(pdf)

Introduction

As part of the American Rescue Plan Act (ARPA) of 2021, Congress drastically reduced the reporting threshold for Form 1099-K. This far lower threshold will impact many more people who sell online on platforms like eBay, or who use apps like Venmo to transfer money to friends or family.

Before ARPA, the reporting requirement was triggered when a seller had an annual total of 200 transactions and a gross dollar amount of $20,000. ARPA dropped the threshold to just $600 per year, with no minimum number of transactions. This will create a deluge of new 1099-K forms distributed to the IRS and to taxpayers, even though many of the transactions reported on this form are not necessarily taxable.

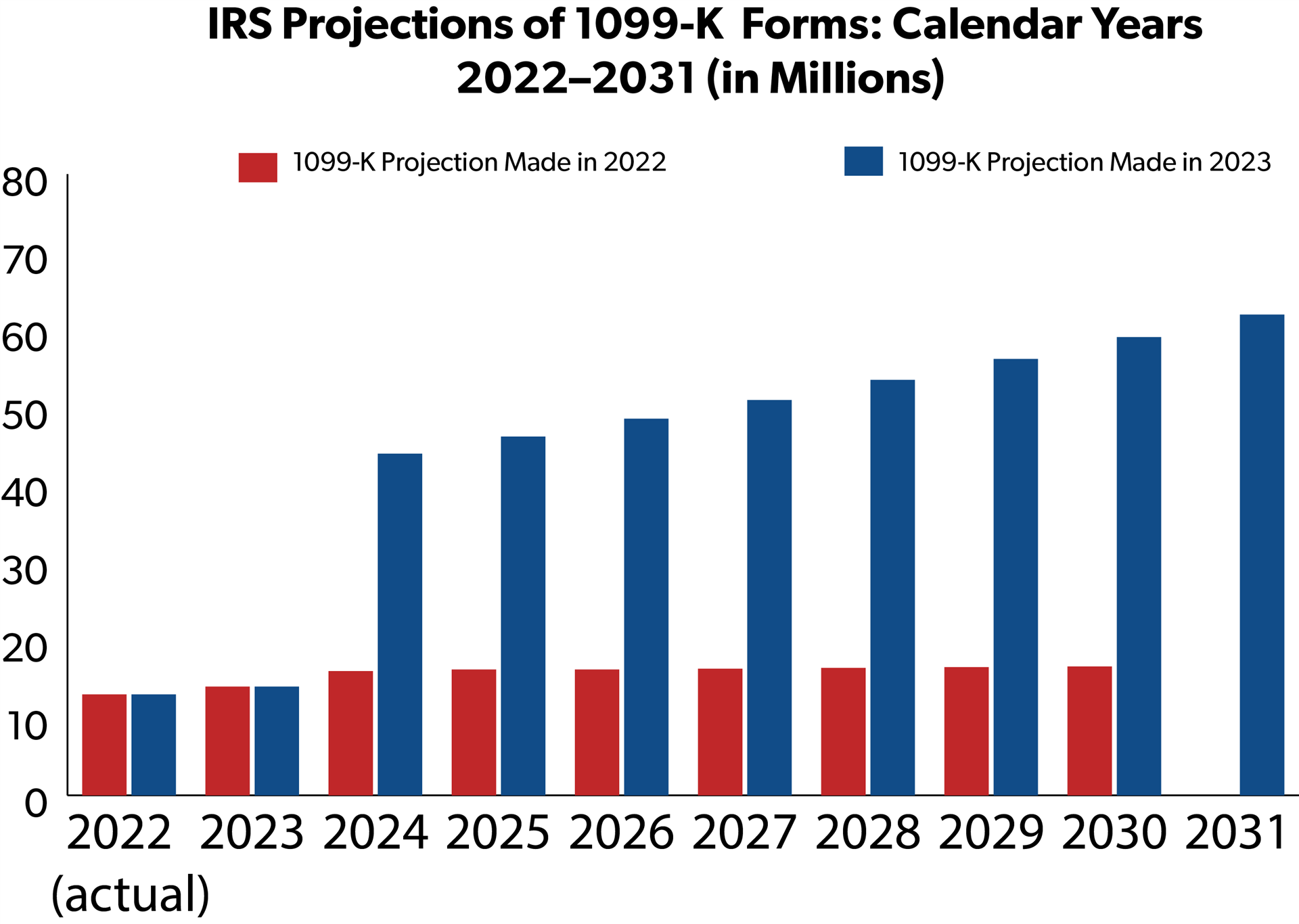

The IRS had previously estimated that 16 million 1099-Ks would be distributed in 2024. NTUF warned that this estimate vastly undercounted the number of people who stand to receive this form. The IRS has now dramatically revised its estimate to 44 million. While this could still be an underestimate based on the methodology provided by the IRS and compared to industry estimates, it is likely much closer to reality, and it should raise eyebrows on Capitol Hill for showing how many additional unsuspecting taxpayers will be impacted by ARPA's 1099-K reporting requirement.

The IRS has not yet updated the paperwork burden associated with this tax form, a calculation that is required for all forms under the Paperwork Reduction Act. In the meantime, all of the other concerns regarding the confusion and headaches associated with the 1099-K remain in place even after the IRS delayed implementation of the lower threshold until the 2024 tax filing season.

Background

The 1099-K form is used by credit card companies and third-party payment processors to report transactions that they process for businesses and individuals. The form is also used by online platforms that process payments. This includes services used by people who sell items online via websites like eBay or Etsy or the popular apps used to transfer money to friends or family in the course of splitting up a bill at a restaurant, for example.

When anyone using any of these platforms exceeds the $600 annual threshold of gross transactions, the payment processor will send them a copy of the 1099-K form and the IRS will also receive a copy. The form will contain the gross amount of all transactions. With the rise of online and cell phone apps, millions more people stand to get a 1099-K.

Massive Increase in New 1099-K Forms

Just how big will the deluge be? In its annual Publication 6961, the IRS projects the number of various forms it expects to receive over the next decade. The data for Form 1099-K shows that the IRS received 11,088,745 in 2021, 12,980,900 1099-Ks in 2022, and projected 14 million in 2023. Last year's report noted, "The requirement of a lower threshold will be enacted for tax returns for CY 2023, resulting in a significant increase in the projected numbers of 1099-K forms starting from CY 2024." Despite that statement, they had projected just 16 million 1099-Ks in 2024 (a 14 percent increase from 2023) with 1 percent annual increases to 16.6 million in 2030, the last year of that projection. In a report earlier this year, NTUF warned that the Internal Revenue Service (IRS) vastly underestimated the number of new 1099-K forms it expected to receive.

The IRS has now revised its 2024 estimate upward, from 16 million 1099-K forms to 44 million -- three times more than the estimate for 2023. Over the rest of the projection, the IRS now sees the number of 1099-Ks generated each year rising by 5 percent, reaching nearly 62 million in 2031.

In its brief explanation on how the estimate was revised, the IRS said, "The increase in the number of 1099-K returns is estimated to be about 28 million due to the lower threshold. This is solely based on the information provided by a few large filers and some states who had enacted a similar reduction in the filing threshold. We will update the numbers as more information becomes available in 2024."

Confusion Persists

The new official projection provides a clearer picture of just how many people will suffer undue headaches and confusion from the lower 1099-K threshold. ARPA's changes were supposed to have gone into effect for the 2023 tax season. However, due to the problems stirred up by the reduced threshold, the IRS delayed implementation until the 2024 tax season. The reasons that led to the previous delay remain unresolved as the new reporting deadline looms.

Some unsuspecting people may think they owe taxes for the gross amount listed. But this is not necessarily the case. Not all of the amount of a transaction will be taxable. If someone resells tickets online they would only be liable for the net gain and should take heed to save and organize all receipts.

Some transactions also might not be liable for taxes. For example, taxpayers reselling old goods online or paying a friend back for covering the bill for a meal are generally not engaging in taxable transactions, but they could still receive a 1099-K for the annual gross amount of those transactions anyway.

Last December, the IRS put out guidance to try and explain which transactions are taxable. They have also updated the guidance and created a frequently-asked questions page and an explainer page to try to address the influx of questions from tax preparers and practitioners. but recent media coverage indicates that confusion lingers. For example,

On September 17, 2023, Natasha Etzel of Motley Fool wrote, “This recent change could lead to double income reporting, which could cause errors and unnecessary stress during tax season. It could also result in non-business-owner taxpayers mistakenly receiving a tax form."

On September 23, 2023, a Wall Street Journal article on resales of Taylor Swift concert tickets reported, “For ticketing companies, the change has so far been a logistical and customer-relations headache. Ticket marketplaces like StubHub and TickPick are used to sending tax forms to professional ticket brokers, and those businesses are used to receiving them. For many individual sellers, the reporting ritual is new. … Users will have to rely on their own records to calculate what they paid for tickets and what they earned from reselling them.”

On September 26, 2023, Intuit published an article from a certified public accountant who warned, “With more people likely to receive the form this year, expect there to be some confusion about how and when to include amounts reported on Form 1099-K on your tax forms. While the answer might seem pretty straightforward, how it plays out on tax forms may not be so simple… The mixing of personal with business accounts can lead to many taxpayers needing to rely on their own records to file a correct tax return next season.”

IRS Commissioner Daniel Werfel told the Senate Finance Committee on April 19, 2023 that ARPA's 1099-K threshold was paused because the agency was "not ready to administer in a way that provides taxpayers the clarity they need." Later in that hearing he also said that the IRS would have a much easier time administering the threshold if it was changed.

Paperwork Burden Estimates

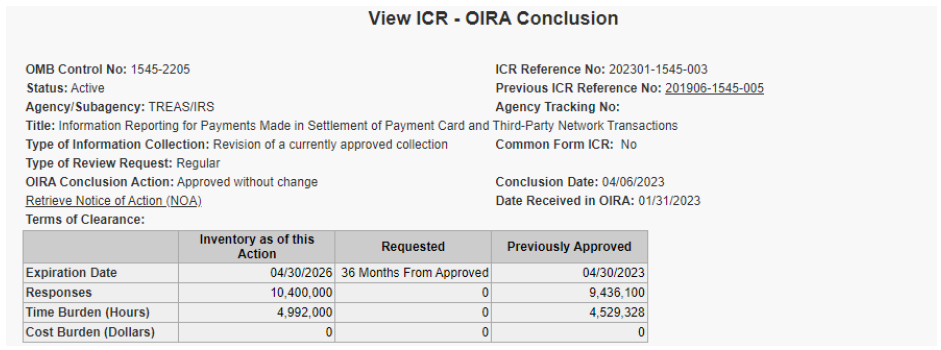

Another key metric is still missing: the IRS has not yet provided an estimate of the compliance burdens with the lower threshold. Under the federal Paperwork Reduction Act, federal agencies are supposed to calculate the time and out-of-pocket expense burden of all forms that the public is required to fill out. This information is published in a database managed by the Office of Information and Regulatory Affairs (OIRA).

The currently available calculation for the 1099-K is out of date. The Supporting Statement the IRS published in January 2023 shows an estimate of only 10.4 million forms. It does note that it takes the payment processing companies 28 minutes to complete each form. Using that time estimate and the new Publication 6961 estimate of 44 million forms in 2024, it will take 20.5 million hours–the equivalent of 10,000 full-time employees–to generate all the 1099-K forms next year. It is unclear how the lower threshold will increase the time burden.

The main OIRA dashboard seems to indicate that there are no out-of-pocket costs associated with preparing this form.

However, this is not necessarily the case. The Supporting Statement clarifies that the IRS has not been able to calculate the out-of-pocket costs:

Form [sic] our Federal Register notice dated October 28, 2022, no public comments were received on the estimates of cost burden that are not captured in the estimates of burden hours, i.e., estimates of capital or start-up costs and costs of operation, maintenance, and purchase of services to provide information. As a result, estimates of these cost burdens are not available currently.

There is a second component to the compliance costs that individuals will face when receiving this form. As noted, millions of taxpayers stand to receive a 1099-K form for the first time and will be surprised to see a suggestion that they may owe significant extra tax on potential income that has been reported to the IRS. Compliance burdens include learning about what this form is, making sense of the guidance associated with the form, figuring out to what extent transactions may be taxable. This part can be especially tricky since the 1099-K will just list the gross amount of a transaction. If you sold an item online, the gross amount could include shipping costs paid by the buyer or fees that go to the selling platform. Moreover, if you sold the item for less than its value, such as what happens at garage sales, that transaction should not be taxable. The lower threshold will drastically increase paperwork burdens on people to track the nature of all transactions conducted on third party platforms. Many will also spend out-of-pocket for tax advice.

Under ARPA's changes to the 1099-K threshold, taxpayers will have to conduct daily life like a business, with a lot of extra, needless documentation to prove that non-taxable events were indeed non-taxable when they review their 1099-Ks and fill out Form 1040 to file income taxes. Yet the IRS has also not accounted for this time burden yet in its paperwork estimate for the individual income tax.

Reforms Are Needed to Provide Safe Harbor for Taxpayers

There is bipartisan support to address this problem with several different proposals introduced in the House and Senate:

Sen. Rick Scott (R-FL) has introduced the Blocking the Adverse and Dramatic Increased Reliance on Surveillance (BAD IRS) Activities Act (S. 123)

Senate Banking Committee Chair, Sen. Sherrod Brown (D-OH) and Senate Health, Education, Labor, and Pensions Committee Ranking Member Bill Cassidy (R-LA) is the Red Tape Reduction Act (S. 1761), which would raise the threshold to $10,000 and 50 transactions.

Rep. Carol Miller (R-WV) has introduced the Saving Gig Economy Taxpayers Act (H.R. 190);

Rep. Michelle Steel (R-CA) and Sen. Bill Hagerty (R-TN) have introduced the Stop the Nosy Obsession with Online Payments (SNOOP) Act of 2023, (H.R. 488/S. 26);

Rep. Chris Pappas (D-NH) introduced the Cut Red Tape For Online Sales Act (H.R. 3530), which would raise the threshold for reporting to $5,000 and have the IRS clarify when sellers need to file the 1099-K form.

House Ways and Means Chair Jason Smith (R- MO) has introduced the Small Business Jobs Act (H.R. 3937), which passed the Committee in June and will be part of a larger tax package, the American Families and Jobs Act.

After Chair Smith’s Small Business and Jobs Act was approved by the Committee, the Joint Committee on Taxation (JCT) estimated that the provision to restore the prior reporting thresholds of $20,000 in annual sales and 200 transactions per year would reduce revenues by $9.7 billion from 2023 through 2033.

If Congress fails to act, the IRS should delay implementation again to provide safe harbor for taxpayers from 1099-K confusion.

Conclusion

Commissioner Werfel has called 2023 a “transition year” implying that the new 1099-K threshold enforcement will start for the 2024 tax filing season. The IRS's revised projection of the deluge of these forms is much closer to reality and should raise eyebrows on Capitol Hill for showing how many additional unsuspecting taxpayers will be impacted by ARPA's 1099-K reporting requirement.

While the JCT estimated the tax burden imposed by the threshold, policymakers need to know if the juice is worth the squeeze. The IRS has not done due diligence to calculate the paperwork and expense burdens imposed on the third-party payment processors and on individuals. The 1099-K compliance burdens could be substantial, which is why the IRS delayed its implementation last year. Lawmakers should act swiftly to protect taxpayers from a tax provision that will cause widespread confusion and compliance headaches.