August 2, 2018

By Demian Brady

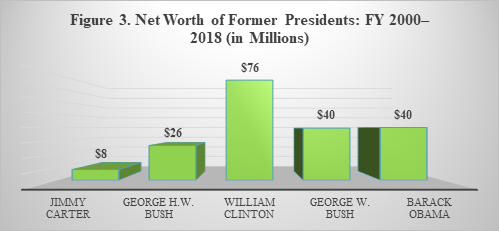

The amount of money spent to subsidize the post-White House lives of former presidents may be surprising to taxpayers. In an era of high deficits and soaring debt, Americans are providing millions of dollars in perks and benefits to former presidents - who themselves are all multimillionaires. The generous pension and allowances available to retired presidents were set in place in 1958 because Harry Truman faced financial difficulty after leaving office. His situation was unique in the modern era: All the presidents serving after Truman have been millionaires. Thanks to pricey speaking fees and lucrative media production and book deals, modern day presidents have ample means of generating income after they leave office. Yet they are still eligible for taxpayer-funded benefits. The benefit system needs to be reformed to take into account 21st century realities and let taxpayers off the hook for expensive perks to millionaires.

NTUF compiled the amounts spent on former presidents (excluding security costs) since 2000, with more detailed information available since FY 2015. Findings:

Since 2000, taxpayers have paid out $63 million in benefits and office allowances to the five living former presidents, whose net worths, as estimated by 24/7 Wall Street, range from $8 million (President Carter) to $76 million (President Clinton).

Clinton has received the most taxpayer-funded benefits since 2000: $21 million.

On an annualized rate, Obama has collected the highest average amount of perks totaling $1.4 million per year, followed by George W. Bush at $1.2 million per year.

President Carter has received $1 million less than George W. Bush, despite Bush’s fewer years of eligibility. Carter has received $11 million, about $580,000 per year, compared to Bush’s $12 million, about $1.2 million per year.

Additionally, over this period, President Ford received $5.4 million and President Reagan received $4.4 million.

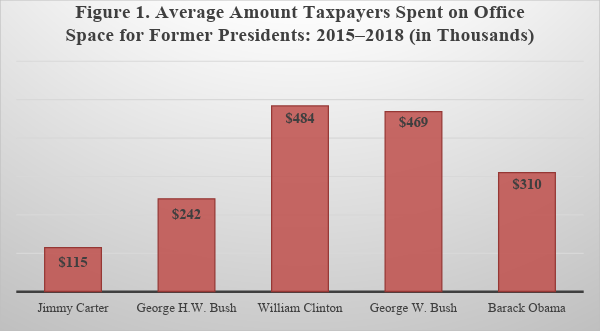

From 2015 through 2018, outlays for office space ($5.9 million) comprised 38 percent of all benefits. The next-highest cost category is for pensions and health care ($3.9 million).

H.W. Bush has run up the most travel expenses since 2015, at $279,000.

G.W. Bush has the most expenses for communication ($359,000) and printing ($96,000).

The latest budget requests $1.7 million for President Obama in FY 2019, including $542,000 for his Washington, DC office space, the most expensive rent among the former presidents.

Table 1. Total Benefits and Pensions Allowances for Former Presidents: FY 2000–2018 (in Millions) | ||||

President | Total Allowances Received | # of Years Allowances Received from FY 2000–2018 | Average per Year | Net Worth |

Jimmy Carter | $11 | 19 | $0.58 | $8.1 |

George H.W. Bush | $17 | 19 | $0.88 | $26.3 |

William Clinton | $21 | 18 | $1.16 | $75.9 |

George W. Bush | $12 | 10 | $1.20 | $39.5 |

Barack Obama | $3 | 2 | $1.35 | $40 |

Total | $63 | $189.8 | ||

Note: Figures in 2018 dollars.Source: Congressional Research Service and General Services Administration budget data. Net worth data is from 24/7 Wall Street. | ||||

Presidential Benefits

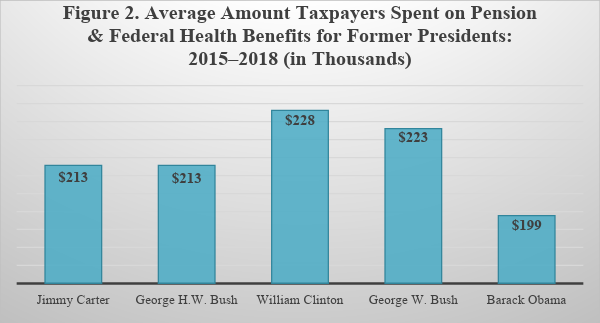

The biggest personal benefit that former presidents are entitled to is an annual pension equal to the pay for a Cabinet Secretary, which is $210,700 in 2018. They are also eligible for additional benefits:

Office Space and Staffing Allowances: Starting six months after a president leaves office, the General Services Administration (GSA) provides funding to establish, furnish, and staff an official office anywhere in the U.S. The Former Presidents Act does not “provide specifications or limitations pertaining to the size or location of a former President’s office space.” Staff compensation is limited to $150,000 for the first 30 months, then capped at $96,000 per year.

Travel Expenses: Chief Executives and up to two staff members are reimbursed for up to $1 million in security and travel-related costs annually. Former First Ladies also are eligible for $500,000 per year for official travel.

Health Benefits: Provided that they had been enrolled in the Federal Employees Health Benefits program for at least five years, former presidents are eligible for health annuities, similar to all federal employees. (Because Jimmy Carter only served a single term and did not hold another federal position, he is not eligible. H.W. Bush has declined this benefit.)

Secret Service Protection: Presidents are eligible for lifetime protection. The related costs are classified.

Table 2. Benefits and Pensions Allowances for Former Presidents: FY 2015–2018 (in Thousands) | ||||||

President | Jimmy Carter | George H.W. Bush | William Clinton | George W. Bush | Barack Obama | Total |

Personnel Compensation | $0 | $391 | $391 | $391 | $179 | $1,353 |

Personnel Benefits | $0 | $291 | $464 | $405 | $160 | $1,320 |

Pension & Federal Health Benefits | $851 | $851 | $912 | $892 | $398 | $3,905 |

Travel | $0 | $279 | $0 | $44 | $13 | $335 |

Office Space | $460 | $968 | $1,935 | $1,876 | $620 | $5,859 |

Communications | $69 | $228 | $40 | $359 | $22 | $718 |

Printing | $22 | $39 | $66 | $96 | $26 | $249 |

Other Services | $390 | $290 | $138 | $179 | $56 | $1,053 |

Supplies and Materials | $7 | $43 | $29 | $115 | $10 | $205 |

Equipment | $0 | $103 | $96 | $146 | $40 | $385 |

Total | $1,800 | $3,482 | $4,072 | $4,504 | $1,525 | $15,383 |

Notes: In 2018 dollars. Personnel Compensation and Benefits for President Carter are provided by contract support under Other Services. | ||||||

Table 3. Presidential Offices | |||

President | Location | Square Feet | 2018 Cost |

Carter | Atlanta, GA | 7,070 | $115,000 |

H.W. Bush | Houston, TX | 5,379 | $286,000 |

Clinton | New York, NY | 8,300 | $518,000 |

G.W. Bush | Dallas, TX | 8,237 | $497,000 |

Obama | Washington, DC | 8,198 | $536,000 |

Table 4. Allowances for Former Presidents: Budget Request for FY 2019 (in Thousands) | ||||||

| Jimmy Carter | George H.W. Bush | William Clinton | George W. Bush | Barack Obama | Total |

Personnel Compensation | $96 | $96 | $96 | $150 | $438 | |

Personnel Benefits | $76 | $123 | $110 | $140 | $449 | |

Pension & Health Benefits | $219 | $219 | $237 | $231 | $243 | $1,149 |

Travel | $68 | $8 | $5 | $81 | ||

Office Space | $117 | $286 | $513 | $500 | $542 | $1,958 |

Communications | $19 | $58 | $1 | $71 | $15 | $164 |

Printing | $7 | $12 | $17 | $22 | $20 | $78 |

Other Services | $92 | $79 | $39 | $48 | $29 | $287 |

Supplies and Materials | $2 | $19 | $7 | $32 | $7 | $67 |

Equipment | $39 | $26 | $35 | $25 | $125 | |

Total | $456 | $952 | $1,059 | $1,153 | $1,176 | $4,796 |

Note: Personnel Compensation and Benefits for President Carter are provided by contract support under Other Services. | ||||||

Presidential Allowance Modernization

As the data shows, the costs are steadily increasing as each successive president leaves office. To address this problem, reform legislation has been introduced in the House by Rep. Jody Hice (R-GA) as H.R. 3739, and in the Senate by Sen. Joni Ernst (R-IA) as S. 1791.

The Presidential Allowance Modernization Act of 2017 would limit the pension a president could receive to $200,000 annually, with the amount being indexed to inflation. It would also limit the annual allowance for office space and other expenses to $500,000 for the each of the first five years, reduced to $350,000 for the next five years, and down to $250,000 per year afterwards. The act would reduce this allowance dollar for dollar by the amount that a president’s adjusted gross income exceeds $400,000. The bill would leave intact current healthcare benefits and Secret Service protection. The Congressional Budget Office (CBO) estimated that the legislation would save $7 million over its first five years, and $23 million over ten years.

Similar legislation was also introduced in the previous Congress (H.R. 1777 and S. 1411) but with office allowances capped at $200,000 and indexed annually for inflation. CBO estimated that version of the bill would have reduced outlays by $10 million over five years.

H.R. 1777 was passed by Congress but was vetoed by President Obama six months before he would have been become eligible for the perks. Because the White House had not issued any veto threat prior to the vote, the thumbs down came as a surprise. The given reason was that the former presidents complained that the reforms would have forced them to immediately terminate salaries and benefits to their staff because it left them “no time or mechanism … to transition to another payroll.”

Conclusion

The current version of the Presidential Allowance Modernization Act was passed in the House by voice vote and awaits action in the Senate. It is not expected that the bill would be vetoed this time around. The higher allowance caps should assuage the concerns of former presidents. Moreover, the reforms in the allowance modernization Act align with the principles laid out in President Trump's comprehensive reorganization proposal to improve the efficiency and accountability of federal programs. President Trump, with an estimated net worth of $3.1 billion, has also led by example when it comes to minimizing direct taxpayer support for the chief executive. To date, he has donated all of his presidential salary to various charities.

Presidents enter office with wealth and leave office with opportunities to earn even more income. In the modern era of Netflix production deals, and speech opportunities ranging from $175,000 to $500,000 per event, it is time to reform this federal program that subsidizes millionaires.

About the Author

Demian Brady is Director of Research with the National Taxpayers Union Foundation.