NOTE: NTU Foundation made updates to this piece on March 7, 2023, which are noted below in paragraphs marked “Update."

Were you one of the lucky few people who snagged face-value tickets to see Taylor Swift in concert on her U.S. tour next year? If so, congratulations!

Are you thinking of reselling your tickets on Ticketmaster or StubHub? If so, congratulations again, because you may be poised to generate a significant return compared to the face value you paid.

Taylor Swift ticket sellers should be aware, though – as should ticket resellers for other concerts, comedy shows, and sporting events – that gains on ticket resales relative to what you paid for the tickets are taxable transactions according to the IRS. What’s more, the tax agency is about to receive a lot more information from the likes of Ticketmaster and StubHub about who is reselling tickets on their platform and how much income those resellers are earning.

Below are a few questions you may have about reselling Taylor Swift tickets, or other concert and sport tickets, and answers from National Taxpayers Union Foundation (NTUF):

I sold my tickets for more than I paid! Do I owe taxes on the gain?

Yes, according to the IRS your gain on a ticket resale is taxable if you held it for personal rather than business use. The gain is generally treated as a short-term capital gain and taxed at ordinary federal income tax rates if you held the tickets for less than a year, and is treated as a long-term capital gain taxed at preferential (i.e., lower) rates if you held the tickets for longer than a year.

Most Taylor Swift fans reselling their tickets will have held onto the tickets for less than a year, given her ticket on-sale took place in November 2022, but her U.S. tour is scheduled to wrap up by August 2023. Most Taylor Swift fans reselling their tickets will also likely make a gain on their tickets. Currently, the least expensive ticket available for many of her shows is several hundred dollars. Tickets that may have been purchased at $50 or $100 face value are listed for upwards of $700 or $800 on StubHub, while floor tickets that may have been purchased for $400 or $500 face value are being sold for $2,500, $3,000, or even more.

How much in taxes will I owe on my resold ticket?

That depends on a number of factors, including but not limited to: 1) the price you originally paid for the resold ticket, including fees and taxes; 2) the payment you received for reselling the ticket, after fees taken out by the resale website (i.e., StubHub, Ticketmaster); 3) how long you held on to the tickets in between purchase and sale; and 4) your taxable income for the year in which you resold the tickets.

Two illustrative examples are below, for a lucky Taylor Swift ticketholder who resold her tickets for a significant gain:

- The Cheap Seats

One fan paid $70 ($50 face value plus $20 Ticketmaster fees) in November 2022 for a nosebleed seat to see Swift, now cannot go to the show, and resells it for a cool $700 on StubHub in February 2023.

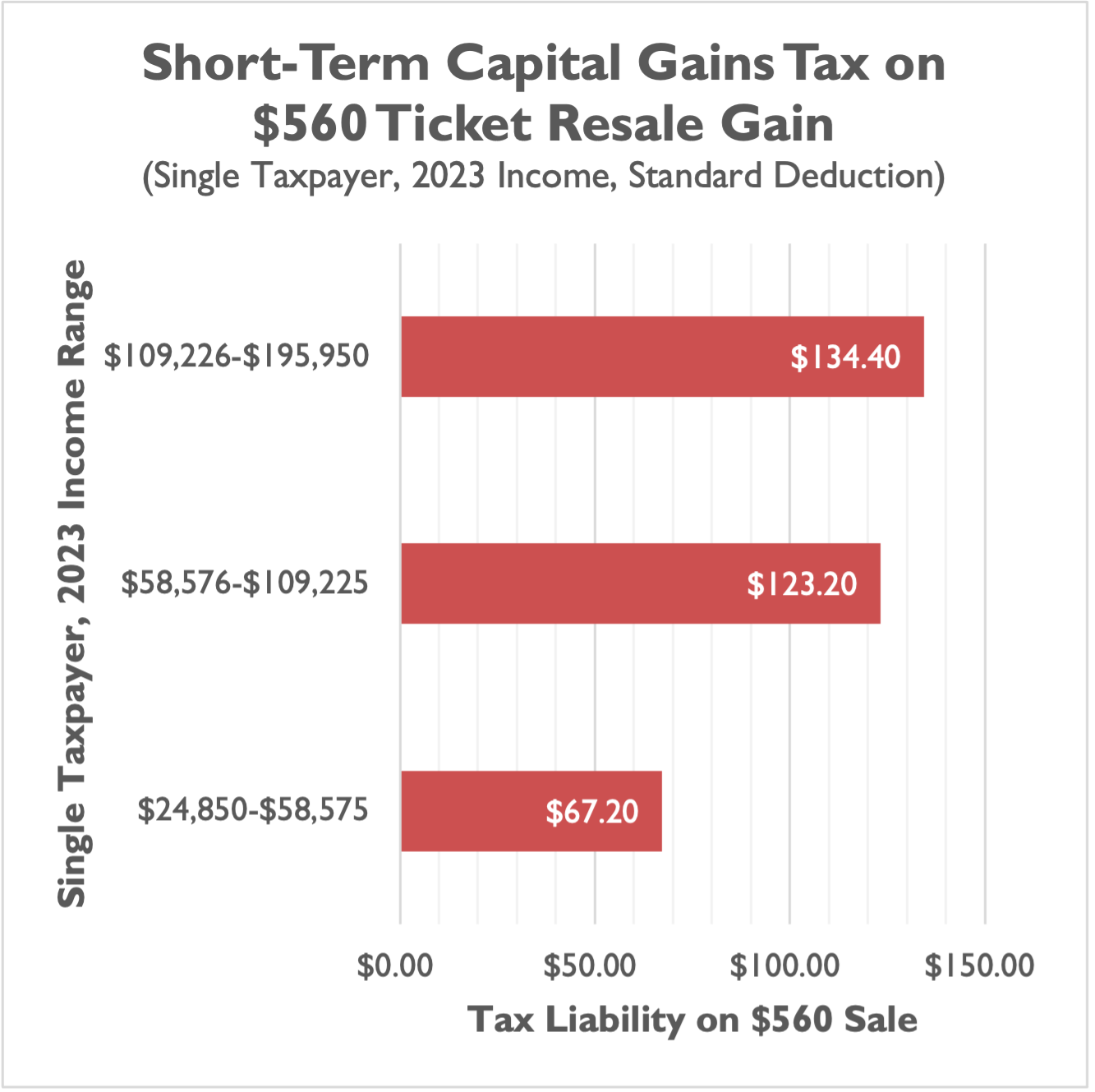

StubHub takes out 10 percent ($70) for their cut, so the fan’s taxable gain on the sale is $560 ($700 sale - $70 StubHub fee - $70 paid for the ticket = $560).

If we assume the fan is a single filer, has a simple tax return, and takes the standard deduction, her federal taxes will vary based on whether her income puts her in the 12-percent bracket, the 22-percent bracket, or the 24-percent bracket. For these three common tax brackets, federal income tax liability in this specific case ranges from $67 to $134.

- The Floor Seats

An even luckier fan paid $600 ($500 face value plus $100 Ticketmaster fees) in November 2022 for floor seats to see Swift up close, but now cannot go to the show. She resells the ticket for a whopping $2,324 on StubHub in February 2023. (If you think we’re exaggerating, this is currently the cheapest floor ticket available for one of Swift’s New Jersey shows.)

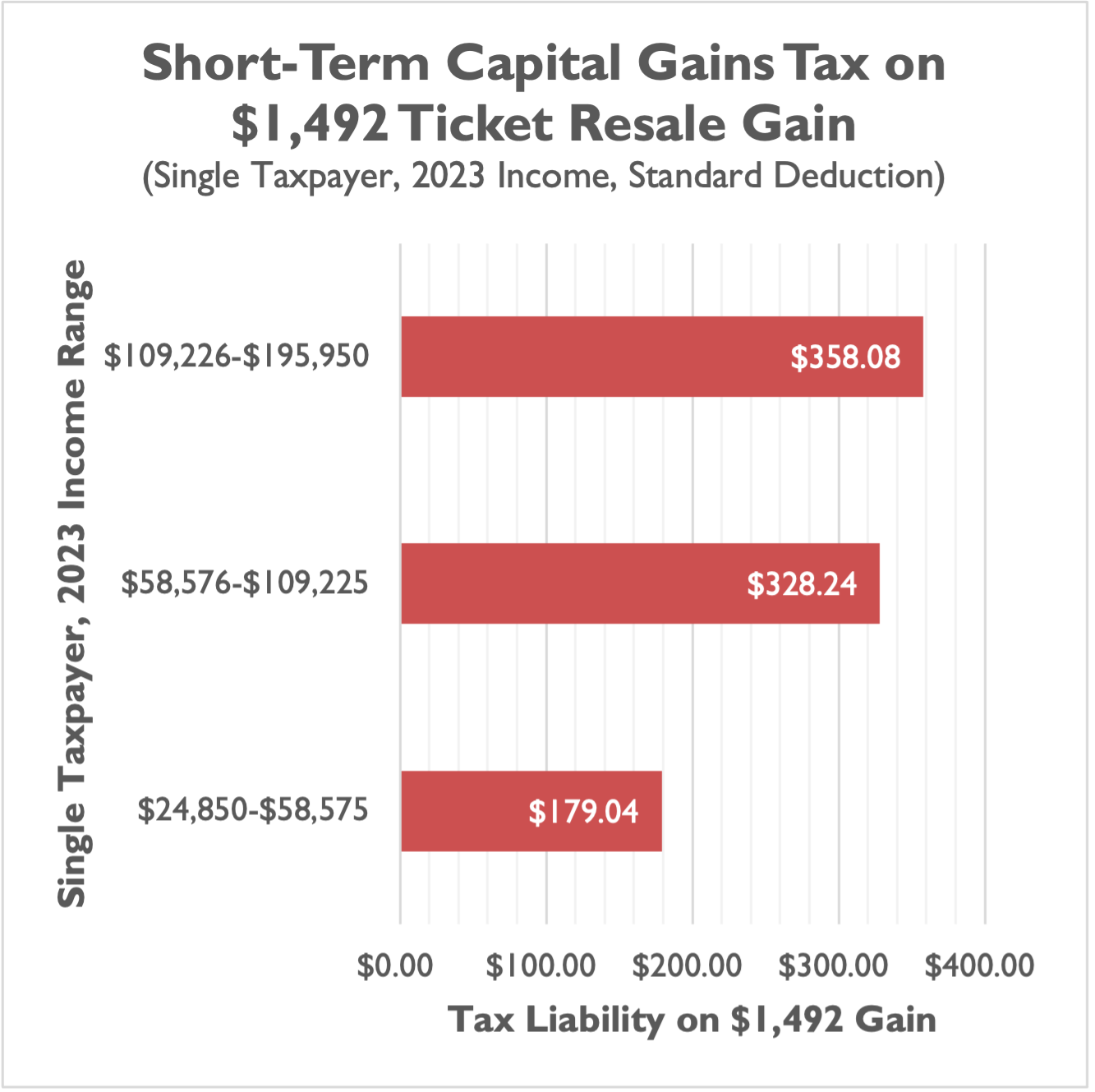

StubHub takes out 10 percent ($232) for their cut, so the fan’s taxable gain on the sale is $1,492 ($2,324 sale - $232 StubHub fee - $600 paid for the ticket = $1,492). That’s a nice chunk of change!

If we assume the fan is a single filer, has a simple tax return, and takes the standard deduction, her federal taxes will vary based on whether her income puts her in the 12-percent bracket, the 22-percent bracket, or the 24-percent bracket. For these three common tax brackets, federal income tax liability in this specific case ranges from $179 to $358.

Will I owe state taxes on my ticket resale as well?

In many cases, yes. In many cases, you will also receive information from the online platform (e.g., StubHub or Ticketmaster) about your gross payments received on that platform within a particular state, similar to the 1099-K. Thresholds for information reporting vary state by state, as do rules for what governs taxable income. Consult with your state tax agency, tax professional, or tax filing software provider.

I sold my tickets for a loss! Can I use the loss to reduce the taxes I owe?

You’re out of luck, at least on federal taxes. The IRS does not allow tickets held for personal use and sold at a loss to be deducted from a taxpayer’s income.

Will Ticketmaster or StubHub tell the IRS about my ticket resale?

Under new requirements passed into law by Congress in 2021 and made effective in 2022, third-party settlement organizations, which include Ticketmaster and StubHub, must report to the IRS on every taxpayer who received more than $600 in gross payments on a given platform.

Those companies also must report to the taxpayer their gross sales on the platform for a given year. Ticketmaster’s website currently states that people who resold tickets and received payments in excess of $600 on their platform can expect to receive a form from Ticketmaster, called the 1099-K form, by January 31, 2023.

Update: In late December 2022, the IRS announced in a notice that the 2022 calendar year would be a “transition period” for IRS enforcement and administration of the new 1099-K reporting requirements. The IRS said the “transition period described in this notice is intended to facilitate an orderly transition for [third party settlement organization] TPSO compliance with section 6050W and participating payee compliance with income tax reporting.” TPSOs like Ticketmaster and eBay are “not required to report payments” to a payee unless they exceed $20,000 and 200 transactions (the pre-2022 threshold).

I received a 1099-K form. What is this all about?

The 1099-K form exists to inform taxpayers of the gross payments they earned on a given online platform. Companies that will be sending out 1099-K forms to taxpayers in the new year include, but are not limited to, Ticketmaster, StubHub, eBay, Venmo, and PayPal. Anyone who received more than $600 of payments on any one of these platforms in 2022 can expect to receive a 1099-K form in early 2023.

Notably, the thresholds for requiring one of these companies to send a 1099-K to the IRS and the taxpayer used to be much higher. Before 2022, the two thresholds for a taxpayer to receive a 1099-K from the likes of eBay or StubHub were 1) receiving $20,000 in gross payments on the platform and 2) having at least 200 transactions on the platform. Someone who bought and resold hundreds of tickets on StubHub as a significant side hustle could have received a 1099-K form before 2022, but someone re-selling just a handful of tickets would not receive one.

With the new $600 threshold, which kicks in regardless of whether someone made one transaction or 200 or more, many more taxpayers will receive 1099-K forms. Many may receive the form for the first time in early 2023. Two important things for taxpayers to know are:

- Receiving a 1099-K form does not always mean your gross payments are taxable. For example, if you bought a Super Bowl ticket in 2022 for $800 and resold it on StubHub for $800, you would not owe federal taxes because you did not have a gain on the sale. However, you would likely receive a 1099-K form from StubHub saying you received $800 in payments on their platform. StubHub does not know you bought the ticket for $800 and did not make a gain on the resale, they only know you earned $800 for the ticket you sold. Consult with your tax professional or tax filing software provider to determine tax liability for payments received on online platforms.

- You may not receive a 1099-K form but still owe taxes on a resale. For example, if you bought a concert ticket in 2022 for $75 and resold it on StubHub for $100, you would owe federal taxes on the $25 gain. However, you would likely not receive a 1099-K form from StubHub if that resale was your only StubHub sale of the year, since the $100 you received for the ticket is well under the $600 1099-K information reporting threshold. The relevant threshold StubHub is required to use to determine whether you receive a 1099-K form is your gross payments received, not your net gain from the resale of tickets.

I sold $500 worth of tickets on StubHub in 2022 for $700, making a total of $200, but StubHub took out $100 in fees on those resales so I only made $100 net after fees. Do I still owe taxes?

Yes, you still owe federal income taxes because you made a $100 net gain on the resale of your concert ticket ($700 in resales - $500 originally paid - $100 StubHub fees = $100 net). The 1099-K you receive from StubHub will not tell you your net earnings on ticket resales, because StubHub doesn’t know how much you paid for the tickets. It will only say you received $700 in gross payments on the platform. It is up to you, as the taxpayer, to know what you originally paid for the tickets and take out any fees from the resale platform in determining your taxable gain.

Or, as StubHub puts it on their website:

“For example, if you made $5,000 USD in ticket sales and were charged 10% ($500 USD) in sell fees, StubHub will report $5,000 USD in gross payments. When calculating gross payments, we don't factor the purchase price of the tickets you sold or the following adjustments: Credits; Discounts; Fees; Refunds; Cancelled events; Substitutions.

…It is your responsibility to report amounts and deduct any fees or charges to sell your tickets.”

This is confusing!

We agree, and we’ve been warning Congress, the IRS, and taxpayers across the country that the new thresholds for 1099-K forms are going to generate a lot of confusion in early 2023. Many taxpayers who use eBay, PayPal, or some other platform as a “digital garage sale” of sorts, to sell used furniture or old college textbooks at a loss, for example, will receive an information return for the first time under the new requirements in January or February 2023. Generally, the sale of used personal items at a loss does not generate federal tax liability, but taxpayers may think they owe taxes because they’re receiving a 1099-K form for the first time.

Taxpayers should consult with their tax professional or tax filing software provider before potentially over-reporting income to the IRS. Taxpayers can also reach out to the IRS with questions ahead of tax filing, but the agency has struggled to answer customer service requests in recent years. It may take taxpayers a long time to connect with a live agent.

There are several pending bills before Congress to raise the threshold from $600, either to $5,000, or to $20,000 and 200 transactions like it was before 2022. This could potentially reduce taxpayer confusion and paperwork burdens. This legislation will not be enacted into law before 2023, though.

Update: No legislation addressing the 1099-K issue was enacted by Congress in late 2022, and as of March 2023 had not yet been enacted by Congress. However, the IRS effectively delayed its enforcement of the $600 threshold for the 2023 tax filing season. NTU Foundation is still urging Congress to provide a permanent legislative solution that will be effective for the 2024 tax filing season (i.e., the 2023 tax year) and years after.