The biggest scare that American taxpayers have to deal with on Halloween every year is not from teenage trick-or-treaters but from the U.S. government’s sugar program, which dupes Americans into paying more for our Halloween candy than the rest of the world. The scheme dates back to the Sugar Act of 1937, which was enacted as an emergency measure during the Great Depression. But eighty years later, consumers are still paying this hidden tax on treats.

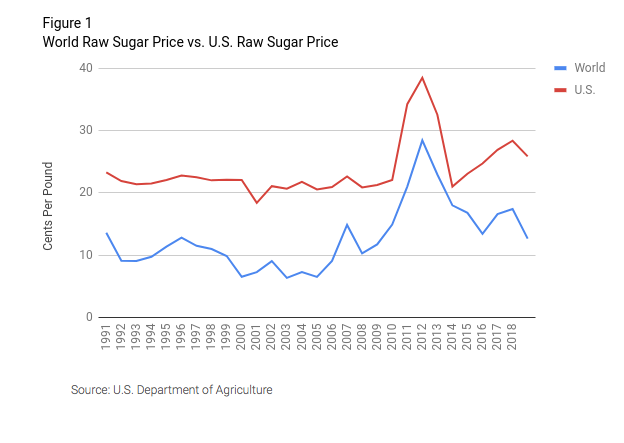

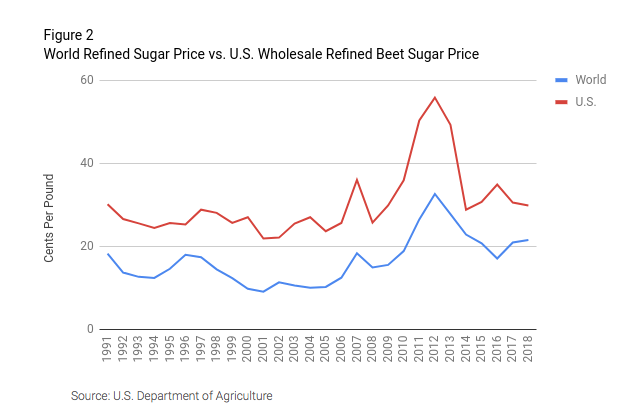

The sugar program caps the quantity of sugar Americans can buy from foreign producers and imposes a prohibitive tariff on any purchases above this cap. This results in a tax on retail candy that inflates costs for consumers. The most recent Department of Agriculture data shows that Americans pay nearly 2.5 times more than the average world price for raw sugar. In September, the world price for raw sugar stood at 10.78 cents/pound compared to 25.40 cents/pound in the United States, in line with historical trends. (Figure 1&2).

To avoid the higher productions costs resulting from the sugar program, some manufacturers of sugary treats have moved their factories outside the United States. Hershey did that by relocating their Oakdale, CA plant to Mexico. Atkinson Candy Co., a Texas-based candy manufacturer, had to move a majority of its peppermint candy production to Guatemala. “It’s a damn shame,” President Eric Atkinson told The Wall Street Journal.

Over the years, Congress has made an effort to reform the sugar program. The Sugar Policy Modernization Act (H.R. 4265/S. 2086) is the most recent proposal towards a more market-oriented policy. Still, sugar reform has a long way to go, as proponents of the sugar program have managed to block the Sugar Policy Modernization Act and other reforms. So far this year, the sugar industry has spent $9.78 million in federal lobbying, compared to $17.76 million in combined lobbying expenditures by crop production and processing companies. Sugar accounts for more than half of the lobbying expenses for the entire crop production and basic processing sector, and the result of these lobbying efforts is that the domestic sugar industry continues to receive government protection from competition.

Every industry and sector of the economy has a right to lobby for its own interests. Yet it is indisputable that compared to agriculture as a whole, the sugar industry has an outsized lobbying presence. Even though sugar represents 1.36 percent of the value of all crop production, it represents roughly a 55 percent share of crop production lobbying and 9.66 percent of agribusiness lobbying money.

The sugar program has favored a small group of politically connected businesses over consumers and taxpayers for too long. It’s time to stop the protectionist ghost from playing tricks on taxpayers’ wallets.