(pdf)

A new report from the Congressional Budget Office (CBO) on the federal government’s loan activities sheds new light on the potential burdens to taxpayers, and in the process illustrates how budget scoring rules mandated by Congress mask the true risks involved in federal backing of home loan liabilities.[1]

Under the Congressionally prescribed accounting method, loan activities planned across the federal government during FY 2022 look like they are a net positive in the budget, resulting in $40 billion in savings. Using an alternative method called fair-value accounting to take into account market risks, however, finds that the loans expose taxpayers to $59 billion in costs.

This new CBO report should open Congress’s eyes to the dual imperatives of improving budget analysis and reducing the taxpayer liabilities that accurate projection uncovers.

The Budgetary Treatment of Federal Loans and Loan Guarantees

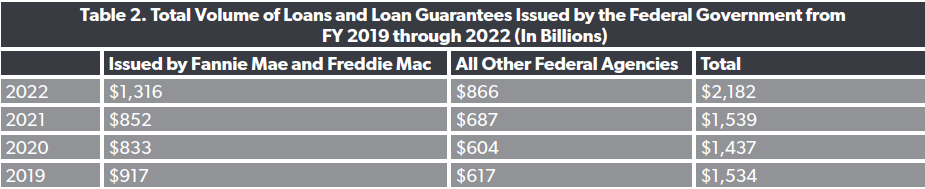

CBO projects that the credit activities engaged in next year across 112 different federal programs will total nearly $2.2 trillion. But to assess how these loans and guarantees will ultimately impact the federal budget, analysts must review the flow of cash from repayments, interest obligations, and default rates. They also apply a discount rate to translate the future cash flows resulting from the loans into current-dollar equivalents.

The Fair Credit Reform Act (FCRA) of 1990 sets the budgetary treatment for most of the federal government’s loan and loan guarantee programs. This stipulates that the discount rate is based on projected yields of Treasury securities. Given the relative stability of Treasury securities, this method tends to underestimate the true value of the loans or guarantees because it does not account for the risk of the loans that are considered by private lenders and investors. Under FCRA accounting, the loans issued will result in a lifetime savings of $40 billion as they are assumed to be repaid with interest.

For its recent report, CBO re-examined these programs using fair value accounting, which is what private sector lenders use to assess the cost of loans. This applies a competitive market value known as a risk premium to the assessment of the federal government’s credit obligations. The risk premium represents the cost to lenders and investors from the extra risk in a given investment over that of a risk-free asset. CBO writes that “fair-value estimates are a more comprehensive measure than FCRA estimates of the costs of federal credit programs, and thus they help lawmakers better understand the advantages and drawbacks of various policies.” Using fair-value method accounting for market and default risks exposes a $59 billion cost to taxpayers.

CBO’s Findings

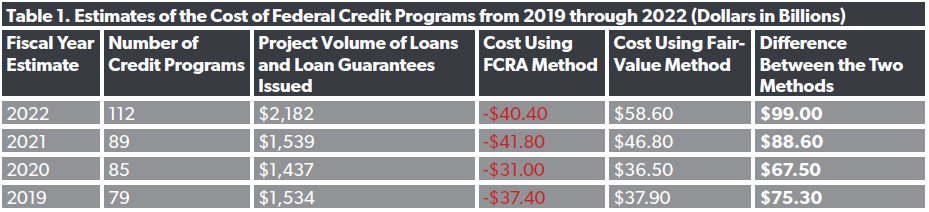

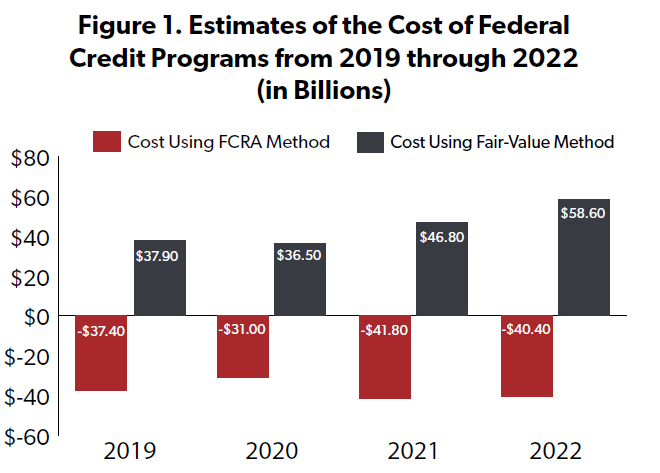

For the past four years, CBO has analyzed the cost of federal credit activities using both methods to score the budgetary impact of the loans over their lifetimes.[2] As Table 1 shows, there is a dramatic difference in outcomes between the two methods as huge savings under FCRA are in fact exposed as large liabilities when market risk factors are included.

For every program that CBO analyzed for 2022, the projected fair-value subsidy rate is higher than the projected FCRA subsidy rate by about 4.5 percentage points, on average. CBO adds that when the rates are weighted by the amount of the programs’ credit, the average subsidy rate is −1.9 percent on a FCRA basis and 2.7 percent on a fair-value basis.

Negative subsidy rates in federal programs should be rare. If the loans are indeed moneymakers, the credit should be attainable through the private market. While the existence of government backing can often crowd out private lenders in a given space, persistent negative subsidy rates are uncommon.

The same three program areas account for the largest level of loans over the four CBO reports. For FY 2022 these include:

- Fannie Mae and Freddie Mac which would show savings of $29.8 billion under FCRA, but which would show a cost of $5.5 billion under fair-value accounting;

- The Department Housing and Urban Development’s loan programs which would show savings of $12.0 billion under FCRA but would reveal costs of $11.9 billion on a fair-value basis; and,

- The Department of Education’s student loan program which yields $1.7 billion in savings on a FCRA basis but shows costs of $12.6 billion on a fair-value basis.

More than half of the government’s annual credit assistance is provided via Fannie Mae and Freddie Mac. In 2008, the federal government bailed out and took control of these two government-sponsored enterprises under a conservatorship.

Because of the conservatorship, CBO considers their loan guarantees as federal commitments and accounts for them on a fair-value basis in its baseline projections. The White House’s Office of Management and Budget, on the other hand, considers the GSEs as private companies and generally only includes cash transactions between them and the Treasury in budget data.

Although the conservatorship was intended to be a temporary measure, there seems to be no end in sight to the arrangement, even as their mortgage portfolios have increased since 2008. On a positive note, the previous administration implemented reforms to protect taxpayers. A rule finalized in November 2020 requires Fannie and Freddie to increase their capital requirement to about $240 billion, or 3.85 percent of their assets. This was a significant increase from a 2018 rule, which set the capital requirement at $180 billion and 2.25 percent of assets.[3] By comparison, large banks have a capital requirement of 4.5 percent.[4]

Much more work is needed to protect taxpayers from liabilities, set these programs on a sustainable financial footing, and unwind the conservatorship. As fair-value accounting uncovers higher levels of risk to taxpayers than previously understood, the need to reform these programs is even greater.

Fair-Value Reform

Representative a Ralph Norman (R-SC) introduced H.R. 3785, the Fair-Value Accounting and Budget Act, that would improve transparency and accuracy in accounting to loan programs administered by the federal government.[5] The Act would require the executive branch and Congress to use fair value accounting in calculating the cost of the federal credit programs. This would align the government’s accounting standards with those that the private sector uses to evaluate the risk of loans. Taxpayers deserve a fair assessment of the government’s expanding loan obligations.

Conclusion

To its credit, CBO has issued recurring reports on the cost of federal credit programs. The fair-value method provides a more realistic accounting of the risk entailed in the government’s expanding loan activities. Congress should make this method the standard. More accurate budget data can pave the way for reform of the government’s loan activities to better protect taxpayers from large liabilities.

[1] Congressional Budget Office. Estimates of the Cost of Federal Credit Programs in 2022. October 6,2021. Retrieved from https://www.cbo.gov/publication/57412.

[2] Congressional Budget Office. Major Recurring Reports: Fair-Value Estimates of the Cost of Federal Credit Programs. Retrieved from https://www.cbo.gov/about/products/major-recurring-reports#21.

[3] Aiello, Thomas. NTU Offers Feedback on Proposed GSE Capital Rule.National Taxpayers Union. August 31, 2020. Retrieved from https://www.ntu.org/publications/detail/ntu-offers-feedback-on-proposed-gse-capital-rule.

[4] Board of Governors of the Federal Reserve System. Dodd-Frank Act Stress Test Publications: Large Bank Capital Requirements. August 2021. Retrieved from https://www.federalreserve.gov/publications/large-bank-capital-requirements-20210805.htm.

[5] Norman, Ralph. H.R.3785 - Fair-Value Accounting and Budget Act. June 8, 2021. https://www.congress.gov/bill/117th-congress/house-bill/3785.