This month the IRS released Notice 2021-61 and RP2021-45 with details on official inflation adjustments to various provisions of the federal tax code for 2022. While consumer price inflation in 2021 will likely be over 6 percent, the IRS adjustments are only around 3 percent because they are mostly based on the year ending August 31.

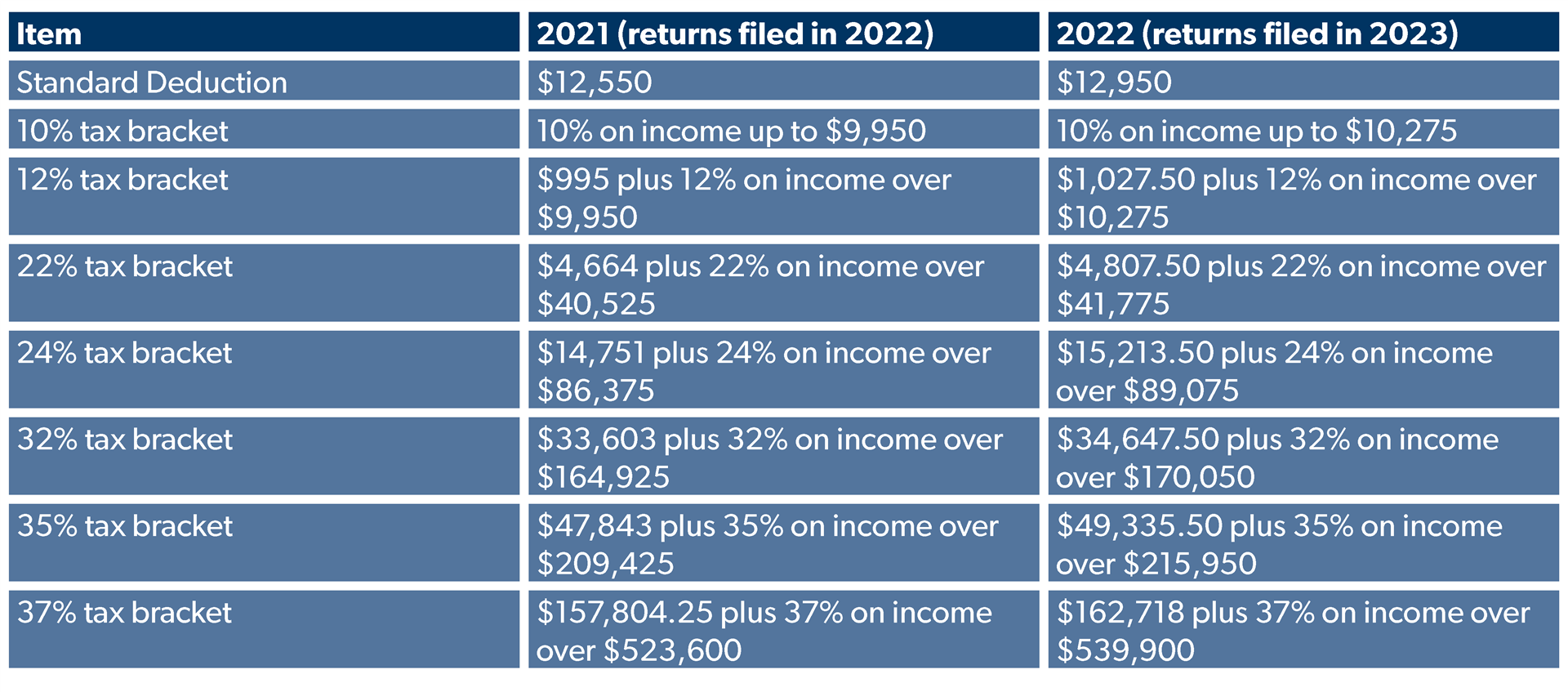

A 3 percent adjustment to the standard deduction may seem small to Americans facing a 6 percent (or more) price spike, but the adjustment for 2023 could be larger. Already, this year’s adjustment is substantially larger than 2021’s 1.2 percent increase. Also, no word yet on a 2022 adjustment to the 56 cents per mile standard mileage rate; that is usually announced in December.

Note that Congress is actively considering changes to 2022 and possibly 2021 tax laws, so this information may change prior to taxes being filed. Consult your tax professional.

Key updates for married filing jointly taxpayers:

Key updates for single taxpayers and married filing separately taxpayers:

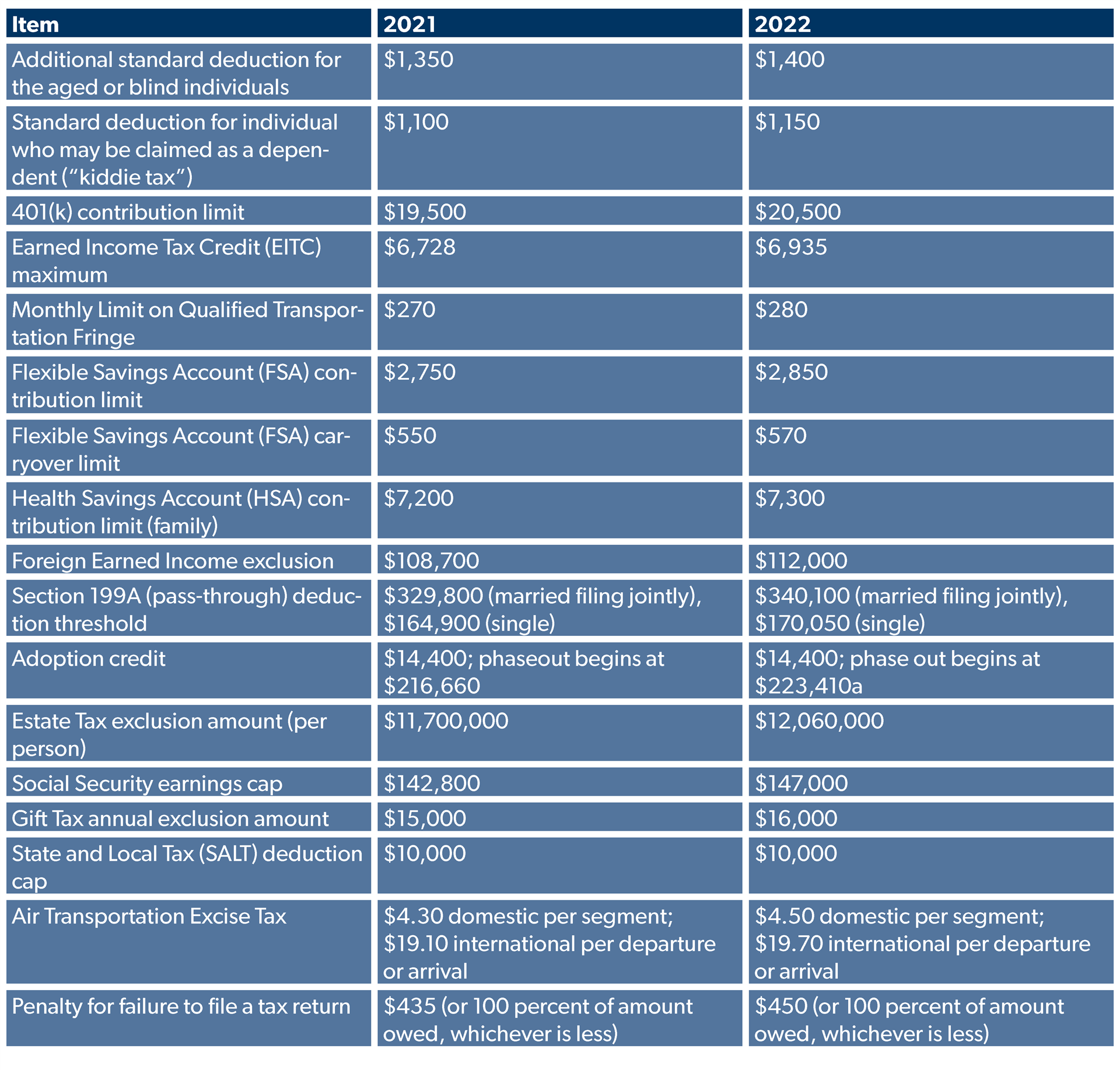

Other adjustments: