(pdf)

Earlier this month, Maryland Senate Bill 2 dropped, shocking the state tax world. The bill, inspired by an opinion piece in The New York Times, would create a new gross receipts tax on digital advertising within the state. Sponsored by Senators Thomas V. Miller Jr. and Bill Ferguson (D), the outgoing and incoming Senate Presidents respectively, the tax would create significant economic and legal ramifications if it’s adopted.

The Bill’s Structure

The bill would create a digital advertising gross receipts tax, imposed on a company’s annual gross revenue in the state. Similarly structured as France’s new digital services tax, the bill’s broad definition of digital advertising includes banner ads, search engine ads, and others posted on a website, an application, or within a piece of software.

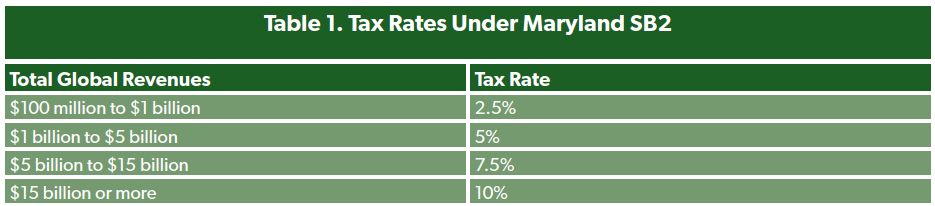

The tax rate would increase with a company’s global revenues. A company making between $100 million and $1 billion would pay 2.5 percent of taxable receipts, rising as high as 10 percent for companies with $15 billion or more in sales.

Taxing companies on their gross revenue creates economic problems. By taxing gross receipts instead of profits (which allows a company to deduct its costs), effective tax rates skyrocket. A $15 billion company would need to exceed a 10 percent profit margin to surpass the break-even point on such a tax. The tax is also nonneutral, applying to one narrow industry, while leaving other competitors untaxed.

The Bill’s Legal Future is Uncertain

If adopted, the bill is forecast to raise $100 million, but its numerous legal hurdles make that unlikely. As written, the legislation is a clear violation of the federal Permanent Internet Tax Freedom Act (PITFA). Signed into law in 2016 by President Barack Obama, the law prohibits states and localities from assessing taxes on internet access. Second, it prohibits “discriminatory taxes on electronic commerce.” Maryland’s proposal appears to be an obvious violation of this component of PITFA.

Similar to most states, Maryland does not currently include advertising in its sales tax base, and for very good reasons. State sales tax bases should only include final personal consumption. Taxing business inputs, such as advertising, leads to higher prices for consumers. While both digital and traditional physical advertising activities would be subject to the state’s 8.25 percent corporate income tax, only digital advertising would be additionally subjected to a gross receipts tax as high as 10 percent.

Even if the tax survived a PITFA challenge, it suffers from additional constitutional flaws as well. Because the tax is assessed on annual global revenues, larger global advertising providers would face a higher tax burden than Maryland-only providers, raising questions about whether the law could survive a challenge alleging that it violates the U.S. Constitution’s Commerce Clause, which functionally prohibits state laws that discriminate against interstate commerce.

The bill also likely violates the First Amendment. In Grosjean v. American Press Co. and Minneapolis Star Tribune Co. v. Commissioner, the U.S. Supreme Court considered the impact of taxes on the news media, ruling that industry-specific taxes violate the First Amendment’s speech protections. In a similar case, the Maryland Court of Appeals ruled that advertising taxes were unconstitutional violations of the First Amendment. Taxing digital advertising, a key revenue stream for media companies, would raise similar challenges.

Nebraska’s Turn

Quickly following the introduction of SB2 in Maryland, Nebraska Senator Justin Wayne introduced LB 989, which would expand the state’s sales tax base to include digital advertising. Expanding a state sales tax base and using the revenue to complete broader tax reform is generally a great approach, but taxing a business input should always give pause. Likewise, failing to include other reforms to reduce burdens elsewhere in the code means that the bill would constitute a significant net tax increase. And similar to Maryland, traditional advertising is exempt from the sales tax base in the Cornhusker State, subjecting the tax to a PITFA challenge if it’s adopted.

The Maryland and Nebraska bills are unlikely to be the only such efforts to impose new, discriminatory tax increases on digital advertising. The rising anti-tech sentiments in some circles are driving new legislative approaches that would have serious impacts for taxpayers and business climates across the country.

Conclusion

Legislators in Maryland are searching for new revenue to pay for the Kirwan Commission's educational recommendations, but the digital advertising tax does not pass the smell test. Even though it was proposed by a Nobel Prize winning economist and strikes some as a good idea, the tax violates federal law and is also likely unconstitutional. Instead of collecting $100 million from the tax, the state is more likely to find itself spending a pretty penny on legal fees to defend an indefensible proposal.