(pdf)

Introduction

The White House has published a letter urging Congress to support “critical domestic needs” through an emergency supplemental package. This request includes additional spending of $56 billion on top of the separate $106 billion supplemental request that the Biden administration requested for the defense spending, international humanitarian assistance, and border security.

One important issue is overlooked in Biden's requests: the critical state of our budget. There are zero offsets included for all the requested spending. Biden's full request would add a total of $162 billion to the federal deficit and also increase debt service costs by an estimated $47 billion.

About the Requests

Even though the House and Senate have not yet enacted Fiscal Year (FY) 2024 appropriations, President Biden has sent Congress two separate supplemental funding requests. The first includes a net of $105.8 billion for defense, border, and international aid:

$61.4 billion for Ukraine

$14.3 billion for Israel

$13.6 billion for border security

$11.2 billion for humanitarian aid

$5.4 billion for the Indo-Pacific region

The second supplemental requests $55.9 billion for "critical domestic needs":

$23.5 billion for disaster response

$16 billion for to extend an American Rescue Plan Act child care grant program for an additional year

$6 billion for the Federal Communication Commission's Affordable Connectivity Program to subsidize access to the Internet

$6 billion for "American Security and Energy Independence" to fund communications infrastructure, uranium enrichment programs, the Strategic Petroleum Reserve, and security at places of worship

$1.6 billion for the Low Income Home Energy Assistance Program

$1.55 billion for opioid response grants

$1.01 billion for international food assistance

$220 million for wildland firefighter pay.

Debt Service Costs

Because the White House did not include any offsets to either supplemental request, the ultimate cost of the package will be higher than indicated because the $160 billion in higher deficit spending will also increase the costs to finance the federal debt.

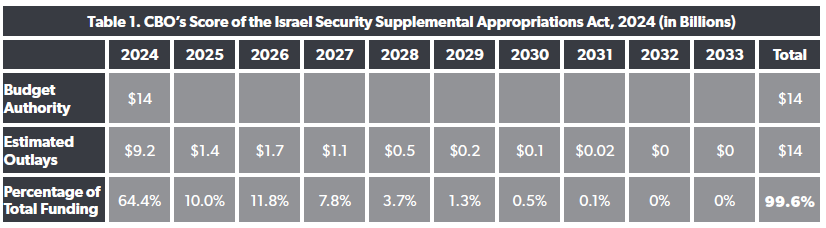

The Congressional Budget Office (CBO) completed an analysis of a House version of the funding for Israel. The bill would provide $14.3 billion in funding for Israel, the same amount as the White House request. Unlike the White House's request, it included an offset: $14.3 billion from the total of $80 billion provided to the Internal Revenue Service in the Inflation Reduction Act of 2022.

CBO projected that nearly two-thirds of the funding for Israel will be spent in 2024, the annual levels would continue to drop through 2031, and that a small portion (0.4 percent) of the funding would not be spent.

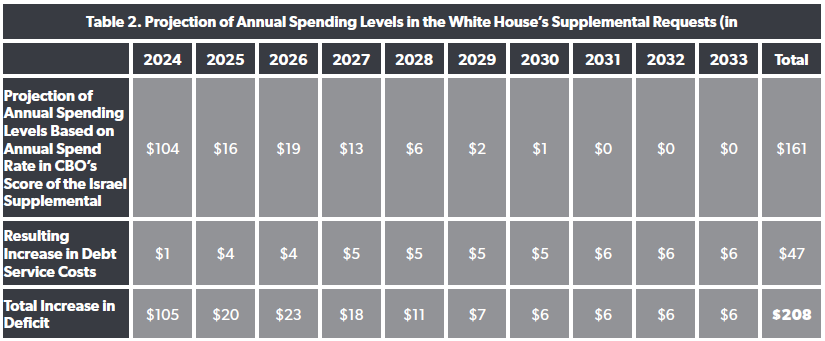

Applying the spend down rate in CBO's analysis of part of the supplement to the White House's total supplemental request will project its annual spending levels. These figures can then be plugged into an interactive worksheet published by CBO that calculates how changes in spending and revenues will impact the federal debt and the costs to finance the federal debt.

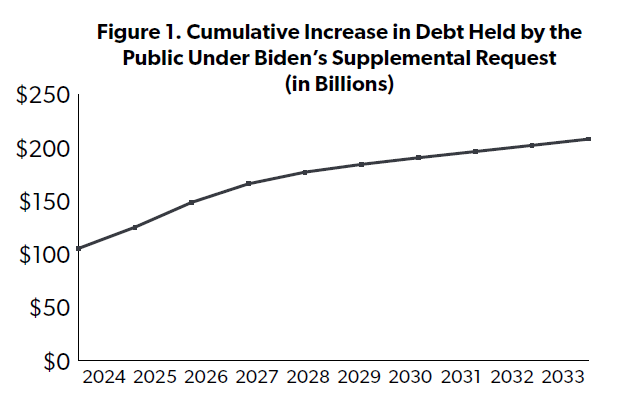

As the tables below show, including debt service impacts will increase the costs of the supplemental by $47 billion -- 30 percent higher than the advertised price. The ultimate cost will depend on the spending rate of the funding. The more quickly the dollars go out the door, the larger the debt service impacts will be, and on the other hand, funds left unspent will reduce the debt interest costs.

About the Debt

With no offsets, all this funding represents debt that will be irresponsibly passed down to future taxpayers. And while the White House says that the funding request will pay for what it describes as “critical needs,” the federal budget itself is fast approaching a critical state.

For too long, the government has spent more than it raises in taxes. This is especially so in the modern era. Since 1950, there were only nine years when the government did not run a deficit, as compared to 23 during the first half of the 20th century. The rate of federal spending has also outpaced population growth. For example, as NTUF detailed last year:

At the dawn of the 20th century, outlays amounted to $217 per person. By the 1950s, as the population doubled, spending swelled to over $4,340 per person. This level more than doubled to $11,909 in the first decade of the current century.

The government finished Fiscal Year (FY) 2023 with a $1.7 trillion deficit and the level of federal debt held by the public rose to $26.3 trillion, comprising 98 percent of Gross Domestic Product (GDP). Looking ahead, the government's debt burden will continue to worsen. Under CBO's most recent budget outlook, the government will spend $20 trillion more than it collects in taxes. Debt held by the public will rise to $46.7 trillion by 2033, 119 percent of GDP. CBO's long-term projection of current spending and revenue trends sees the debt held by the public rising to 181 percent of GDP in 40 years.

This is unsustainable. Unfortunately, this administration has a poor track record of supporting meaningful spending reform without budget gimmicks, price controls, heavy handed regulation, or higher fees and taxes.

A search of the White House's website does find a letter from the Office of the Management and Budget to the Chair of the House Appropriations Committee warning:

Excessive deficits continue to threaten the Nation's progress, and without action to restore the proper size and role of Government, deficits will remain over a trillion dollars per year for the foreseeable future.

But this was a letter from 2019 from the previous administration that is still posted on the new administration's website. But while there are 184 instances on WhiteHouse.Gov that include the phrases "Biden" and "critical needs", just two results remain when the phrase "federal debt" is added to the search query.

At the end of 2022, Biden boasted that “the deficit fell by $1.4 trillion — the largest one-year drop in American history.” But what he failed to point out was that the deficit had been driven up to record levels thanks to the trillions of dollars spent in laws passed in response to the pandemic, including massive rebate checks sent to tens of millions of Americans, the Paycheck Protection Program, and expanded Child Tax and Earned Income Tax Credits. The drop in the deficit Biden cited was the result of those programs naturally winding down.

Continuing to ignore the debt could have negative consequences, as the CBO warns:

Rising interest rates will require higher interest payments on existing debt by the U.S. government, and interest payments on existing debt will eat up a larger and larger share of revenues the government brings in;

Increasing government debt crowds out private sector investment, “which would result in lower business investment and slow the growth of economic output over time”;

Investors may lose confidence in the U.S. government's ability to pay its bills, increasing the risk of a flight from U.S. debt which would raise borrowing costs for the federal government even further; and

Rising debt makes it more difficult for U.S. policymakers to react to future economic and fiscal shocks, such as recessions, military conflicts, natural disasters, and public health crises.

Conclusion

Without spending reform, the U.S. is gradually approaching a tipping point. This August, Fitch Ratings, one of three major credit agencies, followed Standard & Poor's (S&P) in downgrading the U.S. debt from AAA to AA+. Although Moody's still gives the U.S. a AAA rating, this week changed its outlook for the U.S. from Neutral to Negative, signaling that it may be considering a downgrade soon.

The longer reforms are put off, the more costly the solutions will be as interest rates drive up the cost of new borrowing, and policymakers will be left with fewer fiscal tools to respond to an emergency.

Congress and the White House may have a lot of “critical needs” that they want to fund, but it is time for lawmakers to get serious about the critical state of the federal debt before it is too late.