(pdf)

Introduction

As the $3.5 trillion reconciliation package moves through Congress, advocates have claimed that the package will “cut taxes” for middle- and lower-income families. While this framing connotes rate reductions or deductions, the reality is that much of the “tax relief” included in the reconciliation package would take the form of refundable tax credits.

Unlike other tax credits, refundable tax credits provide payments through the tax code to eligible individuals that exceed their income tax liability: the credits reduce taxes owed, but any leftover credits are paid to the filer. In other words, they are akin to ordinary spending programs despite being situated in the tax code.

Lawmakers frequently employ refundable tax credits in the aftermath of economic downturns as a way to provide relatively expedient and direct assistance. However, they are also a frequent source of erroneous and improper payments costing billions of taxpayer dollars per year and the Internal Revenue Service (IRS) warns that the costs necessary to reduce the improper payments in compliance with statutory requirements would be prohibitively large.[1]

Nevertheless, refundable credits have risen in popularity among politicians as the tax system has become increasingly progressive over the past several decades, shifting a greater share of the income tax burden to wealthier earners while significantly reducing income tax liabilities on those who earn less. Refundable tax credits allow politicians to claim that they are cutting taxes. However, to the extent that they result in new spending, these credits should be considered as welfare payments, not tax cuts.

What are Refundable Credits?

To pay taxes, filers calculate their taxable income (based on earnings less allowable deductions) and determine their gross tax liability based on the applicable marginal tax rate. The amount owed is then reduced by subtracting the amount of any eligible tax credits. These credits can potentially zero out a taxpayer’s liability (though certain wealthy filers could then potentially be subject to the Alternative Minimum Tax). Certain types of unused credits in excess of tax liability can be carried forward and applied in future tax years, but otherwise this portion does not result in a refund to the taxpayer.

In the budget, tax credits reduce the government’s collection of tax receipts. For example, the Joint Committee on Taxation (JCT) estimated the residential energy efficient property tax credit for qualified purchases of solar and related properties used in a residence reduced tax revenues by $1.7 billion in 2020.

Refundable tax credits are different because the amount of credit in excess of liability is paid to the taxpayer, essentially resulting in a “negative” tax bill. These are generally designed to provide direct assistance to lower-income taxpayers. In the federal budget, refundable credits reduce tax revenues and also result in spending, recorded as mandatory outlays in the federal budget.

The First Refundable Credit: The Earned Income Tax Credit

Congress enacted the Earned Income Tax Credit (EITC) as the first refundable credit in 1975 in response to the combination of an economic recession and inflation of energy and food prices. Initially, it was in effect only for tax year 1975 and had a maximum value of $400 ($2,100 in 2021 dollars). The credit was equal to 10 percent of the first $4,000 in earnings, with phaseouts between incomes of $4,000 and $8,000. The intention of the credit was to provide assistance and encourage people with children to work rather than depend solely on welfare programs. The Congressional Research Service (CRS) reports that for 1975, the IRS processed 6.2 million tax returns claiming the EITC for a total amount of $1.3 billion, of which $887 million (71 percent of the total) was refunded.[2]

The EITC was subsequently extended and then was made permanent in 1978. Laws enacted over the intervening decades generally tended to increase the value of the credit and expand eligibility (for example, a 1993 law extended the program to workers without children) while also limiting higher-income individuals from claiming it. In 2018, the most recent year for which the IRS has released complete data, 26.5 million returns claimed the EITC for a total of $64.9 billion, of which $56.2 billion (87 percent) was paid out for the refundable portion.

Expansion of Refundable Tax Credits: Temporary Provisions

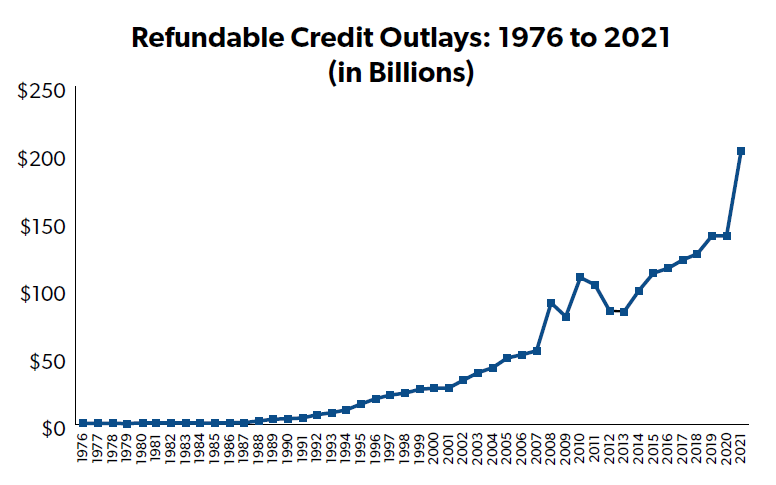

Additional refundable credits were created over time and generally were established in response to economic downturns. The above chart shows the nominal increase in spending on the outlay portion of refundable credits designed to assist individuals. Refundable credits grew from less than $900 million in 1976 (making up 0.2 percent of total outlays that year) to $202 billion in 2021, comprising roughly 3 percent of total outlays.

Previous Temporary Refundable Credits

The EITC was originally a temporary provision, but it was eventually made permanent. Some previous refundable credits were allowed to expire, including:

Making Work Pay Tax Credit

The American Recovery and Reinvestment Act (ARRA) of 2009 created this temporary 6.2 percent credit against earnings in tax years 2009 and 2010, providing a maximum reduction of $400 for singles or $800 for couples. According to data from the Office of Management and Budget (OMB), this resulted in net outlays of $29 billion.[3]

First Time Homebuyers Credit

ARRA also included a maximum $8,000 refundable tax credit for purchases of homes, claimable through 2010 tax returns (members of the military were given an additional year to claim the credit). OMB reports that this resulted in net outlays of $20 billion.[4]

Recovery Rebates (a.k.a. Stimulus Checks”)

After the collapse of the housing market in 2008, Congress enacted the Economic Stimulus Act of 2008 which provided a refundable credit of $300 to $600 for individuals plus an additional $300 credit per child. The credits were advanced so that filers could receive the credits in 2008 rather than waiting until they filed taxes in 2009. The IRS processed the advanced payment of the credit based on filers’ prior income tax return information and, where possible, either mailed checks to individuals or made direct deposits into their bank accounts.

The Treasury Inspector General for Tax Administration (TIGTA) reported that “The IRS issued more than $96 billion in advanced economic stimulus payments to more than 119 million individuals in Calendar Year 2008 and approximately $8.5 billion in recovery rebate credits to almost 21 million taxpayers as of April 17, 2009.”[5] At the time of enactment, the Congressional Budget Office (CBO) and JCT estimated that this would reduce revenues by a net of $75 billion and increase outlays by $40 billion for the refundable portion.[6] Subsequent data from OMB shows the outlay cost was a net of $17 billion.[7]

Current Refundable Credits

In addition to the EITC, the largest of the refundable credits currently available for individuals include:

Child Tax Credit

This credit has been available to filers since 1997 for qualified dependent children under age 17. A capped portion of the amount in excess of tax liability is made refundable through the Additional Child Tax Credit. This credit resulted in net outlays of $29 billion in 2019.[8] Pandemic legislation temporarily expanded this credit (see below).

Premium Tax Credit

This was established in the Patients Protection and Affordable Care Act (ACA) to subsidize the purchase of health care insurance through the ACA’s federal and state exchanges. Through 2020, this credit resulted in over $256 billion in new spending, including $49 billion in 2019.[9] This was also temporarily expanded during the pandemic.

American Opportunity Credit

A credit for allowable education expenses including qualified tuition, fees, and course materials. This was established in the ARRA, extended temporarily by two laws, and made permanent in 2016. In 2019 its outlays were $3 billion.[10]

Health Coverage Tax Credit

This credit is available for individuals whose employment was negatively impacted by trade and for people in pension plans that were taken over by the Pension Benefit Guaranty Corporation. This was originally established in 2002, has since been extended several times, most recently through the end of 2021. In 2019, it resulted in net outlays of $24 million.[11]

Refundable Credits in the Pandemic and Economic Recovery Responses

Lawmakers employed new and expanded refundable credits in response to the onset of the pandemic and the economic recession. These included:

Paid Sick Leave and Family and Medical Leave

The Families First Coronavirus Act enacted a tax credit against payroll taxes for employers to reimburse expenses for paid sick and family medical leave provided to employees. At enactment, JCT and CBO estimated this would provide nearly $95 billion in tax relief and increase outlays by $10 billion. The credits were later extended through September 30, 2021.

Recovery Rebates

The Coronavirus Aid, Relief, and Economic Security (CARES) Act provided an advanceable refundable credit for 2020 of $1,200 per qualified adult and $500 per dependent. CBO and JCT estimated that this would reduce revenues by $142 billion and increase spending by $151 billion.[12] Another round of stimulus checks was provided in the American Rescue Plan Act (ARPA) of 2021, reducing revenues by an estimated $8.5 billion and increasing outlays by $402 billion.[13]

Employee Retention Credit

This is a credit against payroll taxes for employers to help them to keep workers employed during COVID-related economic shutdowns. CBO and JCT estimated that this would reduce revenues by $52 billion and increase outlays by $3 billion.[14] Subsequent laws extended the credit and made other changes. OMB estimates this will cost $62 billion in 2021.[15]

Premium Tax Credit Expansion

This existing credit was expanded in ARPA by increasing the credit amount, making more individuals eligible, and eliminating the requirement for filers to repay excess advance payments received in 2020. OMB estimates that this will result in outlays of $59 billion in 2021.[16]

Child Tax Credit Expansion

ARPA temporarily expanded this credit for additional individuals and made it fully refundable. OMB estimates outlays will total $80 billion in 2021 and $188 billion in 2022.[17]

EITC Expansion

ARPA expanded the credit for tax year 2021. OMB estimates total outlays of $61 billion for the refundable credits in 2021, and $74 billion in 2022.[18]

Reconciliation to Expand Refundable Credits

The $3.5 trillion package working through Congress would further increase outlays for refundable credits by making recent temporary expansions permanent. Proposals unveiled in the House version would expand major tax credits by the following amounts:

- Child Tax Credit: $421 billion

- EITC: $103 billion

- Child and Dependent Care Tax Credit: $32 billion

It would also create a new refundable credit for plug-in electric vehicles through 2031, increasing spending by $1.2 billion.[19]

Why Refundable Credits?

Refundable Credits vs. Tax Cuts

One reason that lawmakers frequently turn to refundable credits is that the tax code has been made increasingly progressive. Compared to 40 years ago, tax rates have been ratcheted down across the board. Yet because of various credits and exclusions added over time, a greater share of the income tax burden has been shifted to wealthier earners. For example, in 1980 the income tax share of the top one percent of filers was 19 percent – less than half of what it was in 2018 (40 percent), the most recent year of comprehensive data from the IRS.[20] This is despite the fact that the top marginal income tax rate was 70 percent in 1980 and was eventually reduced to 37 percent in 2018.

The bottom 50 percent of earners owe roughly three percent of all income taxes. Many in this group have no income tax liability. The number of filers owing no income taxes increased from 21 percent in 1980 to 35 percent in 2018.[21] As a result, targets of economic relief or other forms of government spending often do not have income tax bills that can be lowered substantially, meaning that any attempt to provide them a benefit through the tax code must come in the form of a refundable credit.

Because tax cuts tend to sell better than stimulus payments or other forms of welfare, politicians use refundable credits to extend “tax relief” to middle- and lower-income households. News reports and headlines then echo the claim about “tax cuts.” For example, an article published by Forbes claimed that ARPA provided the “largest tax cut in history.”[22] CNN ran a headline claiming, “Biden’s stimulus provides larger single-year tax breaks than Trump’s or Reagan’s cuts.”[23] These claims are misleading because they conflate tax reductions with transfer payments. As the numbers show, the vast majority of those “tax cuts” were paid out above and beyond what the recipients were liable for in income taxes. In fact, 85 percent of the “tax relief” in ARPA occurred as spending.[24]

Expedited Aid

A significant advantage that refundable credits have over other federal grant or support programs is that they can be processed relatively quickly, delivering needed benefits directly to individuals during an economic emergency. The IRS demonstrated this with the processing of the recovery rebate checks. There were a few hiccups, such as concerns that some payments were issued to deceased individuals, but the operation was quicker and more successful than a targeted spending program would likely have been.

Refundable Credit Concerns

A downside to refundable credits is that they can add complexity to the tax code and cause confusion for filers. Refundable credits, and the EITC in particular, are also a significant source of the federal government’s improper payments.[25] The IRS estimates that 24 percent of EITC payments in 2020 were improper.[26] Similarly, the advanceable child tax credit had an improper payment rate of 12 percent, and the American Opportunity Tax Credit rate was 26 percent. TIGTA reports that the health-related Premium Tax Credit is another high-risk program but the IRS did not calculate its improper payment rate because of demands placed on the agency related to the pandemic and partial shutdown of IRS facilities. Some of these are due to taxpayers mistakenly claiming a credit for which they weren’t eligible, but there is also a significant amount of intentional fraud.

A recent TIGTA report revealed that the Department of the Treasury and the IRS are trying to get the refundable credits excluded from improper payment requirements. A Business Case was presented to OMB for approval[a][b]. The document is not publicly available but TIGTA notes that it argues that the “refundable portion of tax credits, or outlays, should not be considered separately from the rest of the credit because the IRS and Treasury Department need to view any errors to address them effectively” and that tax gap estimates already effectively “monitor changes in refundable tax credits over time.”[27]

There may be some merit to this if the IRS regularly updates its tax gap analyses, presents them in a clear and comprehensive format, and highlights the problems as well as the progress made in reducing erroneous payments under refundable credit programs. However, TIGTA has also raised concerns that “the resources dedicated to EITC audits are not currently considered as part of a larger integrated framework together with the other compliance risks that make up the Tax Gap.” Without these steps, taxpayers may be concerned that officials are attempting to sweep the problems with these credits away from public scrutiny so as to minimize the negative press coverage that accrues from the Government Accountability Office’s annual improper payment reports.

Conclusion

While refundable credits are high-risk for improper payments due to errors and fraud, they are frequently employed in response to economic emergencies, and the IRS has shown that it can expedite delivery of assistance to most taxpayers. While this is relief that is granted through the tax code, to the extent that refundable credits are paid to taxpayers above their income tax liability, these payments should be distinguished from true tax relief and considered as direct transfer payments.

As the reconciliation package relies heavily on these forms of payments to claim that it significantly “cuts taxes,” taxpayers should not be confused. Refundable tax credits are far closer to spending provisions than they are to tax cuts.

[1] Government Accountability Office. Improper Payments. Retrieved from https://www.gao.gov/improper-payments.

Department of the Treasury. (2020). Agency Financial Report: FY 2020. Retrieved from https://home.treasury.gov/system/files/266/Treasury-FY-2020-AFR.pdf.

[2] Congressional Research Service. (2021). The Earned Income Tax Credit (EITC): How It

Works and Who Receives It. Retrieved from https://crsreports.congress.gov/product/pdf/R/R43805.

[3] Office of Management and Budget. (2021). Budget FY 2022 - Outlays. Retrieved from https://www.govinfo.gov/app/details/BUDGET-2022-DB/BUDGET-2022-DB-2.

[4] Ibid.

[5] Congressional Research Service. (2020). COVID-19 and Direct Payments to Individuals: How Did the 2008 Recovery Rebates Work? Retrieved from https://crsreports.congress.gov/product/pdf/IN/IN11255.

[6] Congressional Budget Office. (2008). H.R. 5140 Economic Stimulus Act of 2008. Retrieved from https://www.cbo.gov/sites/default/files/110th-congress-2007-2008/costestimate/hr5140pgo0.pdf.

[7] Office of Management and Budget. (2021). Budget FY 2022 - Outlays. Ibid.

[8] Office of Management and Budget. (2020). Budget of the United States Government, Fiscal Year 2021. Appendix: Department of the Treasury. Retrieved from https://www.govinfo.gov/content/pkg/BUDGET-2021-APP/pdf/BUDGET-2021-APP-1-19.pdf.

[9] Office of Management and Budget. (2021). Budget FY 2022 - Outlays. Ibid.

[10] Ibid.

[11] Ibid.

[12] Congressional Budget Office. (2020). H.R. 748, CARES Act, Public Law 116-136. Retrieved from https://www.cbo.gov/publication/56334.

[13] Congressional Budget Office (2021). Estimated Budgetary Effects of H.R. 1319, American Rescue Plan Act of 2021. Retrieved from https://www.cbo.gov/publication/57056.

[14] Congressional Budget Office. H.R. 748, CARES Act, Public Law 116-136: Revised Apr 27, 2021 Retrieved from https://www.cbo.gov/system/files/2020-04/hr748.pdf.

[15] Office of Management and Budget. (2021). Budget FY 2022 - Outlays. Ibid.

[16] Ibid.

[17] Office of Management and Budget. (2021). Budget of the United States Government, Fiscal Year 2022. Appendix: Department of the Treasury. Retrieved from https://www.govinfo.gov/content/pkg/BUDGET-2022-APP/pdf/BUDGET-2022-APP-1-18.pdf.

[18] Ibid.

[19] Joint Committee on Taxation. (2021). Estimated Budgetary Effects of an Amendment in The Nature of a Substitute to the Revenue Provisions of Subtitles F, G, H, I, and J Of The Budget Reconciliation Legislative Recommendations Relating to Infrastructure Financing and Community Development, Green Energy, Social Safety Net, Responsibly Fund. Retrieved from https://www.jct.gov/publications/2021/jcx-42-21/.

[20] Brady, Demian. Who Pays Income Taxes: Tax Year 2018. National Taxpayers Union Foundation. December 7, 2020. Retrieved from https://www.ntu.org/library/doclib/2020/12/2018-who-pays-1-.pdf.

[21] Brady, Demian. Who Doesn't Pay Income Taxes? Tax Year 2018. National Taxpayers Union Foundation. October 14, 2021. Retrieved from https://www.ntu.org/foundation/detail/who-doesnt-pay-income-taxes-tax-year-2018.

[22] Gleckman, Howard. “Biden’s Pandemic Relief Bill Is One Of The Biggest One-Year Tax Cuts In Modern US History.” Forbes. March 16, 2021. Retrieved from https://www.forbes.com/sites/howardgleckman/2021/03/16/bidens-pandemic-relief-bill-is-one-of-the-biggest-one-year-tax-cuts-in-modern-us-history/.

[23] Lubi, Tami. “Biden's Stimulus Provides Larger Single-year Tax Breaks than Trump's or Reagan's Cuts.” CNN. March 17, 2021. Retrieved from https://www.cnn.com/2021/03/17/politics/stimulus-temporary-tax-cut/index.html.

[24] Brady, Demian. No, the ARP Act Isn’t the Biggest Tax Cut in History. National Taxpayers Union Foundation. March 29, 2021. Retrieved from https://www.ntu.org/foundation/detail/no-the-arp-act-isnt-the-biggest-tax-cut-in-history.

[25] Government Accountability Office. Ibid.

[26] Treasury Inspector General for Tax Administration. (2021). Improper Payment Rates for Refundable Tax Credits Remain High. Retrieved from https://www.treasury.gov/tigta/auditreports/2021reports/202140036fr.pdf.

[27]Ibid