(pdf)

Introduction

The Republican Study Committee (RSC) recently released its budget vision, the Blueprint to Save America, which includes a package of reforms to the budget process and lays out a plan to balance the budget. Included among the recommendations in the 122-page document are options to improve the operation of the Congressional Budget Office (CBO), an agency that plays a pivotal role in the policy making process through its fiscal analysis and cost estimates of proposals. The RSC would implement many changes that NTUF has recommended to make sure that lawmakers and the public have access to estimates that are as accurate as possible.

Scorekeeping Reforms for the Congressional Budget Office

CBO exists at the heart of the policymaking process in the nation’s capital. As Congress’s budget forecasting and scorekeeping agency, it completes hundreds of formal cost estimates every year, and on top of that it responds to numerous requests from lawmakers for the potential fiscal impact of proposals that are still in the drafting stage. CBO’s impact extends beyond the halls of Congress as well — reporters rely heavily on CBO’s budget impact projections when determining how to frame legislation, as seen in coverage of a recently passed law as “paid for” despite the blatant use of a budget gimmick.

In the course of producing its cost estimates, CBO’s analysts occasionally make assumptions some experts disagree with. However, it is more often the case that concerns about its budget estimates stem from the rules it operates under as designed by Congress. When drafting legislation, all too often members will take advantage of these rules and craft their legislation to obtain favorable estimates.

The RSC’s blueprint includes several reforms that would improve CBO’s cost estimates by either having CBO include additional information in its analyses or by revising the baseline to provide for more realistic budget data.

Dynamic Scoring: The RSC would restore dynamic scoring that assesses the macroeconomic impact analysis of major proposals, a critical tool that helps lawmakers understand how economic behavior will respond to changes in policy. For example, under the current static analysis used by CBO and the Joint Committee on Taxation, reducing marginal income tax rates would lower tax revenues. A dynamic score would also look at how the lower rate would enable further investment and economic growth, which could potentially offset a portion of the foregone revenues. Democrats sought to include a dynamic score of the new spending in the Build Back Better Act to show that federal spending on infrastructure would have a positive impact on economic activity.

The RSC plan would restore a previous House rule to have CBO conduct dynamic analysis of revenue and mandatory spending in proposals that would have a budgetary impact of at least 0.25 percent of GDP, equal to about $62 billion 2022.

Account for Debt Service Costs: The RSC budget would implement Rep. Michael Cloud’s (R-TX) Cost Estimates Improvement Act, a bill to require the CBO to include the projected debt service costs in its legislative cost estimates. It is an oversight that CBO is not already required to provide this data to show the full fiscal impact of proposals.

CBO Director Phillip Swagel recently confirmed that this proposal could be implemented with few additional resources. CBO’s most recent budget outlook notes a general rule of thumb that a $100 million increase in the FY 2023 deficit would also incur $27 million in debt interest payments over the decade. It also published an interactive workbook where users can see how changes in revenue and spending would impact deficits, debt service costs, and the debt. While these tools are useful for budget transparency, there is little reason why this information should not be directly included in cost estimates.

Cloud’s bill would also improve cost estimates by requiring CBO to report on duplicate, fragmented, or overlapping programs in its cost estimates. The Government Accountability Office produces an annual report listing these types of programs that CBO could use in this analysis. The long-sought completion of an inventory of all federal programs would also help identify overlapping functions across the vast federal bureaucracy.

Better Accounting for the Risk of Federal Credit Programs: In addition to issuing spending through grants and entitlement programs, the federal government also issues loans and loan guarantees, putting taxpayers on the hook if the lender defaults on the repayments (or when lawmakers decide to forgive loans owed to taxpayers).

Unfortunately, the method that Congress requires CBO to score the government’s credit activities understates the risk of default. The RSC budget would implement fair value accounting to allow CBO to officially report the real cost of the loans.

Instead of factoring the risk based on the risk premium associated with Treasury securities, the fair-value accounting method uses a market-based discount rate that private institutions use. As part of its goal to be transparent and provide objective, impartial analysis, CBO regularly reports on loan activities using both methods. In the newest release, the official scoring method makes it looks as though all of the government’s loan expenditures next year would actually have a positive return over their lifetimes as loans are paid back with interest, netting $41 billion in savings. But when accounting for market risk of default, the outlook is much less rosy. Instead of savings, taxpayers end up losing $51 billion.

Include Confidence Intervals in Cost Estimates: The RSC would also require CBO to publish confidence intervals in its findings that would assess the likelihood of the outcomes presented in its analysis. This data would be a useful way to gauge the level of uncertainty in complex policy proposals.

Trust Funds Reform: When producing its baseline projection, CBO assumes that entitlement programs including Social Security and Medicare are fully funded, even as their trust funds deplete in coming years. The RSC budget would require that transfers from the general fund into the trust funds to cover these shortfalls are counted as new spending. It would also require CBO to show how any future legislation pertaining to these trust funds would change their long-term unfunded liabilities.

Improve Transparency and Accountability for Unfunded Mandates: Laws enacted by Congress can also impose uncompensated burdens on individuals, businesses, or state and local governments through mandates, defined by CBO as “requirements for or prohibitions against certain activities.” If the cost of intergovernmental mandates in a proposal exceeds a threshold ($85 million in 2021, adjusted annually for inflation), a point of order can be raised to stop consideration of the legislation.

The RSC budget proposal would adopt Rep. Virginia Foxx’s (R-VA) Unfunded Mandates Information and Transparency Act, which would improve reporting of unfunded mandates by extending reporting requirements to fifteen independent agencies that were excluded from the original law. These include powerful regulators such as the Securities and Exchange Commission, the Federal Communications Commission, and the Federal Deposit Insurance Corporation. The proposal would also strengthen enforcement by creating a point of order against proposals private sector mandates, another odd oversight in the original law.

Other CBO reforms in the RSC plan would help strengthen budget discipline and boost transparency.

Require Reauthorization when a CBO Estimate is Inaccurate: Projecting cost estimates for complex legislation generally entails a degree of uncertainty which increases the greater the time period of the estimate. The RSC budget would trigger a reauthorization vote for mandatory spending programs when actual outlays exceed CBO’s estimate by a certain percentage. Entitlement programs such as Social Security and Medicare which are funded through specific trust funds would be excluded from this rule.

Scorekeeping Transparency: CBO produces regular reports showing how recently enacted legislation has impacted budget totals. These reports are not posted on CBO’s website like its other publications but are instead shared directly with the House and Senate Budget Committees.

The Chairs of those committees are required by the Budget Act of 1974 to periodically update their respective chambers with scorekeeping reports based on this data. Unfortunately, the current chairs have gone for long periods of time in noncompliance with this basic statutory requirement. Senate Budget Committee Chair Sanders (I-VT) waited a whole year before making his first scorekeeping update. The RSC budget would make these CBO reports public.

The RSC would similarly require CBO to make its appropriations bills analyses publicly available. These reports display account-level detail of the budgetary effects of the proposals but are normally just distributed to “interested parties in the Congress.” This data should be made available for the general public.

Transparency from the Budget Scorers: CBO has made strides to improve its transparency but the CBO Show Your Work Act would take this a step further. The bill, introduced by Rep. Warren Davidson (R-OH) and Senator Mike Lee (R-UT) would boost CBO’s efforts to make available more of the underlying data and models used in its estimates.

Balanced Budget

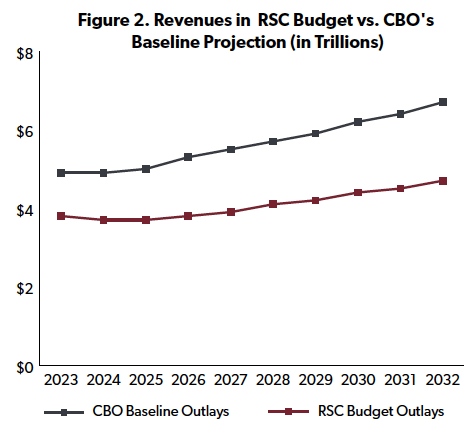

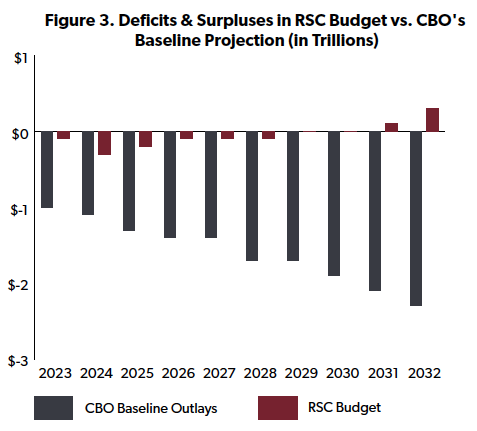

Under CBO’s baseline projection, the federal government is on track to collect $56.5 trillion in taxes over the next decade but spend $72.2 trillion, cumulatively growing the national debt by $15.7 trillion.

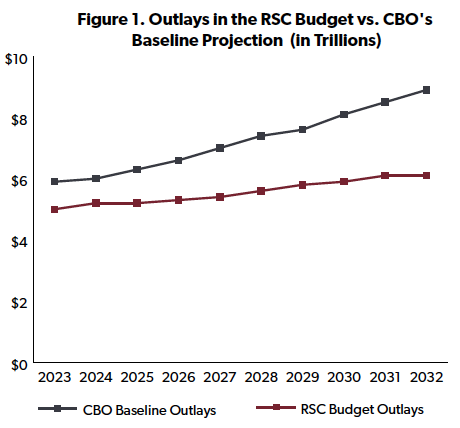

The RSC budget blueprint would seek to restore fiscal discipline, leading to a balanced budget. This would be accomplished by restraining the growth in outlays to 2.4 percent annually over the decade versus 4.8 percent under CBO’s current-law baseline.

The RSC would also have the government collect less in taxes and allow for the continuation of the individual income tax reforms in the Tax Cuts and Jobs Act of 2017 (TCJA), which are set to expire under current law. It would also include other pro-growth tax policies such as allowing businesses to deduct the full value of investments from their tax liability the year of the investment. As NTUF pointed out in 2017, full expensing reduces “the staggering complexity of tax treatment for business assets and encourage[s] increased investment that can fuel economic growth.”

Under the CBO baseline, annual deficits will significantly grow over the decade, adding trillions to the national debt. Under RSC’s budget, the combination of slower spending growth and pro-growth tax policies would set an alternative course for the budget, shrinking annual deficits and generating surpluses starting in 2029.

Conclusion

It is simply untenable for the federal government to continue to spend trillions more each year than it collects in taxes. While some argue that the solution is more tax increases, federal tax revenues have increased compared to pre-TCJA projections. Yet spending has increased even faster, and spending growth is expected to accelerate rapidly by the end of the decade.

Even if overspending was not so clearly the culprit, tax hikes would have a negative impact on the economy, pulling investment capital out of the productive private sector and impeding job creation. This is especially true at a time when so many families are facing increased costs for nearly everything because of inflation — a problem that only continues to worsen thanks to far too much government spending.

The RSC lays out a plan that would balance the budget by slowing the growth in spending while also allowing taxpayers to keep more of what they earn. As an added bonus, its CBO reforms would also help ensure that lawmakers and taxpayers alike have access to more realistic budget data.