(pdf)

As cases of COVID-19 continue to proliferate nationwide, federal policymakers are hard at work to come up with solutions to the economic consequences that Americans are facing. In the coming weeks, Americans affected by the economic turmoil will receive some financial relief in the form of expanded unemployment benefits, paid sick leave, and cash payments to individuals.

Yet while the federal government is opening its checkbook to Americans struggling to get by, many state governments are in no position to do so. For taxpayers in already cash-strapped states, that could mean some pain to their wallets down the road.

State Budgets During Recessions

Economic contractions mean less revenue for state governments. State spending often rises during growth periods as if those growth periods will continue indefinitely, leaving state treasuries bereft when a contraction occurs.State budget offices saw receipts drop by $87 billion over a one year period from October 2008 to September 2009, an 11 percent decline. Federal aid to states helped to blunt the impact in the short term, but the effects of this aid quickly diminished as federal aid dried up.

Such a significant decline in revenues would make it difficult to cover pre-recession spending obligations, but spending pressures often rise during a recession. Unemployment insurance and Medicaid enrollments spiked in the wake of the 2008 recession as Americans lost their jobs.

Generally, state budget shortfalls are a far more significant near-term problem than federal shortfalls. Forty-one states have a constitutional or statutory requirement that the legislature pass a balanced budget, while 38 prohibit a budget deficit. In practice, every state effectively abides by a balanced budget requirement. While these protections keep states from budgeting irresponsibly, they can function as an added wrinkle when states fail to maintain rainy-day funds.

When states face sudden shifts in economic conditions that impact their bottom lines, they are often constitutionally or statutorily required to make the budget math work that year. In 2009, 43 states ended up facing budget shortfalls after they had passed their budget for that year, necessitating emergency actions.

The Coming Recession

The coronavirus recession has already begun to hit Americans and businesses across the country. Stocks have tumbled since the beginning of the year, with the S&P 500 having fallen nearly 30 percent by late March. This precipitous fall from a bull market has occurred despite extensive relief efforts from the Federal Reserve and the Federal Open Market Committee.

Of course, states can expect far more significant impacts than a marked decline in capital gains tax revenue. The 45 states with income taxes can expect a significant drop in income tax receipts. Over 6 million Americans filed for unemployment last week, shattering previous records, with millions more expected to do so in the coming weeks. That will mean a one-two punch for states, with cratering income tax revenue combined with a spike in unemployment claims.

In a “normal” recession, states could take some solace in the fact that personal consumption is generally more stable during recessions than income. That’s slightly less comforting to state budget planners than it may sound, however — given much of the stability in personal consumption comes from the continued purchasing of daily necessities, such as groceries, which are not taxable in most states.

Additionally, social distancing may have a more profound effect on personal consumption than the economic downturn. Many jurisdictions, including cities like Washington, D.C. and New York, have already taken measures to shut down many non-essential businesses. Even without formal bans, businesses that rely on foot traffic can expect to see a significant downturn in patronage as Americans stay in their homes.

Hotels, for example, are already feeling the pain as travelers cancel their trips — with occupancy rates down by a quarter , hoteliers expect around half of U.S. hotels to close, at least temporarily. Theater giants AMC and Regal Cinemas have both announced the closure of all their U.S. theaters. Every major professional sport has suspended or cancelled their seasons. And as businesses shut down their operations, states lose out on sales tax revenue they may otherwise have gained.

States are already bracing for impact. New York State’s Comptroller recently announced that he was anticipating a budget shortfall of at least $4 billion relative to the state’s total budget of $87 billion. In that announcement, the comptroller also noted that the shortfall could climb to more than $7 billion should the economic backslide continue.

State Budgetary Responses to Recessions

States generally have four non-mutually exclusive options when faced with budget shortfalls: raise taxes, cut spending, paper over the shortfall with budget gimmicks, or seek additional federal assistance. Across the country, taxpayers can expect to see a combination of these approaches as states work through their budget challenges.

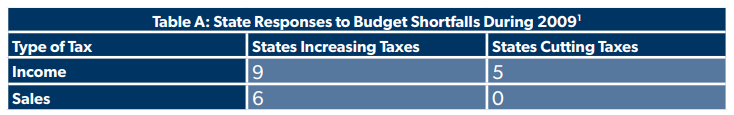

Unfortunately, the first option was a popular one for many states during the 2008 recession. Table A shows state responses to budget shortfalls during the worst year of the recession.

All told, 33 states approved tax changes that increased revenues. Twenty states enacted various tax changes during 2009 that increased revenues by at least a percentage point over the previous year. Ten states approved tax changes that increased revenues by at least five percent. In other words, just because American taxpayers are struggling with their finances doesn’t mean they should expect help from their state departments of revenue.

The one piece of good news for states is that the federal government is doing its best to get out in front of declining state revenues. The recently-passed coronavirus response legislation, the CARES Act, includes hundreds of billions of dollars in additional aid for state governments, and additional funds are likely forthcoming. While it is unlikely that these dollars will be sufficient to fill the entirety of growing state budget gaps, it will reduce the pressure that states feel to raise taxes or pursue revenue gimmicks.

Retroactive Taxation?

In addition to needing to watch out for states hiking their taxes, taxpayers can’t count on the tax rates and regulations they filed their taxes under being the rates and regulations state tax bureaucrats attempt to hold them to. Desperate budget offices and legislators sometimes engage in unsound tax policy actions, including retroactive taxation.

In fact, retroactive taxation in the case of a recession is more of a likelihood than a possibility. During the last recession, several states used retroactive tax interpretations and legislation to combat budget shortfalls — often with the implicit approval of the courts.

One example of the difficulty in preventing retroactive taxation comes from a dispute between Dot Foods and Washington State’s Department of Revenue. The feud between the two goes back to 1999, when the state Department of Revenue changed its interpretation of a 1983 statute granting exemptions from its business and occupation (B&O) tax that Dot Foods had previously qualified for (without any changes to the underlying statute). Eventually, the case reached the state’s Supreme Court, which ruled in favor of Dot Foods that the state’s interpretation was contrary to the underlying statute.

Rather than accepting that Dot Foods qualified for the B&O tax exemption, in 2010 Washington state legislators simply amended the 1983 statute at issue in the case. With the underlying statute changed, the state once again argued that Dot Foods was not, and had not been, eligible for the B&O exemption. Dot Foods attempted to challenge this under the due process clause, but the U.S. Supreme Court denied cert.

Dot’s case is simply one of many. Retroactive tax changes are an active legal battleground, with courts split on the issue. Different courts have upheld retroactive tax changes going back over ten years as permissible, and struck down retroactive tax changes going back 16 months as excessive.

The Supreme Court ostensibly ruled on this issue back in 1994, when it upheld a 1987 amendment to a law drafted in October of 1986 concerning estate tax exemptions. In this case, United States v. Carlton, the Supreme Court allowed the amendment to be applied retroactively on the basis that the amendment was drafted soon after the original law and was fairly clearly intended to be a clarification, not a revision.[2]

Since Carlton, more than 30 cases regarding retroactive tax legislation have been taken up by lower courts. Many have been upheld on the sole basis of an unexpected decrease in state revenue, which the courts have considered a legitimate legislative purpose to pass retroactive tax legislation. Roughly forty percent of these were cases like Dot Foods, where courts had previously ruled on a state’s interpretation of an underlying statute, then the state simply amended the statute at issue.

As a result, taxpayers have relatively little protection by statute or in the courts from aggressive efforts to collect taxes retroactively.

E-Retail and Wayfair

One class of taxpayers that may be particularly at risk here are remote businesses. The potential for retroactive tax collections was a serious concern in the buildup and immediate aftermath of the Court’s decision in South Dakota v. Wayfair. Though the South Dakota law at issue in the case explicitly prohibited retroactive tax collections, Justice Anthony Kennedy never explicitly stated in his majority opinion that retroactive tax collections are unconstitutional.

The fact that Wayfair overturned past Supreme Court precedent made this an open question, as well. States that had economic nexus laws, or laws that allowed states to tax businesses based on sales within the state rather than physical presence, on the books prior to the Wayfair decision could conceivably argue that Wayfair retroactively gave the “OK” to economic nexus laws that were in place in the past, even though they were, at the time, still unconstitutional under Quill v. North Dakota.

Fortunately, up until this point most states have avoided applying their economic nexus laws retroactively. Some states such as Florida, Hawaii, and Alabama initially suggested that they were considering retroactive taxation before backing off.

However, many states made these determinations administratively, rather than drafting a prohibition on retroactive tax collections into underlying economic nexus legislation. Avoiding retroactive taxes may feel like less of an imperative if states are up against significant budget shortfalls.

Not every state has been so circumspect about avoiding retroactive tax collections. One notable instance is California, a frequent offender in terms of flouting good tax policy practices, which decided after the Court’s decision in Wayfair to pursue retroactive taxes as far back as 2012.

Back in 2012, California’s Board of Equalization (the name of its tax agency at the time) had come to an agreement with Amazon for the platform to collect and remit sales taxes on sales of its own products, but neither the state nor third-party sellers applied those tax rules to so-called “Fulfilled by Amazon” sales, where the web giant offers storage and shipping assistance to smaller sellers. That’s because then-current Supreme Court precedent was understood by all to mean that states couldn’t require tax collection of businesses without a physical presence in the state.

Emboldened by Wayfair, California is now sending out notices demanding taxes all the way back to 2012 for those third-party sellers. Under their new interpretation, any sellers using Amazon’s platform to sell to California consumers were liable to collect and remit sales taxes as far back as 2012, despite the fact that the legal basis for this requirement did not appear until 2018.

South Carolina is currently involved in a similar dispute with third-party marketplace sellers over a 2011 deal with Amazon for the company to begin collecting and remitting sales tax in 2016. In South Carolina’s case, the state’s Department of Revenue has been consistent in its claim that third-party merchants using Amazon’s platform are responsible for collecting and remitting sales tax since Amazon began complying with collection obligations.[3] In both cases, however, the states’ claims, which would have been unconstitutional under Quill, have taken on new relevance under Wayfair.

There is also the unique nature of this specific economic downturn to consider. While most brick-and-mortar outlets are likely to suffer from closings and reduced foot traffic, e-retailers need not worry about limitations on in-person interactions. That may cause states to view them as cash cows that can be safely milked — a source of revenue that won’t destroy their tax base.

This would be a mistake. The goal of federal relief policies have been to preserve the ability of the economy to rebound after the need for social distancing has passed. Eroding the viability of industries through desperate tax hikes, even those better prepared to handle the specific difficulties the coronavirus presents, would work directly against this goal.

Conclusion

Right now, individuals and businesses have enough to worry about when they’re expecting assistance from their government in this turbulent economy. But states up against the budget wall may soon go from being a source of aid to a cause of further financial pain.

Taxpayers and businesses should be alert to the potential for unsound tax policy being advanced by governors and lawmakers as they attempt to salvage their bottom lines. States should be wise to avoid causing further hardship to taxpayers through their budget practices, particularly by avoiding retroactive taxes.

[1] Bishop-Henchman, Joseph. “A Review of Significant State Tax Changes During 2009.” Tax Foundation, December 21, 2009.

[2] Justice Sandra Day O’Connor’s concurrence in Carlton is important to note. In her opinion, retroactive taxation could violate the Due Process clause if the length of retroactivity is excessive. She suggested less than one year as a relevant framework.

[3] This fact makes this example not a precise example of retroactive taxation, as the state’s position has been unchanged. Of course, third-party sellers had every reason to believe they could safely ignore the state’s position prior to the Court’s decision to overrule Quill. Whatever terms one uses, businesses should not be expected to anticipate future Supreme Court decisions in order to comply with state tax laws.