(pdf)

Introduction

The Congressional Budget Office (CBO) released an update of the budget outlook since January, and estimates that this year the government will run a deficit of $896 billion. The slightly good news is that this is $1 billion less than its estimate from January. The bad news is that the ten-year outlook shows total deficits of $11.4 trillion, with mandatory programs on track to grow by 40 percent. Under a more realistic baseline with policies not included in the official projection, deficits can be expected to rise even higher.

The Republican Study Committee (RSC) has introduced a new budget blueprint to tackle the deficit problem head on and set a path to balance in six years. The plan reins in out-of-control spending while also providing for permanence of the individual income tax cuts in the 2017 tax reform law. Over the decade, total spending would be $12 trillion lower than CBO’s official baseline. This presents a stark contrast to the budget that had been proposed by the Chairman of the House Budget Committee to blow through the remaining budget caps and add $2 trillion in new spending over the decade.

Tax Reform in the RSC Budget

Because of Senate rules, the individual income tax reductions passed in the Tax Cuts and Jobs Act of 2017 (TCJA) are set to expire after 2025. The RSC’s budget would make them permanent and lower the tax rates in the first two brackets from 10 and 12 percent to 9.5 and 11 percent, respectively. Additional reforms include:

eliminating marriage penalties in tax law;

consolidating and reforming the Earned Income Tax Credit and the Additional Child Tax Credit to encourage labor force participation;

eliminating the Affordable Care Act taxes;

permanently eliminating the estate tax, which imposes a hefty compliance burden relative to the amount of revenues it raises; and,

creating Universal Savings Accounts, “allowing Americans to invest up to $10,000 a year without double taxation.”

Budgetary Impact of the Tax Reforms

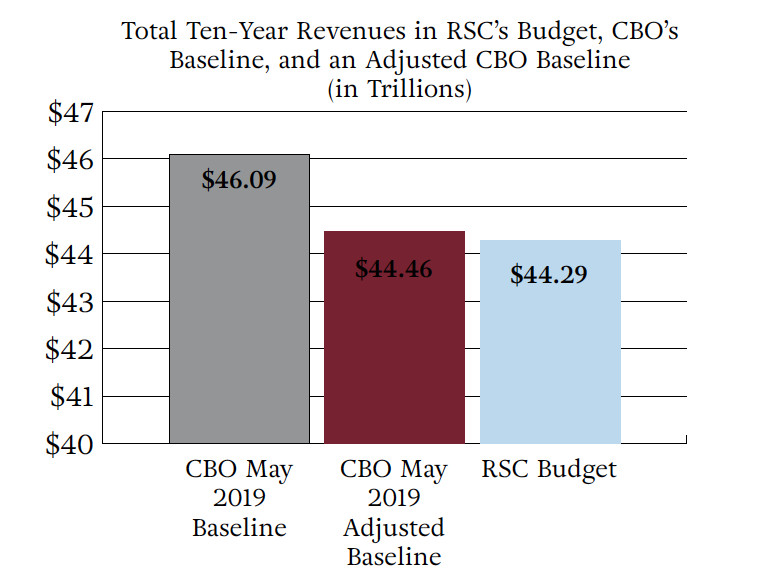

CBO’s May 2019 budget outlook projects that the government will rake in over $46 trillion in tax revenues over the next decade. RSC’s budget plan would collect $44.29 trillion—$1.8 trillion less than in the official baseline. However, this figure is roughly in line with revenue forecasts using a more realistic baseline with assumptions that takes into account likely policies that will be enacted.

CBO is required to construct the official baseline using current-law policies, so it includes the scheduled expiration of the TCJA’s tax cuts. Recent history of similar “temporary” tax cuts passed using the same procedure as the TCJA were eventually extended. To its credit, CBO ran some numbers with an alternative assumptions (xls) that includes extension of many of the TCJA’s provisions. This “unofficial” outlook shows $44.46 trillion in revenues over the decade.

Spending Levels in the RSC Budget vs. the Baseline

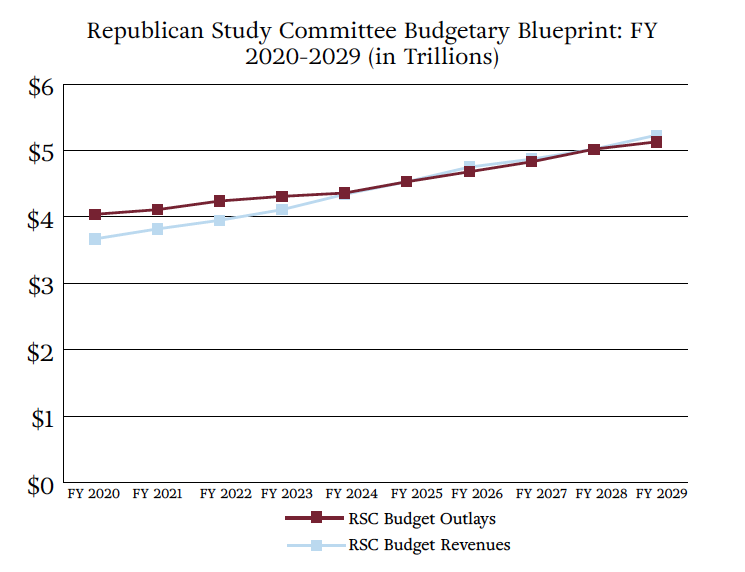

Drafting a ten-year spending plan based on CBO’s official yet inadequate revenue baseline would still be expected fall short of balance because of the policies not included in the forecast. The RSC’s projected receipts are in line with a more realistic view of CBO’s current outlook and would achieve balance in six years.

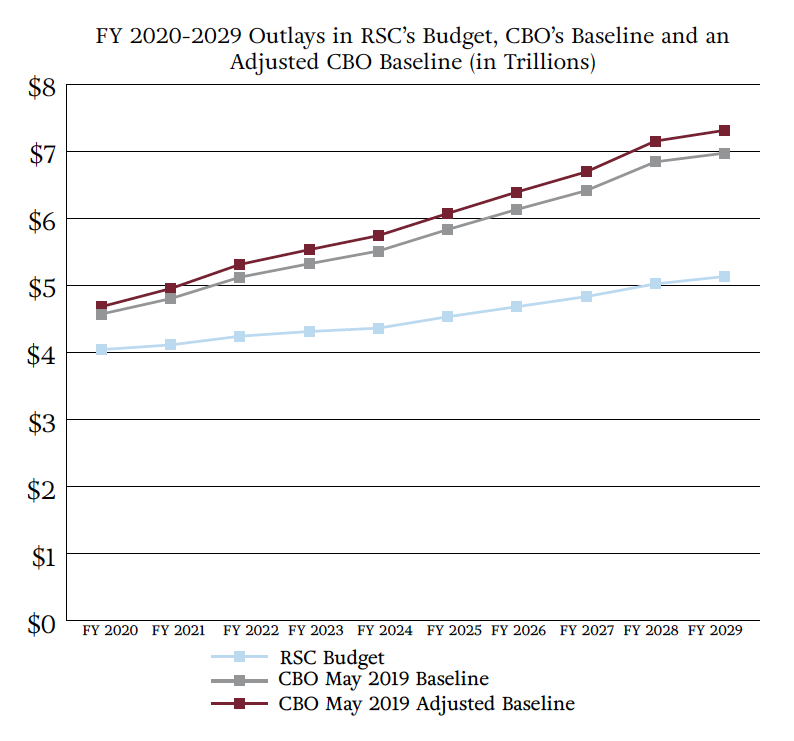

According to the latest estimates, the government is on track to spend $4.41 trillion this year. Under CBO’s official baseline, spending will increase by $267 billion per year from $4.57 trillion in 2020 reaching $6.97 trillion in 2029. However, this fails to account for spending policies that are expected to occur. For example, there is an effort underway among Congressional leaders and the White House to wipe out spending caps to accommodate higher spending levels. The Budget Control Act of 2011 set discretionary spending caps through FY 2021. Although lawmakers have repeatedly voted to override these limits (allowing for $439 billion in additional spending so far) CBO’s official projection cannot factor in the higher spending that would result from erasing the remaining caps.

Under an alternative scenario produced by CBO, which assumes that discretionary spending grows at the rate of inflation instead of being limited by the remaining statutory budget caps, outlays will total $4.68 trillion in FY 2020 and rise to $7.31 trillion in FY 2029, growing annually by $293 billion.

The RSC’s budget would immediately hit the brakes on spending by preserving the spending caps for next year. Outlays would be rolled back to $4.04 trillion in FY 2020, a $364 billion reduction from this year’s expected levels. Spending would then grow by $121 billion annually, topping $5 trillion in FY 2029. The budget would be balanced starting in FY 2025 and the ten-year deficit total would amount to $948 billion – a dramatic turnaround from the $15.4 trillion deficit under the adjusted baseline.

Spending Reforms in the RSC’s Budget

The blueprint contains a number of specific and needed reforms to eliminate the budget gap. The most important policies would reform runaway spending through entitlement programs. The blueprint would repeal the Affordable Care Act (ACA) and increase competition in the health insurance market by allowing the purchase of health insurance across state lines and equalizing the tax treatment of health insurance provided by employers and insurance purchased by an individual. ACA, Medicaid, and the Children’s Health Insurance Program would be rolled into block grants, reducing administrative overhead and allowing states to tailor programs to suit the needs of their respective populations.

The Medicare Hospital Insurance Trust Fund will only be able to pay full benefits through 2026 when it becomes insolvent. The RSC would improve Medicare’s fiscal outlook by increasing choices within the program in line with the way the Medicare Prescription Drug program has been able to contain costs. The plan also phases in means-testing to ensure that the program serves those who truly need assistance and it raises the age of eligibility in alignment with the retirement age for Social Security.

Social Security is also headed for insolvency. Starting next year, its costs will exceed its revenues, and the trust fund will be drained by 2035. The RSC plan would link retirement ages to life expectancy and implement a more accurate cost-of-living adjustment formula. It would also encourage proposals that allow individuals and employers to redirect a portion of payroll taxes to invest in private retirement options.

The blueprint also includes reforms to the budgetary process that would encourage Congress to step up its oversight responsibilities. It would direct that several programs that currently receive mandatory funding, which puts them essentially on auto-pilot, be converted into discretionary programs. The plan would also limit funding for programs that are unauthorized. CBO identified $307 billion in FY 2019 appropriations for programs whose authorizations have expired. And a permanent ban on earmarks would help ensure that grant funding decisions are made on the basis of merit, not political connections.

Improving Scorekeeping

As noted above, the official “current-law” baseline underestimates the size of deficits that will occur. NTUF routinely calculates a more realistic baseline in order to correct obvious oversights in the official projection of long-term deficits. It is also important to ensure that the baseline is as accurate as possible because it is the yardstick that is used to measure the impact of legislation being considered in Congress. Under “pay as you go” budgeting rules, certain proposals that increase the deficit through either spending increases or revenue decreases must be offset.

To address baseline issues, the RSC budget would adopt zero-baseline budgeting to discretionary spending. Currently CBO is required to inflation-adjust such programs’ most recent appropriation, baking automatic spending increases into the baseline. It would also make changes in the assumptions used in the current-law baseline regarding unfunded entitlement program liabilities.

The proposal also makes fixes to improve the accuracy, transparency, and availability of cost estimates, including:

requiring CBO to include projected debt service costs in its cost estimates;

using fair-value accounting to disclose the real market risk of federal loan and insurance programs;

increasing transparency of the methodology and models used to score, while also protecting proprietary data that CBO uses; and

requiring that Congress reauthorize new mandatory spending when actual spending exceeds CBO’s cost estimate by a certain percentage.

Conclusion

Under the official baseline, federal debt held by the public will amount to 92 percent of GDP in 2029 – the highest level seen since just after World War II. A new report from the Mercatus Center warns that the U.S.’s high debt level is not just a looming threat on the horizon, but that it is already impacting the economy by reducing the rate of growth. The RSC would address this problem immediately with specific reforms, although further savings could be achieved by restraining the growth in defense and homeland security spending enabled in the plan. The path set out by the RSC’s ambitious budget blueprint would lock in tax cuts, promote economic growth, put the brakes on runaway spending, and correct the long-term fiscal imbalances.