On August 8, President Trump issued an executive order that announces deferral of certain payroll taxes for the period September 1 to December 31, 2020. The taxes deferred are the employee portion of the Social Security tax, which is normally collected at a tax rate of 6.2 percent. The executive order states that the deferral applies to any employee whose bi-weekly pay “generally is less than $4,000, calculated on a pre-tax basis,” and that amounts are deferred “without any penalties, interest, additional amount, or addition to the tax.” In announcing the executive order, President Trump stated he anticipates congressional action to forgive the deferred amount.

Before the executive order was issued, we detailed some of the legal and implementation questions that an executive order suspending the payroll tax would likely raise. While Treasury Secretary Steven Mnuchin has clarified that employers are not required to participate in the payroll tax suspension, he did not immediately address questions over when repayment is due, who would owe it, and whether interest and penalties could be assessed. The U.S. Chamber of Commerce has requested guidance from the Treasury Department on these and other points, as has the American Institute of CPAs, and that guidance is expected soon.

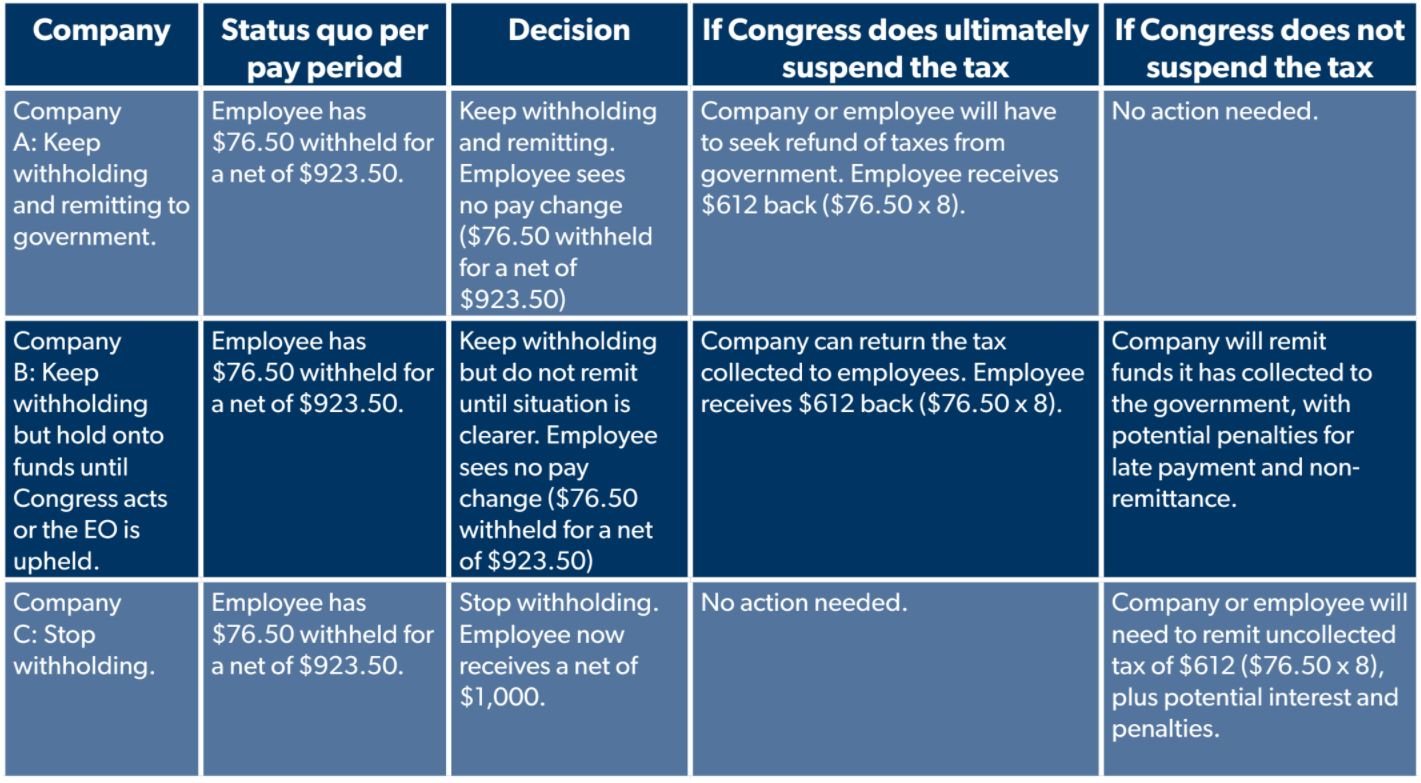

The table below highlights some of the choices employers could make, using the example of three different companies making different choices with an employee who earns $1,000 per pay period, which normally would be subject to $76.50 in withheld payroll taxes for a net figure (before income tax and state taxes) of $923.50.

- Company A decides to continue current practice of withholding employee payroll taxes and remitting them in full to the government, essentially disregarding the executive order. An employee of Company A would see no change in net pay. If Congress does ultimately suspend the tax and forgive amounts owed from September 1, 2020 onwards, the company or the employee would then seek a refund from the IRS of the amounts paid during that time. If Congress never acts to suspend the tax, no action needs to be taken by Company A or its employees to be compliant.

- Company B decides to continue withholding employee payroll taxes but instead of remitting them to the government, they choose to hold them in trust until the due date or until Congress acts to forgive the obligation. An employee of Company A would see no change in net pay. If Congress does ultimately suspend the tax and forgive amounts owed from September 1, 2020 onwards, the company could then refund the amounts collected to the employee. If Congress never acts to suspend the tax, Company A can remit the collected amount to the government. Depending on the legality of the executive order, Company B may face penalties for late filing and late payment.

- Company C decides to stop withholding employee payroll taxes for the time period provided by the executive order. An employee of Company C would see an increase in net pay. If Congress does ultimately suspend the tax and forgive amounts owed from September 1, 2020 onwards, no action needs to be taken by Company A or its employees to be compliant. If Congress never acts to suspend the tax, either Company C or its employee will need to remit the taxes due, with any associated late filing and late payment penalties. Under Section 3102(f)(2)-(3) of the Internal Revenue Code, the obligation to collect and remit is on the employer, but if the employer fails to do so, the obligation shifts to the employee with penalties due from the employer. Company C could pay the amounts out of its own funds and/or attempt to collect the amounts due from the employee.

As we said earlier this month, “A payroll tax delay or reduction might be worthy of consideration as a way to reduce the tax burden associated with employment, but its path would be infinitely clearer if it was mapped out by Congress in statute rather than in an executive order.”