(pdf)

This week marks the 45th anniversary of the Congressional Budget Office (CBO), the agency that acts as the scorekeeper for the House and Senate. CBO annually projects a baseline of spending and outlays and produces cost estimates of legislative proposals. Last week, the Appropriations Subcommittee on the Legislative Branch, chaired by Representative Tim Ryan (D-OH) and ranking member Jaime Herrera Beutler (R-WA), held a hearing to review CBO’s FY 2021 budget request. This was the first such hearing for Dr. Phillip Swagel who was sworn in last year as CBO’s tenth director. CBO requested a modest increase to support and improve its capability to respond to the needs of Congress. Lawmakers should also consider additional reforms to bolster the production of a baseline that provides a more accurate projection of federal revenues and spending.

CBO’s Budget Request

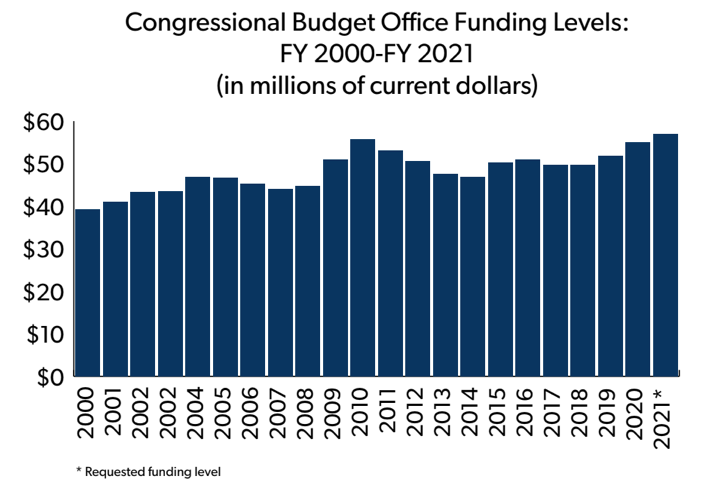

CBO requests a $2.4 million increase over last year, bringing its budget to $57.3 million.[1]The increase would fund salaries and benefits of new staff members hired this year. More than 90 percent of CBO’s budget is for personnel costs, with the remainder supporting information technology, purchases of commercial data, communications, equipment, supplies, and travel.

* Requested funding level

CBO’s increased budget over the past few years reflects the increased demands on the agency from Congress. The agency has worked to bolster its responsiveness to congressional staff while improving transparency regarding the models and underlying data that the agency uses to score legislation. CBO implemented several upgrades to its website over the past year including, adding filters to its cost estimate search function to drill down by effects on spending, revenues, and the deficit, providing data XML format, and publishing several interactive tools.[2]

In his prepared testimony, Director Swagel said that the funding request will support the agency’s work, including:

- the production of approximately 750 formal estimates;

- responding to thousands of requests for technical assistance to committees and members seeking potential scoring implications about legislation still in draft stage;

- 130 scorekeeping reports and projections, including appropriations acts; and

- about 70 analytical reports and papers such as the budget outlook, and analysis of particular policy topics such as defense, health care, and Social Security.

Director Swagel also emphasized his initiatives to further increase CBO’s responsiveness. With the new hires noted above, CBO hopes to improve coordination and integration of analysis by expanding the skill sets among its staff so that they can work on “broader, shared [issue] portfolios.” To that end, the director also would make greater use of expert consultants in high-priority research areas. Given feedback from offices and by monitoring the political landscape, CBO tries to anticipate the issue areas that will be on Congress’s agenda so that the agency can prepare itself by considering in advance the methodological and research questions that would be necessary to develop scoring models.

With a small portion of the increase ($45,000) CBO would set up an internal information technology system to track and manage documents. This would help coordinate internal efforts as its workforce has gradually expanded and would help the agency streamline the process for providing information to Congress via the formal and informal scoring and technical information.

Improving Responsiveness

The members in attendance at the hearing generally supported CBO’s ongoing efforts to improve responsiveness. One concern that was brought up by Representative Katherine Clark (D-MA) was the ability of rank-and-file Member offices to be able to get formal cost estimates on their legislative proposals. This has been an ongoing complaint raised by junior members of Congress; House and Senate offices want more access to CBO reports, but there are a lot of demands on CBO’s workload, and it is the chairmen and ranking members who set the priorities for CBO.

Similarly, Representative Dan Newhouse (R-WA) asked about what would happen if a Member of Congress asked CBO to produce a dynamic score of a bill. This type of analysis takes into account the macroeconomic feedback of proposal in order to provide a more realistic projection of spending or tax receipts. Swagel responded that sometimes legislation is moving too fast for CBO to provide a dynamic analysis but that he hopes that over the next few years of his tenure CBO will be able to increase its capacity to complete these types of studies more quickly, starting with a process of analyzing and assessing the past studies they’ve completed. But before proceeding on a dynamic score, the jurisdictional committee chairs would have to approve the work, potentially leaving rank-and-file members out of luck.

A solution to this impasse would have to come from Congress. CBO may consider scoring reform proposals by junior members to include in its biennial list of Budget Options to reduce the deficit, but in general, the prioritization of CBO’s workload is set by the committee leadership, especially those on the House and Senate budget committees.

Expanding Work on More Realistic Baseline Projections

As lawmakers consider the budget for the next fiscal year, not just for CBO but for the entire government, they should have access to the most reliable information of how policy proposals will impact the current and long-term outlook for spending and revenues. One of the most substantial reforms they could implement to achieve this would be to change the rules dictating how CBO sets the baseline. A baseline based on the course of current law rather than Congress’s actual policy tends to understate the magnitude of deficits. A truer picture could help shape the design of reforms to tighten over-spending.

CBO does normally include a chapter on Alternative Fiscal Scenarios in its annual budget outlook report. These scenarios project different outlays and revenues based on the types of policies that Congress tends to implement, including, for example, higher levels of discretionary spending than get captured in the current-law baseline, or lower revenues if the individual income tax reductions from the Tax Cuts and Jobs Act are extended similarly to previous recent tax cuts. The budget outlook report published this year was the first in nearly 20 years that did not include an Alternative Fiscal Scenario discussion, but CBO did subsequently release two interactive worksheets that help illustrate alternative outcomes for discretionary spending levels, and also how changes in key economic variables could impact the budget.

There are numerous other commendable ideas from members of Congress and the think tank world that would seek to improve CBO’s scorekeeping work such as requesting reporting of gross spending levels that are masked by offsetting receipts in order to illustrate the sheer size government’s fiscal footprint. Additionally, giving CBO sufficient time to provide formal cost estimates of legislation before markup hearings would ensure that committee members are taking the fiscal impact of proposals into account before sending them to the House or Senate floor.

Conclusion

It is important to support CBO’s budget in order to make sure that Congress has the most accurate, reliable information when they are considering the budgetary impact of legislation. Many of the new proposals would add to CBO’s workload, so while balancing these demands, there are also proposals that would moderately reduce the burden. For example, Senators Mike Enzi (R-WY) and Sheldon Whitehouse (D-RI) the Chair and Ranking Member of the Senate Budget Committee, have cosponsored a plan that would lighten CBO’s workload by simplifying the process for producing the annual baseline.[3]And because of fiscal restraints, Congress should also embrace many of the spending reforms listed in CBO’s budget options report. These would more than finance the important work that CBO does, and go a long way toward tackling the long-term fiscal imbalance.

[1]United States Cong. House. Committee on Appropriations, Subcommittee on the Legislative Branch. “CBO’s Appropriation Request for Fiscal Year 2021,” February 12, 2020. (Testimony of Phillip L. Swagel, Director, Congressional Budget Office.)

[2]Swagel, Phillip L. “Celebrating CBO’s 45th Anniversary,” Congressional Budget Office, February 24, 2020.

[3]Brady, Demian. “Improving CBO is a Key Part of Enzi-Whitehouse Budget Process Reform,” National Taxpayers Union Foundation, December 19, 2019.