(pdf)

Executive Summary

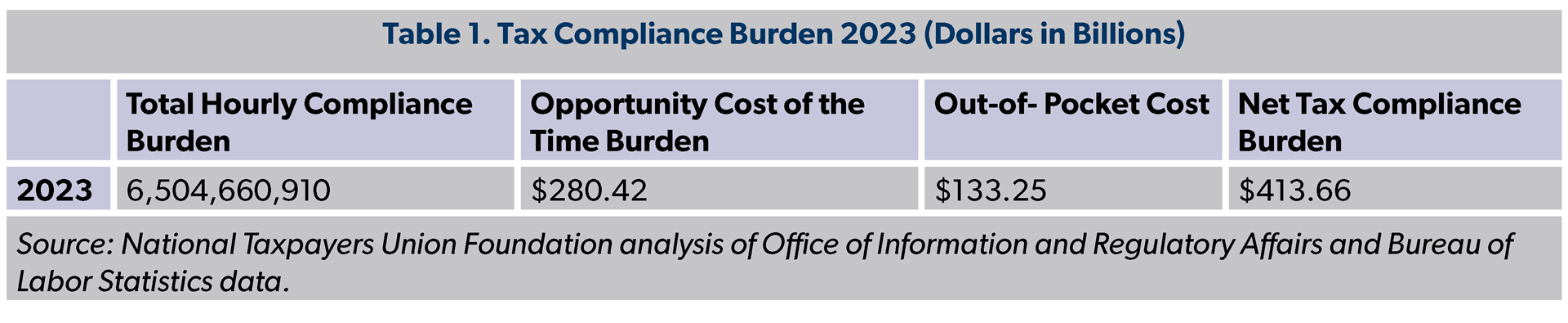

This latest edition of NTUF’s annual study on tax code complexity and its compliance burdens on filers finds that Americans will spend 6.5 billion hours collectively preparing and filing their taxes for the current tax season. The opportunity cost of the time spent laboring over taxes comes out to $280 billion, while filers also incur out-of-pocket expenses on preparation costs amounting to at least $133 billion. That total is likely higher but the IRS has not complied with statutory requirements to assess this cost across its full inventory of tax forms. The IRS is expected to collect nearly $5 trillion in taxes, but above and beyond that amount, complying with the tax system imposes a $414 billion burden on Americans.

This report takes a deep dive into the compliance burden data associated with the tax code, including tax complexity metrics over recent years.

Introduction

Tax Day is once again upon us: the day of reckoning to settle accounts with the Internal Revenue Service (IRS) to determine what taxes might be owed on top of amounts either withheld from paychecks or made through quarterly estimated payments throughout the year. Some may feel fortunate that they are eligible for a refund, but this often indicates that they either had too much withheld or paid too much already.

Whatever the financial outcome, it fails to consider the value of the time spent on taxes. This process involves storing, retrieving, and organizing documents; deciphering the instructions for the needed forms and schedules; filling them out; and then submitting them to the IRS. These steps are increasingly completed with paid assistance through either tax preparation software or a professional tax preparer. All of this time and expenses add up – consuming 6.5 billion hours and imposing a tax compliance burden of $414 billion. That’s 14 percent higher than last year’s burden.

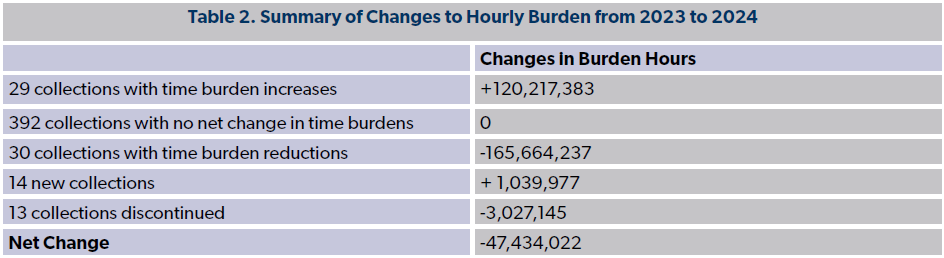

The total compliance burden increased – largely due to inflation – even though the time burden decreased by a net of 47 million hours. This drop was mainly due to a methodological change by the IRS for two particular forms which saw the estimated burden shrink by 156.7 million hours. If the burden estimates for the two forms remained unchanged since last year (similar to 392 other collections of tax forms) the net compliance burden would have reached 6.61 billion hours.

This is not the first time that the compliance burden has been reduced due to technical revisions in the methodology used by the IRS to track the time and out-of-pocket expenses imposed on taxpayers. NTUF reported on this in a recent edition of our annual study on tax complexity.[1]

While it is commendable that the IRS is making an effort to revise estimates in light of experience, the underlying issue remains that the tax code imposes immense burdens of time and out-of-pocket expenses. The IRS needs to do a better job of tracking out of pocket expenses; those required estimates are missing from some of the forms the IRS requires taxpayers to fill out.

Zooming in the burden for the part of the tax system that most taxpayers have to contend with, Americans spent more time complying with the Individual Income Tax through Form 1040. Compared to last year, the net burden imposed by individual income tax laws increased by 38 million hours to 2.25 billion hours, imposing a compliance burden of $142 billion.

Ever-mounting tax compliance burdens are a byproduct of complacency in Congress over the complexity of the tax code. Taxpayers deserve not only a simpler filing system, they deserve real and sustained effort on the part of their elected representatives to reduce burdens where possible.

The Tax Code’s Complexity and Compliance Burden

Time and Cost Burdens in 2023

NTUF’s estimate of tax complexity uses analysis of data and supporting documentation that the IRS files with the Office of Information and Regulatory Affairs (OIRA) pursuant to statutory requirements to track paperwork burdens. Complying with the tax code in 2023 consumed a staggering 6.505 billion hours, including tasks such as recordkeeping, learning about the law, filling out the required forms and schedules, and submitting information to the IRS.[2]

This is valuable time that could have been devoted to other, more productive endeavors. NTUF determines exactly how valuable this time is by calculating an estimate using private sector labor costs. According to the Bureau of Labor Statistics (BLS), U.S. non-federal civilian employers spent an average of $43.11 per hour worked by their employees in 2023. This includes all wages, salaries and benefits provided.[3] Because of inflationary pressures, the cost of labor was up 7.2 percent from 2022 ($40.23). The opportunity cost of the 6.5 billion hours spent on taxes for the current filing season represents $280 billion worth of taxpayers’ time.

The out-of-pocket expenses add to the compliance cost. This accounts for the estimated $133 billion (an incomplete IRS estimate, more on this below) spent on software, professional preparation services, or other filing expenses (such as copying).

In total, the economic burden imposed by tax code compliance reaches $414 billion.

To put this figure into context, this is larger than the 2023 revenues of all but two U.S. companies: Amazon ($554 billion) and Walmart ($639 billion).[4] On the other hand, Americans expected to spend $214 billion on summer vacations in 2023.[5] With the cost of the compliance burden, taxpayers could have nearly tripled their time off! Taxpayers would probably much rather be spending their hard-earned money and free time on vacation than poring over records to head off a tax audit.

Meanwhile, the cumulative 6.5 billion hours spent each year on taxes would stretch out to over 742,500 thousand years.

The Methodology for Calculating the Compliance Burden

Under the Paperwork Reduction Act, every agency issuing a form must estimate the time required for public respondents to complete it, as well as any potential out-of-pocket expenses incurred. Moreover, agencies are required to obtain approval from the Office of Management and Budget (OMB) for their forms and the estimates before these information collections are imposed on the public.

While federal agencies are typically required to seek re-approval for each of their collections on a three-year cycle, most collections related to the tax code undergo annual review. Once approved, these burdens are published on a website overseen by the OMB's Office of Information and Regulatory Affairs, along with Supporting Statements provided by each federal agency.

NTUF annually compiles the burdens associated with the IRS’s information collections, many of which comprise multiple forms and schedules.

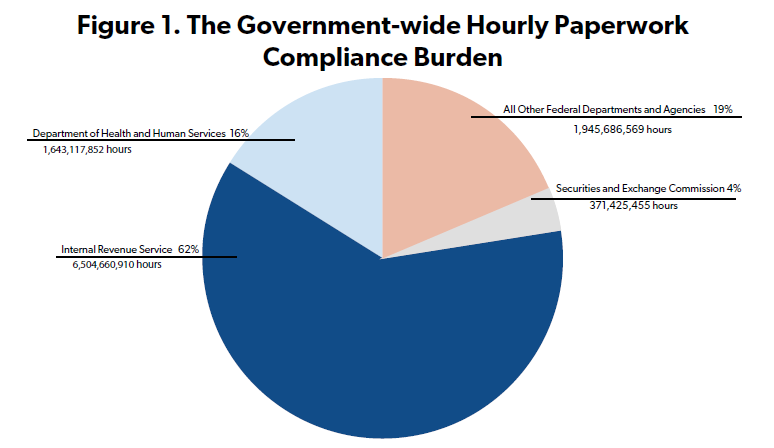

Tax Forms Dominate the Government-wide Paperwork Burden

It comes as little surprise that IRS forms constitute the lion's share of the overall paperwork burdens across the federal government. Currently there are 10,589 different information collections from all the federal departments, agencies, and commissions. While the IRS’s various forms comprise a mere 4 percent of this total, they account for 62 percent of the 10.5-billion-hour paperwork burden imposed by the federal government. Trailing in second place by a significant margin is the Department of Health and Human Services, with a burden of 1.6 billion hours, while the third place Securities and Exchange Commission obligates taxpayers to spend 371 million hours complying with its forms.

Summary of Changes in the IRS Information Collection Since a Year Ago

Table 2 provides a summary of the changes in tax time burden estimates from April 2023 to April 2024.

- 392 of the IRS’s current information collections (84 percent) were re-approved with no change in the estimated burdens.

- Thirteen forms were discontinued last year, reducing the time burden by just over 3 million hours. Most of this burden reduction was from expiring Form 720-TO (2.3 million hours) which was used for reporting monthly receipts and disbursements related to fuel excise taxes.

- 13 new collections added just over 1 million hours. Most of this increase (941,159 hours) related to energy or semiconductor provisions established in the Inflation Reduction Act. The list also includes a form for referring complaints about tax-exempt organizations that may not be acting in compliance with tax laws. The IRS expects 8,000 complaints. However, the Supporting Statement for the form notes that the IRS has had this referral available previously but it was not officially included in its list of information collections.[6]

The IRS increased the burden estimates of 29 pre-existing forms by a net of 120 million hours. Most of the major time burden increases were the result of an upward revision in the number of forms expected to be received. These include forms for W-2s, estates and trusts, and dividends and distributions. A notable outlier is an increase in the hourly burden by 38 million for individual income tax returns despite expecting 800,000 fewer forms.

Thirty forms saw their estimated compliance burden revised downwards by a net of 165.7 million hours. Most of this was from just two information collections: the Employer's Quarterly Federal Tax Return and U.S. Business Income Tax Returns. The supporting statement notes that this is a technical change related to transitioning "from the legacy Arthur D. Little (ADL) model to the IRS Taxpayer Burden Model. Burden is defined as the time and out-of-pocket costs incurred by taxpayers in complying with the federal tax system." In addition, the revision takes into account survey results from taxpayers about increased efficiency from the use of software to help prepare forms and electronic filing.

In February 2023, the IRS published a Taxpayer Compliance Burden report which provides an overview of the recent history of the methodologies used and the gradual transition from ADL to the new Taxpayer Burden Model.[7] It notes that the IRS is taking a more taxpayer-centric approach. Rather than estimating each form within a collection separately, they consider their relations to other forms.

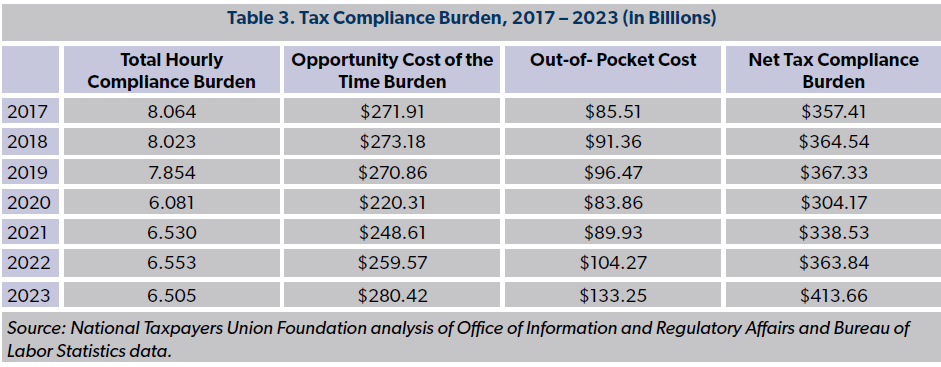

Comparing the Burden over the Recent Past

n 2017 the hourly tax complexity burden stood at 8.06 billion hours. The next three years saw burdens ease. Much of this was due to the reforms enacted in the Tax Cuts and Jobs Act (TCJA) of 2017. The law went into effect for 2018 and simplified compliance burdens for many filers by reducing the number of people who would need to file tax returns and shortening the 1040 Form. The TCJA also increased the standard deduction, meaning much less time lost to paperwork on itemized deductions, and reduced the double-filing burden of the Alternative Minimum Tax.

As NTUF reported in an edition of our tax complexity study, the smaller compliance burden recorded in 2020 was due to the IRS revising their methodology for business tax compliance.[8] The IRS realized years earlier from data it received from surveys that it had significantly overestimated the time it takes for businesses to fill out tax paperwork. They decided to wait to apply that technical adjustment until after the TCJA changes were implemented. This would let them see how the tax reforms would impact burdens before implementing the new revision to the burden estimate methodology.

The overall time burden decreased since 2022, but as noted above, this is primarily due to methodological revisions to two information collections that resulted in significantly smaller burdens. If those collections had remained the same as last year, the net compliance burden would have reached 6.61 billion hours.

Elements of Complexity

Length of the Tax Code and Regulations

One factor behind the complexity and confusion associated with tax compliance is the sheer size of the tax code. The income tax code was originally enacted in 1913 at just 27 pages long. Amendments, regulations, and judicial rulings shortly after passage grew the code to 400 pages.[9]

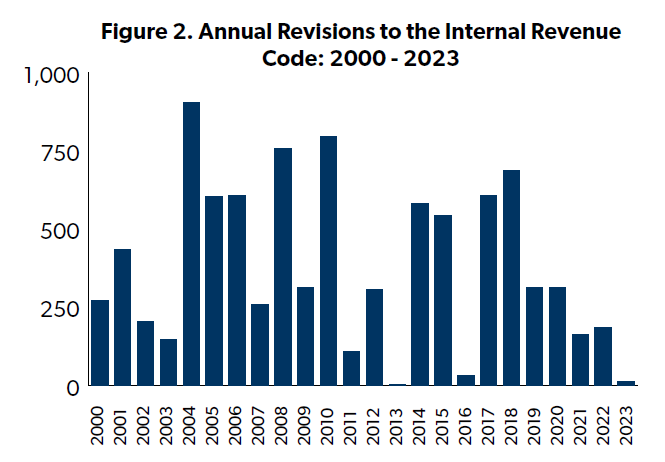

Lawmakers, of course, make frequent revisions and additions to tax laws. From 2000 through 2022, Congress enacted, on average, 399 changes to the tax code each year (see Figure 2), ranging from just three in 2013 to 797 in 2010.[10] The pace slowed in 2023 with just 15 changes, the fewest since 2013. Nevertheless, the sum total of these changes resulted in an expansion of the tax code.

Comparing the number of pages in the tax code over time can be challenging due to variations in formatting such as different layouts, column widths, fonts, or margins, all of which can significantly impact the length of the document. To ensure consistent year-to-year comparisons, NTUF employs a standardized approach: we copy the texts of the tax code into Microsoft Word and utilize its word count feature. While this method may not be perfect due to the numerous cross-references to various sections of law throughout the code, it offers a consistent methodology. Additionally, it has been previously used by the Office of the Taxpayer Advocate, which found that in 2017, the tax code consisted of 4 million words.[11]

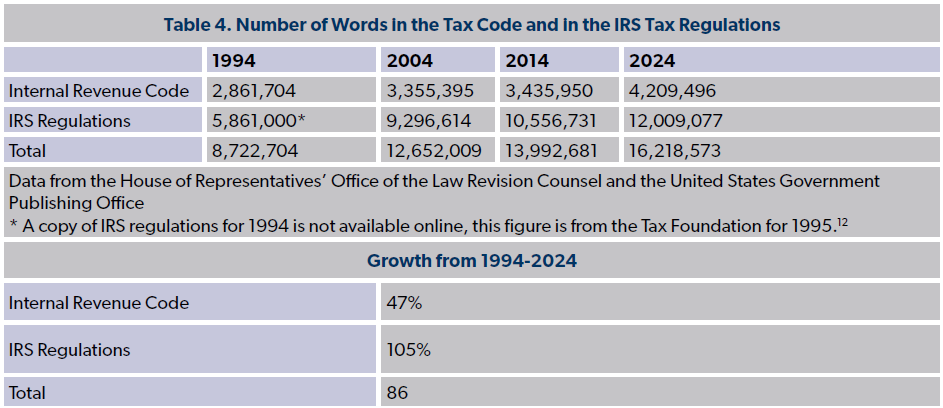

Following the passage of the TCJA, the number of words began to decrease, shrinking to 3.96 million by 2020. However, the tax code then resumed its expansion, with the word count rising to 4,085,524 words in the version published on the House of Representatives’ website in 2022, reaching 4,138,788 as of April 12, 2023, and currently standing at 4,209,496 words.[12] Factoring in associated IRS regulations, the total size of the tax code exceeds 16 million words.

Apart from the 2017 tax reform and simplification, the general trend has seen the tax code grow bigger over the last several decades. The number of words in the tax code has grown by 47 percent compared to thirty years ago.

To interpret and implement the tax laws, the Department of Treasury develops and publishes regulations across 22 volumes of the Code of Federal Regulations (CFR). The most recently available complete version of tax regulations, published online with revisions through April 2024, comprises a length of 17,472 pages (including tables of contents and additional introductory prefaces in each volume).[14] In terms of the number of words in the tax regs, The expansion rate has been twice as high as the Internal Revenue Code itself and has more than doubled over the past three decades.

Beyond the issuance of regulations, the IRS regularly provides guidance through notices, announcements, private letter rulings, and technical advice memorandums to address emerging issues.[15] While some of these documents are specific to individual cases and carry limited scope, others involve substantive interpretations of tax laws. For taxpayers with complex financial situations, keeping abreast of this wealth of information is crucial to ensure a thorough understanding of relevant tax laws, regulations, and rulings.

Substandard Taxpayer Services

The IRS has made improvements in taxpayer services since 2020, when government agencies were largely shut down. Only $3.2 billion of the $80 billion budget boost to the IRS provided in the Inflation Reduction Act was dedicated to taxpayer services, and the funding increase was front-loaded to demonstrate immediate results but there is still a long way to go to reach pre-pandemic levels.

Letters and forms mailed to the IRS remained unopened during the shutdown. The backlog of taxpayer documents awaiting to be processed spiked to 16.6 million in 2020 compared to 1.1 million the year before. The most recent audit report from the Treasury Inspector General for Tax Administration (TIGTA) shows that calendar year 2023 started out with a backlog of 4.4 million.[16]

IRS Commissioner Daniel Werfel has boasted about the improved service levels and reducing wait times for the IRS’ phone lines, in particular highlighting increased response rates. However, a recent study from the Government Accountability Office (GAO) provides some context to these claims. In 2023, the IRS managed to address more phone calls, with 7.7 million answered compared to 4.6 million in 2022.[17] But the improved response rate is largely attributable to a steep decline in total attempts by taxpayers to contact the IRS via phone, decreasing from 63.7 million to 25.9 million in 2023. Even with the smaller volume of calls, the 2023 response rate of 62 percent was still below the pre-pandemic rates which had higher call volumes.

Moreover, this does not shed light on whether taxpayers got the answers they were hoping for when they tried to contact the IRS. Metrics are needed to track whether the taxpayer wanted to speak to a live assistor. Some may have ended up getting an automated response and hung up disappointed. According to the IRS, this would count as an answered call.

Another issue related to getting through to a live assistor is that the agent who answers the phone might not be able to help a taxpayer. The IRS has classified over 130 areas of the tax code as “out of scope” for telephone assistance.[13] The guidance means that IRS employees cannot answer questions about these specified areas of the tax laws. Similarly, IRS tax preparation assistance programs like Volunteer Income Tax Assistance and Tax Counseling for the Elderly also cannot provide assistance or can only provide limited assistance for certain topics.[14]

Moreover, a live assistor may be hindered in offering assistance because of the 60 different legacy case management systems run by the IRS. The representative on the other end of the phone might not be able to access the caller’s specific information. After decades of multiple attempts and billions of dollars spent to modernize the IRS information technology, its core program, the Individual Master File (IMF), is still based on 1960s-era assembly computer programming. The strategic plan from the IRS regarding its objectives for use of the IRA funding has set an ambitious goal of completing a replacement of the IMF in 2025.[18] However, the limited funds available for that business system modernization in IRA (just $4.8 billion of the budget boost to the IRS), the long and winding history of the IRS’s modernization efforts over the years, and the agency's shifting priorities could make this much needed goal hard to achieve.

The IRS and Taxpayer Privacy: Persistent Security Risks Amidst Growing Data Collection

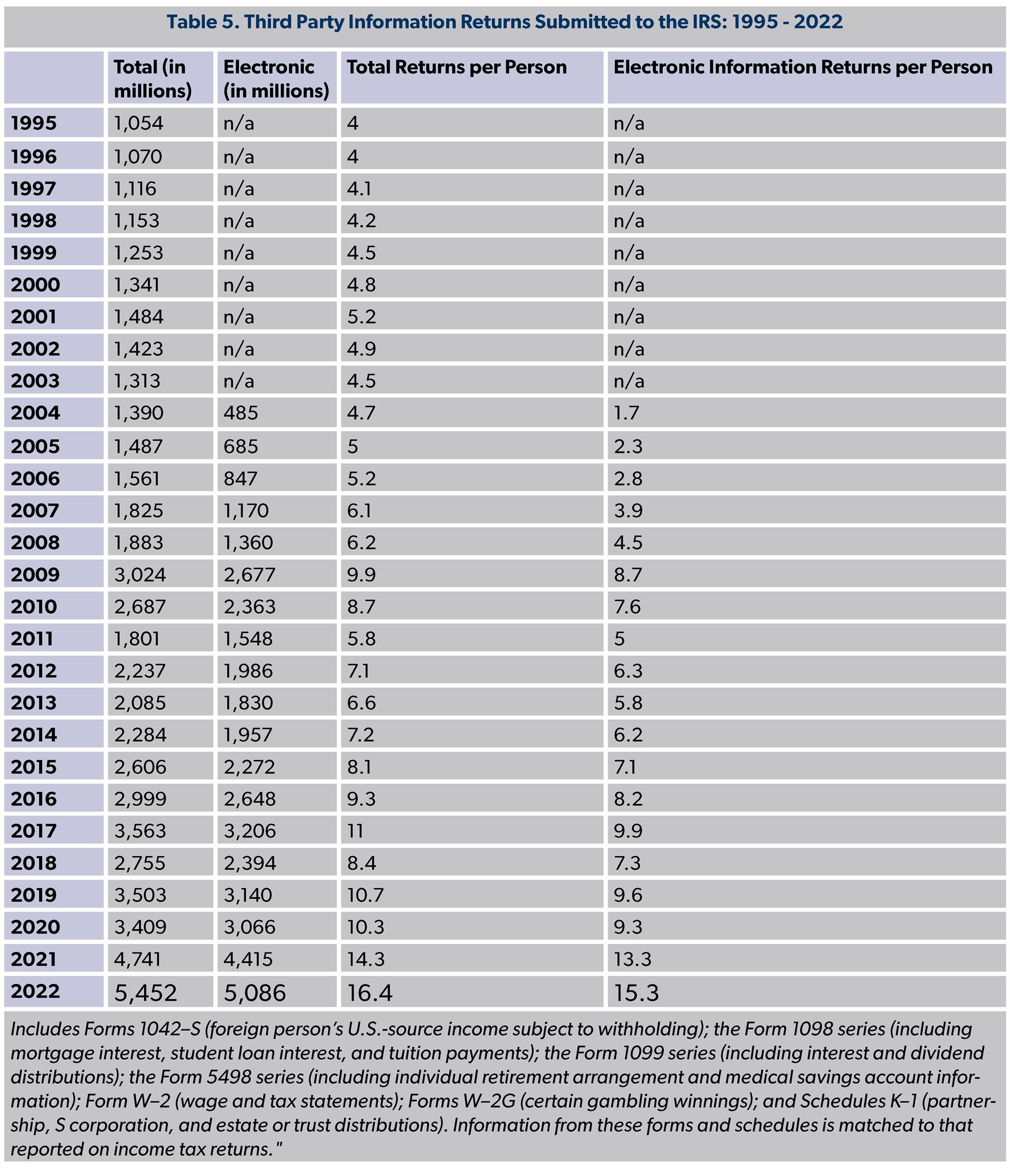

An additional indicator of how complex and sweeping the tax code has become is the fast-growing increase in the number of third party information returns submitted to the IRS. This issue gained attention after the proposed version of IRA, known at the time as the Build Back Better Act, was to require every financial institution to report to the IRS on accounts with net annual inflows and outflows of greater than just $600 per year. This would have set an extremely broad threshold causing a torrent of additional information to the IRS on nearly everyone with a bank account.

The issue arose again with the IRA's $600 reporting threshold for Form 1099-K. This radically low threshold will impact many more people who sell online on platforms like eBay, or who use apps like Venmo to transfer money to friends or family. This was set to trigger nearly 44 million forms in 2024 – 30 million higher than its previous projection – being sent to taxpayers and to the IRS.[19] As a result, a great deal of confusion would ensue for taxpayers because not all of the transactions that would show up on a 1099-K would be taxable, causing people to unintentionally overpay. The IRS delayed implementation of the threshold for a second time last November.[20]

Table 5 shows the volume of total third-party information returns since 1995 and the growth in e-filing of these forms starting in 1995. In 2022, the latest available data, the IRS now collects an average of 16 third-party forms for every person in the country. If the recent growth rate continues through the rest of this decade, the amount will surpass the expected number of people on the planet in 2030 (8.5 billion).

The technology and modernization challenges raise questions on whether the IRS could even handle this enormous flood of data, but it also poses a risk that taxpayers private data will be stolen, as happened with the leak to ProPublica by an IRS contractor. The Treasury Inspector General for Tax Administration, following up on previous reports, has continuously warned that security risks persist in the IRS’s case management system. Among the issues raised are that activity logs need to be better monitored to see who is accessing and modifying data, and inactive accounts need to be deactivated on a stepped-up timetable to restrict unauthorized access.[21]

The Complexity Burden of Sections of the Tax Code

Overview of Tax Forms

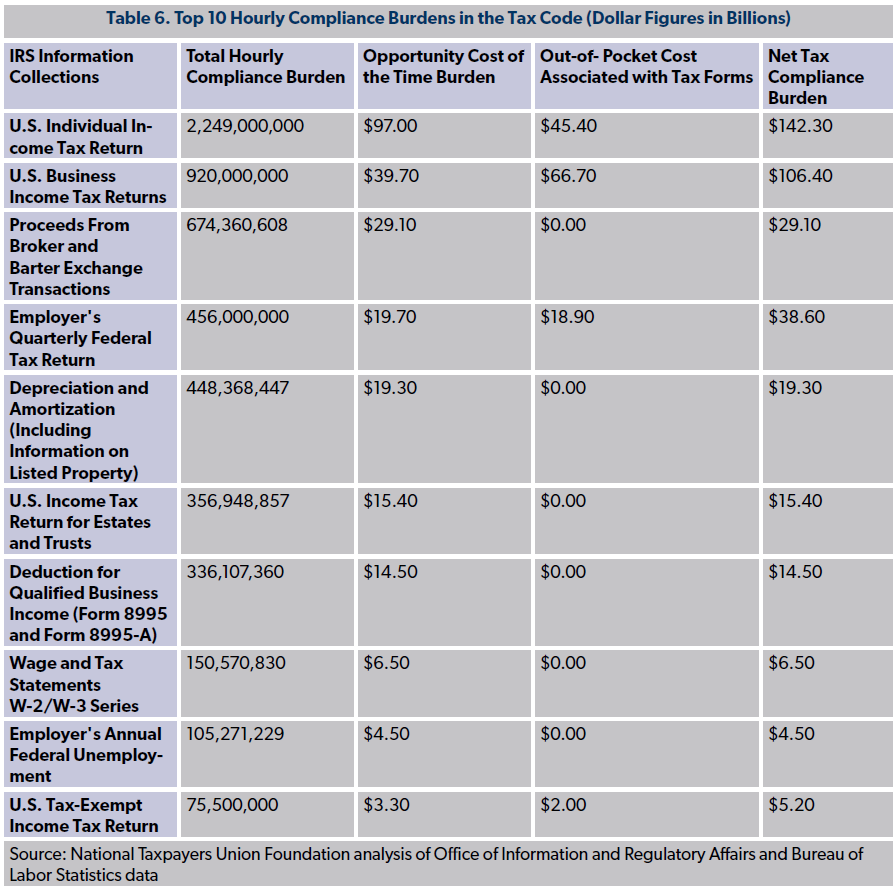

Table 6 breaks out the latest data on compliance burdens for the top ten information collections by the hourly compliance burden. The top two areas, the individual and business tax forms, are discussed in sections below. The third area most time-intensive forms are for Proceeds from Broker and Barter Exchange Transactions for brokers to report capital gains and losses. Form 1099-B, which has been listed as the worst tax form, takes up over 674 million hours of compliance.[22] The IRS expects to receive 1.4 billion submissions of this form - nearly eleven per household in the country. Yet, the IRS has not calculated the out-of-pocket expense burden imposed by this information collection.

As noted, the IRS has only estimated the out-of-pocket expenses for four of these information collections. Out of all the information collections in the IRS’s inventory, only 25 include an associated out-of-pocket cost estimate. This is seven more than last year. As noted above, the IRS applied a new taxpayer burden to the Employer's Quarterly Federal Tax Return which enabled the IRS to calculate expense burdens. Three of the other revised information collections included new fees for filing, and for the other three collections, the IRS used hourly BLS to quantify the labor costs of the time involved.

For some of the 440 information collections showing no expenses, the cost is probably minimal if there is any at all, especially in cases where there is very little time involved with filling out the form. For example, filling out W-2 forms is generally straightforward, especially when using payroll software..

The Supporting Statement for Form 1099-B includes this language:

This information collection will be included in the consolidated OMB submission for information returns currently being developed. IRS is working on the methodology for evaluating information return burden and cost; and will update the cost and burden estimates as part of the consolidation.[23]

Similar language is included in other Supporting Statements that are missing a dollar burden estimate. It is good that the IRS is making an effort to calculate the missing burdens. A better way to distinguish between collections with no real expense burden and those for which the IRS has been unable to calculate one would be to include “N/A” rather than “$0” in the paperwork burden database on reginfo.gov. This would improve transparency on gaps in the IRS’s compliance with the Paperwork Reduction Act.

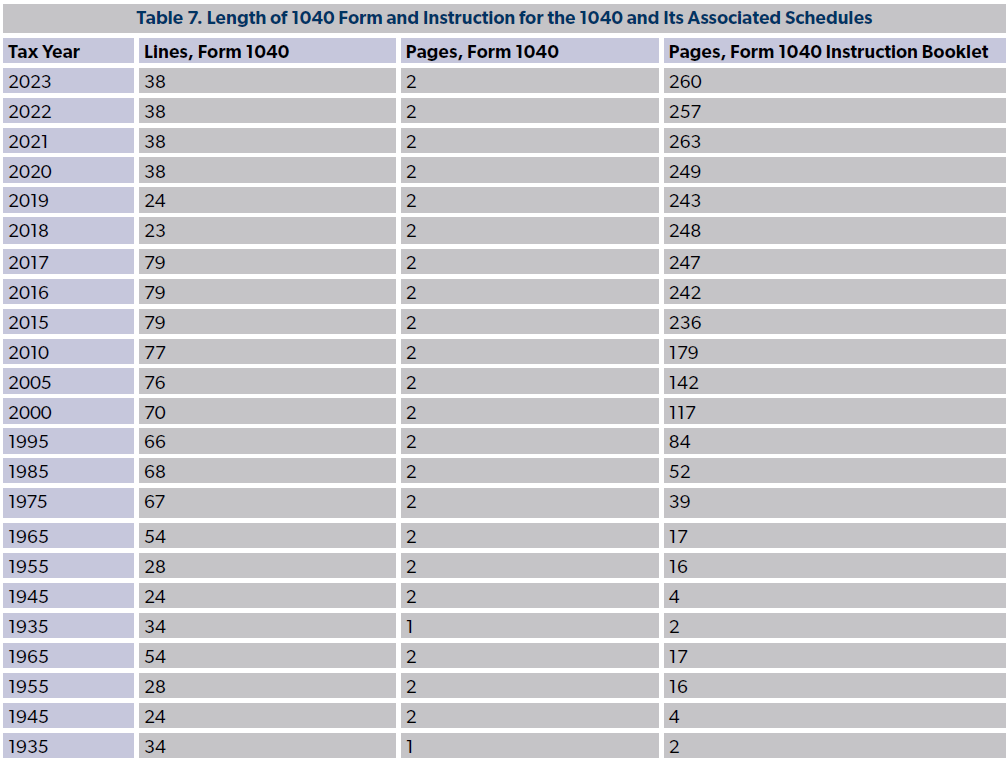

The Overall Individual Income Tax Compliance Burden

The part of the tax code that most Americans are familiar with is the Form 1040 and its associated schedules and filings under the individual income tax. Filers have a few additional pages of instructions to wade through this year as the basic form instructions and the instructions for two schedules were each one page longer than a year ago.

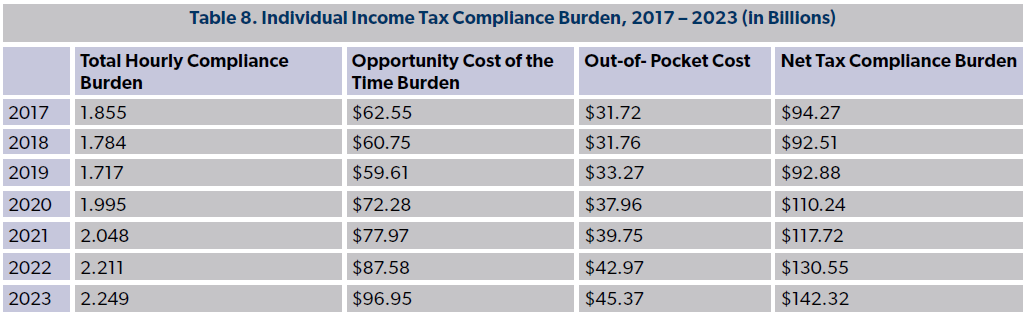

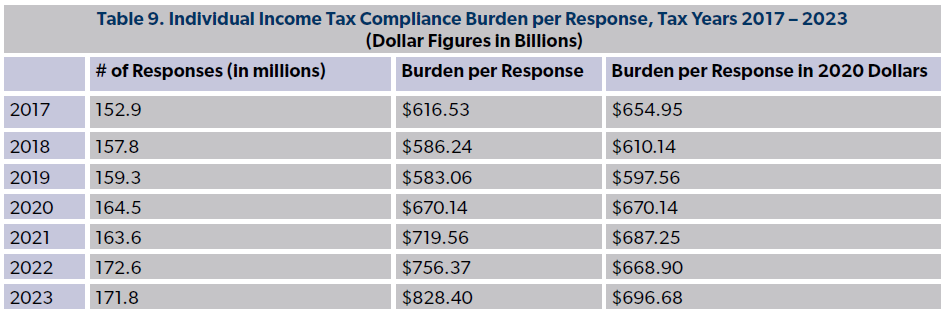

As shown in Tables 8 and 9, the hourly compliance burden of the individual income tax has been on the rise since 2019. The total hourly burden, the out-of-pocket expenses, and the burden per response all reached new highs in Tax Year 2023 despite a drop in the number of tax forms expected to be filed.

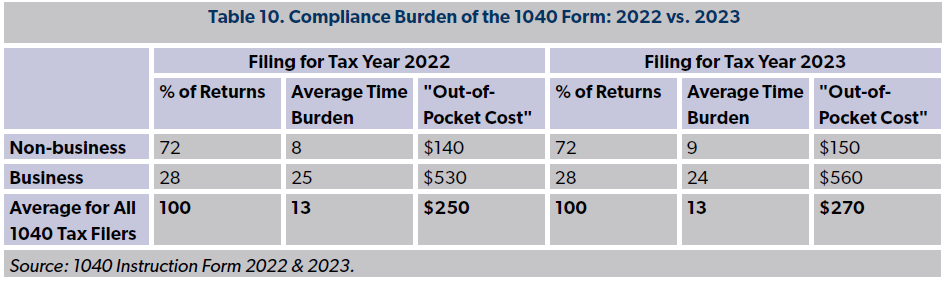

It is also important to note that the experience of different taxpayers can vary greatly from the average time burden calculated by the IRS. Individuals have much lower average time burdens (nine hours) than pass-through businesses (24 hours) that use the 1040 Form to file individual income taxes. Out-of-pocket costs for individual and business filers have also increased since 2022.

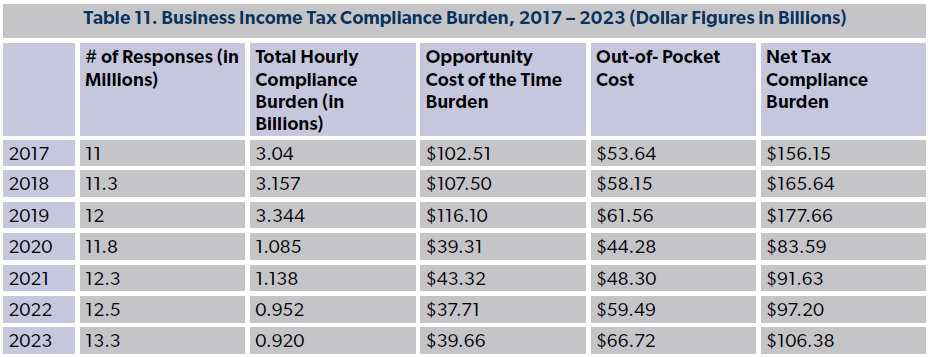

Business Income Tax Compliance Burden

Business Income Tax returns are filed by corporations and certain partnerships. The newest data projects a higher number of respondents in 2023 but the overall time burden and out-of-pocket expenses dropped. Inflation pressures drove the out-of-pocket estimate to $66.7 billion.

As with the Individual Income Tax Returns, the averages are reflective of a wide-range in burdens imposed on different businesses.[24] For example, large corporations with assets over $10 million have an average compliance burden of 830 hours compared to 55 hours for small corporations.

Improving the IRS and the Tax Code

As it stands following the IRA and subsequent clawbacks, the IRS has an unprecedented $60 billion budget boost, with most of this funding locked in for enforcement. The goal of this spending is to increase compliance through tactics such as investigations and audits. However, the IRS plan for this money has hit a major hurdle: hiring goals for new auditors is falling short of targets. This has raised concerns that the IRS is breaking Treasury Secretary Janet Yellen’s directive not to target audits on individuals earning less than $400,000.

There are other more taxpayer-friendly methods to increase enforcement, especially given the history of heavy-handed treatment of taxpayers. Simplifying the tax code and making it easier for taxpayers to get their tax questions answered from the IRS could go a long way to improving compliance by making it easier for citizens to comply with a convoluted tax system. Several non-partisan tax experts, including National Taxpayer Advocate Erin Collins, have called on Congress to re-allocate some of the remaining funding reserved in the law for tax enforcement to other areas.[25] This money would be better spent on improving taxpayer services and helping the IRS achieve other operations goals such as replacing its legacy Individual Master File.

As noted, the IRS should also step up its efforts to comply with the Paperwork Reduction Act and calculate the costs associated with forms. More transparency regarding its taxpayer burden models could help improve the situation so that outside experts could review the process and suggest improvements. The IRS should also make it easier to identify information collections whose cost is truly zero from those where the IRS has not been able to determine an estimate.

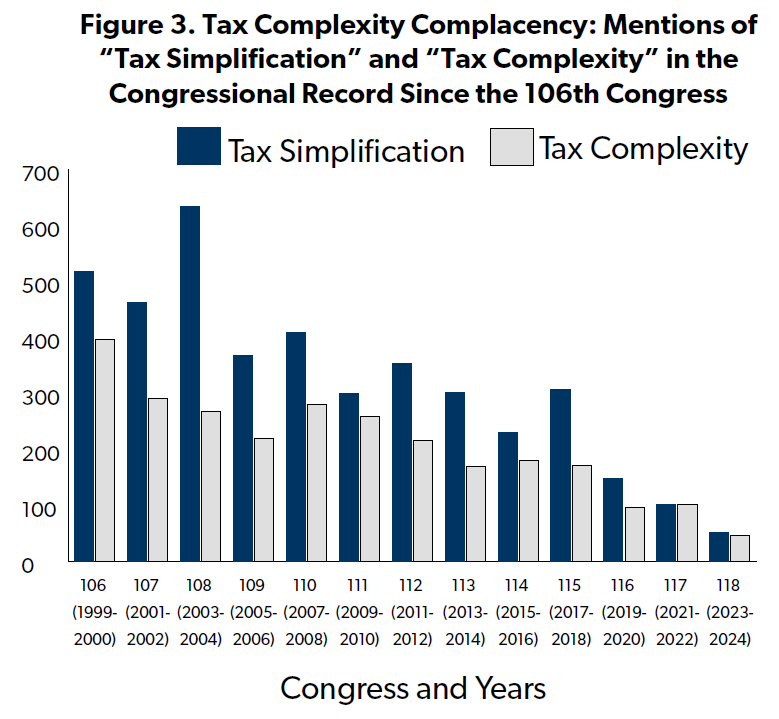

With improved data, lawmakers could then review those areas of the code that impose excessive burdens and hassles on taxpayers. Unfortunately, there is too much complacency in Congress regarding our overly complex tax system. To track this, NTUF searched in the Congressional Record since 2000 for mentions of the phrases “tax complexity” and “tax simplification.” The use of both phrases declined over the years. The most important step to fixing the tax code is to reduce the tax complexity complacency bias in Congress.

Conclusion

The findings of this annual study on tax code complexity and compliance burdens highlight the substantial time and financial costs borne by American taxpayers. The 6.5 billion hours spent preparing and filing taxes, with an opportunity cost of $280 billion, along with out-of-pocket expenses totaling at least $133 billion, underscore the significant burden imposed by the tax system. Despite slight decreases in time burdens attributable to methodological changes, the overall compliance burden remains substantial, totaling $414 billion.

Reform is necessary to alleviate the burdens imposed on taxpayers and enhance the efficiency and effectiveness of the tax system. Addressing these issues requires concerted efforts from policymakers, the IRS, and other stakeholders to simplify the tax code, improve taxpayer services, and strengthen cybersecurity measures. By doing so, we can work towards a tax system that is fairer, more transparent, and less burdensome for all Americans.

[1] See, for example, Demian Brady. “Tax Complexity 2021: Compliance Burdens Ease for Third Year Since Tax Reform.” National Taxpayers Union Foundation. April 15, 2021. https://www.ntu.org/foundation/detail/tax-complexity-2021-compliance-burdens-ease-for-third-year-since-tax-reform.

[2] Office of Information and Regulatory Affairs. “Inventory of Currently Approved Information Collections.” Retrieved on April 4, 2024 from https://www.reginfo.gov/public/do/PRAMain.

[3] Bureau of Labor Statistics. “Employer Costs for Employee Compensation – December 2023.” March 13, 2024. https://www.bls.gov/news.release/pdf/ecec.pdf.

[4] Ali Ahmed. “Top 30 Largest US Companies by 2023 Revenue.” Yahoo!Finance. December 14, 2023. https://finance.yahoo.com/news/top-30-largest-us-companies-134902253.html.

[5] https://www.allianztravelinsurance.com/travel/vacation-confidence-index/2023-vacation-confidence-index-summer-record-spending.htm#:~:text=As%20a%20whole%2C%20Americans%20anticipated,2023%2C%20according%20to%20NerdWallet's%20analysis.

[6] Internal Revenue Service. “Supporting Statement: Tax-Exempt Organization Complaint.” September 13, 2023. https://www.reginfo.gov/public/do/PRAViewDocument?ref_nbr=202308-1545-005.

[7] Internal Revenue Service. Taxpayer Compliance Burden. Revised April, 2023. https://www.irs.gov/pub/irs-pdf/p5743.pdf.

[8]Brady, Demian. Increasing Complexity Brings Back Bigger Compliance Burdens. National Taxpayers Union Foundation. April 18, 2022. https://www.ntu.org/library/doclib/2022/04/2022-tax-complexity.pdf.

[9] Wolters Kluwer, CCH. “Fact Sheet: 100-Year Tax History: The Length and Legacy of Tax Law.” 2013. Retrieved from: https://www.cch.com/wbot2013/factsheet.pdf.

[10] Office of the Law Revision Counsel. United States Code Classification Tables. https://uscode.house.gov/classification/tables.shtml.

[11] Taxpayer Advocate Service. “Most Serious Problem #7 Employee Training: Changes to and Reductions in Employee Training Hinder the IRS’s Ability to Provide Top Quality Service to Taxpayers.” 2017. https://www.taxpayeradvocate.irs.gov/wp-content/uploads/2020/08/ARC17_Volume1_MSP_07_EmployeeTraining.pdf.

[12] Office of the Law Revision Counsel. United States Code: Current Release Point. March 23, 2024. https://uscode.house.gov/download/download.shtml.

[13] Susan Moody et al. “The Rising Cost of Complying with the Federal Income Tax.” December 2005. Tax Foundation. https://files.taxfoundation.org/legacy/docs/sr138.pdf.

[14] U.S. Government Publishing Office. Code of Federal Regulations (Annual Edition). 2023. Retrieved from: https://www.govinfo.gov/app/collection/cfr/.

[15] Internal Revenue Service. “Understanding IRS Guidance - A Brief Primer.” May 1, 2023.https://www.irs.gov/newsroom/understanding-irs-guidance-a-brief-primer.

[16] Treasury Inspector General for Tax Administration. The IRS Continues to Reduce Backlog Inventories in the Tax Processing Centers. March 18, 2024. https://www.tigta.gov/reports/audit/irs-continues-reduce-backlog-inventories-tax-processing-centers.

[17] Government Accountability Office. “2023 Tax Filing: IRS Improved Customer Service, but Could Further Improve Processing and Evaluate Expedited Hiring,” Jan. 2024. https://www.gao.gov/products/gao-24-106581.

[18] Internal Revenue Service. Internal Revenue Service Inflation Reduction Act Strategic Operating Plan: FY 2023 – 2031. April 5, 2023. https://www.irs.gov/pub/irs-pdf/p3744.pdf.

[19] Demian Brady. “GAO Confirms NTUF’s Findings on 1099-K Compliance Confusion.” National Taxpayers Union Foundation. November 17, 2023. https://www.ntu.org/foundation/detail/gao-confirms-ntufs-findings-on-1099-k-compliance-confusion.

[20] Joe Bishop-Henchman. “IRS Postpones 1099-K Enforcement Again.” National Taxpayers Union Foundation. November 21, 2023. https://www.ntu.org/foundation/detail/irs-postpones-1099-k-enforcement-again.

[21] Treasury Inspector General for Tax Administration. The Enterprise Case Management System Did Not

Consistently Meet Cloud Security Requirements. March 27, 2023.

https://www.tigta.gov/sites/default/files/reports/2023-03/202320018fr.pdf.

[22] Laura Saunders. “The Worst Tax Form.” The Wall Street Journal. February 19, 2016. https://www.wsj.com/articles/the-worst-tax-form-1455877800.

[23] Internal Revenue Service. “Supporting Statement: Proceeds From Broker and Barter Exchange Transactions (Form 1099-B).” January 26, 2024. https://www.reginfo.gov/public/do/PRAViewDocument?ref_nbr=202311-1545-015.

[24]Internal Revenue Service. “Supporting Statement: U. S. Business Income Tax Returns.” December 22, 2023. https://www.reginfo.gov/public/do/PRAViewDocument?ref_nbr=202310-1545-005.

[25] Andrew Lautz. “IRS Funding Reallocation Could Improve Taxpayer Service, Modernization Efforts.” National Taxpayers Union Foundation. March 31, 2023. https://www.ntu.org/foundation/detail/irs-funding-reallocation-could-improve-taxpayer-service-modernization-efforts.