(pdf)

Introduction

Since President Biden released his FY 2023 budget proposal, the bulk of the media coverage has credulously parroted the administration’s claims that the budget “reduces the deficit.”[1]But while spending for 2023 would indeed be down compared to last year, this is because the unprecedented multi-trillion spending spree, kicked off in response to the pandemic’s inception in 2020, is finally winding down.

However, looking ahead, Biden would still add $14 trillion to the federal debt even with over $2.5 trillion in tax hikes. Unfortunately, there are very few reforms to rein in spending in this budget blueprint. The bulk of the “deficit reduction” would come from controversial taxes that are not likely to be enacted by Congress during a midterm election, especially with the risks of triggering an economic recession.

Tax Hikes

Biden’s proposed tax increases include $1.6 trillion in job-killing tax hikes on business income, taxes which would be passed on to consumers and labor. They also include $44 billion in taxes on oil and gas development that would only exacerbate the current issues with gas prices by making it more expensive and risky for businesses to increase the domestic oil supply. What’s more, the higher rates will flow through to the supply chain of transported consumer goods.

There’s also $722 billion in higher taxes on individuals, which along with business tax increases would act like a hammer on incentives to private sector production, investments, and savings. Many of these proposals were already included in the Build Back Better Act that was blocked in the Senate. The prospects of their passage are even less favorable given the inflationary headwinds from supply chain issues, disruptions stemming from Russia’s invasion of Ukraine, and concerns about an economic recession.

Spending Hikes

Meanwhile, the budget proposes $5.79 trillion in spending for FY 2023, slightly lower than the outlays for FY 2022 of $5.85 trillion (a figure which underreports actual totals because, even though the budget was late on arrival, it was not adjusted to include spending for FY 2022 enacted through the Consolidated Appropriations Act, 2022 signed into law on March 15).

It is good that spending is down year over year, but this should be put into the proper context: this reduction is solely the result of the natural winding down of pandemic-related spending. Outlays soared to $6.8 trillion in FY 2021 (30.5 percent of GDP, the highest since WWII) and have still not returned to pre-pandemic levels. The spike was due to the $1.9 trillion in spending enacted during 2020 in response to the pandemic and economic shutdown, plus the additional amount of roughly $1.5 trillion provided for 2021 and 2022 through the American Rescue Plan Act.

For comparison, the Congressional Budget Office’s (CBO) January 2020 budget outlook– published just a few months before the start of the economic shutdown – projected that outlays for FY 2023 would total $5.3 trillion.[2]The other side of CBO’s ledger projected tax receipts of $4.2 trillion for FY 2023. Revenues are on pace to top that level for 2023 even if the $131 billion in Biden’s proposed tax hikes for the year are excluded.

Clearly more work is needed to get spending back in line where it would have been without the crisis and to tackle the growing federal debt. But, after 2023, Biden’s budget would grow spending by 4.9 percent, or $342 billion, per year, topping the annual 4.8 percent rate for tax receipts through the period ($272 billion per year) which includes massive tax hikes.

Despite the budget’s release coming two months after the deadline required under the Budget and Accounting Act of 1921, it is still incomplete. Table S-6 in the budget book which lists “Mandatory and Receipt Proposals” includes eight potential spending initiatives that have a footnote advising, “Estimates were not available at the time of Budget publication.” The bottom-line price tag could end up higher.

Biden’s Budget is Short on Spending Reforms

Unfortunately, there are very few spending reforms included in Biden’s budget. For example, pages 124 through 130 of the primary budget book includes the mandatory and spending proposals in Table S-6. On these pages, there are 53 proposals with specified outlay increases and 10 showing savings (both counts exclude section subtotals, other interactions, and budget-neutral pairs of proposals to reclassify budget accounts). The savings include:

- $35 million in civil monetary penalties for noncompliance with new regulations on employers

- $180 million in savings for reduced reimbursement rates for certain foster care placements (related to a separate line item to increase spending by $1.3 billion for foster care placements)

- Net savings of $12.4 billion to extend sequestration for an additional year to 2032 – a budget savings trick used multiple times by Congress since 2013, including instances where the sequestration is extended years from now while rolling back similar cuts up front. Sequestration should be made permanent so that lawmakers are forced to find other offsets.

- $4.2 billion in savings related to coverage of pre-exposer prophylaxis (PrEP) under Medicare – related to a separate line item creating a PrEP Delivery Program costing $9.7 billion.

- $2.1 billion in savings through “[enhancing] Medicaid managed care enforcement.” While there is no other information about this in the budget books currently available, the Department of Health & Human Services explains:

This proposal would revise Section 1903(m)(2)(A) to condition federal match in Medicaid managed care plan contract capitation payment amounts on a service-by-service basis and provide [Centers for Medicare & Medicaid Services (CMS)] with additional enforcement options. The proposed revisions would enhance CMS’s ability to take meaningful actions to protect beneficiaries and enforce requirements, making these managed care compliance tools more effective and consistent with similar authorities in fee-for-service.[3]

- $5.9 billion in savings to extend customs and Border Protection user fees through 2029. Like the sequestration extension above, this is another frequently employed budget gimmick.[4]Congress should make these user fees permanent.

- A net of $1 million in savings through expanding Foreign Labor Certification Fees. The certification allows an employer to hire a foreign worker to work permanently in the United States.

After accounting for the fees, penalties, extensions, and partial offsets to increases, there is one programmatic reform recommendation to reduce payments to Medicaid managed care service providers.

In addition to the items detailed above, there are proposals to boost spending on program integrity for Medicare and Medicaid, Unemployment Insurance, and Social Security. Every administration’s budget has hoped to find savings from improper and fraudulent payments by increasing spending for enforcement. This is one common weapon used in the never-ending war on budget waste.[5]Biden’s budget would increase program integrity spending by a total of $28.7 billion across the three programs and projects, resulting in savings of $42.4 billion over the decade. This is a worthy goal, but the savings may end up being more difficult to realize than hoped for. For example, the Government Accountability Office has listed Medicaid as a “high risk” programfor many years because of program integrity concerns.[6]

Dating back to President George W. Bush, presidential budgets have included a publication specifying reforms to discretionary and mandatory spending programs, such as President Obama’s list of Terminations, Reductions, and Savingsincluded in his budget proposal for FY 2011 or President Trump’s Major Savings and Reformsfor FY 2021.[7]President Biden’s budget last year did not include a similar document. However, as some of the analytical sections and supporting tables for this year’s budget have not yet been published, it is unclear whether a list of discretionary spending reforms will be included among the forthcoming documents.

An Alternative Projection of Revenues & Outlays

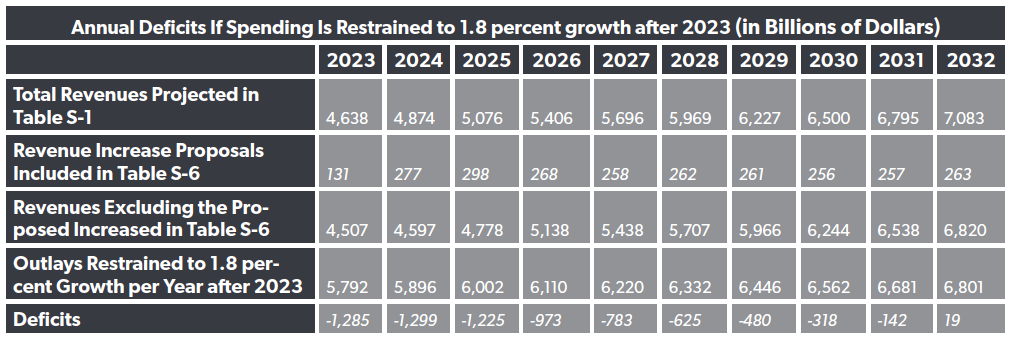

If growth in spending after 2023 were restrained to 1.8 percent per year, the deficits would decline steadily per year, resulting in a small surplus in 2032. This calculation excludes the higher receipts from Biden’s $2.5 trillion in tax hikes included in Table S-6 of the Budget.

Alternative options are to reduce and eliminate overlapping or poorly performing programs. In 2020, NTUF and U.S. Public Interest Group Education Fund worked together on a “Common Ground” report to identify nearly $800 billionin wasteful spending.[8]Thismenuof bipartisan savings options is a good place for Members of Congress to start tightening the federal budget and reeling in the federal debt.[9]

Biden’s Budget Attempts to Rebrand the Federal Debt

This year’s budget continues a new trend started last year to elevate a questionable number to make it seem as though the federal debt is not as bad as it looks. Table S-1 of the annual budget shows each administration’s projection of spending, revenues, deficits, GDP, and debt. It also shows the level of federal debt as a share of GDP. For example, the new budget estimates debt held by the public will comprise 101.8 percent of GDP and will rise to 106.7 percent of GDP by the end of the decade.

Starting last year, Biden’s budgets have added a new line to Table S-1 showing “Debt held by the public net of financial assets” which finds that debt is 90.9 percent of GDP this year rising to 98.6 percent. This figure has been included in each year’s budget but as part of another table showing data regarding “Federal Government Financing and Debt.”

The assets include:

- Treasury operating cash balance” -- the total of U.S. funds held in the Federal Reserve Cash account and Treasury’s Tax and Loan Account reflecting the U.S. government’s interest-bearing “savings” account of excess funds invested in financial institutions)

- Direct loan and Troubled Asset Relief Program equity

- Some guaranteed loan accounts, and

- Government-sponsored enterprise (GSE) preferred stock, and Non-Federal securities held by the National Railroad Retirement Investment Trust.

By elevating this information from what is generally one of the last tables in a budget submission into the very first table of data, the administration is trying to suggest that the debt isn't quite as bad as it looks. But there are several caveats regarding these assets. For example, under government accounting rules, federal loan programs are scored using a methodology that makes them look more financially favorable than they would look under other methods considering the market risk of the financial activities. It’s highly ironic for President Biden to frame federal loans as fiscal assets in order to downplay the severity of the national debt when he himself has claimed to want to cancel billions of dollars in student loan debt.[10]

Similarly, the data doesn’t not reflect the risks entailed by the government’s takeover of the GSEs: the mortgage giants Fannie Mae and Freddie Mac. Yet another drawback of GSE conservatorship is shown here – it makes their preferred stock look like a federal asset. If they intend to count it that way, have they not effectively admitted they do not foresee Fannie and Freddie leaving conservatorship?

Conclusion

The Biden administration should not claim credit for spending being lower this year than last year, especially considering its role in pushing through the massive spending hikes in ARPA on the heels of the trillions already obligated through laws in 2020, and also for failing to do more to hold back spending in its new budget proposal. Presidents shouldn’t get credit for blowing out the budget slightly less than they did the year before.

Despite the happy talk that Biden’s budget emphasizes deficit reduction, nearly all of this is proposed through tax hikes that are dead on arrival. The administration should take this budget blueprint back to the drawing board and come back with realistic, bipartisan plans to draw down the debt.

[1]Office of Management and Budget. (2022) Budget of the U.S. Government: Fiscal Year 2023. Retrieved from https://www.whitehouse.gov/wp-content/uploads/2022/03/budget_fy2023.pdf.

[2]Congressional Budget Office. (2020). The Budget and Economic Outlook: 2020 to 2030. Retrieved from https://www.cbo.gov/system/files/2020-01/56020-CBO-Outlook.pdf.

[3]Department of Health and Human Services. (2022). Fiscal Year 2023 Budget in Brief. Retrieved from https://www.hhs.gov/sites/default/files/fy-2023-budget-in-brief.pdf.

[4]Brady Demian. “One Weird Trick Congress Uses to Game Budget Numbers.” National Taxpayers Union Foundation. August 4, 2021. Retrieved from https://www.ntu.org/foundation/detail/one-weird-trick-congress-uses-to-game-budget-numbers.

[5]Brady, Demian. “The War on Federal Redundancy.” The Ripon Forum. 2011. Retrieved from https://riponsociety.org/article/the-war-on-federal-redundancy/.

[6]Government Accountability Office. (2021). Strengthening Medicaid Program Integrity. Retrieved from https://www.gao.gov/highrisk/strengthening-medicaid-program-integrity.

[7] United States Government Publishing Office. Budget of the United States Government: Fiscal Years 1996 to 2023. Retrieved from https://www.govinfo.gov/app/collection/budget.

[8]National Taxpayers Union Foundation. (2020). “Report: Groups Find "Common Ground" On Nearly $800 Billion in Cuts To Wasteful Federal Spending.” Retrieved from https://www.ntu.org/foundation/detail/report-groups-find-common-ground-on-nearly-800-billion-in-cuts-to-wasteful-federal-spending.

[9]Brady, Demian and Cross, R.J. Toward Common Ground 2020: Bridging the Political Divide with Deficit Reduction Recommendations for Congress. National Taxpayers Union Foundation and U.S. PIRG Education Fund. April 23, 2020. Retrieved from https://www.ntu.org/publications/page/toward-common-ground-bridging-the-political-divide-with-deficit-reduction-recommendations-for-congress.

[10]Turner, Cory. “Biden pledged to forgive $10,000 in student loan debt. Here's what he's done so far.” NPR. December 7, 2021. Retrieved from https://www.npr.org/2021/12/07/1062070001/student-loan-forgiveness-debt-president-biden-campaign-promise.