Protectionism Will Not Improve National Security

Pavel A. Yakovlev, Ph.D Associate Fellow

October 19, 2018

(pdf)

Introduction

On July 21 of 2017, U.S. President Donald Trump issued a new executive order directing the federal government to assess the nation’s manufacturing and defense industrial base with an eye toward shifting production capabilities to domestic entities. The result of that order, a report released on October 5 entitled “Assessing and Strengthening the Manufacturing and Defense Industrial Base and Supply Chain Resiliency of the United States,” makes a laudable case for improving government procurement and business practices. Yet, the central argument of the report relies on the old, worn-out rhetoric that extraordinary steps involving subsidies, protectionism, and other top-down policies will supposedly help boost America’s supposedly ailing industrial base and create new jobs, while making America more secure again. Now that the Administration’s DIB report has been released, after several delays, taxpayers should be concerned that it could pave the way for protectionist measures that will only increase the cost of defending the nation, force into service inferior or unnecessary military equipment, alienate our allies, and slow down economic growth − all for the benefit of a few entrenched, politically-connected firms. Politics as usual is a messy business, but in this case it also means higher taxes and a less secure America.

The Politics and Economics of National Security

Too often, the U.S. military-industrial-political complex is a system where political and lobbying interests are put ahead of concerns for national security or economic prosperity. As one of the leading defense economists, Keith Hartley, aptly notes:

The military-industrial-political complex comprises interest groups of the Armed Forces and national Defense Departments, producer groups of major prime contractors and politicians with an interest in defense spending in their constituencies. Such groups have vested interests in lobbying governments to influence the award of contracts and so seek to affect the competitive process in arms procurement.19

The Administration’s report could exacerbate this flawed situation, where the terms of trade are skewed for the benefit of the few and at the expense of the many. It does nothing to improve national security, but would certainly limit competition in the defense industry, raise the cost of defending the nation, slow down economic growth, and poison relations with our trading partners.

There is nothing new in this business of crony capitalism. As if the Tariff Act of 1930 did not do enough damage to the economy by plunging it deeper into the Great Depression, the U.S. government made things worse by enacting the Buy American Act in 1933, which further restricted foreign trade by requiring the federal government to buy domestically produced goods. Later came the Berry and Kissell Amendments, which further limited national security agencies to purchasing goods produced in the United States. Proponents of these amendments have argued that they serve to promote domestic employment and limit the military’s dependence on foreign suppliers during times of war or military mobilization.36 However, critics of the amendments argue that these laws undercut competition, delay weapons delivery, and result in higher defense procurement costs by violating modern manufacturing practices, which often rely on supply chains that source components and raw materials from multiple countries that in turn buy U.S. produced goods.36

The so-called “Buy American” provisions create a protected niche market for a few entrenched firms, which use their political connections to burden the American taxpayers with more expensive military equipment under the false guise of preserving domestic employment, manufacturing, and technology in “key defense industries.” And what might be those “key” industries and technologies so critical to national security that they must be protected through “Buy American” provisions? Some of the “key” domestic products that have benefited from these protectionist policies are hard to list with a straight face: Pennsylvania coal shipments to power U.S. military facilities in coal-rich Germany, anchors and mooring chains, ball and roller bearings, auxiliary equipment, sneakers, peacoats, tarpaulins, and, last but not least, American flags. These examples, far from being truly essential to national security, illustrate the real reason why the “Buy American” provisions are enacted in the first place: to protect the market share of the few existing firms from competition from abroad or from new market entrants that possess newer or better technologies, production processes, or products.

The fundamental problem with the protectionist argument is that technology changes rapidly, along with production processes. What might seem like a promising technology today can become obsolete tomorrow. The lesson here is that key industries or technologies are hard to identify but far too tempting to protect from competition for private gain at a high societal cost.

Unfortunately, politicians appear to be very effective at using the same worn-out key industries argument to justify burdening American taxpayers with overpriced, unreliable, and sometimes completely unnecessary weapon systems. Prime examples of such questionable practices include Congress forcing the U.S. Army to buy more M1 Abrams tanks it does not need just to keep the production line running at the tank manufacturing plant in Lima, Ohio, supporting an overly ambitious F-35 Joint Strike Fighter (JSF) program that suffers from an unending stream of technical difficulties and routine cost overruns, and requiring the Pentagon to field an unproven, unreliable, and overpriced Littoral Combat Ships (LCS). Perhaps the most questionable weapon system of the three is the LCS. Designed to be a jack-of-all-trades, much like the JSF, the LCS is a rather over-priced, unreliable, and unsafe master of none. In two separate reports, the Government Accountability Office (GAO) highlighted significant problems with the LCS such as crew workload and logistics, major mechanical problems, high operational costs, and questionable role of the ship in the Navy’s own global strategy.

So why was such a debacle allowed to happen in the first place? Entrenched political interests backed by an army of lobbyists from vested defense firms could explain why protectionist policies remain in place despite the fact that they tend to produce a detrimental outcome for both national security and the American taxpayers.

Public choice economists have long argued that domestic firms have an ulterior motive in lobbying the government for protection against foreign competition on the grounds that it will improve national security, job creation, technology, and the trade balance.20 Economists are generally skeptical of these claims and contend that trade restrictions represent an inferior method of achieving national security objectives. Nobel Prize-winning economist James Buchanan and other public choice economists have noted that the government tends to promote the interests of the few at the expense of the many.5 Usually, this tendency manifests itself in government policies that favor producers over consumers and in bureaucracies that are inefficiently large.20, 9, 29 In other words, the government is more likely to heed the interests of the few large defense firms rather than broad national security concerns:

It has been argued that U.S. DoD procurement practice is consistent with the actions of an industry-captured regulator, who manages the competition among defense contractors for the benefit of the entire industry. The stylized facts of source selection, contract management, and gold-plated weapons can be explained by a regulatory capture model of DoD. 39

Many defense analysts argue that the U.S. arms procurement process is designed to benefit interest groups in the defense sector.34, 39, 19 The budget-maximizing bureaucrats in DoD have every incentive to support defense contractors’ optimistic cost, time and performance estimates for new weapons programs, while simultaneously enticing the “losers” to remain in the defense industry on the grounds of maintaining “competition” and supporting the “defense industrial base.”19 The end result is a situation where efficiency and national security concerns become subservient to protecting the established national defense firms from competition.14 Hartley’s observations on the influence of interest groups on national defense policy could not be more relevant today:

These groups will try to persuade governments to allocate contracts in their favor using various arguments about support for jobs and plants in high unemployment areas, the need to support the national defense industrial base, the importance of retaining “key” technologies and the export potential of a new arms programme. Such arguments are often dominated by myth, emotion and special pleading, lacking economic analysis, critical evaluation and empirical evidence.19

The principal-agent model provides a good description of the actual weapons procurement process in the United States, where the government is the principal and the defense firms are the agents.30, 23 Because of inherent information asymmetries between the principal and the agents, the weapons procurement process suffers from adverse selection and moral hazard problems, which lower efficiency and increase the cost of weapons acquisition.8 It is not surprising then that the defense sector exhibits extraordinary cost overruns, delays in delivery, deficiencies in performance, poor reliability, waste, fraud, and general inefficiency of the process.1, 34 Two world-renowned defense economists, Sandler and Hartley, argue that the government-run military sector lacks the operational efficiency of the competitive free market.39 As a result, it functions like a command economy, which is ill-suited to keeping the costs of arms procurement down.

An even more damning description of the U.S. defense industry can be found in the Cato Institute’s defense policy analysis:

The industry has a socialist component: government laboratories, shipyards, depots, and arsenals that, in many cases, compete with private companies. Even the part of the industry that is in private hands is subjected to DoD’s industrial policy and excessive regulation. Congress, to win votes in states and districts that are home to such industrial concerns, keeps unneeded government and private facilities open through phony ‘competitions,’ creating much excess capacity in an industry that was insufficiently downsized after the Cold War.14

Economists argue that the absence of competition forces the government to rely on regulation to ensure that taxpayers receive the most efficient product for the money. But regulation can be very costly and ineffective at achieving this objective. One study found that regulatory costs accounted for 5-10 percent of total program costs and caused some delays without any discernable effect on product quality or performance.41 In fact, policymakers attempting to protect the “public interest” may actually lower efficiency by micromanaging the arms procurement process. The likely result of increased regulation and scrutiny is a commonly observed effect of reduced market entry and increased exit, which reduces competition.22

Further restrictions in competition in the highly monopolistic U.S. defense sector will only exacerbate the existing problems, afflicting the nation with excessive defense burdens and inhibiting its ability to defend itself. Mandatory domestic sourcing of weapons systems further reduces competition and amounts to “a form of protectionism through preferential purchasing which is then justified by governments pointing to the ‘substantial’ economic and industrial benefits from such procurement choices.”19 Prime examples of such policies are Article 296 of the European Community Treaty and Buy American Act, both of which seek to protect, respectively, the EU and U.S. domestic defense industries from foreign competition, ostensibly for reasons of national security.20 The end result of these anti-competitive policies is less efficient arms procurement. As Hartley notes: “Since 1945, the long-run trend has been towards a smaller number of larger firms, reflected in mergers and exists form the defense sector. As a result, EU states will only be able to maintain competition by opening up their national markets to foreign suppliers.”21

Given these concerns, it may not be surprising that the U.S. defense contractors appear to earn significantly greater profits than comparable firms in the civilian sector.25, 42 As Sandler and Hartley note, “weapons production occurs in plants which are too large relative to the output actually produced.”39 The available empirical evidence suggests that existing outputs could be produced more cheaply in smaller-scale plants, which means inefficient production is in fact occurring.37, 38 And the future of the defense industry is likely to see a further increase in industrial concentration of ever-larger firms.40, 19

The antidote to the complex problem of defense procurement consists of several policy measures: streamlining the acquisition process, improving the quality of acquisition personnel, expanding the use of commercial products, and a greater reliance on competition.15, 6, 24, 34 Conversely, preventing foreign firms from competing with domestic firms increases the cost of military hardware and limits the number of weapons a nation can afford, which does not improve national security. Recent studies show that higher military burdens impede economic growth.13, 43, 35, 11, 7 A country with lower GDP growth is less able to afford an advanced and effective military force. National security needs are better met by a more competitive and efficient defense sector with a capable, lean, and nimble defense force.

The U.S. Defense Industrial Base Grows with Trade

Despite ubiquitous references to the so-called defense industrial base (DIB), no one can define the term conclusively. Although many policymakers and scholars like to talk about the national DIB as a monolithic or homogenous entity, it is nothing of the sort.19 One of the broader definitions of DIB comes from an authoritative source, the Handbook of Defense Economics, which describes the industry as “companies which provide defense and defense related equipment to the defense industry.”10 Still, there are challenges to operationalizing and measuring DIB including: how to treat issues such as firm ownership and location, maintenance services, and a range of products sourced by the military from the civilian sector and their dual nature. The difficulties do not end there:

There are further problems in defining defense industries. The definition needs to embrace research and development activities, in-service support, mid-life updates and disposal (e.g., nuclear weapons) as well as production. Nor should the focus be solely on prime contractors: there is an extensive and complex network of suppliers to the primes.19

The challenges in defining DIB are even greater today because the defense sector is increasingly buying off-the-shelf civilian components and outsourcing many of its functions to the civilian sector. For example, civilian aircraft and merchant shipping industries provide crucial re-supply capabilities for the armed forces.21 The scope of what is defense related could be further extended to include telecommunications, food, and clothing industries that do play an important role in supporting our troops. And the list of industries relevant to national security could be expanded even further. To exclude the civilian sector from the definition would severely underestimate the defense industrial capability of a country. A more encompassing definition of the goods and services relevant to national security would have to include not only the weapons themselves, but also the clothing, food, and countless other resources needed to maintain a viable defense force and the civilian population that feeds it.

Thus, even a narrow definition of DIB should include at least the entire industrial and manufacturing sector, with the broadest definition possibly using the entire GDP as a proxy for a country’s potential defense output base. During World War II, much of the U.S. private sector was dedicated to the needs of the defense sector. Many civilian factories and their products were repurposed for military needs. In essence, the entire U.S. private sector became the defense industrial base during the war: “Carmakers built everything: tanks, airplanes, radar units, field kitchens, amphibious vehicles, jeeps, bombsights, and bullets. Billions and billions of bullets. Detroit, with 2 percent of the population, made 10 percent of the tools for war.” It would not be a far stretch to say that it was the unparalleled productivity of the U.S. private sector that helped win the war.

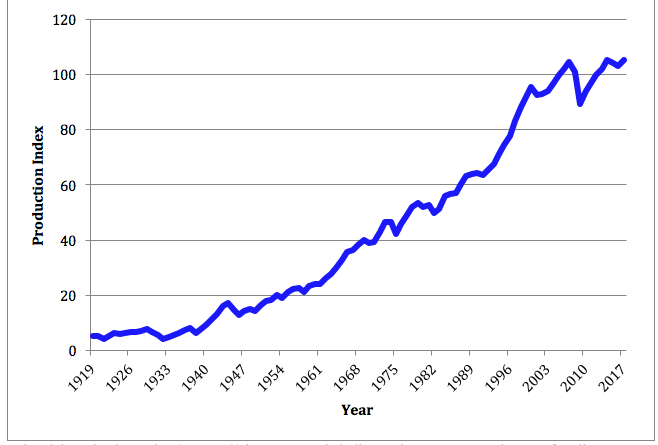

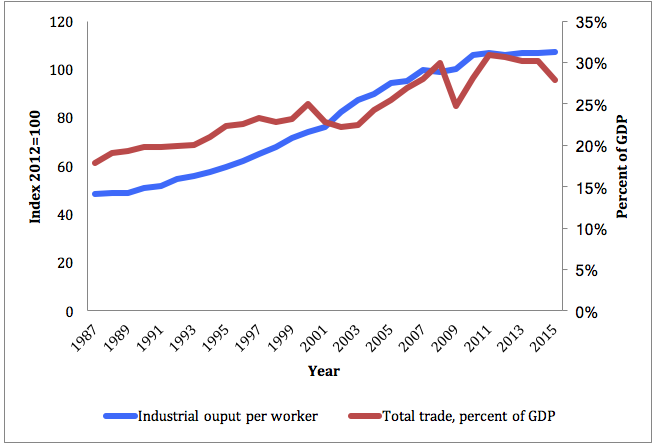

Despite the Trump Administration’s repeated references to an ailing American industrial base, it is still alive and doing very well. Judging by the industrial production and manufacturing figures, the U.S. industrial base is as large as ever and still growing. After a severe economic downturn during the recent Great Recession, the level of industrial and manufacturing activity has fully rebounded and now the U.S. economy is generating more industrial output than ever before, as shown in Figure 1.

Figure 1. The U.S. Industrial Base Shows Tremendous Growth

Industrial Production Index (INDPRO) is an economic indicator that measures real output for all manufacturing, mining, electric and gas facilities located in the United States (excluding those in U.S. territories).

Source: Board of Governors of the Federal Reserve System (U.S.), Retrieved from FRED, Federal Reserve Bank of St. Louis March 10, 2018.

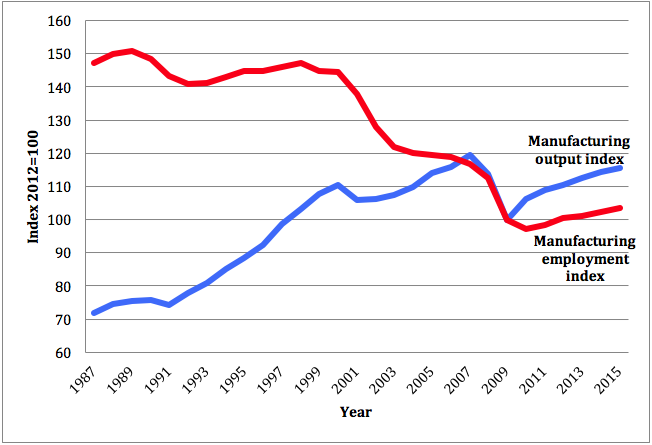

According to recent data compiled by the Federal Reserve, U.S. manufacturing output, a subset of industrial production, has also generally risen over time despite the occasional short-lived declines during recessions. While U.S. manufacturing output has been growing, the data presented in Figure 2 also shows that total employment in the manufacturing sector has been declining over time.

These broad trends of simultaneously rising manufacturing output and declining manufacturing employment point to improvements in industrial productivity. This is good news for the U.S. economy because rising productivity allows us to produce more stuff with fewer workers, allowing surplus labor to be employed productively in other U.S. industries. While there might be short-term costs in finding productive employment for the displaced workers, the long-term gains in economic performance are well worth it. The economic gains could be used to help the displaced workers acquire new skills and education in order to make them more productive and employable in other industries.

Figure 2. U.S. Manufacturing Output Rises as Employment Declines

Source: U.S. Bureau of Labor Statistics. Accessed on 03/10/2018.

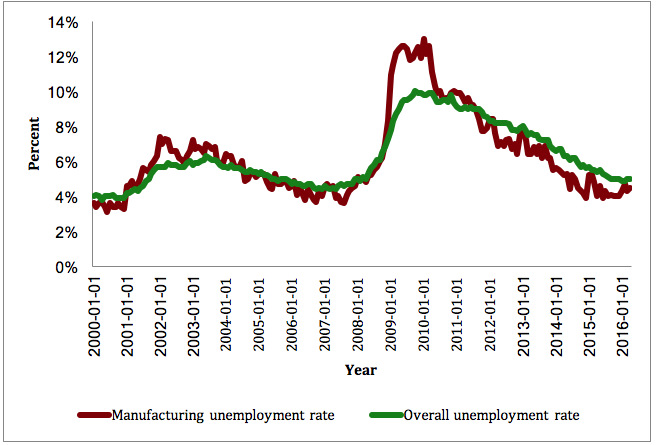

Fears of rising unemployment in the U.S. industrial and manufacturing sector are exaggerated. With the exception of recessions that historically do have a disproportionately negative effect on unemployment, the manufacturing sector typically enjoys lower unemployment than the rest of the economy. Of course, more work needs to be done to ensure that the unemployed in all sectors of the U.S. economy can quickly find new, productive jobs. One of the key solutions to the unemployment problem is a free and flexible labor market that can easily absorb any surplus labor. The U.S. labor market has generally been very good at absorbing the surplus workers freed up in the manufacturing sector largely due to automation rather than foreign trade.

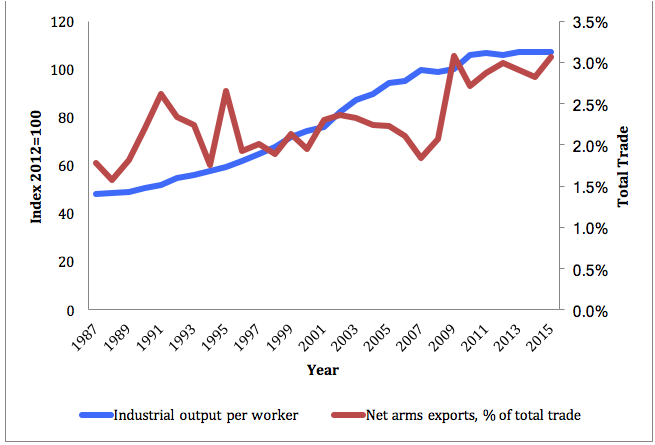

This technology-driven improvement in manufacturing productivity can be clearly observed in Figure 4. Higher productivity in the industrial sector not only improves the average material well-being or income in the nation but also makes the United States a leader in several manufacturing industries, including weapons systems. Figure 4 also shows that U.S. net arms exports tend to increase with improvements in manufacturing productivity as evidenced by a statistically significant positive correlation between the two variables.

Figure 3. The U.S. Manufacturing Sector Has a Lower Unemployment Rate

Source: U.S. Bureau of Labor Statistics. Accessed on 03/10/2018.

Not coincidently, the United States is the leading and largest net exporter of advanced weapons systems in the world. A largely free, productive, and massive industrial base in the United States attracts some of the best technologies and brightest minds from all over the world, resulting in some of the best products in general and in defense sector in particular.

A critical part of this success story hinges on free trade: the ability of U.S. manufacturers to acquire the best resources, technologies, and talent in the world and export the resulting world-class products freely to other nations. Economist Ann Markusen argues that nowadays it is people, ideas, and technologies rather than weapons that move across national borders.26

In the modern integrated world, there is no longer a purely American-made car, and we are generally better off for that. Car parts outsourced to other countries where they can be built cheaper, better, or faster allow American workers to concentrate on the other tasks that they do best. For the same reasons, trade in arms-related components is replacing trade in complete weapons systems.2, 27 States are no longer self-sufficient in weapons production as trade is becoming an unavoidable facet of modern arms industries: “Virtually no regular or irregular armed force is equipped with a comprehensive range of arms that is self-produced in its entirety. Instead, the rule is that self-produced weapons are complemented by weapons imported from elsewhere.”3

Figure 4. U.S. Manufacturing Productivity and Net Arms Exports Grow Together

Industrial output data source: U.S. Bureau of Labor Statistics, Manufacturing Sector: Real Output [OUTMS], retrieved from FRED, Federal Reserve Bank of St. Louis, March 10, 2018.

Arms exports data source: WMEAT, Department of State. Accessed on 03/10/2018.

Since the end of the Cold War, completely indigenous development and production of major weapons systems has become unaffordable to virtually every country except the U.S.12 The arms industry has globalized and re-organized itself to generate cost savings through component specialization, wider use of off-the-shelf civilian technologies and products, niche market targeting, and supply-chain integration.

Take the American F-16 fighter jet, for example. It is the most popular fighter jet in the world. Built using a mixture of high-tech components from Germany, Israel, Japan, and Russia as well as less-costly, commercially available components from Brazil, Poland, South Africa, and Spain, this plane is a great value for the money thanks to free trade.26 International collaborations like the F-16 project exemplify the benefits of free arms trade that enable the United States and its allies to maintain national security without breaking the bank.

Free arms trade between members of a military alliance, like NATO, could lead to gains from specialization and trade based on comparative advantage, necessitating the abolition of tariffs, subsidies, and preferential purchases by member states.19 A larger arms market could also deliver gains from scale, learning, and scope economies. The cost savings from competitive free markets could range from 10 to 25 percent, while scale and learning economies could contribute between 15 and 25 percent in additional cost savings over the status quo situation.18 These sizeable cost savings would decrease the defense cost-burden, boost economic growth, improve national security, and lead to a more integrated alliance. Such an offer is hard to refuse.

As can be seen in Figure 5, a very strong positive correlation exists between U.S. manufacturing productivity and international trade. This positive and statistically significant correlation implies that not only does the overall U.S. economy benefit from freer international trade but also the U.S. industrial base and, by extension, national security. This fact is especially noteworthy considering that the United States runs a persistent trade deficit with other nations (i.e., imports more than exports).

Figure 5. U.S. Manufacturing Productivity and Trade Grow Together

Industrial output data source: U.S. Bureau of Labor Statistics, Manufacturing Sector: Real Output [OUTMS], retrieved from FRED, Federal Reserve Bank of St. Louis, March 10, 2018.

Trade data source: World Bank. Accessed on 03/10/2018.

Attempts to restrict international trade through policies like tariffs on aluminum and steel will only make the U.S. industrial base less productive and the economy less prosperous. In turn, a less productive and prosperous nation is less able to feed and defend itself.

Since the publication of The Wealth of Nations in 1776 by the Scottish economist and philosopher Adam Smith, economists have confirmed repeatedly, both theoretically and empirically, his treatise that free trade makes nations more prosperous. As the Nobel prize-winning economist Paul Krugman once put it: “If there were an Economist’s Creed, it would surely contain the affirmations ‘I understand the Principle of Comparative Advantage’ and ‘I advocate Free Trade’.” A survey conducted by the University of Chicago has shown that 98% of economic experts agree that the U.S. citizens have benefited from the North American Free Trade Agreement (NAFTA). Moreover, 100% of the same economists agree that trade with China makes Americans better off. In May of 2018, more than 1,100 economists – including fifteen winners of the Nobel Prize in Economics and chairs of the Council of Economic Advisors for the past three presidential administrations – signed an open letter (organized by the nonpartisan National Taxpayers Union) to President Trump and the U.S. Congress reaffirming the dangers of protectionist policies, just as 1,028 economists did decades before in opposition to the notorious Smoot-Hawley Tariff Act. The original letter warned, “A tariff war does not furnish good soil for the growth of world peace.”

One of the reasons economists overwhelmingly support free trade is because it has a positive effect on both economic development and technological progress. One can outsource a task to either a machine or another person who can do it better, cheaper, or faster. The result is an increase in overall prosperity, regardless if it comes from a job being done more efficiently by a machine or by a worker in another country. When countries trade freely, markets naturally replace unproductive jobs with more productive ones through the process termed “creative destruction” by Austrian-born, Harvard University economist Joseph Schumpeter.

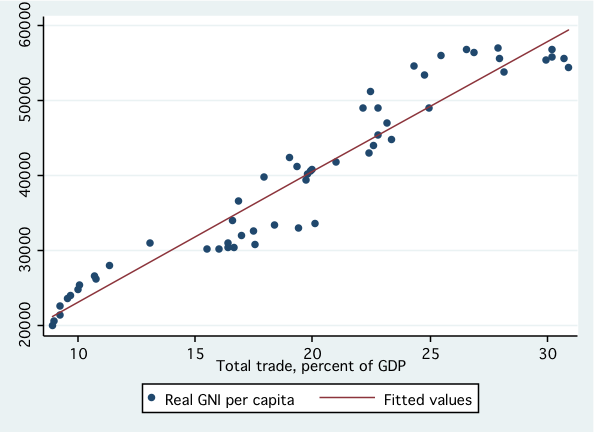

The evidence that trade promotes prosperity is overwhelming. As can be seen in Figure 6, there is a striking positive and statistically significant correlation between U.S. real Gross National Income (GNI) per capita and foreign trade as a share of GDP. This should not be surprising to anyone who has taken even a basic economics course. Trade and technological progress are similar in their effects on prosperity: both move labor from less productive to more productive jobs, increasing average incomes across the board. While it is true that technological progress and international trade can make some jobs obsolete, they simultaneously create new jobs that are often more productive than the jobs they replace. The result is a more prosperous society, as confirmed in Figure 6.

This is not to say that “creative destruction” is painless. Some people will lose their jobs in the short term and will have to move or acquire new skills in order to find new jobs. There is a lot that could be done to help the displaced workers find productive employment, but restricting international trade is not the solution.

>Figure 6. U.S. Per Capita Income Rises with Trade

Notes: plot based on annual observations during the 1960-2016 period.

Data source: World Bank. Accessed on 03/10/2018.

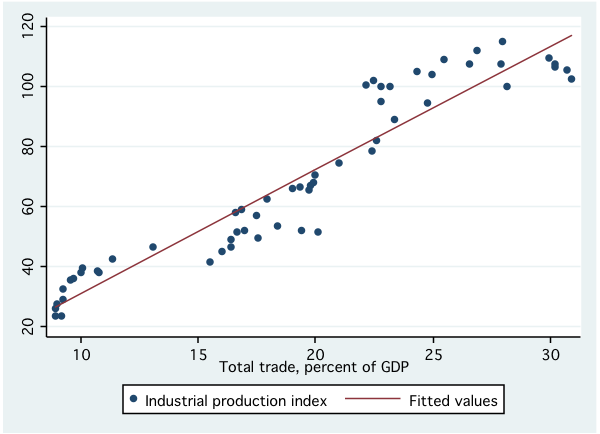

The contribution of foreign trade to U.S. industrial output is even more astounding. As can be seen in Figure 7, despite significant increases in foreign trade and, by extension U.S. trade deficit over time, the U.S. industrial output only gets larger with trade.

The evidence presented thus far implies that technological progress and international trade go hand in hand with rising industrial and manufacturing output in the United States. This can only be good news for the supporters of a stronger DIB. Figures 6 and 7 clearly demonstrate that foreign trade improves both the U.S. defense industrial base and national security by increasing industrial output and GDP.

Proponents of domestic arms production often cite numerous military and economic benefits that would arise from lesser reliance on foreign suppliers. The supposed military benefits usually entail independence, security, and proximity of supply lines, especially during a conflict. The government can also exercise greater control over domestically-designed and -built weapons systems, ensuring their security and operability during war. The purported economic benefits include more, better paying high-skill jobs, technology spinoffs, and possible reductions in trade deficit due to greater net arms exports.

Figure 7. U.S. Industrial Base Grows with Trade

Notes: Plot based on annual observations during the 1960-2016 period.

Industrial production data source: Board of Governors of the Federal Reserve System (US). Accessed on 03/10/2018.

Trade data source: World Bank. Accessed on 03/10/2018.

But this comes at a cost, which can easily outweigh the benefits. Many defense economists are skeptical of the aforementioned “benefits” and are very cognizant of the high opportunity costs associated with artificially induced domestic production.40 Often, better alternatives to protectionist policies are available for achieving the stated benefits. For example, supply security can be achieved more efficiently by purchasing needed strategic materials and stockpiling them at home.40 The claim that domestic arms production may stimulate the domestic economy and increase employment has not been backed by credible theoretical or empirical evidence.4, 40

Import Restrictions Do Not Improve National Security

Importing raw materials and other inputs from abroad allows American workers to concentrate on producing high tech weaponry and technology that may not be available elsewhere. Like technological progress, trade frees up labor for more productive uses, such as the development and manufacturing of high-tech weaponry, which the U.S. does so well.

Proponents of domestic arms sourcing argue that less reliance on foreign imports improves national security by lowering the risk of supply interruptions. This is often not true.

Concentrating the production of even “key” technologies or military components in the hands of just a few or even one domestic firm elevates the risk that an enemy’s precision strike or act of sabotage will destroy it. In other words, putting all of the metaphorical eggs in one basket (i.e., one domestic firm) is a sure way to encourage monopolistic behavior and increase the risk of losing a key defense supplier if something goes wrong. The timeless economic lesson that diversification reduces risk could not be more relevant for national security. In fact, additional security benefits may arise from relying on foreign shipments: a nation that goes to war with the United States and threatens its supply chain may also find itself in a war with U.S. trading partners.

U.S. sensitivity to attacks on its shipping interests highlights the positive role that trade has played in boosting the U.S. domestic defense output. Foreign imports of raw materials from abroad were critical to the U.S. WWII effort as revealed in a declassified CIA report:

In the first years of the war sinking of Allied shipping exceeded new construction and United States imports of raw materials from Africa and the Western Hemisphere were severely threatened. The United States was forced to uneconomical expansion of domestic sources of raw materials.

What this means is that any U.S. restriction of its imports, be they aluminum or steel, would undermine our ability to maintain a vibrant economy and strong defense. Arguing against trade restrictions, American philosopher Henry George acutely observed that we “do to ourselves in time of peace what enemies seek to do to us in time of war.” In other words, import restrictions are equivalent to self-imposed sanctions, which can only undermine the national DIB.

Furthermore, the risk of major foreign supply interruptions for the U.S. is virtually zero. The concept of Mutually Assured Destruction assures that there would be no winners in a war between major nuclear-armed superpowers, making a full-scale war between the U.S. and other major powers highly unlikely. If a nuclear war does break out, then supply-chain interruptions will be the least of our worries. The more likely scenario for the U.S. is a small intensity conflict or a proxy war, which would not result in such severe interruptions of international trade that could threaten national security.

Free Trade Promotes Peace

There is a very well-documented propensity of free markets to promote peace.31-33, 17, 28, 44 Known as the capitalist peace theory, the argument postulates that economically interdependent countries have much to lose in terms of forgone trade from fighting with each other. Cool commercial interests are more likely to prevail over hot heads with itchy trigger fingers. This leaves not only U.S. trading partners, but also the U.S. itself, with little incentive to initiate hostilities against each other. To put it bluntly, wars are bad for (most) business.

Much of the time hostilities break out as a result of trade restrictions and embargoes. This is one of the grave dangers of trade wars: they may escalate into real wars. In a personal letter to Eleanor Roosevelt, who was growing concerned about the consequences of the U.S. oil embargo against Japan, President Franklin Delano Roosevelt once wrote:

The real answer which you cannot use is that if we forbid oil shipments to Japan, Japan will increase her purchases of Mexican oil and furthermore, may be driven by actual necessity to a descent on the Dutch East Indies. At this writing, we all regard such action on our part as an encouragement to the spread of war in the Far East.

A popular expression “if goods do not cross borders, soldiers will” is a rather accurate description of the true causes of many wars. Often mistakenly attributed to Frédéric Bastiat, it can be traced back to American economist Otto Mallery, who believed in free trade as the antidote to economic nationalism and power rivalries.

Furthermore, free arms trade between allies or alliances are a public good: the forces of one country have spillover benefits for other countries by increasing joint alliance capability and inter-operability.16 Attempts to restrict trade are likely to poison relations with our allies and turn trading partners into enemies. It is hard to see how this will improve national security.

Conclusion

President Trump’s 2017 executive order and the subsequent report it generated carry with them a serious risk of crony capitalism, where the government picks winners and losers in the private sector for political gain. Protectionist policies such as “Buy American” provisions are often touted as being good for America’s industrial base and national security. In actuality, these laws protect powerful, entrenched businesses from competition, foreign or domestic, often forcing the U.S. military to source inferior or overpriced products from domestic firms that should not be considered “key defense industries.” This study reviews the evidence and concludes that protecting the defense industrial base from foreign competition will only increase the cost of defending the nation, force into service inferior or unnecessary military equipment, alienate U.S. allies, and slow down the nation’s economic growth. Drawing the wrong conclusions (and implementing the wrong recommendations) from the Administration’s report on the defense industrial base would achieve little if anything in terms of national security but would increase costs at taxpayers’ expense.

About the Author:

Pavel A. Yakovlev, Ph.D. is an Associate Professor of Economics at Duquesne University. He typically teaches microeconomics, macroeconomics, and public economics courses. Yakovlev joined Duquesne University in 2007, after earning his doctorate degree from West Virginia University (WVU) in 2006 and completing a year of post-doctoral research in the Bureau of Business and Economic Research at WVU. He also has an M.A. in economics from WVU and a B.S. in economics and business administration from Shepherd University. Pavel is a recipient of the WVU Foundation Distinguished Doctoral Fellowship in Social Sciences. Pavel was born in Siberia and moved to the U.S. in pursuit of higher education.

National Taxpayers Union Foundation (NTUF)

Founded in 1978, NTUF is a 501(c)(3) nonprofit, nonpartisan research and educational organization that shows Americans how taxes, government spending, and regulations affect them.

Resources

1. Austin, R., and Larkey, P. “The Unintended Consequences of Micromanagement: The Case of Procuring Mission Critical Computer Resources.” Policy Sciences, Vol. 25 no.1 (1992): 3-28. Retrieved from https://www.jstor.org/stable/4532241.

2. Bitzinger, R. A. “The globalization of the arms industry: The next proliferation challenge.” International Security, Vol. 19 no. 2 (1994): 170-198.

3. Brauer, J. “Arms Industries, Arms Trade, and Developing Countries.” Handbook of defense economics, Vol. 2 (2007): 973-1015.

4. Brauer, J., and Dunne, P. Arms trade and economic development: theory, policy and cases in arms trade offsets. Routledge. (2004).

5. Buchanan, J. M. Liberty, market and state: Political economy in the 1980s. Wheatsheaf Books. (1986).

6. Burnett, W. B., and Kovacic, W. E. “Reform of United States weapons acquisition policy: competition, teaming agreements, and dual-sourcing.” Yale J. on Reg., Vol. 6 (1989): 249.

7. Chang, H. C., Huang, B. N., and Yang, C. W. “Military expenditure and economic growth across different groups: A dynamic panel Granger-causality approach.” Economic Modelling, Vol. 28 no. 6 (2011): 2416-2423.

8. Cummins, J. M. “Incentive contracting for national defense: a problem of optimal risk sharing.” The Bell Journal of Economics, (1977): 168-185.

9. Dunleavy, P. “Bureaucracy, democracy and public choice.” Hemel Hempstead: Harvester Wheatsheaf, Hemel Hempstead. (1991).

10. Dunne, J. P. “The Defense Industrial Base.” Handbook of Defense Economics, Vol. 1 (1995): 399-430.

11. Dunne, J. P. and Nikolaidou, E. “Defence Spending and Economic Growth in the EU15.” Defence and Peace Economics, Vol. 23 no. 6 (2012): 537-548.

12. Dunne, J. P., and Surry, E. “Arms production.” SIPRI Yearbook, (2006): 419-427.

13. Dunne, J. P., Smith, R. and Willenbockel, D. Models of military expenditure and growth: A critical review. Defense and Peace Economics, Vol. 16 no. 6 (2005): 449–461.

14. Eland, I. “Reforming a defense industry rife with socialism, industrial policy, and excessive regulation.” Cato Institute. (2001).

15. Gansler, J. S. “Affording defense: the changes that are needed.” National Contract Management Journal, Vol. 23 no. 1 (1989): 1.

16. Garcia-Alonso, M. D., & Levine, P. “Arms Trade and Arms Races: A Strategic Analysis.” Handbook of Defense Economics, Vol. 2 (2007): 941-971.

17. Gartzke, E. “The capitalist peace.” American Journal of Political Science, Vol. 5 no. 1 (2007):166-191.

18. Hartley, K. “Defence Industrial Policy in a Military Alliance.” Journal of Peace Research, Vol. 43 no. 4 (2006): 473-489.

19. Hartley, K. “The Arms Industry, Procurement and Industrial Policies.” Handbook of Defense Economics, Vol. 2 (2007): 1139-1176.

20. Hartley, K. The Economics of Defence Policy: A New Perspective. Routledge. (2012).

21. Hartley, K., & Hooper, N. Study of the Value of the Defence Industry to the UK Economy: A Statistical Analysis for DTI, MoD, SBAC and DMA. Centre for Defence Economics, University of York. (1995).

22. Kovacic, W. E. “Regulatory Controls as Barriers to Entry in Government Procurement.” Policy Sciences, Vol. 25 no.1 (1992): 29-42.

23. Laffont, J. J., & Tirole, J. A Theory of Incentives in Procurement and Regulation. MIT Press. (1993).

24. Leitzel, J. “Competition in Procurement.” Policy Sciences, Vol. 25 no. 1 (1992): 43-56.

25. Lichtenberg, F. R. “A Perspective on Accounting for Defense Contracts.” The Accounting Review, Vol. 67 No. 4 (1992): 741-752.

26. Markusen, A. “The rise of world weapons.” Foreign Policy, (1999): 40-51.

27. Markusen, A. “Arms trade as illiberal trade.” Arms Trade and Economic Development: Theory, Policy, and Cases in Arms Trade Offsets. Routledge. (2004).

28. Martin, P., Mayer, T., and Thoenig, M. “Make Trade Not War?.” The Review of Economic Studies, Vol. 75 no. 3 (2008): 865-900.

29. Mayer, K. R. The Political Economy of Defense Contracting. Yale University Press. (1991).

30. McAfee, R. P., and McMillan, J. “Bidding for Contracts: A Principal-Agent Analysis.” The RAND Journal of Economics, (1986): 326-338.

31. McDonald, P. J. “The Purse Strings of Peace.” American Journal of Political Science, Vol. 51 no. 3 (2007): 569-582.

32. McDonald, P. J. The Invisible Hand of Peace: Capitalism, the War Machine, and International Relations Theory. Cambridge: Cambridge University Press. (2009).

33. McDonald, P. J. “Capitalism, Commitment, and Peace.” International Interactions, Vol. 36 no. 2 (2010):146-168.

34. McNaugher, T. L. Defense Management Reform: For Better or for Worse? Brookings Institution. (1990).

35. Mylonidis, N. “Revisiting the Nexus Between Military Spending and Growth in the European Union.” Defence and Peace Economics, Vol. 19 no. 4 (2008): 265-272.

36. Platzer, M. D. “Buying American: Protecting U.S. Manufacturing Through the Berry and Kissell Amendments.” Congressional Research Service, R44850. (2017).

37. Rogerson, W. P. “Incentives, The Budgetary process, and Inefficiently Low Production Rates in Defence Procurement.” Defence and Peace Economics, Vol. 3 no. 1 (1991):1-18.

38. Rogerson, W. P. “Excess Capacity in Weapons Production: An Empirical Analysis.” Defence and Peace Economics, Vol. 2 no. 3 (1991): 235-249.

39. Sandler, T., and Hartley, K. The Economics of Defense. Cambridge University Press. (1995).

40. Sandler, T., and Hartley, K. (Eds.). Handbook of Defense Economics: Defense in a Globalized World. Elsevier. (2007).

41. Smith, G. K., Drezner, J. A., Martel, W. C., Milanese, J. J., Mooz, W. E., and River, E. C. A Preliminary Perspective on Regulatory Activities and Effects in Weapons Acquisition. RAND Corporation, R-3578-ACQ. (1988).

42. Trevino, R., and Higgs, R. “Profits of US Defense Contractors.” Defence and Peace Economics, Vol. 3 no. 3 (1992): 211-218.

43. Yakovlev, P. “Arms Trade, Military Spending, and Economic Growth.” Defence and Peace Economics, Vol. 18 no. 4 (2007): 317-338.

44. Yakovlev, P. “Saving Lives In Armed Conflicts: What Factors Matter?.” The Economics of Peace and Security Journal, Vol. 3 no. 2 (2008).