Introduction

Interacting with the IRS can be one of the most frustrating parts of the taxpayer experience. Whether it is by mail, on the phone, or online, there are plenty of improvements to be made in how the IRS communicates with taxpayers.

Two new reports from watchdog agencies overseeing the IRS bring to light two issues that go hand-in-hand to prevent meaningful progress in the taxpayer experience. The Government Accountability Office (GAO) reports that the IRS does not have an evidence-based approach to enhancing the taxpayer experience, and the Treasury Inspector General for Tax Administration (TIGTA) reports that the evidence the IRS published during the 2024 filing season to demonstrate success is misleading.

Neither the reluctance to develop evidence-based approaches to measuring success of initiatives nor the publishing of misleading data are new phenomena at the IRS. But measures to force a new course have had disappointing results. Congress gave the IRS a cash infusion through the Inflation Reduction Act (IRA) of 2022, then, in subsequent years, froze some of those funds in light of limited progress. Meanwhile, there has been a change in Administration and changes in leadership at the IRS.

Earlier this year, Senator Mike Crapo (R-ID) and Senator Ron Wyden (D-OR) released a tax administration reform package that could finally upgrade taxpayer interactions with the IRS. Many elements of the bipartisan Taxpayer Administration and Service (TAS) Act discussion draft would address the deficiencies of the taxpayer experience documented by GAO and TIGTA, through increased structure and accountability. While the two watchdogs regularly make recommendations for the IRS to improve its processes and functioning, it is clear that a legislative solution from Congress is needed to ensure transparent and adequate data collection on the taxpayer experience.

Failure to Measure Success

GAO’s July 2025 report highlights the IRS’s lack of evidence-based approaches to measure success in taxpayer experience improvements. This comes after the IRS spent just $14 billion of its $80 billion cash infusion from the IRA over three years, with the $3.2 billion in funding allocated to Taxpayer Services due to be depleted by the end of this year. The IRS’s goals for its IRA-funded transformation were outlined in its Strategic Operating Plan, which was released well behind schedule and offered vague goals over a short term period.

According to GAO, the IRS has failed to complete the following tasks that are necessary to determine whether taxpayer experience initiatives funded by the IRA and guided by the Strategic Operating Plan have been successful:

- Define taxpayer experience goals related to service improvements

- Generate new evidence from measures, analytical tools, and dashboards to track progress with the taxpayer experience goals

- Involve external stakeholders to help assess the effects of its service improvements on the taxpayer experience

- Promote accountability for achieving the taxpayer experience goals

IRS officials told GAO that these initiatives have been delayed, and that the offices responsible for coordinating initiatives funded by the IRA were disbanded earlier this year. While the Transformation and Strategy Office was disbanded in March, as has been previously reported, the office had at that time the intent to define goals, create dashboards to track progress, and involve stakeholders to assess its efforts.

The strategy the IRS was using to measure success was clearly not working. Disbanding the Transformation and Strategy Office was part of a broader course change at the IRS that also includes shifting away from Strategic Operating Plan, removing non-technical staff from technical roles, and hosting a hackathon to improve data sharing across internal systems.

Furthermore, the lack of evidence-based approaches to track the taxpayer experience likely violates the Taxpayer First Act of 2019, which requires the IRS to develop a thorough strategy for customer service. While the IRS did submit a report outlining next steps to implement the Taxpayer First Act, the failure to adequately measure success of any strategies implemented is a missed opportunity.

To build on these changes, the IRS can take action today to improve its processes for measuring success. For example, it should implement GAO’s recommendation to fully establish an evidence-based approach to assess the effects of service improvements on the taxpayer experience. Furthermore, it should engage with stakeholders to develop other ideas for action.

Along with a cross-partisan group of experts through the Taxpayers for IRS Transformation (Taxpayers FIRST) initiative, NTUF has made several recommendations to better measure the success of IRS taxpayer experience initiatives.

- Adopting more metrics that focus on outcomes rather than merely counting inputs or outputs.

- Transparently producing data used to track clearly defined metrics on a rolling basis, which would provide real-time updates.

- Producing an enhanced modernization plan, including for its taxpayer experience initiatives, that includes itemized cost analyses along with any relevant deadlines, deliverables, and benchmarks for each of its initiatives.

- Quantifying the benefits of improved taxpayer services and taxpayer knowledge in boosting tax compliance.

- Adding a strategic oversight entity to the IRS with a high-level panel of experts who provide ongoing, independent, non-adversarial guidance to the IRS on its taxpayer experience initiatives, such as the IRS Oversight Board created by the IRS Restructuring and Reform Act of 1998.

While there is certainly more that can be done to ensure adequate measurement of the success of various new initiatives, including very basic objectives the IRS has thus far failed to complete, such as defining goals related to service improvements, these additional recommendations pave a definitive path forward for improvement if implemented.

Misrepresenting Success Thus Far: LOS Is a Flawed Metric

Without evidence-based approaches to measure success, federal agencies can misrepresent success.

Overstating the success of initiatives is shortsighted, as it will contribute to lack of trust from taxpayers, stakeholders, and policymakers, as evidenced by recent funding freezes. We have pointed out several ways in which the IRS has underperformed implementing IRA initiatives to improve taxpayer service, close the tax gap, and modernize technology.

In 2023 and 2024, the IRS released “report cards” grading its own success in completing its IRA objectives. However, when we compared the report card with its checklist of goals included in the IRA Strategic Operating Plan Update released in May 2024, we found several key objectives went unfinished. The IRS had not completed all of these important goals set to be completed that Fiscal Year:

- Customer service standards created, implemented, and measured IRS-wide

- Increased service availability and services are offered in TACs and on phones to meet taxpayer demand

- Payment capabilities over the phone and through employees launched

- Data and analytics capabilities are used to predict taxpayer demand and staffing needs for customer service and to project estimated processing time for certain returns and other forms

Despite this, the IRS gave itself a glowing review in its report card issued that year, noting that it provided callback options for 97% of callers, but failing to include any initiatives to reduce call wait times, improve results, or track the quality of taxpayer discussions with IRS representatives. For that reason, we graded the IRS’s taxpayer service initiatives as a “C,” observing that detailed metrics are needed to determine true success.

TIGTA’s report highlights the IRS’s failure to accurately represent data on the percentage of phone calls that were ultimately picked up, a metric known as the Level of Service (LOS). The report states that, “taxpayers often experience a significantly reduced LOS and longer wait times than those generally reported by the IRS during the filing season.” In response to the report, the IRS disagreed with TIGTA’s conclusion and rejected its recommendations as confusing to the public.

LOS is a flawed metric to measure the percentage of taxpayer phone calls picked up by IRS representatives. In several different reports, we have pointed out that the LOS metric does not account for the majority of calls, does not reflect decreases in the volume of calls at any given time, and measures only the quantity of phone calls received rather than the quality of service provided by representatives on those calls.

The IRS claimed that it exceeded its target of answering 85% of phone calls for the Fiscal Year 2025 tax filing season, with an 87% LOS and a three minute average wait time. However, the LOS figure only tracks its 35 Account Management (AM) phone lines, whereas a broader Enterprise LOS that tracks AM phone lines plus 27 other phone lines is generally not publicized. Wait times on other lines not tracked by the traditional published LOS were about 17 to 19 minutes during the 2024 filing season.

TIGTA underscores that these other lines that are not accounted for in the traditional LOS figure handle approximately one-third of all phone calls answered by IRS representatives, and many are in the top ten phone lines called by taxpayers. The second most called phone line this filing season, the Installment Agreement/Balance Due line, had an abysmal LOS of only 46% of all calls being answered by a representative and an average wait time of 26 minutes as of April 19, 2025, according to data from the National Taxpayer Advocate. The fifth most called phone line this filing season, the Taxpayer Protection Program line, had a LOS of 29% and an average wait time of 17 minutes.

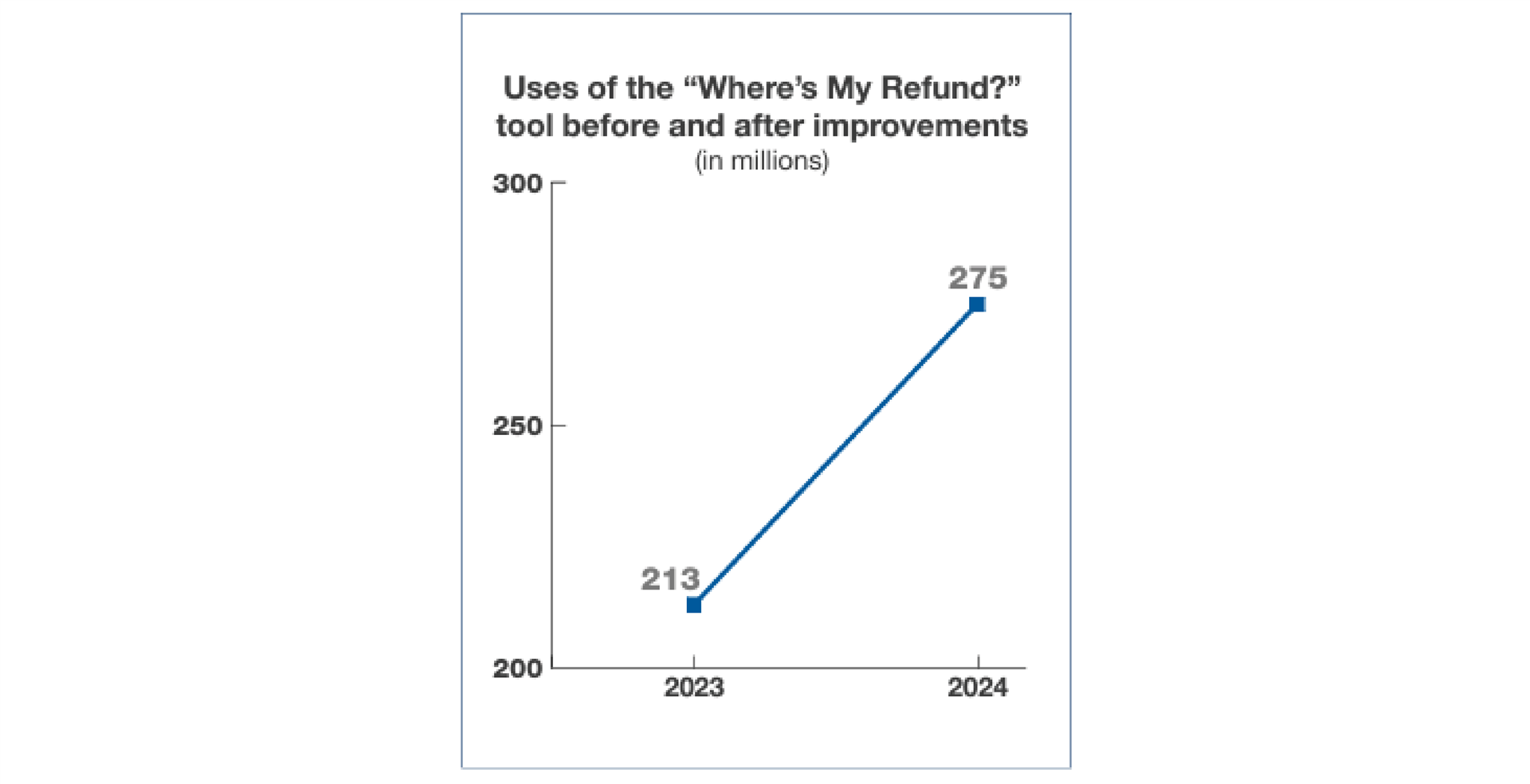

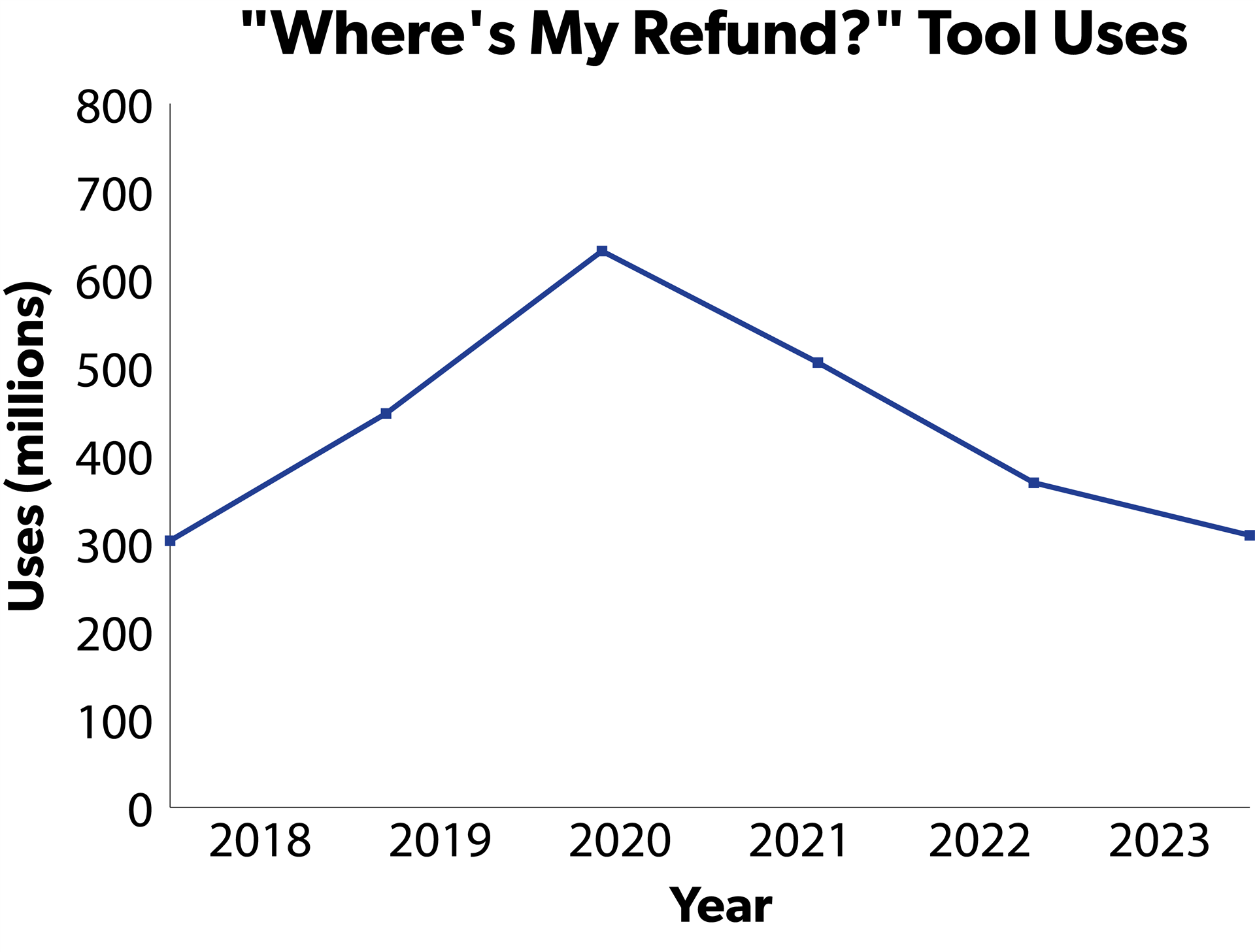

The IRS also published flawed information showing the success of specific initiatives in its report card, such as improvements to the “Where’s My Refund?” web page. The report card credits these improvements with sending millions more taxpayers to the IRS website that year. Its Strategic Operating Plan update provides a chart showing progress over a one-year period, which does not show the usage of “Where’s My Refund?” over multiple years.

Unfortunately, the IRS rejected TIGTA’s recommendations for sensible approaches to transparency in information reporting. TIGTA’s recommendations were to widely report to the public the Enterprise LOS and AM LOS and the average wait times throughout the entire fiscal year for all telephone lines that provide live assistance to taxpayers. The IRS countered that this information “does not provide information to determine taxpayer experience” and “would be confusing to the public.” What might actually confuse members of the public who wish to contact the IRS is that an “average” 3-minute phone wait might take far longer if they call any lines outside of AM.

Taxpayer Assistance and Service Act

Earlier this year, the Taxpayer Assistance and Service Act discussion draft released by Senators Mike Crapo (R-ID) and Ron Wyden (D-OR) provided a commendable package of proposals that would mandate that the IRS implement commonsense approaches to enhance the taxpayer experience.

The Act would require, among other things, that the IRS establish an up-to-date dashboard to inform taxpayers of backlogs and wait times. Given the IRS’s rejection of TIGTA's recommendation to provide transparent LOS and wait time data to the public, passing the Taxpayer Assistance and Service Act may be the best way to ensure this is accomplished. Collecting and swiftly publishing comprehensive taxpayer experience data is the best way to safeguard against ongoing misrepresentations of taxpayer satisfaction.

In a February 2025 testimony before the U.S. House of Representatives Committee on Ways and Means, NTUF President Pete Sepp stated:

The path forward to reform tax administration will be made easier with bipartisan collaboration. History has shown that durable, effective IRS reforms—such as the IRS Restructuring and Reform Act of 1998—stem from consensus-driven efforts. The IRA’s partisan approach to IRS funding demonstrates the risks of failing to build broad support: without bipartisan buy-in, reforms are more likely to be undone, defunded, or rendered ineffective over time. The 2025 Taxpayer Assistance and Service Act discussion draft, on the other hand, demonstrates the benefits of both staff- and Member-level cooperation on devising solutions to known, longstanding tax administration maladies. This draft is a testament to the fact that even though RRA ‘98 is a distant memory to most, it is possible for Congress to come together in today’s highly volatile political environment to make transformative changes to the way the tax system functions. Future efforts to modernize the IRS, improve taxpayer services, and enhance compliance must be crafted with input from both parties to ensure lasting, meaningful change.

National Taxpayer Advocate Erin Collins has also praised the discussion draft: “Now that the reconciliation bill has been enacted, I encourage Congress to continue moving forward with the TAS Act and related bills. While tax policy often gets more headlines, tax administration in many ways has a more tangible impact on people’s lives in terms of the direct experience they have working with the IRS and complying with tax law requirements.”

Conclusion

Watchdog findings from GAO and TIGTA make clear that IRS self-reporting of its metrics and objectives is inadequate at providing structure and accountability. Instead, durable improvements will require transparent data, rigorous performance metrics, and independent oversight—standards that the bipartisan Taxpayer Assistance and Service Act discussion draft is well positioned to deliver. If enacted and implemented faithfully, these reforms could finally align IRS service delivery with taxpayer expectations, ensuring that modernization efforts translate into tangible improvements for millions of Americans.