(pdf)

Introduction

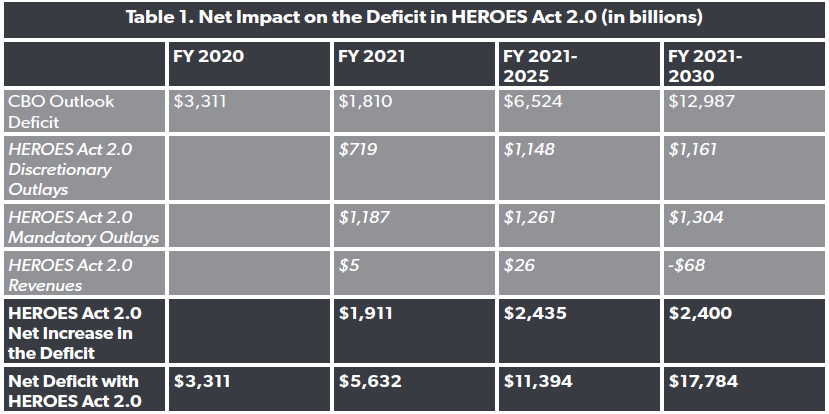

The Congressional Budget Office (CBO) and the Joint Committee on Taxation (JCT) have published cost estimates of the revised version of the House Democrats’ HEROES Act as passed by the House on October 1.[1] The new bill would more than double the projected deficit for FY 2021 and cost $2.4 trillion over the decade. This version is scaled back from the original $3.4 trillion HEROES Act passed in May.[2]

HEROES Act vs. HEROES Act 2.0

The original HEROES Act was introduced as H.R. 6800 and passed by the House on May 15.[3] H.R. 925 is the legislative vehicle for the revised version of the HEROES Act, referred to as HEROES Act 2.0, and was passed by the House on October 1.[4]

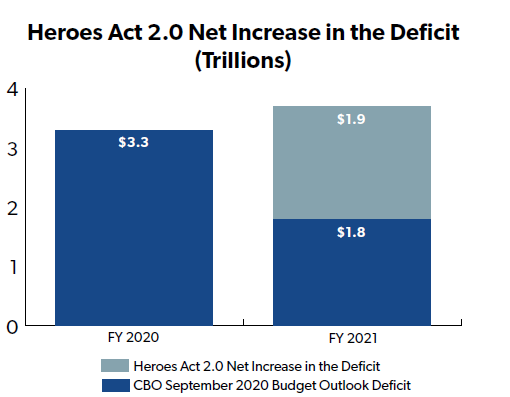

The package would boost spending over the decade by $2.5 trillion, including $1.2 trillion in discretionary spending and $1.3 trillion in mandatory spending. Over three-quarters of this amount, $1.9 trillion, would be spent in FY 2021. This would more than double next year’s deficit to $3.7 trillion, making it even worse than 2020’s red ink total of $3.3 trillion.

The major components of HEROES Act 2.0 include:

- State and local fiscal relief: $436 billion (compared to $915 billion in H.R. 6800)

- Additional recovery rebates to individuals: $307 billion (compared to $435 billion in the original)

- Multiemployer pension fund bailout: $59 billion (compared to $60 billion in H.R. 6800)

- United States Postal Service bailout: $15 billion (compared to $25 billion in H.R. 6800)

As NTU’s Andrew Lautz noted in an analysis before the vote on the revised bill, it also includes hundreds of millions of dollars in appropriations to federal programs such the Corporation for Public Broadcasting, the National Endowments for the Arts and Humanities, and the Essential Air Services. All these programs should be considered for the chopping block rather than receiving additional taxpayer funding.[5]

The bill also includes tax changes that would decrease revenues by $26 billion over five years but would increase them over ten years by $68 billion.

One large tax break in the bill would eliminate the limit in FY 2020 on the deductibility of State and Local Taxes (SALT). The SALT deduction allows individuals to deduct some taxes that are paid at the state and local level from their federal income tax bill. This deduction has primarily benefited the wealthy: before enactment of the Tax Cuts and Jobs Act (TCJA) , 84 percent of the benefit went to those with incomes over $100,000, while only 3.5 percent flow to those with incomes under $50,000.[6] The deduction also provided incentives to states and localities to boost taxes.

The TCJA capped the deduction in order to fuel lower tax rates across the board. JCT estimates that repealing the limit for one year would reduce revenues by $65 billion.

HEROES Act 2.0 also includes tax changes that would result in new spending for refundable credits that can be claimed above and beyond a filer’s income tax liability. Making the Child Tax Credit fully-refundable for 2020 would increase spending by $22.9 billion in 2021 and $27.8 billion over the decade. Another provision expanding the Earned Income Tax Credit for individuals with no qualifying children would reduce revenues by $1.3 billion and increase outlays by $8.3 billion in 2021.

Net Deficit Impact

The year started out with an expected deficit of $1 trillion for both FY 2020 and 2021.[7] In September, the CBO updated the outlook and found that the impact of the pandemic and legislative responses have boosted the budget deficit to $3.3 trillion for 2020 and $1.8 trillion in 2021.[8] If enacted, the revised Heroes Act would add $1.9 trillion to the deficit in 2021 and $2.4 over the ten year period.

Conclusion

Although scaled back by a trillion dollars to $2.4 trillion from the original HEROES Act, the current iteration still contains many of the same flaws as its predecessor: wasteful spending, bailouts to the multiemployer pension system that lack reforms to provide security to taxpayers, and as the CBO and JCT data show, it would pile on additional deficit spending.

[1] The Congressional Budget Office’s cost estimates of legislation incorporate the Joint Committee on Taxation’s revenue estimates. Congressional Budget Office (2020). “H.R. 925, Heroes Act As passed by the House of Representatives on October 1, 2020.” Retrieved from https://www.cbo.gov/publication/56686. Joint Committee on Taxation (2020). “Estimated Revenue Effects Of The Revenue Provisions Contained In The Heroes Act, As Passed By The House Of Representatives On October 1, 2020 (Rules Committee Print 116-66).” Retrieved from https://www.jct.gov/publications/jcx-21-20/.

[2] Congressional Budget Office (2020). “CBO Estimate for H.R. 6800, the Heroes Act, as Passed by the House of Representatives on May 15, 2020.” Retrieved from https://www.cbo.gov/system/files/2020-06/56383-HR6800.pdf.

[3] H.R. 6800, The HEROES Act: Text as Placed on Senate Calendar. June 1, 2020. Retrieved from https://www.congress.gov/bill/116th-congress/house-bill/6800/.

[4] H.R. 925, The HEROES Act: House Amendment to Senate Amendment. October 1, 2020. Retrieved from https://www.congress.gov/bill/116th-congress/house-bill/925/text.

[5] Lautz, Andrew. “Pelosi’s Updated HEROES Act Still Misses the Mark With Wasteful Spending,” National Taxpayers Union. September 30, 2020. https://www.ntu.org/publications/detail/pelosis-updated-heroes-act-still-misses-the-mark-with-wasteful-spending.

[6] Wilford, Andrew and Moylan, Andrew. “What’s the Deal with the State and Local Tax Deduction?” National Taxpayers Union Foundation. October 24, 2017. https://www.ntu.org/foundation/detail/issue-brief-whats-the-deal-with-the-state-and-local-tax-deduction.

[7] Congressional Budget Office (2020). ”The Budget and Economic Outlook: 2020 to 2030.” Retrieved from https://www.cbo.gov/publication/56020.

[8] Congressional Budget Office (2020). “An Update to the Budget Outlook: 2020 to 2030.” Retrieved from https://www.cbo.gov/publication/56517.