(pdf)

Introduction

A coalition of good-government organizations and advocates sent an open letter to the House and Senate lead appropriators urging them to increase the budget for the legislative branch by 10 percent, a $530.9 million funding increase.[1] This is just the latest in a series of transpartisan efforts aimed at strengthening the institutional capacity of Congress and its primacy in the budgeting process, some of which has been

The letter notes that funding levels for Congress have lagged behind increases in discretionary spending in other parts of the federal government and says that increased funding would provide additional resources to “lead in federal policymaking, provide services for constituents, and conduct oversight that roots out waste, fraud, abuse, and malfeasance.”

Lawmakers may find it necessary to increase resource available to Congress to modernize operations, increase policymaking and support staff, improve constituent service, and strengthen the institution’s analytical and oversight capabilities – including cost estimates of legislative proposals from the Congressional Budget Office (CBO) – but broader budget implications must also be taken into consideration.

With the record levels of federal debt accumulated after years of overspending, calls to increase allocations for the legislative branch can easily be offset with spending reductions elsewhere in the budget to minimize impact on taxpayers.

Legislative Branch Funding Levels

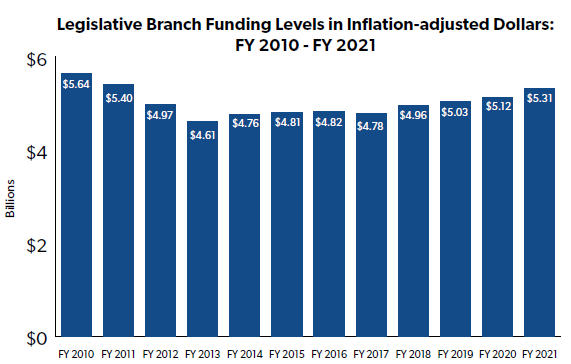

Legislative funding has been relatively flat over the past eleven years, with reductions each year through 2013 followed by annual increases. The FY 2010 spending level of $4.67 billion is equal to $5.64 billion in today’s dollars.

Based on CBO data for FY 2020 outlays, the major components of the legislative branch funding include:

- House of Representatives: a total of $1.49 billion including:

- Salaries and expenses for staff: $1.36 billion

- Compensation and administrative expenses for Members: $120 million[3]

- Senate: a total of $990 million including:

- Senators’ official personnel and office expense account: $442 million

- Salaries for officers and employees: $211 million

- Inquiries and investigations: $129 million

- Sergeant at Arms and Doorkeeper of the Senate: $128 million

- Compensation for Members: $30 million

- Government Accountability Office (GAO): $642 million

The GAO was established in the Budget and Accounting Act of 1921 to assist Congress in accounting for the use of federal funds. Thanks to the leadership of the late Senator Tom Coburn (R-OK), GAO provides annual reports identifying duplicate and overlapping federal programs.

- Library of Congress: $707 million

Funding for the Library includes $119 million for the Congressional Research Service which produces hundreds of policy and legislative reports each year to educate Members of Congress and their staff. In the recent past, it was difficult for taxpayers to gain general access to their reports without having to pay extra fees. Following a public reform campaign for more transparency, most of the agency’s reports and analyses are now made publicly available online.

- Architect of the Capitol (AOC): $693 million

The AOC is responsible for maintaining the Capitol building, offices, grounds, and infrastructure including the Congressional Power Plant and an extensive underground network of tunnels and pipes. Major infrastructure projects related to upgrades of congressional office buildings and underground infrastructure have increased the agency’s funding over recent years.

- United States Capitol Police (USCP): $474 million

The USCP’s total budget for protection of the Capitol complex is just shy of the $545.7 million budget afforded to the District of Columbia’s Metropolitan Police Department, which has responsibility for maintaining public safety for the entirety of the district and its 700,000 residents.[4] The budget for the USCP has increased dramatically since before September 11, 2001, with FY 2000 funding amounting to “just” $115 million (equivalent to $177.5 million in today’s dollars).

- Government Publishing Office (GPO): $117 million

The GPO is responsible for printing and distributing official documents from Congress and federal agencies.

It is worth noting that salaries for elected members of the House and Senate have been frozen since 2009. They would otherwise be much higher today, consuming a greater part of the legislative branch budget. Members of Congress are eligible for an automatic annual cost-of-living-adjustment unless they vote not to accept it, which they have done since 2009. Rank-and-file members’ salary stands at $174,000 annually. The Speaker of the House receives $223,500 per year while leaders of the House and Senate and the Senate President pro tempore collect $193,400 annually.

Salaries for members of Congress are recorded in CBO’s budget baseline as discretionary spending, but the pay freeze is recorded as mandatory spending. This means that CBO assumes the pay freeze will be maintained throughout the ten-year budget window reducing outlays by $24 million over the period.

An additional smaller cost crops up occasionally due to the outmoded practice of providing lump sum payments equal to the annual congressional salary to heirs upon the passing of members of Congress. This is in addition to the eligibility for survivor benefits under the Federal Employees Retirement System.

There are also other smaller components of the legislative branch budget that might not be widely known to the public:

- Congressional Budget Office: $55 million

The CBO produces budget baseline projections throughout the year, reports cost estimates of legislation under consideration in Congress, and provides dozens of additional analytical reports of federal programs and policy areas. Its cost estimates are crucial to the policymaking efforts on Capitol Hill and CBO’s recent budget proposals have requested additional funding because its workload has significantly increased over the past few years in response to requests for data, transparency, and budget scores from member offices and committees.[5]

It is important to support CBO’s budget in order to make sure that Congress has the most accurate, reliable information when they are considering the budgetary impact of legislation, and as noted below, there multiple ways that Congress can do so while being mindful of fiscal constraints. Additional reforms to the way CBO produces its budget projections to take into account a policy baseline rather than a current law baseline would also improve the accuracy of its reports.

- Botanic Garden: $16 million

Located near Congress, the Botanic Garden is a museum of plants administered by the Architect of the Capitol. The last-minute rescission package from President Trump requested to eliminate funding for the Botanic Garden, but the request was subsequently rescinded by the incoming administration.[6]

- Open World Leadership Center: $6 million

This program was originally established in 2000 to encourage federal and local Russian leaders to visit the U.S. In the years since then, the program was expanded to include additional countries.

Impact of Spending Increases

Any increase in legislative branch costs will get built into the annual budget projections produced by CBO. As a result, an initial one-year boost of $530.9 million would add over $5 billion to the budgetary baseline over the decade. Unless there are corresponding offsets to the increases, there would also be increased payments from the federal debt.

There will likely be pressure for additional increases in legislative branch funding after the security breach of the Capitol building on January 6. On that day, the USCP was seemingly unprepared and overwhelmed by the large crowd, instigating a significant presence of National Guard troops defending the complex that will extend through at least mid-March. According to reports, the USCP has also recommended construction of a permanent barrier to boost security to the Capitol building. This would also boost annual maintenance and manpower costs.

Offsets

Lawmakers could start by looking within the legislative branch budget for offsets to the new spending. For example, based on CBO’s projection of funding, eliminating taxpayer funding of the Botanic Garden would save an average $19 million per year, amounting to $185 million over the decade. While the Botanic Garden may provide valuable services, it is reasonable to assume it could survive through private support as many other facilities in the District do.

Additional offsets can be found in the unique joint Toward Common Ground publication from National Taxpayers Union Foundation and the U.S. Public Interest Research Group Education Fund listing nearly $800 billion in savings across the federal budget.[7] This project is unique as an effort to bridge the political divide. Our organizations may have very different ideological perspectives, but we worked together on this report to “mutually identify areas of wasteful, cronyistic, and excessive spending that plague our federal budget”.

CBO also released its biennial Budget Options report last December which included updated savings estimates for several of the items that were included in the Common Ground report.[8]

As noted above, the GAO produces regular reports identifying duplicate governmental efforts wasting taxpayer dollars each year. Following up on GAO’s recommendations would reduce unnecessary expenditures dramatically.[9]

Members should resist using gimmicky offsets to spending increases. Spending bills often include “offsets” that eliminate expired budget authorizations. However, in many cases, these funds would never actually be spent so using these as offsets amounts to a mere accounting trick.

Conclusion

The signatories of the letter make a case that Congress needs more funding to “rebuild Congress’s lost institutional capacity.” Increased resources could also improve the budgetary analysis and cost estimates provided by CBO, whose role is only more important in a world governed by the complex rules of budget reconciliation.

At the same time, lawmakers also have an opportunity to prioritize the use of taxpayer funds by trimming overspending. Congress can kill two birds with one stone by strengthening its capacity and reducing wasteful spending elsewhere in the budget.

[1] Schuman, Daniel et al. "Letter to Chair DeLauro, Chair Leahy, Ranking Member Granger, and Vice Chair Shelby Re: Strengthening American Democracy by Increasing Legislative Branch Capacity” (2021). Retrieved from https://s3.amazonaws.com/demandprogress/letters/Increase_Leg_Branch_Funding_Letter_-_February_2021.pdf.

[2] Power of the Purse Coalition. (2020) “Letter to Leader McConnell, Speaker Pelosi, Leader Schumer, and Leader McCarthy. Retrieved from https://www.ntu.org/library/doclib/2020/07/power-of-the-purse-coalition-letter-1-.pdf.

[3] For additional information, a 2020 report from the Congressional Research Service (CRS) further breaks out components of the House’s top line spending listed above by CBO, including $615 million for Members’ Representational Allowance, which provides for office expenses, personnel, travel, and mail. Congressional Research Service. (2020). Legislative Branch: FY2021 Appropriations. Retrieved from https://fas.org/sgp/crs/misc/R46469.pdf.

[4] Golding, Eliana. “What’s in the FY 2021 Police and Public Safety Budget?” DC Fiscal Policy Institute. October 8, 2020. Retrieved from https://www.dcfpi.org/all/whats-in-the-fy-2021-police-and-public-safety-budget/.

[5] Brady, Demian. “CBO’s Budget Request: Boosting the Agency’s Responsiveness and Improving the Budgetary Baseline.” National Taxpayers Union Foundation. February 25, 2020. Retrieved from https://www.ntu.org/foundation/detail/cbos-budget-request-boosting-the-agencys-responsiveness-and-improving-the-budgetary-baseline.

[6] Brady, Demian. “President Trump’s Late Term Rescission Request Would Save Taxpayers $27 Billion.” National Taxpayers Union Foundation. January 27, 2021. Retrieved from https://www.ntu.org/foundation/detail/president-trumps-late-term-rescission-request-would-save-taxpayers-27-billion.

[7] Brady, Demian and Cross, R.J. “Toward Common Ground 2020: Bridging the Political Divide with Deficit Reduction Recommendations for Congress,” National Taxpayers Union Foundation and U.S. PIRG Education Fund. April 23, 2020. Retrieved from: https://www.ntu.org/publications/page/toward-common-ground-bridging-the-political-divide-with-deficit-reduction-recommendations-for-congress.

[8] Congressional Budget Office. (2020). Options for Reducing the Deficit: 2021 to 2030. Retrieved from https://www.cbo.gov/publication/56783.

[9] Government Accountability Office. (2020). Duplication & Cost Savings. Retrieved from https://www.gao.gov/duplication/overview.