Key Facts:

- New IRS data disproves popular conception of what states are preferred destinations for young people.

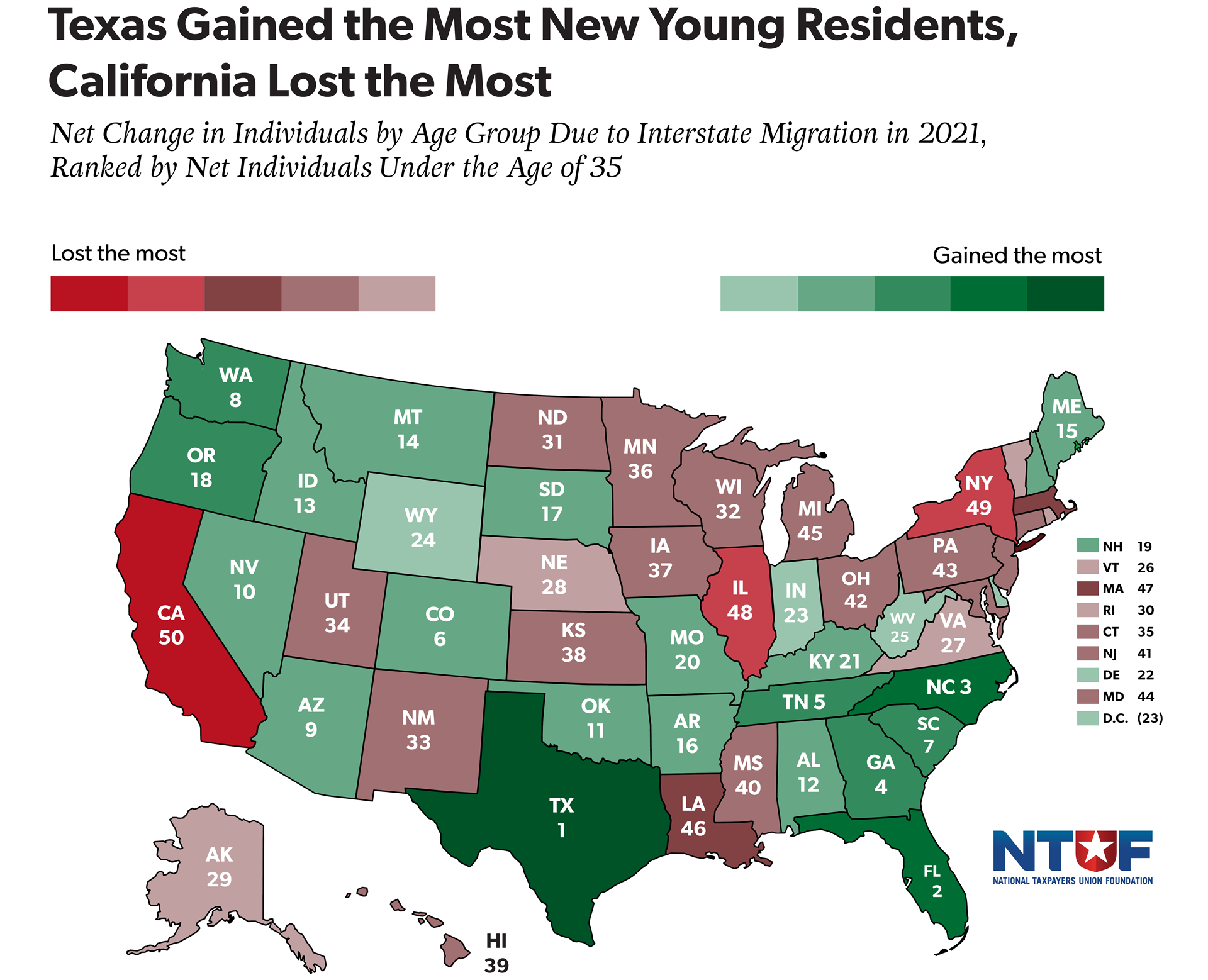

- Texas, Florida and North Carolina gained the most young Americans from interstate migration, while no other state lost more young residents than California, New York, and Illinois.

- Adjusting for population sizes shows that Montana, South Carolina and Tennessee are also popular youth destinations, while Hawaii, Louisiana, and Massachusetts struggle to retain youth.

All taxpayers are equal, but some are more equal than others. At least, that paraphrase of a famous porcine proclamation in George Orwell’s Animal Farm sums up how states view new residents — no state legislator who wants to keep their office would ever say so out loud, but while all states want to encourage taxpayers of all ages to move from other states, they all especially want to attract young people.

It is easy enough to understand why. Just as the fiscal sustainability of the federal government’s entitlement programs is threatened by demographic challenges, so too are state governments facing similar problems. Social services funded by revenue from younger, working-age taxpayers are becoming less feasible as the population pyramid’s base narrows. Attracting younger taxpayers is therefore an important goal for many states.

Most people understand that taxes are a significant — likely the most significant — reason why Americans decide to move to other states. But ask someone to picture someone moving for tax-related reasons, and they will likely think first of a retired couple whose children have moved out of the house.

This does happen, but the latest IRS data, covering Americans’ interstate moves in 2021, challenges the idea that states attracting the most new residents are only filling up their retirement communities.

Florida, for instance, is the stereotypical retiree destination, but the state actually gained almost 10,000 more new residents, on net, who were under the age of 35 than retirees.

On the other hand, we see that high-tax states thought of as trendy destinations for young people, like New York and California, are in fact experiencing some of the most significant and persistent outflows of youth to other states. No states lost more residents under the age of 35, on net, than California, New York, and Illinois.

5

5

Source: ntu.org/under35

Texas rightly comes out on top, with nearly 90% of its net gain from domestic taxpayer movements attributable to individuals under the age of 55 (compared to just over 60% for Florida and 70% for North Carolina). The three states losing the most net individuals under 35 are familiar bottom-dwellers — Illinois, New York, and California — despite each of these states containing one of the three largest American metropolitan areas, and traditionally being considered popular destinations for young Americans.

Every state that gains young people on net also gains in every other age group except four. Those four exceptions are Colorado, Washington, Oregon, and the District of Columbia — which actually lose in every other age group.[1]

Washington and Oregon may be relatively attractive to young people by comparison to California, being the only West Coast alternatives to the 50th-ranked state in the nation. D.C. is likewise fairly easy to understand, because the city attracts young people looking to work in government who then move outside the city limits when they are ready to graduate from apartment-hopping to home ownership.

Colorado is more interesting, being neither composed of a single city nor benefiting from an exodus from a neighbor. Colorado’s neighbor, Utah, is one of only two states (Mississippi is the other) that lost young people on net while gaining in every other age group, despite the two states being close both in terms of climate and, seemingly, in tax environment, with both states having similarly low flat income taxes.

There are a couple possible explanations. One is housing — both states have experienced increased median home prices. Utah has done more to address the problem, increasing its housing supply by 9.3% between 2020 and 2023 compared to 5.9% for Colorado. Right around the age of 35, when many Americans start families and seek to buy their first homes, is when Americans become more sensitive to home prices, so it makes sense that as Coloradans seek more permanent residences they would move to Utah instead.

The other is that state income taxes are not a complete picture of a state’s tax environment. Colorado has been steadily accumulating new “fees” that are functionally taxes as legislators seek to raise revenue while avoiding the state’s constitutional requirement that tax increases be approved by referendums. Additionally, Colorado’s status as a home rule state means that some local jurisdictions levy additional income and sales taxes. All told, it is probably less the case that Colorado is doing a great job attracting young people and more that the factors driving older Coloradans to leave the state are less important to younger people.

Population-Adjusted Figures

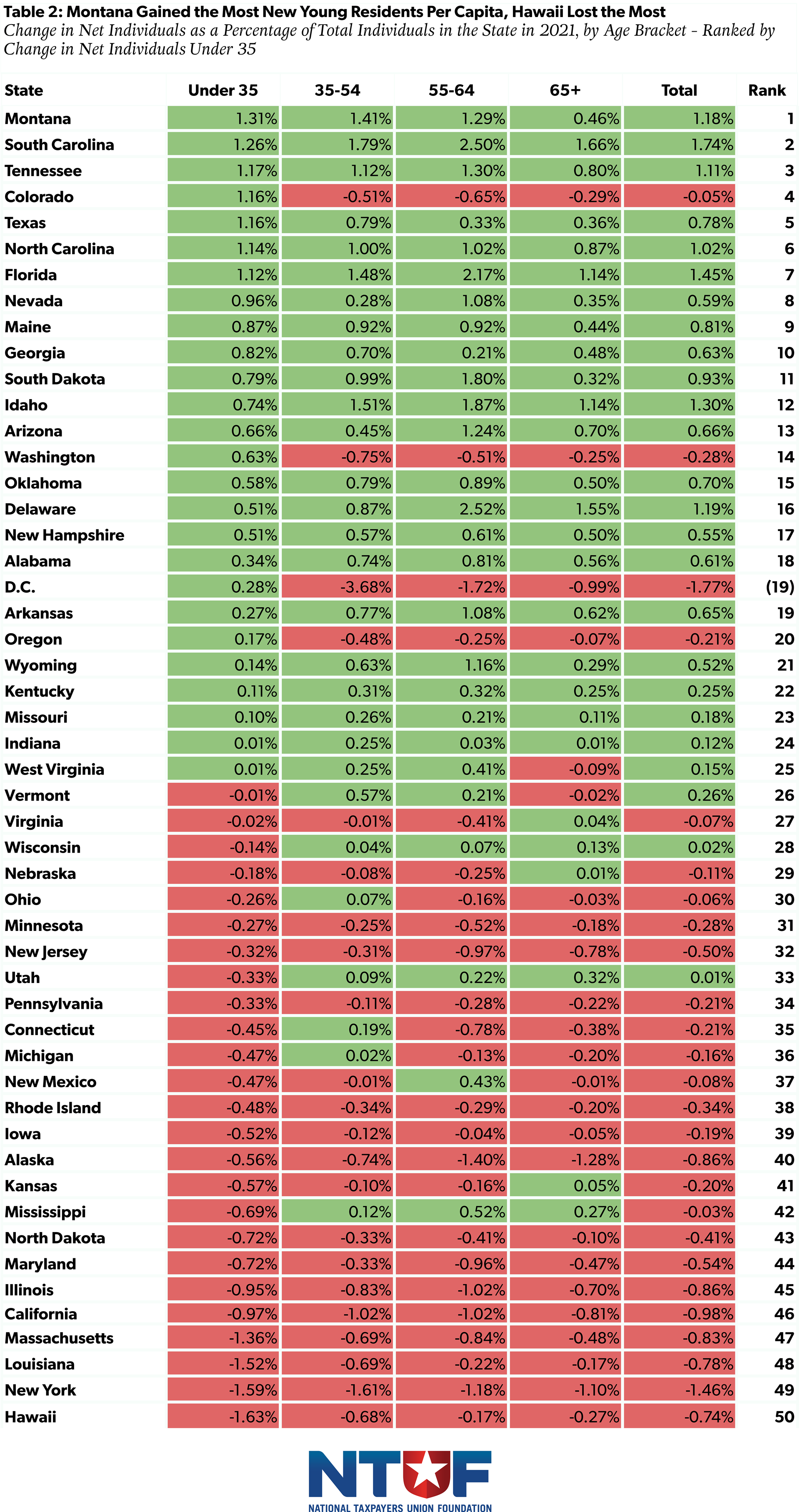

Adjusting for population gives more perspective on how interstate moves impact smaller states as well as larger ones. Table 2 shows each state’s net change in each age group because of interstate migration as a percentage of total individuals in the state.

Montana, which comes in at 14th on non-population-adjusted figures,gains the biggest influx of net under-35 individuals when adjusting for population. On the opposite side of things, Hawaii is losing more young people than it’s gaining, ranking dead last for net new residents under 35.

At the same time, even adjusting for population, Texas and Florida clearly remain attractive destinations for young Americans, while New York, California, and Illinois are seeing significant outflows.

It also shows the ounce of truth to the idea that movement to Florida is driven by empty-nesters preparing to retire, as the 55-64 age group is seeing the biggest increase due to interstate migration. But, at the same time, Florida is seeing some of the biggest proportional increases in younger age groups, with the seventh-largest proportional net increase to its under-35 age group and the third-largest increase to 35-54 year olds. In fact, Delaware, much less of a stereotypical retiree state, is seeing far more lopsided gains towards older individuals than Florida is.

More than any other states, Hawaii and Louisiana stand out as losing young Americans to interstate migration. While New York is sandwiched between these two states at 49th, the Empire State is losing every other age bracket at about the same rate. Hawaii and Louisiana (and to a lesser extent North Dakota and Iowa) are losing under 35s to interstate outmigration at much faster rates than other age groups.

Finally, adjusting for population shows that interstate migration trends cannot be explained in simple geographical terms. Just about every continental state has at least one neighbor whose under-35 interstate migration arrow is pointed the opposite direction. Upward-trending Montana borders downward-trending North Dakota, Massachusetts is right next to New Hampshire, big winner Texas is a neighbor to big loser Louisiana, and so on.

In the case of D.C., Oregon, and Washington, proportional data highlights the futility of gaining young people when the next age bracket is leaving at an even faster pace. Adding young people through interstate migration can only go so far when they pack up and leave as soon as they are ready to start families.

Conclusion

In more than a few states, the under-35 age bracket’s interstate migration trends are entirely different than those of other age brackets. Unlike with our analysis of the interstate migration trends of the highest-income taxpayers, the movements of the youngest generations defy simple policy prescriptions. Younger Americans are simply less sensitive to the direct impact of taxes, for the simple reason that younger individuals do not view their residency decisions with the same sense of permanency that older Americans do.

Yet that does not mean that tax policy is irrelevant to attracting younger Americans — quite the opposite. Tax-happy states like Hawaii, New York, California, Massachusetts, Illinois, and Maryland are some of the biggest proportional losers of young Americans to interstate migration because tax-and-spend policies have led to diminishing economic opportunities and skyrocketing costs of living, things to which young people are quite sensitive.

So, while the impact of tax policy may be less directly obvious to young people than older, wealthier Americans, even young people go where jobs are available and housing is affordable. Smart tax policy that encourages and enables economic dynamism and does not drive away newer industries with short-sighted and heavy-handed tax enforcement might not attract young people on their own, but the impact it has on the economy certainly will.

[1] West Virginia as well, but West Virginia’s under-35 gain is a mere 19 individuals.