(pdf)

Due to new tariffs on Chinese goods, small businesses are facing the destruction of their bottom line. Already-small margins are at risk of vanishing overnight under the weight of heavy import taxes, and thousands of businesses have petitioned the Office of the U.S. Trade Representative (USTR) for relief from these crippling tariffs. A business or trade organization can petition the US government for a “Tariff Exclusion” if they can prove that: 1) the requested product can only be obtained from China and 2) the import tax would do meaningful harm to their business and employees.

The result is that scores of businesses across the country are applying for exclusions to save their companies, and incurring a steep cost in doing so. The National Taxpayers Union Foundation (NTUF) surveyed several small businesses about their experiences with the exclusion process, finding that USTR has radically underestimated costs of applying for a tariff exclusion, highlighting the very real danger tariffs pose to their livelihood.

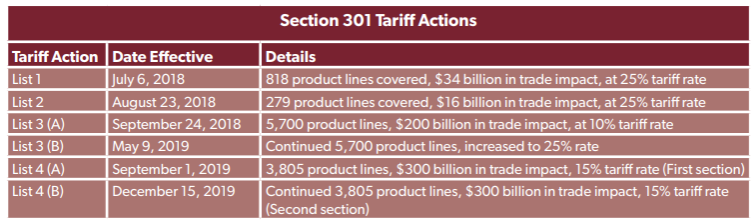

On October 21st, USTR announced the most recent list of goods hit by tariffs (known as List 4), comprising $300 billion of Chinese goods. These tariffs are in addition to $250 billion in existing tariffs implemented since July of 2018 in Lists 1 through 3 (see table below). As List 4 looms on the horizon, a new portal for exclusion applications will open at the end of October, again providing companies the opportunity to apply for product-specific exclusions from business-stifling tariffs. The $300 billion increase in tariffs will be deployed in two stages, the first having already taken effect on September 1, 2019, with a second round slated for December 15, 2019. The round of exclusion applications studied by NTUF was for items targeted by the List 3 tariff action.

The Cost of Tariffs

The goal of the Section 301 tariffs is to deal with acts, policies, and practices of China that are unreasonable or discriminatory and burden or restrict U.S. commerce. In practice, however, Section 301 tariffs have created undue burdens on businesses, both large and small, throughout the United States.

NTUF has estimated that an additional 15 percent tax on $160 billion (List 4B) on Chinese imports, scheduled to take effect on December 15, 2019, would bring the total direct cost to U.S. taxpayers resulting from Section 301 tariffs to at least $91.6 billion per year. Standing tariff actions, along with the proposed increases, would cost the average American household $718 per year, one of the largest tax increases since World War II. The impending weight of the List 4 tariff action heralds a new round of burdensome costs for US consumers and businesses. As noted by Christine McDaniel: “If [list] four takes effect, in principle, by our calculations over 95 percent of US imports from China will be subject to some type of special tariff. Further, the average tariff on US imports from China could reach well above 20 percent”.

Seeking an Import Exclusion

In addition to the seen costs of tariffs, tariffs also impose costs on businesses, particularly small businesses. Businesses must balance several competing demands simultaneously. First, can they continue to import their goods? How should they distribute the costs of the tariffs? Should they increase prices, reduce job opportunities for their employees, starve already tight profit margins, or something completely different? Additionally, businesses need to investigate whether it is possible to import their products from another country outside of the tariffs. These are difficult decisions to make, especially for small businesses.

In theory, the Trump administration provides an outlet of relief for these businesses: a tariff exclusion. Securing an exclusion could prove the difference between collapse and growth for many small businesses, but the process to apply for an exclusion can be complex. USTR requires an application for exclusion to demonstrate two things: First, that the product is not available from no other third-party country or within the US; Second, the cost of the tariff on the petitioned product would prove to have a “substantial negative impact” on the finances of the petitioning business.

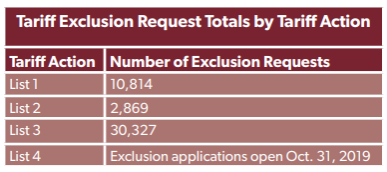

Businesses have been quick to utilize this tariff exclusion process. As of October 28, 2019, USTR has received more than 40,000 exclusion requests from the various Chinese tariff actions taken by the Trump administration. Table 1 shows the breakdown.

Real Costs to Small Businesses

Applying for a trade exclusion is not easy. It requires legal know-how to jump through numerous bureaucratic hurdles. We can make some cursory assessments about the burden of seeking such exclusions in part because the Paperwork Reduction Act requires agencies, such as USTR, to report the time burden and out-of-pocket expenses for complying with federal forms. The USTR’s estimates leave something to be desired. They initially estimated applicants’ cost to be 60 minutes for the preparation of the exclusion request materials, incurring no hard-dollar cost. USTR failed to account for the amount of time and energy required to fill out an exclusion request for small businesses, without the consultation of expensive trade lawyers, dramatically underestimating the costs.

In its latest public comment notification, USTR has revised its cost estimates to “120 minutes and roughly $200.” However, this is still likely understating the actual paperwork burden. Many businesses contacted by NTUF have disputed this estimate. Speaking off the record, one response from a small businesses indicated that USTR’s cost estimates were “absurd.” Employees spent “no less than 8 hours” to prepare USTR paperwork. Other respondents noted the hiring of attorneys or external firms to help prepare requests, incurring rapidly accumulating costs.

Below are a selection of additional comments from other contacted businesses:

“The approximate time to complete our exclusions have been underestimated, in my opinion, by the USTR approximation. Since our company is still fairly young, we are having to do heavy amounts of research in order to even really understand the process and requirements as well as having to look up all the requirements for each product/HTS code for the application.”

“We spent roughly 120 minutes (on each application). I have the help of an import attorney and those costs are ongoing. I did not find the process to be fair.”

“Because we are a very small woman-owned business without any experience with government procedures, we spent hours and hours reading everything we could find on the 301 Tariffs and the Exclusions so that we could present the best possible representation of our situation to the USTR in our request for exclusion. We spent no less than 8 hours working on the document itself, preparing for weeks. If we were a large company with a department dedicated to and experienced with government affairs then we could probably have done it in two hours. To say that the cost of putting the exclusion request together is $200 is absurd.”

“This process took me the better part of a day to do for the first one. The second one went much faster but I would still say longer than the estimate.”

Applying for an exclusion can prove much more difficult for small businesses than larger ones. Negotiating with the US government, navigating trade terminology, and identifying individual products for exclusion can prove tremendously costly for a small business, who lack the legal and financial resources of larger companies. As noted by a small business owner above, some must turn to import attorneys (if they can afford them) to make sense of the tariff exclusion application process, adding additional cost to the process.

None of this begins to account for the opportunity costs associated with seeking tariff exclusions. Any time or money spent consulting with attorneys or filling out paperwork is time or money not spent on improving the business and investing in its future productivity. Companies that should be spending their time innovating to improve their businesses are instead spending time defending themselves from damaging tariffs that undermine their success.

Requests for Exclusions from Section 301 Tariffs Are Mostly Rejected

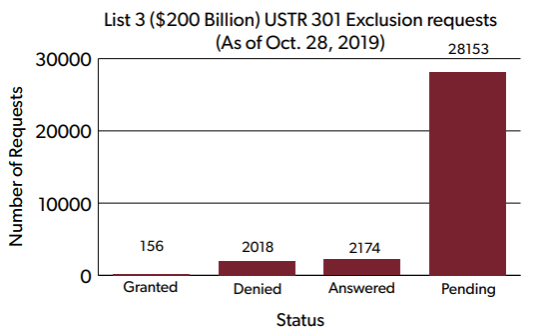

Even if small businesses manage to navigate the maze created by USTR to apply for an exclusion, there is little hope that their request will be granted. Out of 30,000 requests for exclusion from the List 3 tariff action, a paltry 156 requests, or 7.18 percent, had been granted.

The two previous tariff actions, List 1 and List 2, resulted in 10,814 fillings and 2,870 fillings respectively. As of October 28, USTR has received 30,327 exclusion requests for List 3, and the filing deadline has now passed. The chart below tracks the total number of exclusion applications, as well as their status over the course of 301 tariff actions.

Compounding the difficulties of the exclusion process, businesses must submit requests for each individual product, meaning the same business must apply many times. The challenges are then amplified, because they might receive an exclusion for some products, and denials for others, leading to increased confusion regarding the mechanics of USTR’s decision making.

USTR’s replies are often not instructive. USTR frequently responds that “(the petitioner) failed to show that the imposition of additional duties...would cause severe economic harm to you or other U.S. interests,” leaving little clue as to how an exclusion could be secured in the future.

The chart below illustrates the mountain of requests that await an answer from USTR, while small businesses wait in apprehension for a verdict on their bottom-line.

Many businesses continue to sit in limbo as they wait for their pending applications to be reviewed. With 2,174 finished cases, the USTR has a long road ahead of it to address the petitioners lined up in the public docket.

Action Needed to Address Burdens on Small Business

The financial horizons of many small businesses remain uncertain. The list of individual petitions for product exclusions continue to stack up. The dozens of small businesses contacted by NTUF, and many others, are caught in a destructive trade contest, with the costs and burdens borne heavily by everyday American businesses.

The tariffs targeting imports from China are shouldered squarely by small American businesses. Two- and three-employee companies have been forced to put aside dozens of additional working hours to comply with USTR application policy, only to be left in suspense for months, or worse, arbitrarily denied. If the aim of US trade policy is to provide opportunity and prosperity for American businesses, tariffs with little flexibility to seek exclusion serve only to stifle progress and innovation. It is time to end the “Infinity Trade War”.