The Congressional Budget Office (CBO) released its newest biennial Budget Options for Reducing the Deficit report for Congress. Each of those options would either reduce spending or increase revenues from fiscal years (FY) 2023 through 2032. Unlike previous editions, this year’s report is published in two volumes. Volume I contains 17 policy options that would each reduce the deficit by at least $300 billion. Volume II contains 59 options with smaller reductions, ranging from $7 billion to $257 billion on the spending side and from $12 billion to potentially $272 billion on the revenue side.

Without a change in course, CBO’s latest budget outlook projects that deficits are expected to average $1.6 trillion each year between 2023 and 2032. CBO produces these policy options at the request of the House and Senate Budget Committees. They are not intended as recommendations, but to inform lawmakers of ways to tackle the federal debt.

There are several noteworthy policy reforms in the report that lawmakers should consider. Below we highlight eight of the top options included in CBO’s list. These provisions cut across a variety of issue areas and programs, but each generally meet three criteria: 1) NTU and NTUF have supported some form or degree of these deficit reduction proposals in the past, 2) they would have a meaningful impact reducing pressure on federal deficits and debt; and 3) they would play a role in reducing inflation in the short and/or the long term.

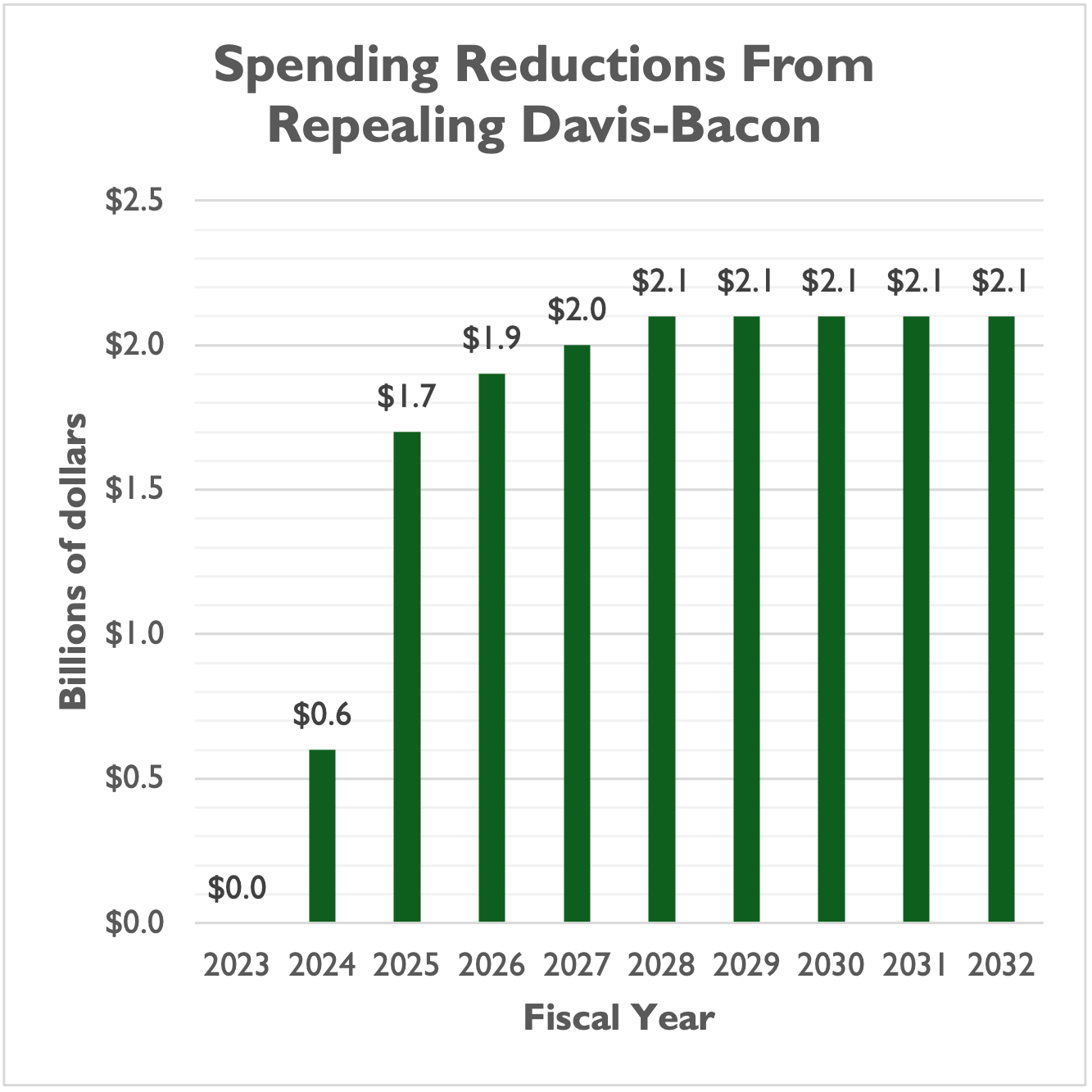

Repeal of the Davis-Bacon Act: $17.1 billion

This option would end an antiquated law that artificially raises construction costs. Davis-Bacon requires that workers on all federally funded projects be paid no less than the prevailing wages in the area where the project is located.

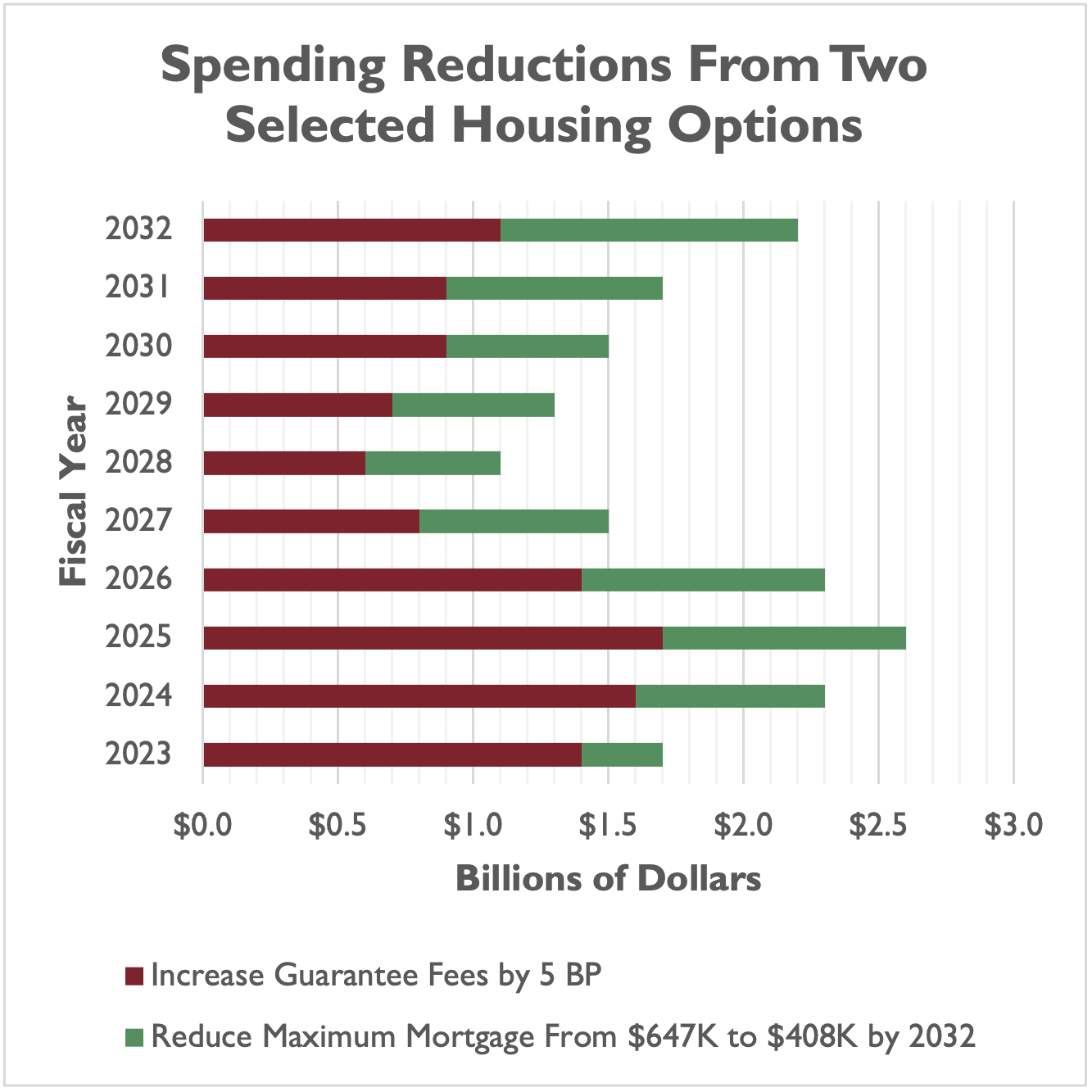

Two Selected Housing Options: $18.2 billion

This option would implement two important reforms to reduce taxpayers’ exposure to financial liabilities through Fannie Mae and Freddie Mac. These government-sponsored entities (GSEs) have been under a federal conservatorship since September 2008. The first option would increase the average guarantee fee that the GSE's assess on loans by 5 basis points starting in 2023. The second option would limit the size of the mortgages that the GSEs can back to $647,200 and then reduce that by 5 percent per year. To be clear, neither of these options should be employed as gimmicks to offset higher spending as was done with a fee increase in the 2021 infrastructure law. The limits CBO suggests should also be carefully examined to ensure they help to mitigate taxpayer risk, rather than simply “hit a number” for deficit reduction. Thus, the budgetary savings below could be higher or lower, depending upon the right policy mix for addressing risk.

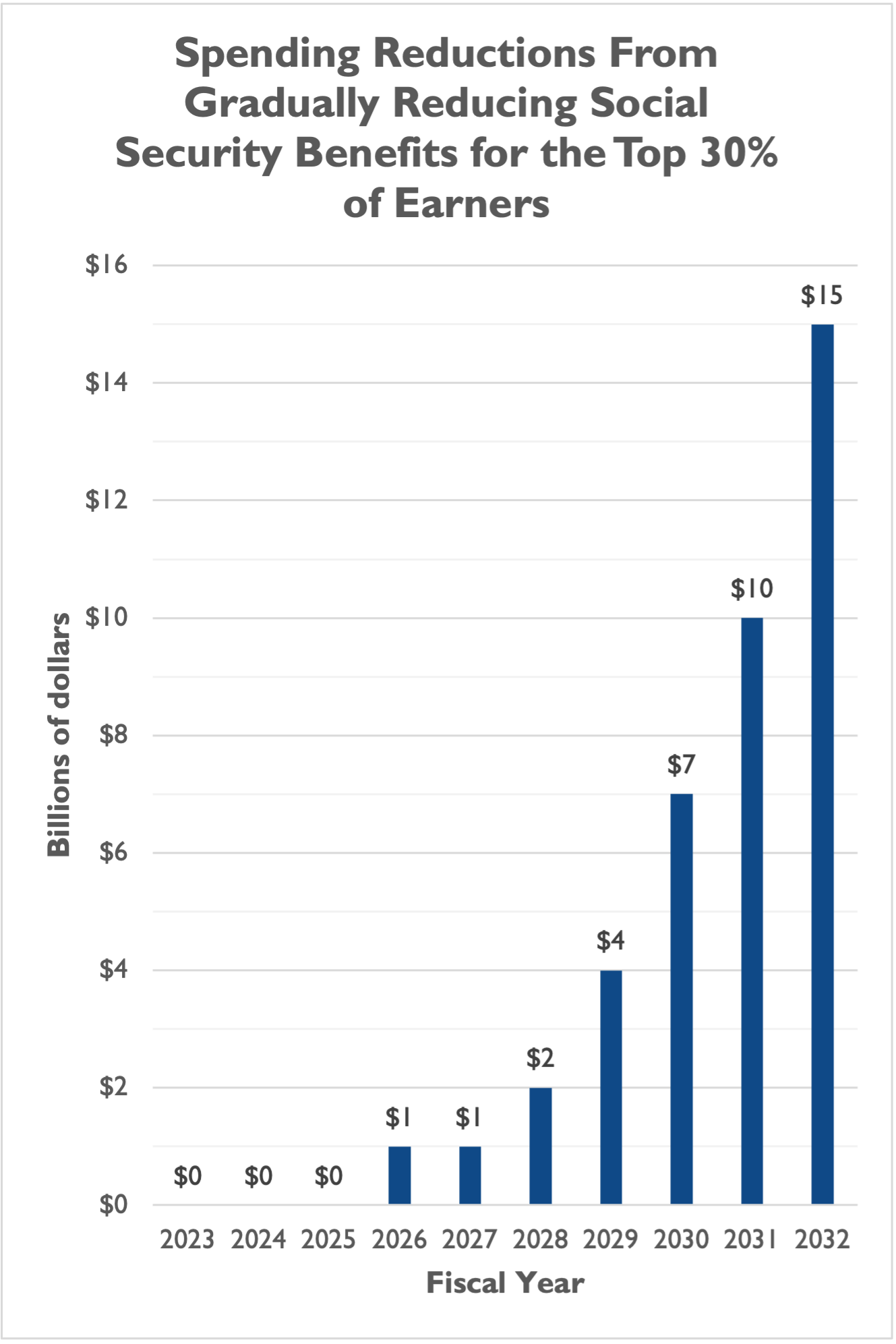

Reduce Social Security Earnings for the Top 30 Percent of Earners: $40 billion

With the aging of the population, Social Security is a significant contributor to federal deficits in CBO's budget outlook.The Social Security Board of Trustees projects that as program costs rise, by 2035, taxes will only be able to pay for 75 percent of scheduled benefits. This option would reduce Social Security benefits (also known as the primary insurance amount) paid to the top 30 percent of income earners.

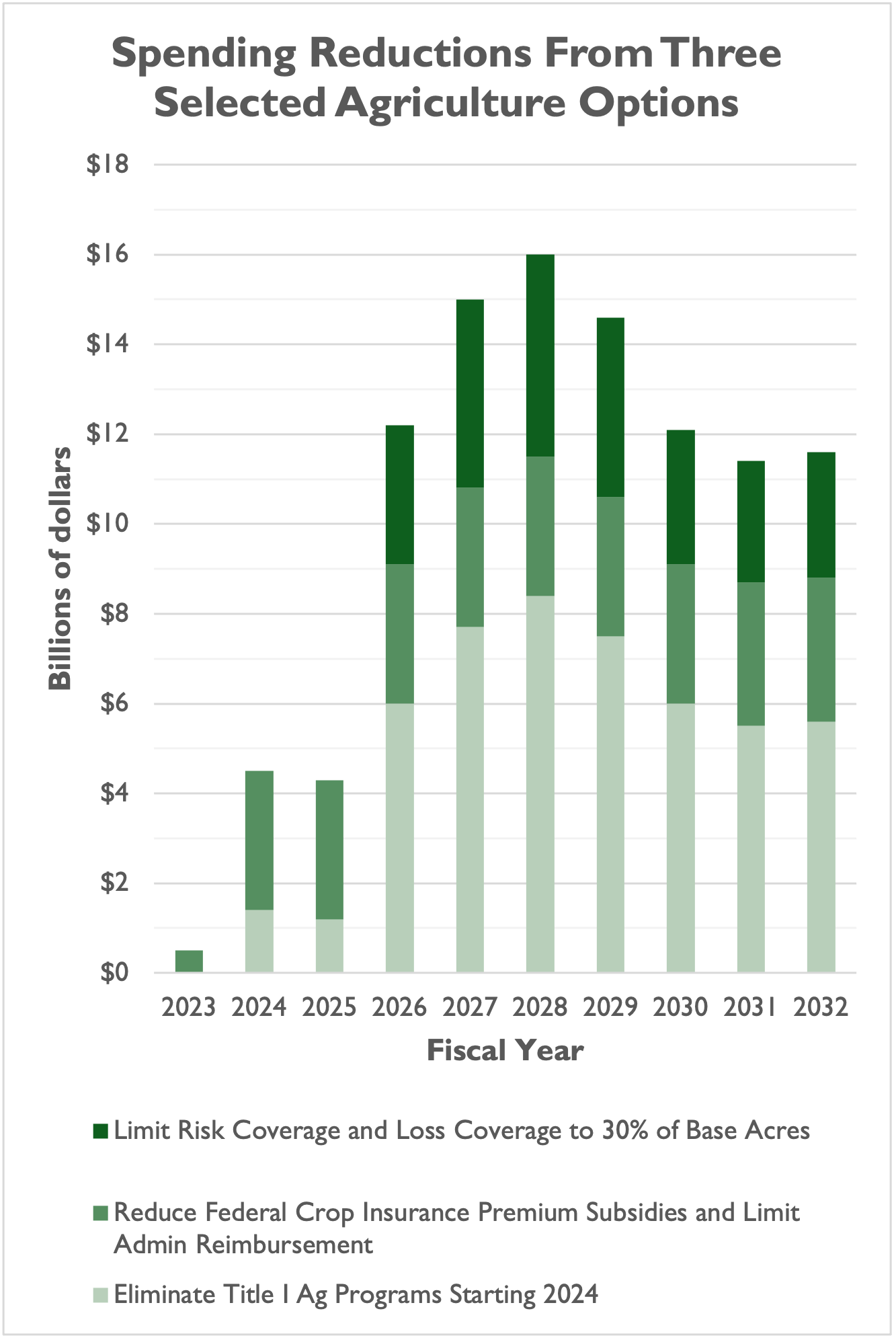

Three Selected Agriculture Options: $102 billion

- Eliminate Title I Agriculture Program: $49 billion. Starting in 2024, this option would end price support programs for producers of dairy, sugar, and other commodities

- Reduce Subsidies in the Crop Insurance Program: $28.3 billion. The federal government subsidizes premiums and reimburses private insurance companies that sell and service policies through the crop insurance program. This option would reduce premium subsidies and limit the reimbursement rate.

- Limit Agriculture Risk Coverage and Price Loss Coverage Program Payment Acres: $24.4 billion. This would limit payments from these two programs that pay farmers when crop revenue or commodity prices fall below certain amounts. Limiting payment to 30 percent of base acres decreases the advantage that more established farms with base acres have over farms that do not have base acres.

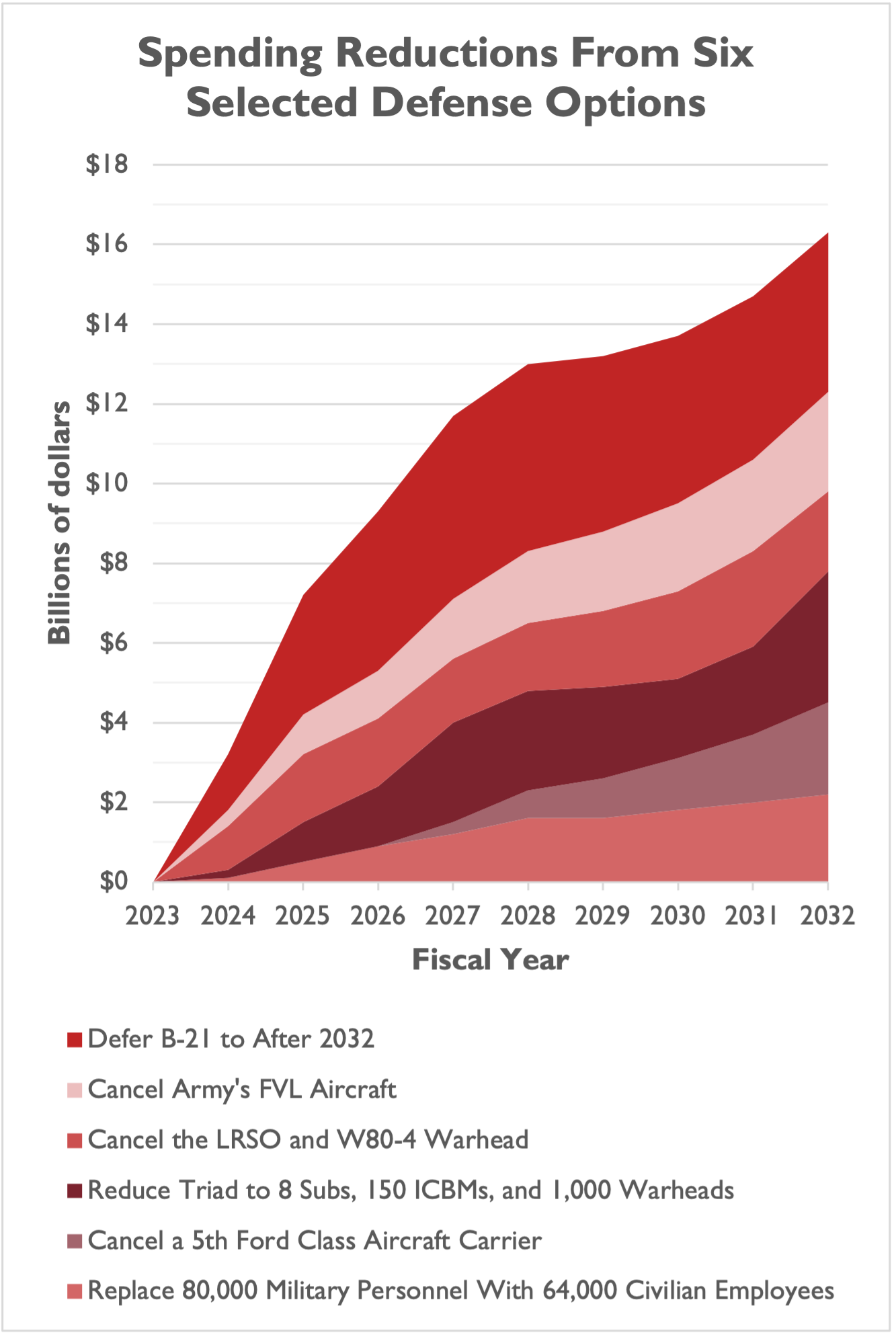

Six Selected Defense Options: $102.4 billion

NTU and NTU Foundation are staunch advocates for reducing unnecessary and wasteful spending in the defense budget, and six options selected from CBO’s recently published work would reduce spending by $102.4 billion in the aggregate. Our selections seek to spread the reductions across the Air Force (deferring the B-21 bomber), Army (canceling the future vertical lift, or FVL), Navy (canceling a fifth Ford class aircraft carrier), nuclear triad (broad triad reductions, cancelation of Long Range Standoff Weapon), and Defense-wide (replacing military personnel with less expensive civilian employees). We forgo some short-term savings options, such as retiring the F-22, in pursuit of longer-term and more impactful spending reductions such as reducing F-35 purchases. While these options are illustrative, and different mixes of policies could prove more judicious in adapting to evolving security challenges, the need to seriously consider spending restraint at this level, in this part of the federal budget, remains urgent.

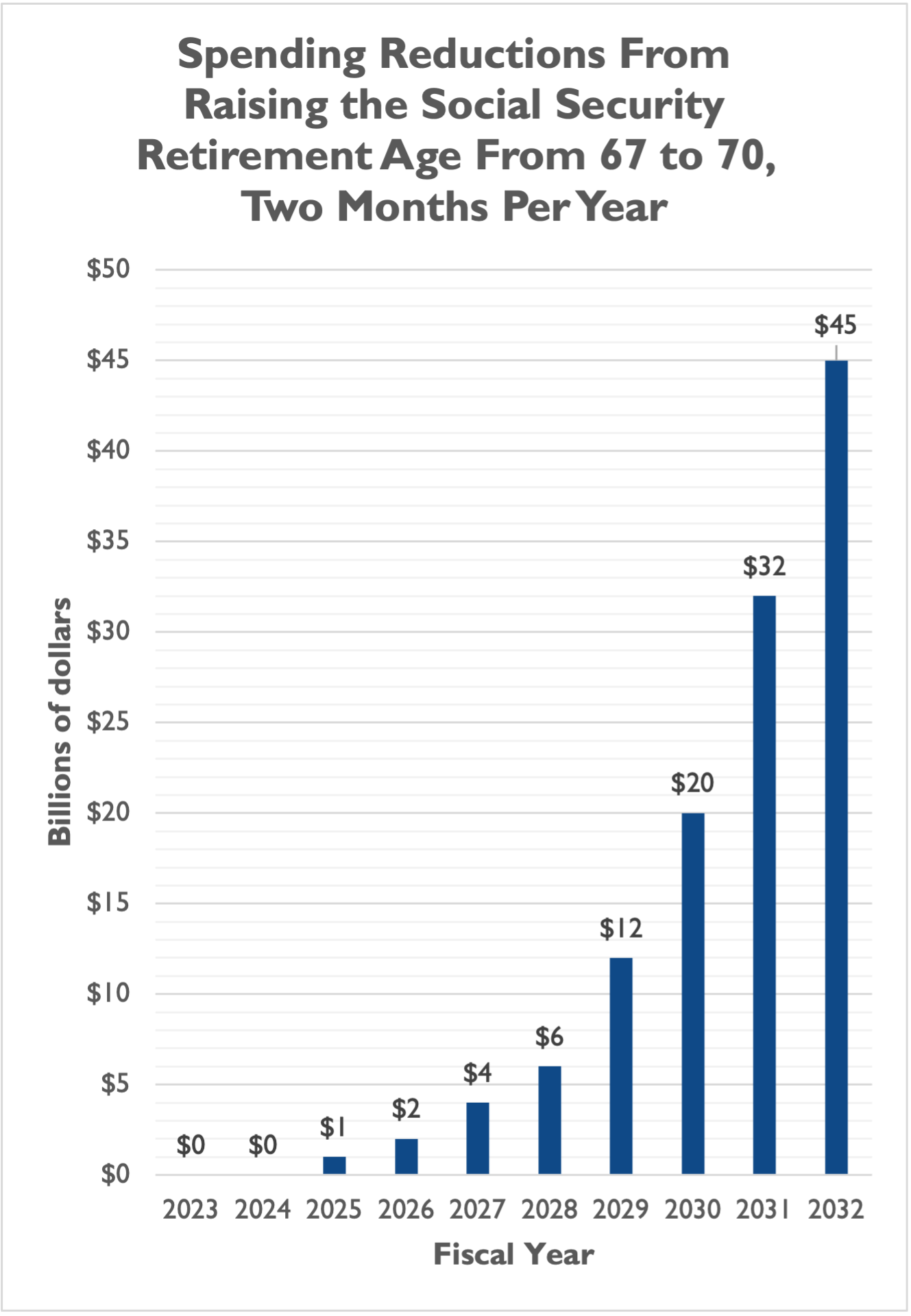

Raise the Social Security Retirement Age From 67 to 70, Two Months Per Year: $121 billion

Raising the Social Security retirement age to better reflect demographic realities is an important policy option to reduce deficits in the short term and help achieve program solvency in the long term. This option provides an extremely gradual on-ramp to raising the retirement age, from 67 to 70, by two months per year. Only individuals born in 1978 or later, who are 44 and younger today, would be subject to a retirement age of 70.

When Congress created Social Security in 1935, they set the full retirement age at 65. Life expectancy was 60 for men and 64 for women in that year. In 2022, life expectancy is up 13 years from 1935 for men (to 73) and 15 years for women (to 79). However, the full retirement age for Social Security has only increased two years in that same time period.

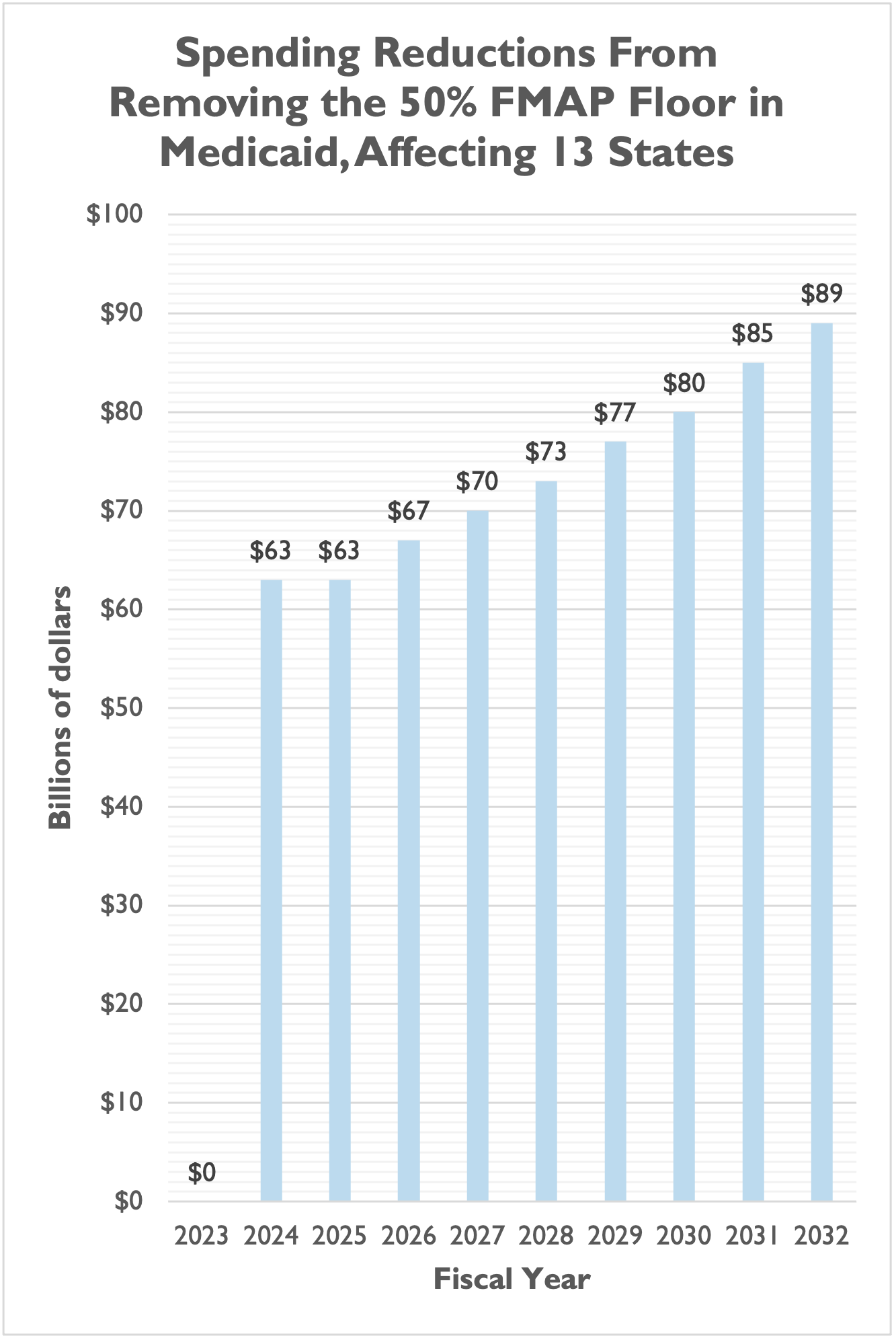

Remove the Floor for Federal Share in Medicaid: $667 billion

States currently receive different levels of federal cost sharing for their Medicaid programs based on the per-capita income of their state; the federal medical assistance percentage (FMAP) goes as high as 83 percent for the lowest-income states but under current law cannot go lower than 50 percent. This option would remove the 50 percent floor, requiring the wealthiest states to pay more of a fair share into the Medicaid program. CBO estimates that this would reduce federal spending by $667 billion over a decade. The eliminated floor would affect 13 states, but CBO predicts that “most of the affected states would probably not seek savings by reducing eligibility because they have a history of expanding Medicaid coverage.”

Of the various options CBO presents to reduce spending on the Medicare and Medicaid programs, this option may offer the best combination of significant cost savings without sacrificing enrollment and eligibility for those who need the Medicaid program.

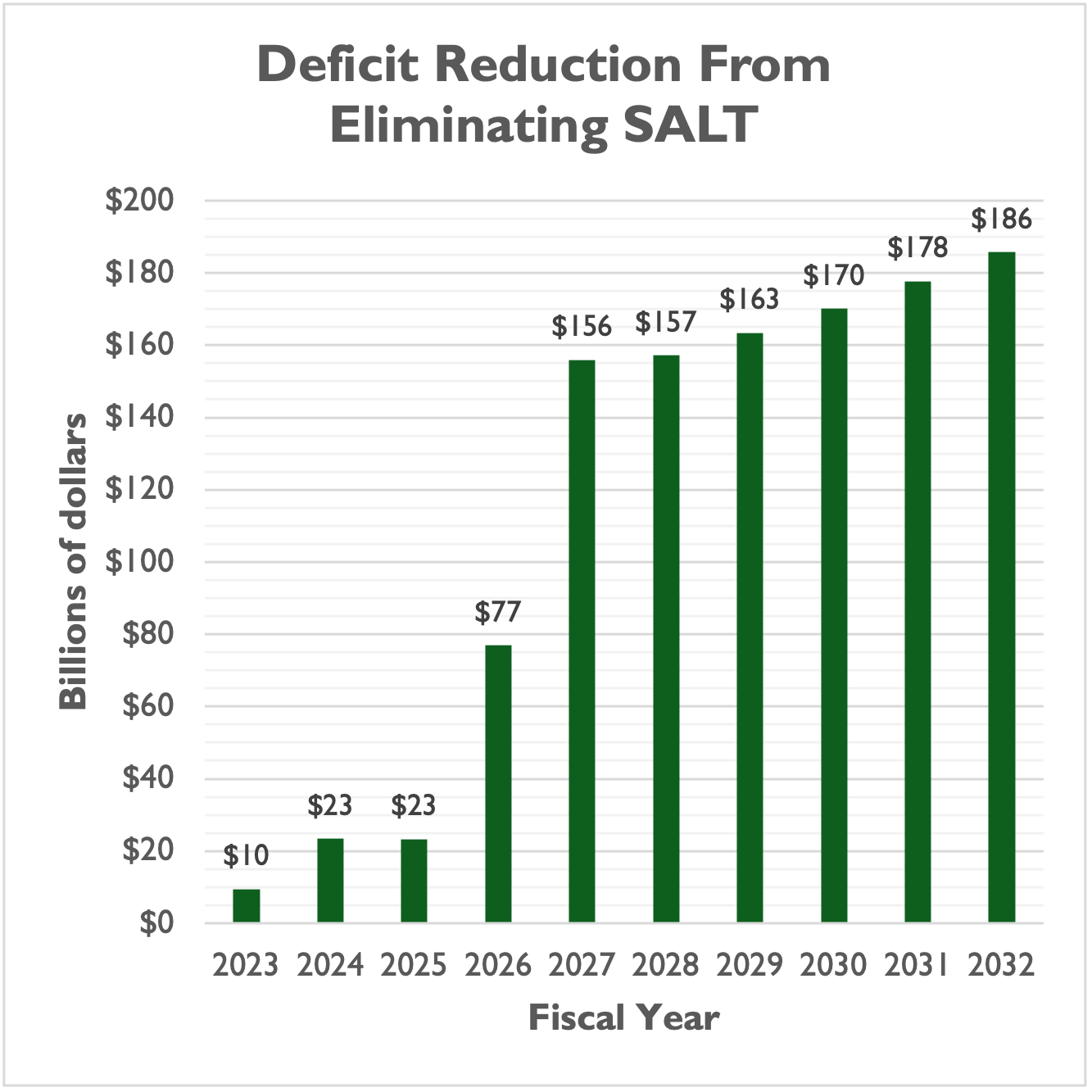

Eliminate the State and Local Tax (SALT) Deduction: $1.143 trillion

This option would eliminate the state and local tax (SALT) deduction effective January 2023, which under the 2017 Tax Cuts and Jobs Act (TCJA) is capped at $10,000 per household through 2025. The option would raise federal revenues by $1.143 trillion over the next decade, a notable sum. CBO has estimated that even with a $10,000 cap, 78 percent of the benefits of the SALT deduction accrue to the top 20 percent of income earners. SALT also indirectly incentivizes state and local governments that choose to raise taxes on their residents, by providing federal taxpayers with a reduction in federal taxes owed based on state and local taxes paid.

In our view, this option could be seen as a key offset to extending and/or making permanent some of the key tax provisions of the TCJA, such as lower individual rates (which would reduce revenues $1.529 trillion over a decade if made permanent), doubling the standard deduction (which would reduce revenues $887 billion over a decade if made permanent), and the expansion of the Child Tax Credit (which would increase deficits by $514 billion over a decade if made permanent). As a general rule, eliminating tax provisions such as SALT should be utilized to provide broader-based tax relief and simplification in a manner that has less impact on federal deficits.

Total, Eight Options: $2.211 trillion

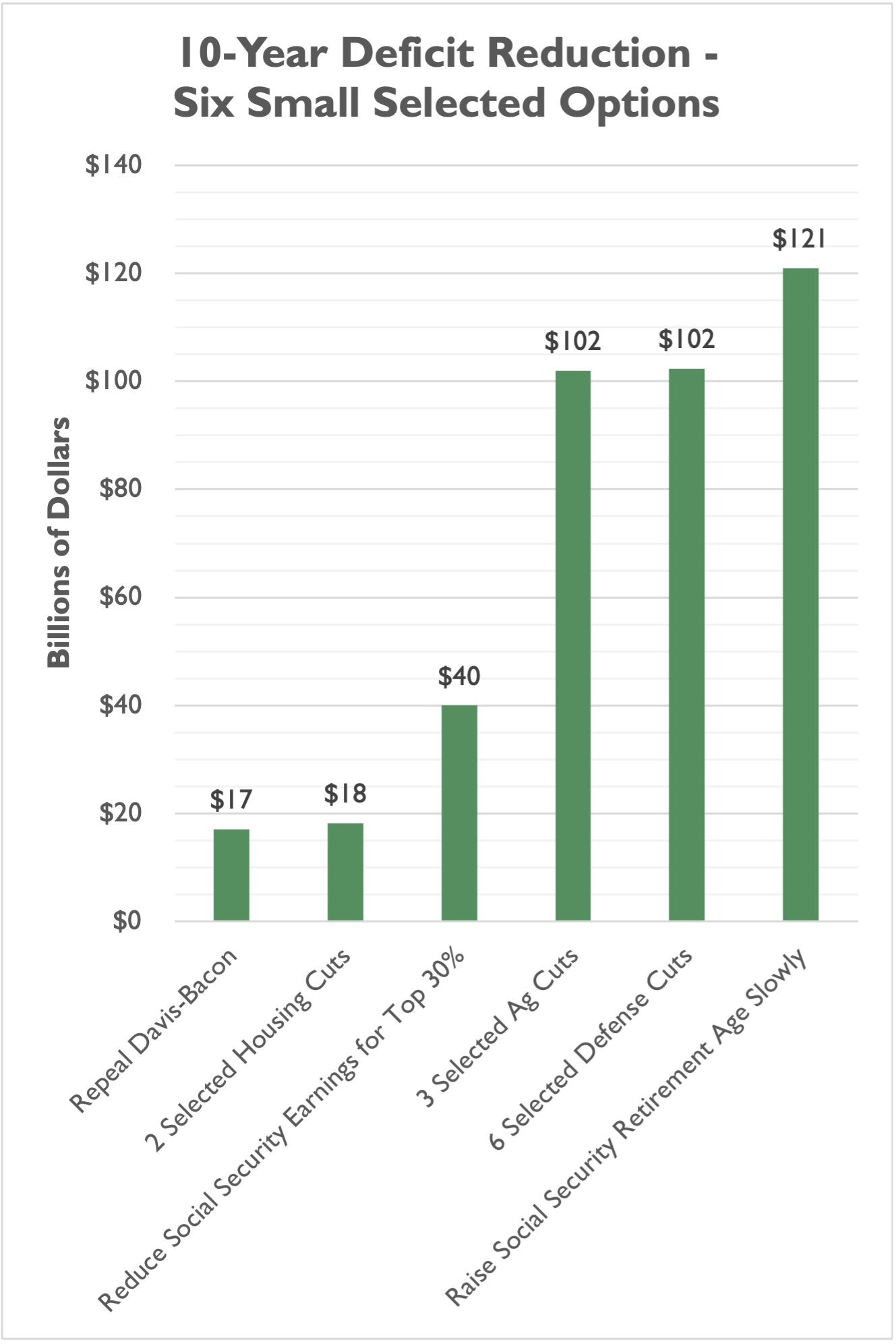

In total, and without accounting for interactions, these eight options combined would achieve $2.2 trillion in deficit reduction over the next 10 years. Even the six smaller options together would achieve $400 billion in deficit reduction collectively, as illustrated in the chart below:

NTUF will follow up with deeper dives into CBO’s policy options. It should also be remembered that CBO's list is not all-inclusive, there are many other good-government savings ideas that lawmakers could implement, many of which CBO has included in its cost estimates of pending legislation. For example, these include smaller savings of $4 million for limiting the benefits provided to former Presidents, or nearly $2 billion to reform operations of the U.S. Postal Service to centralize business mail delivery.

CBO is to be commended for its work to inform lawmakers and the public about the state of the budget and ways to address chronic deficit spending. The agency has also made the list of options easily searchable on its website, along with explanation and analysis of each policy. The hard work is for Congress and the President to implement budget reforms to ease the burden on taxpayers.