Ahead of President Biden’s 2023 State of the Union address, one of his aides strongly rejected the idea of a bipartisan commission tasked with proposing reforms to Social Security and Medicare, calling it a “death panel.”

According to Bloomberg’s Jack Fitzpatrick, White House deputy press secretary Andrew Bates said of proposals like the bipartisan TRUST Act:

“The American people want more jobs and lower costs, not a death panel for Medicare and Social Security. … With the president poised to announce new plans to keep making our economy work from the bottom up and the middle out — not the top down — House Republicans are dead-set on the opposite.”

Bates is incorrect to label these proposals a “death panel.”

What is the TRUST Act?

The TRUST Act, legislation Bates appears to be referring to, would create a special committee to make recommendations that would address the long-term fiscal insolvency of Medicare – the program’s hospital insurance (HI) component in particular. The TRUST Act would also create commissions tasked with recommending reforms to correct the long-term insolvency of both Social Security and the Highway Trust Fund (HTF), which supports building and repair on the nation’s roads.

These special committees would feature equal representation from Democratic and Republican lawmakers, and any recommendations they made would still have to clear the House, 60 votes in the Senate, and be signed into law by the president.

Sens. Mitt Romney (R-UT) and Joe Manchin (D-WV) lead the legislation in the Senate, but it had nine Republican cosponsors, three Democratic cosponsors, and one Independent cosponsor in the last Congress. A nearly identical bill in the House has the support of 10 Republicans and four Democrats.

What Even is a “Death Panel”?

Bates appears to be drawing on a conservative criticism of the Affordable Care Act (ACA) during the Obama administration and its Independent Payment Advisory Board or IPAB.

IPAB, which was included in the ACA, would have consisted of “15 experts including doctors and patient advocates” nominated by the president to “recommend policies to Congress to help Medicare provide better care at lower costs.” It would be up to Congress whether or not to approve these recommendations, and IPAB was “specifically prohibited by law from recommending any policies that ration care, raise taxes, increase premiums or cost-sharing, [or] restrict benefits.” This was, to put it lightly, no small task.

Former Alaska governor Sarah Palin at that time called IPAB a “death panel” in a Facebook post that went viral. The term stuck, and eventually Congress ended IPAB before it really got off the ground.

Is This a Republican Proposal?

No. The TRUST Act is actually a strongly bipartisan proposal, and has been since it was first proposed in 2019.

Speaker McCarthy stated in February 2023 that “[c]uts to Medicare and Social Security are off the table.”

Why Do Some Say Social Security and Medicare Are in Need of Reform?

Unfortunately, Congress and the president do not have that much time to act before automatic, across-the-board cuts to both Medicare and Social Security take effect.

Social Security and Medicare Part A (which covers hospitalization costs for seniors) are both funded by federal payroll taxes, 12.4 percent of wages for Social Security and 2.9 percent of wages for Medicare split equally between a worker and their employer. Medicare Part A is also partially funded by deductibles, copays, and a monthly premium for a small portion of individuals. Federal payroll tax revenues are generally deposited into separate trust funds for Social Security (the Old-Age and Survivors Insurance or OASI Trust Fund and the Disability Insurance or DI Trust Fund) and Medicare (the Hospital Insurance or HI Trust Fund).

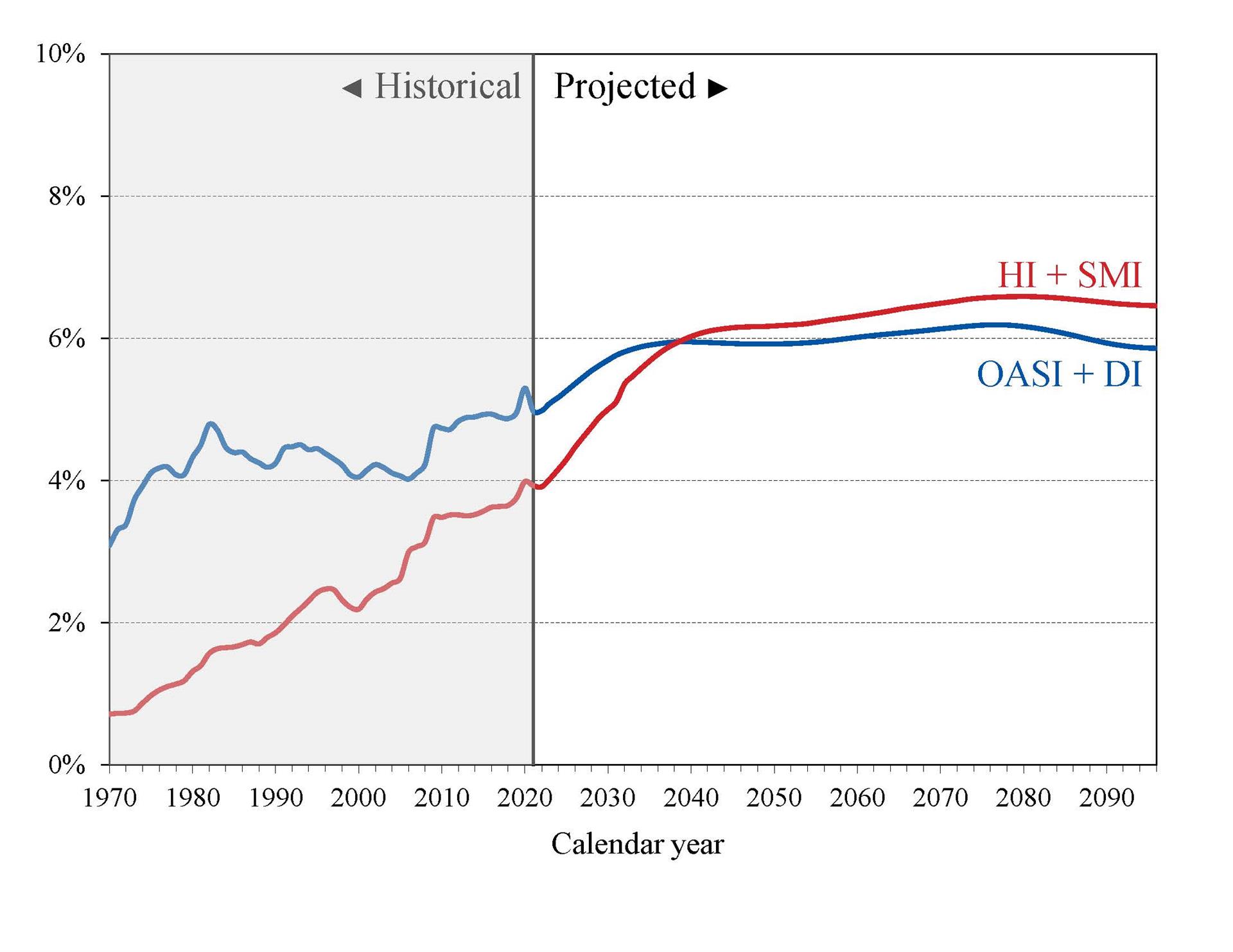

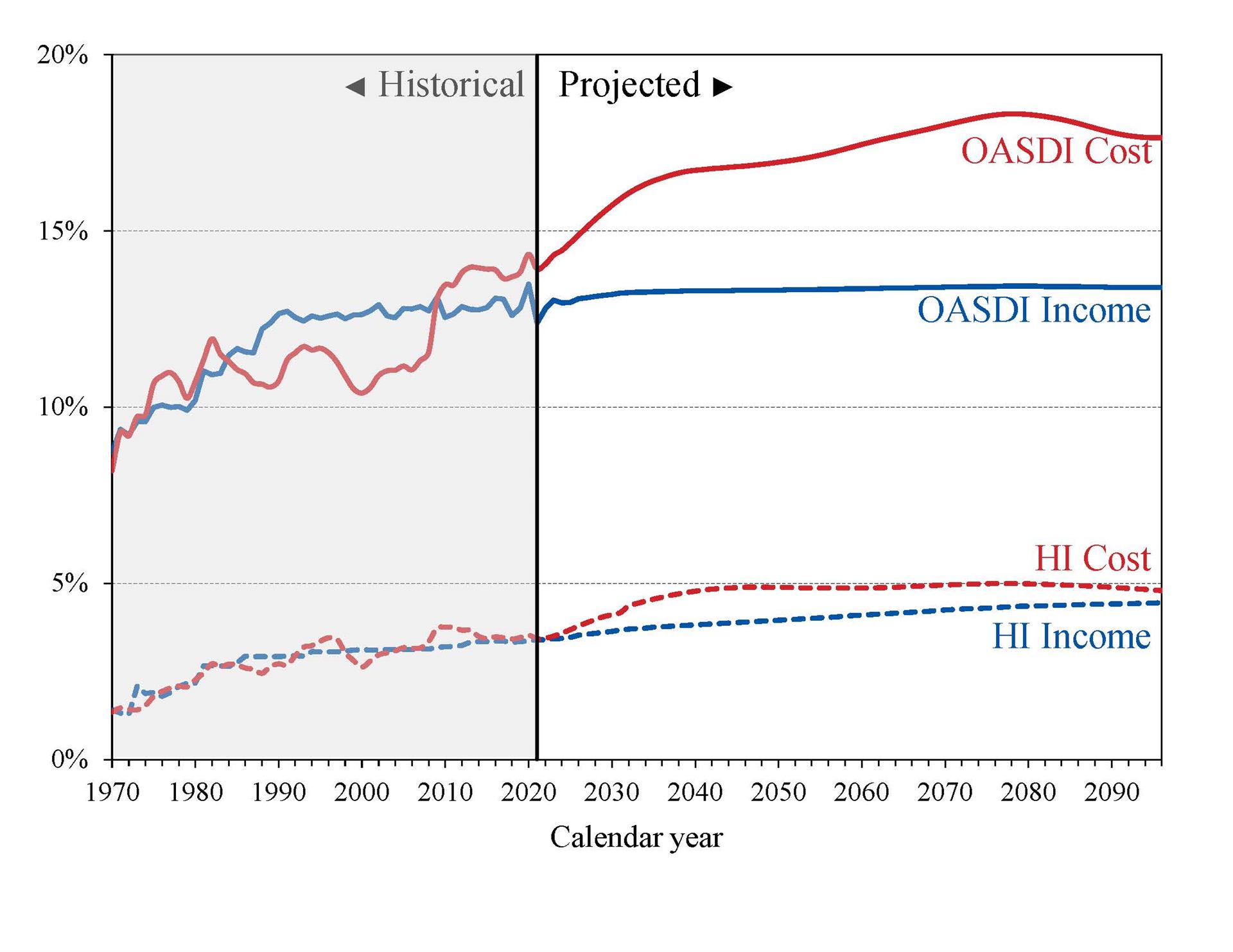

In recent years the costs of Social Security and Medicare Part A have not kept up with the payroll tax revenues funding the programs, as illustrated by the following chart from the Social Security and Medicare Boards of Trustees:

According to the Trustees, the combined OASI and DI trust funds are projected to be depleted in 2035 – just 12 years from now – and the HI Trust Fund will be depleted even sooner, in 2028.

When the trust funds for Social Security are depleted, the non-partisan Congressional Research Service (CRS) explains that the Social Security Administration would be forced into one of two scenarios:

“...either full benefit checks may be paid on a delayed schedule or reduced benefits would be paid on time. In either case, total payable benefits would be lower than scheduled benefits.”

This is a terrible scenario where either every retiree receives reduced benefits – as much as a 20 percent cut – or some retirees receive their full benefits while some receive nothing at all, based randomly on the day of the month they were born.

The Centers for Medicare and Medicaid Services (CMS) could be forced into a similar choice if and when the HI Trust Fund becomes insolvent in 2028, per CRS. The Trustees have also warned that:

“...in the event of HI trust fund insolvency, there could initially be delays in payments to plans and providers and, following soon after, beneficiary access to Part A services could ‘rapidly be curtailed.’”

Conclusion

Despite the characterization given by the White House deputy press secretary, the TRUST Act is a bipartisan proposal designed to forestall drastic cuts and put the Social Security, Medicare, and highway programs back to solvency. The TRUST Act is designed to build consensus and then have Congress vote on particular reforms – subject to a 60-vote majority in the Senate, meaning any changes have to be bipartisan. It is not a “death panel.”