookback requirement and the need to allow for fluctuations in net worth would not be easy, but it’s essential to ensure that unfortunate business owner from being stuck with a massive tax bill that he is unable to pay.

Conclusion

As advocates continue to push for a wealth tax, citing the potential revenue raised as well as deconcentration of wealth, it is also important to consider other consequences a wealth tax could have. Innovation and market competition provide important benefits to consumers in the form of new products and services as well as lower prices, not even considering the potential for socioeconomic mobility that successful entrepreneurs can attain.

Along with its many well-documented potential economic harms, a wealth tax, particularly those as extensive as Sanders and Warren are proposing, would stifle innovation at a time when entrepreneurship should be encouraged. It’s just one more reason why any wealth tax proposal should be dead on arrival should it appear on Congress’s doorstep.

[1]See previous paper, “The Wealth Tax's Impact on Private Charities,” (NTUF, December 9, 2019) for a further explanation of how this is the case.

[2]Wealth tax advocates may argue that this is a good thing, as it would force “democratization” of businesses by taking shares out of the hands of single founders in favor of a broad swath of shareholders. However, those calling for corporate “democratization” are advocating for a nebulous good, with the implication being that it should be targeted at the largest corporations.

[3]Sale of the business could still result in an entrepreneur having assets above the wealth tax’s exemption, but presumably structuring their assets is easier when they are more liquid, i.e. not business ownership interests.

[4]Establishing a valuation for a privately owned business would be one of the biggest administrative nightmares of a wealth tax. Most businesses this size would likely not be held solely by a single owner, however the majority owner would also likely have other assets in his estate. This hypothetical controls for all these factors for simplicity’s sake.

[5]Sanders has proposed this change for filers with household income above $250,000.

[6]Warren has proposed this tax for individual taxpayers with household incomes above $250,000.

[7]Both these calculations assume that the taxpayer has enough income to fall into the top marginal income tax bracket. It also uses the 13.3 percent capital gains tax rate for California, rates vary by state.