As Congress considers the debt ceiling deal, lawmakers should be mindful of a Government Accountability Office’s (GAO) report to Congress, titled “The Nation’s Fiscal Health.” Published earlier this month, the report begins with a stark warning about the federal debt: “The federal government faces an unsustainable long-term fiscal future.”

The annual fiscal health report examines the future fiscal path of the federal government by running a 75-year simulation, extrapolating current policies for revenue and program spending into the future. GAO’s model is based on 10-year and 30-year economic and fiscal projections by the Congressional Budget Office (CBO), 75-year projections by the Board of Trustees for Social Security and Medicare, and the 75-year fiscal projections developed by the Office of Management and Budget and Treasury. GAO uses these sources to project ratios of the deficit and debt to GDP over the time period.

The analyses made by Treasury, CBO, and GAO project the long-term fiscal outlook using different budgetary and economic assumptions. However, the findings of these projections are generally the same: the debt held by the public will soon reach historical highs and continue to grow.

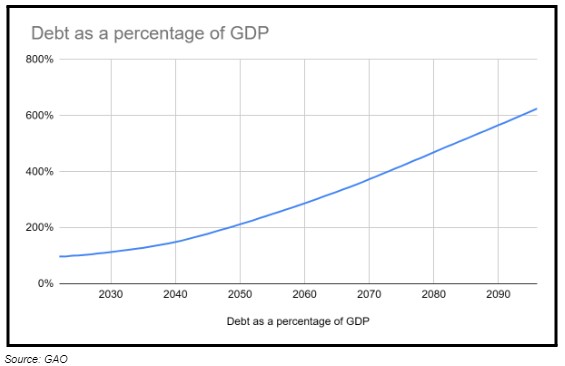

The debt was about 97 percent of GDP at the end of the fiscal year 2022. According to GAO’s simulation, it is on track to reach a historical high of 106 percent of GDP by 2029 and would rise to 212% by 2050. Without any change, GAO estimates that the debt will reach 625% of GDP in 2096.

The deficit for the fiscal year 2022 was $1.4 trillion, which makes it the fourth largest in U.S. history in nominal terms after 2021, 2020, and 2009, the report says. Even though higher tax revenues and lower pandemic-related spending led to a 50 percent decline from the 2021 deficit level, the debt still rose by $2 trillion, reaching $24.2 trillion. This is partly due to a 35 percent rise in the costs to service the national debt.

If nothing is done to reduce the future deficits, the debt burden will become unbearable, triggering a vicious circle of growing deficits and higher costs to finance the debt. In 2022, 9.7% of the federal government revenue was net interest spending. In GAO’s projection, these costs will consume over a quarter of the federal budget in 30 years, and nearly half of all spending in 75 years.

GAO sounds the alarm on a potential fiscal crisis where the investors lose confidence in the government’s ability to manage the budget as interest rates climb. Borrowing money would be more expensive for the government, slowing down economic growth and reducing the living standard of future generations.

This is what GAO projects for the future if the government does not change its fiscal path. While the revenue would be stable over the 30 years to come, both the primary deficit and interest rates would grow, increasing the budget deficit substantially.

Some of the primary contributors to the growing deficit are spending on Social Security, federal healthcare programs, and all other federal program spending, which would reach 6.1 percent of GDP by 2051, compared to 2.9 percent in 2019 (before the COVID-19 pandemic). The trust funds of the country's two main spending programs, Social Security and Medicare Part A, are expected to be insolvent in 2033 and 2031, respectively. This is the consequence of an aging population as the Baby Boomer generation became eligible for retirement benefits, and more expensive health care.

The costs to service the federal debt are also projected to consume a greater share of federal revenues, rising from about 9.7 percent of revenue in 2022 to 48.4 percent of revenue in 2051, and reaching 141.4 percent of revenue in 2096. This will result from a combined effect between the accumulated debt, the future deficit, and projected average interest rate. The higher these are, the fewer private investments take place than would have happened had interest rates remained low, directly impacting economic growth. The report notes that primary spending reflects “policy decisions, whereas net interest spending reflects the consequences of those prior policy decisions.” In order to limit the interest rate growth, lawmakers must reduce spending.

The GAO report makes it clear that actions are urgently needed to promote fiscal sustainability. GAO proposes to redesign fiscal rules to help manage debt setting spending and revenues to meet a debt-to-GDP ratio target. Assessing the drivers of the primary deficit are also important, such as the mandatory and discretionary spending. Finally, the report recommends consideration of alternative approaches to the debt limit, in order to not disrupt the financial market and to not raise borrowing costs. For example, GAO suggests that the debt limit could be set by Congress annually in the budget resolution. An improved version of the 2011’s Budget Control Act, detailed here, would be a good basis for beginning to address the national debt. The National Taxpayers Union Foundation and U.S. Public Interest Research Groups also identified bipartisan areas of agreement on spending cuts, as laid out in the “Common Ground'' report that identified $797 billion in spending reductions over the next decade.

Congress’s priority should be to address the deficit now before reform becomes more difficult and expensive. Without appropriate reform, future generations will suffer from our unwillingness to act.