(pdf)

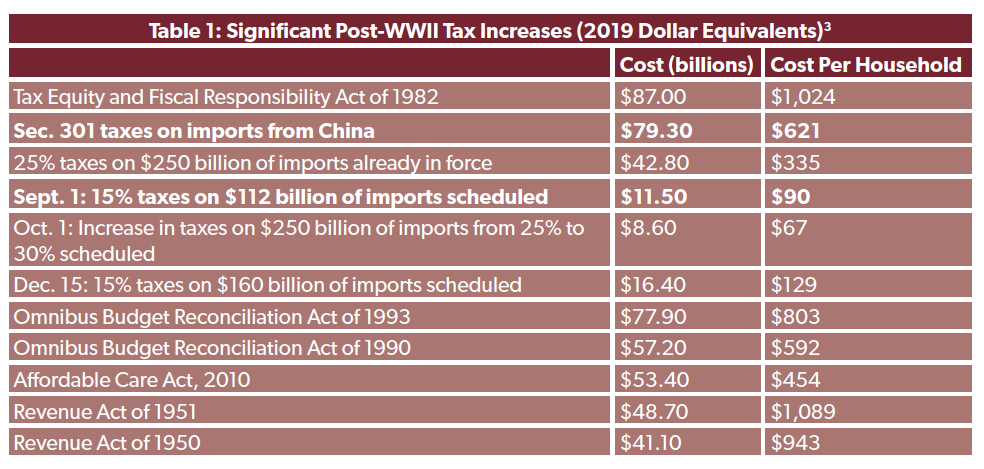

The newest trade taxes imposed on imports from China under Section 301 of the Trade Act of 1974 take effect on September 1. When added to previously imposed trade taxes, along with additional tariffs scheduled to hit on October 1 and December 15, these actions will cost the average American household $621 a year in new taxes.

If imports remain at current levels, the average cost per household will be about $908. But the value of goods coming from China is likely to fall as families put off purchases of tariffed shoes, clothing, and electronic goods due to their inflated after-tax cost. For example, imported sweaters and sweatshirts made from man-made fiber currently are currently taxed at a rate of up to 32 percent. Starting September 1, just in time for fall, the tax on sweaters and sweatshirts from China will increase to as much as 47 percent.

In addition, the U.S. tariffs may cause companies currently producing in China to relocate to Vietnam and other countries where it was more expensive to operate prior to the tariffs. This would also increase costs for Americans but reduce revenue generated by taxes on Chinese-made goods.

Tariff exclusions granted by the government for selected products will also reduce the overall tax cost.

Infinity Tariffs

Estimates of the tax impact per household are based on a 31.5-percent reduction in imports from China, based on research on the impact of tariffs imposed in 2018. The tax cost is only a partial measure of the overall cost inflicted by tariffs. At some point, high U.S. tariffs render imports uncompetitive, essentially blocking them from our market. Upcoming 30-percent tariffs would be effectively prohibitive - an “infinity” tariff rate - for some products that Americans import from China.

Similarly, as Trump administration tariffs increase, the value of imports will fall as tariffs approach an effective rate of infinity. The tax cost to households will fall toward zero because “zero imports” means “zero tariff revenue.” However, it does not mean zero costs for American families and businesses.

U.S. Congressional Budget Office on Tariff Costs

The U.S. Congressional Budget Office (CBO) recently identified three ways the Trump administration’s tariffs are costly for Americans:

They reduce the purchasing power of U.S. consumers and businesses.

They increase uncertainty, leading businesses to delay or forgo new investments, or to make expensive changes to their supply chains.

They prompt retaliatory tariffs and reduce exports.

According to CBO, tariffs will reduce real GDP by 0.3 percent, or about $58 billion in 2020. This would amount to lopping off Maine or North Dakota from the U.S. economy.

The CBO report actually understates the cost of tariffs, because since it was released new tariffs have been announced by the United States and China that will raise the cost for consumers and businesses even higher.

End the Infinity War

When it comes to trade policy, the Trump administration is in a hole that it keeps digging deeper. A good first step would be to stop digging by imposing a moratorium on any new taxes, including tariffs, that weaken the U.S. economy.

Even better, the White House should remove its ineffective and self-destructive tariffs. In The Art of the Deal, President Trump wrote: “I also protect myself by being flexible. I never get too attached to one deal or one approach.” It’s time for him to apply that flexibility to his tariff policies.