No interstate migration data is as detailed and useful as that which the IRS releases. The IRS data is comprehensive, covers the movements of all taxpayers, can be broken down by state/county, age group, income level, and so on.

The main downside of the IRS data is that it comes from the IRS, so it is usually about three or four years behind. The latest data we have to work with from the IRS covers changes in where taxpayers lived between 2020 and 2021, which may lead some to wonder whether the IRS data is showing trends that have since shifted.

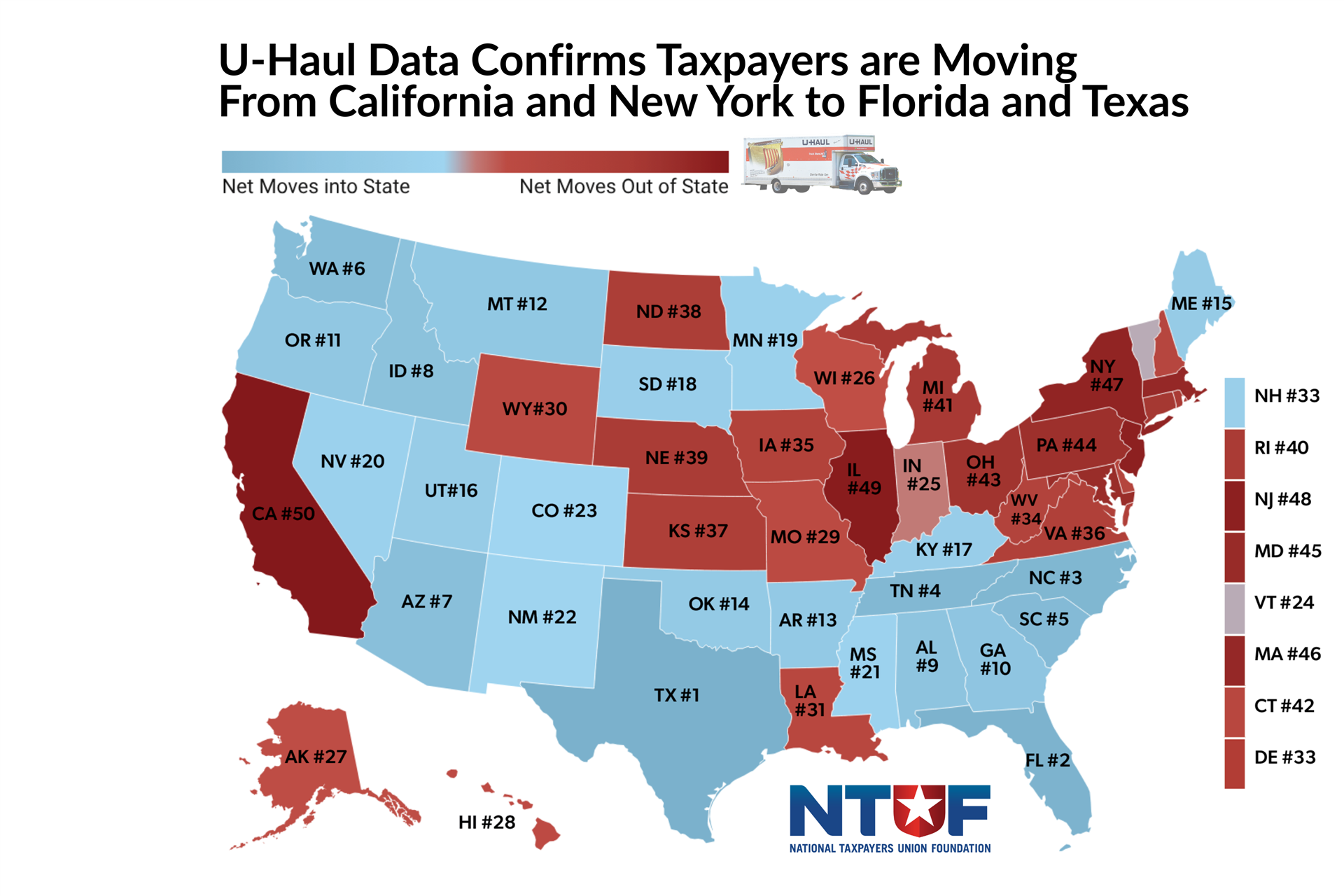

Evidently not. A recent report by U-Haul, showing where U-Haul customers rented trucks or moving containers and where they dropped those U-Haul products off, shows much the same trends as those shown by the IRS: taxpayer migration away from high-tax states and into low-tax states. The top 5 migration winner states on the U-Haul report are Texas, Florida, North Carolina, and South Carolina. The bottom 5 states are California, followed by Illinois, New Jersey, New York, and Massachusetts. It’s the same groups of 5 states on the top and bottom as in the latest IRS data, albeit in slightly different orders.

The full list:

High-tax states hoping that the latest IRS data is nothing more than a pandemic-era blip should disabuse themselves of that notion. These trends are here to stay, and their taxpayers aren’t.