The Congressional Budget Office’s (CBO) newest fiscal baseline paints a grim picture, with annual trillion-dollar deficits into the foreseeable future. The outlook will only worsen as the highest levels of inflation recorded in 40 years and rising interest rates will increase the already hefty costs of financing the federal debt.

Senator Mike Braun (R-IN) is offering a budget resolution for a Senate vote this week that lays out an alternative path to restrain the growth in spending, save taxpayers trillions of dollars, lock in the 2017 tax reform law’s expiring provisions, and move towards a balanced budget.

How the Plan Would Impact Spending

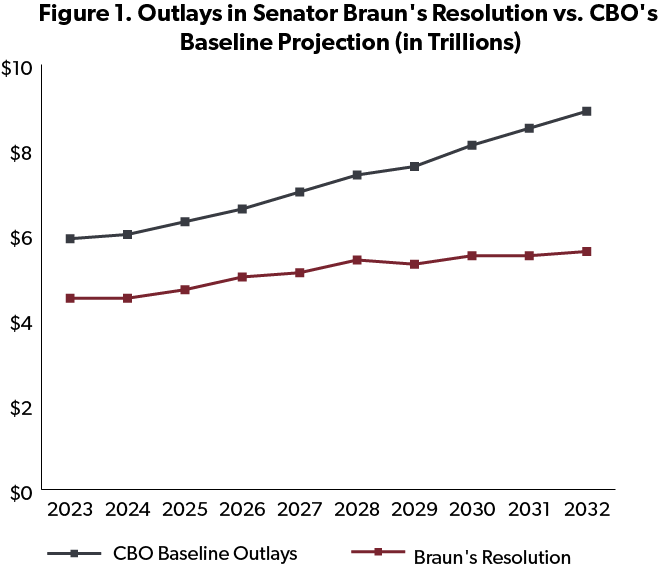

CBO’s baseline, which projects spending over the next ten years based on current law, foresees spending increasing at an annual rate of 5 percent. Outlays would grow from $5.9 trillion next year to $8.9 trillion in a decade. Braun’s resolution would modestly reduce spending levels in 2024 and then slow the annual growth of spending to 3 percent over the remaining years. Total spending would be $17 trillion less than CBO’s baseline.

By year ten, federal outlays would be capped at 17.5 percent of GDP, equal to the average of federal revenues over the past 50 years. Tying overall spending to the economy in this way would encourage lawmakers to develop pro-growth policies, such as preserving and extending the Tax Cuts and Jobs Act of 2017 (TCJA), which would be locked in under Braun's proposal. This tax reform helped fuel economic growth and increased take home pay for taxpayers across the income spectrum before the pandemic hit.

How the Plan Would Impact Revenues

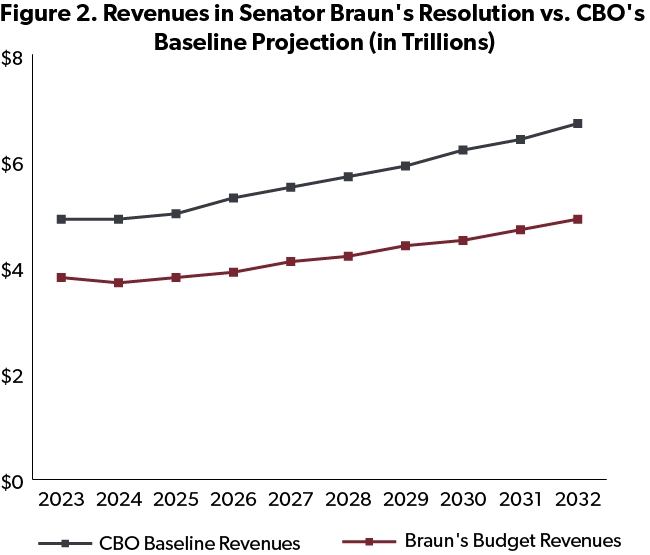

Under current law, many of the provisions in the TCJA are set to expire after 2025, including the individual income tax rate reductions, the expanded child tax credit, and full expensing for businesses. Braun’s plan would extend these provisions, allowing workers to keep more of what they earn and preventing a tax hike. Even with the revenue reductions relative to the CBO baseline, the proposal would reduce deficits by $6.5 trillion over the decade.

Additional Reforms

Braun's plan would also immediately cancel last year's reconciliation instructions, putting an end to the countless efforts to revive the trillion-dollar tax and spending splurge known as the "Build Back Better Act."

Senator Braun would also abolish earmarks again after the current Congress brought them back. Earmarks divert federal funds to specific pet projects, contributing to wasteful spending. Budget enforcement would also be strengthened with reforms including:

making it harder to waive points of order against provisions that breach established spending level,

cracking down on unfunded mandates that impose uncompensated burdens on the private sector or state and local governments, and

establishing a new point of order against budget resolutions that do not include a balanced budget.

Importantly, the Braun resolution would require CBO to conduct dynamic scores of major legislation to account for the macroeconomic feedback, providing lawmakers with better budget data showing the real world impact of Beltway policy proposals.

Conclusion

The government's current fiscal path is unsustainable. Braun’s budget blueprint would make for a far better “BBB” than Build Back Better, and NTUF applauds his proposal to plot a sensible course towards a balanced budget by restraining the growth in spending and protecting Americans from tax hikes.