(pdf)

Politicians love to complain about U.S. trade deficits, but the trade deficit is a statistic that doesn’t begin to tell the complete story about international trade and investment.

In 2018, the United States had a deficit of $629 billion based on trade in goods and services.[1]This means that Americans spent $629 billion more on foreign goods and services than we sold to people in other countries.

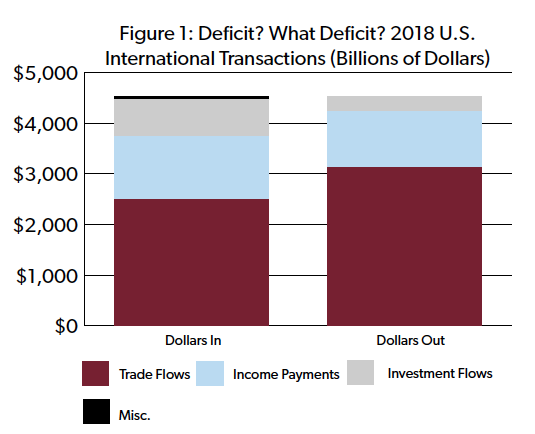

However, this number represents just a fraction of U.S. international economic transactions. The trade deficit statistic does not take into account many other transactions, including beneficial new foreign investment in U.S. factories and the stock market. When all these transactions are accounted for, the United States does not have a deficit with other countries. In fact, in 2018, Americans received $4.5 trillion from abroad, and we sent $4.5 trillion to other countries. This is just one reason the term “trade deficit” is misleading.

Trade Deficits Are Not Deficits

In 1776, economist Adam Smith observed:

Nothing, however, can be more absurd than this whole doctrine of the balance of trade, upon which, not only these restraints, but almost all the other regulations of commerce are founded. When two places trade with one another, this doctrine supposes that, if the balance be even, neither of them either loses or gains; but if it leans in any degree to one side, that one of them loses and the other gains in proportion to its declension from the exact equilibrium. Both suppositions are false.[2]

Part of the problem is that the phrase “trade deficit” when taken at face value seems to mean Americans owe money to foreigners.

But all it really means is Americans bought more from people in other countries than we sold to them, and that isn’t a bad thing. As economists Daniel B. Klein, Donald J. Boudreaux, Mark J. Perry and others have pointed out, there is no reason that what is traditionally called a trade deficit couldn’t instead be called a trade surplus, since we got more stuff from abroad than vice-versa.[3]

And historically, U.S. economic growth has coincided with trade deficits. In 1988, President Ronald Reagan explained:

During the first 100 years of our nation's history, while we were developing from an agricultural colony to the industrial leader of the world, the United States ran a trade deficit. And now, as we're leading a global movement from the industrial age to the information age, we continue to attract investment from around the world. Now, some people call this debt. By that way of thinking, every time a company sold stock it would be a sign of weakness, and it would be much better to be a company nobody wanted to invest in rather than one everybody wanted to invest in…. Historically, fast-growing economies often run deficits in the trade of goods and services, experiencing net capital investment from abroad.[4]

Certainly, it is not the case that our 2018 trade deficit of $629 billion means Americans owe foreigners $629 billion, or $100 billion, or a nickel. It is true that if foreign entities use some of those dollars to buy Treasury securities, American debt to them will increase. But this debt increase is due to federal overspending and not a result of the trade deficit.

Reporting only the $629 billion trade deficit in goods and services and not other transactions implies that Americans are losing because we have a “deficit” that drains money from the United States. This is incorrect because it ignores other beneficial transactions, including our country’s $425 billion foreign investment surplus and our $267 billion surplus in income generated from international investment. These capital inflows are, in fact, a mirror image of the trade deficit. For every item that Americans purchase from another country, that country then has dollars to spend or send to the U.S. market.

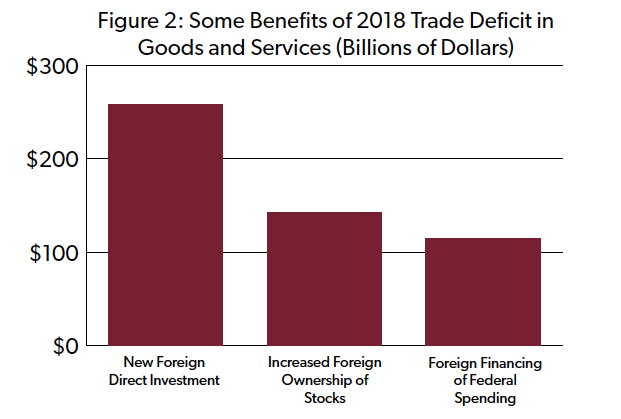

The trade deficit also allows for three other worthwhile things to happen. It encourages greater foreign direct investment, greater financing of our federal deficit and debt, and increased ownership of stock.

Trade Deficit Benefit 1: Massive Foreign Investment in U.S.-Based Factories

In 2018, the United States received $258 billion in new foreign direct investment in our economy. Foreign direct investment provides jobs to 8.1 million Americans, including 2.6 million manufacturing workers, representing nearly 20 percent of all manufacturing employment.[5]According to the Organization for International Investment, international employers account for 16 percent of all research and development performed by U.S companies.[6]

If that $258 billion in 2018 investment had been used to buy U.S. exports instead of to invest in U.S. factories, the trade deficit could have been slashed by more than 40 percent. But that doesn’t mean Americans would have been better off.

The Trump administration continues to pursue policies designed to discourage foreign direct investment. In 2019, President Trump suggested that foreign investment in automobile manufacturing is a national security threat because it displaces “American-owned” production.[7]A response from Toyota summed up the implications of this misguided belief: “Today’s proclamation sends a message to Toyota that our investments are not welcomed, and the contributions from each of our employees across America are not valued.”[8]

More recently, President Trump and others in his administration have threatened to impose new tariffs on cars and auto parts from Europe. These tariffs would threaten the jobs of thousands of Americans who work for companies like BMW and Mercedes-Benz.

Since January 2009, real U.S. motor vehicle output increased from $228 billion to $595 billion, driven in part by expanded U.S.-based production by companies based outside the United States.[9]New tariffs would threaten to interrupt this growth in U.S. auto manufacturing. International trade and investment strengthen U.S. economic security, and subject to legitimate national security threats, the government should not attempt to pick winners and losers between Americans who assemble cars for Ford and those who work for Volkswagen.

Trade Deficit Benefit 2: Preventing $900 per Household Tax Hike

In 2018, $115 billion in federal government spending was financed by foreign purchases of treasury securities, allowing the federal government to spend more than it collects in federal revenue.[10]If those dollars had instead been used to purchase U.S. exports, the trade deficit would have been slashed. However, the federal government would have to replace the $115 billion in lost income. One option would have been to impose a $115 billion tax hike, costing the average American household about $900.[11]

According to the Congressional Research Service, “The burden of a foreign-financed [budget] deficit is borne by exporters and import-competing businesses, because borrowing from abroad necessitates a trade deficit.... Economically, the only way government could reduce its reliance on foreign borrowing is by raising the U.S. saving rate, which could be done most directly by reducing budget deficits. ”[12]This would mean either tax increases or spending cuts.

It is concerning that the federal government spends more than it collects in tax revenue. For those who are worriedabout the fact that about 39 percent of federal debt is owed to foreign entities, including 6.4 percent to China, the solution is to reduce or eliminate federal borrowing.[13]

Trade Deficit Benefit 3: Boosting Americans’ Retirement Funds

In 2018, foreign investors purchased $142 billion in U.S. equities and investment fund shares.[14]This investment represents an increase in the U.S. trade deficit of as much as $142 billion because it is money that otherwise could have been spent on American-made exports. .

Foreign investment in publiclytraded companies has increased substantially in recent years. In 2000, foreign ownership of long-term equities was equivalent to 11.3 percent of the value of all domestic stocks. In 2018, foreign ownership was up to 26.7 percent.[15]

Foreign ownership has allowed companies to invest and expand, while also pushing the stock market to record highs and helping secure the retirement of millions of Americans who rely on pensions and investment income.

Unfortunately that’s not the view of Peter Navarro, Assistant to the President and Director of the Office of Trade and Manufacturing Policy, who calls this beneficial investment “conquest by purchase.”[16]U.S. policy can and should continue to support our founding values of freedom of speech, free enterprise, and free expression without unnecessarily restricting foreign investment that bolsters the financial fortunes of Americans.

Conclusion

The bottom line is that international trade statistics aggregate millions of mutually beneficial transactions. Americans benefit when someone purchases a U.S. export (reducing the trade deficit) and when they invest in the U.S. economy (increasing the trade deficit.) President Trump and Congress should stay out of the way of these mutually beneficial exchanges.

[1]U.S. Bureau of Economic Analysis (2020). “U.S. International Transactions.” Retrieved from: https://apps.bea.gov/iTable/iTable.cfm?ReqID=62&step=1. (Accessed 1/28/2020).

[2]Smith, Adam. An Inquiry into the Nature and Causes of the Wealth of Nations, 1776. Retrieved from: https://www.econlib.org/library/Smith/smWN.html?chapter_num=28#book-reader.

[3]Klein, Daniel B. and Boudreaux, Donald J. “The ‘Trade Deficit’: Defective Language, Deficient Thinking,” The Library of Economics and Liberty, June 5, 2017. Retrieved from: https://www.econlib.org/library/Columns/y2017/KleinBoudreauxtradedeficits.html#.WTVaJ8BBHjI.facebook; and Perry, Mark J. “Trade Deficit = Merchandise Surplus?” American Enterprise Institute, December 25, 2006. Retrieved from: https://www.aei.org/carpe-diem/trade-deficit-merchandise-surplus/.

[4]Reagan, Ronald. “Remarks and a Question-and-Answer Session With Members of the City Club of Cleveland, Ohio,” January 11, 1988. Retrieved from: https://www.presidency.ucsb.edu/documents/remarks-and-question-and-answer-session-with-members-the-city-club-cleveland-ohio.

[5]U.S. Bureau of Economic Analysis (2020). “Data on activities of multinational enterprises.”Retrieved from: https://apps.bea.gov/iTable/index_MNC.cfm(Accessed 1/28/2020); and “Total Full-Time and Part-Time Employment by NAICS Industry.” Retrieved from: https://apps.bea.gov/iTable/index_regional.cfm(Accessed 1/28/2020).

[6]“Fueling American Innovation,” Organization for International Investment. Retrieved from: https://ofii.org/our-focus/fueling-american-innovation. (Accessed 1/28/2020).

[7]“Adjusting Imports of Automobiles and Automobile Parts Into the United States,” The White House, May 17, 2019. Retrieved from: https://www.whitehouse.gov/presidential-actions/adjusting-imports-automobiles-automobile-parts-united-states/.

[8]“Toyota’s Statement Re: WH Proclamation on 232,” May 17, 2019. Retrieved rom: https://pressroom.toyota.com/toyotas-statement-re-wh-proclamation-on-232/.

[9]U.S. Bureau of Economic Analysis (2020). “Real gross domestic product: Motor vehicle output, Billions of Chained 2012 Dollars, Quarterly, Seasonally Adjusted Annual Rate.” Retrieved from: https://fred.stlouisfed.org/series/A953RX1Q020SBEA.

[10]U.S. Bureau of Economic Analysis (2020). “U.S. International Financial Transactions for Portfolio Investment” Retrieved from: https://apps.bea.gov/iTable/index_ita.cfm(Accessed 1/28/2020).

[11]Author’s calculation based on data from the Census Bureau via Federal Reserve Bank of St. Louis, “Total Households,” retrieved from: https://fred.stlouisfed.org/series/TTLHH.

[12]Labonte, Marc, and Nagel, Jared C. “Foreign Holdings of Federal Debt,” Congressional Research Service, Updated July 26, 2019. Retrieved from: https://fas.org/sgp/crs/misc/RS22331.pdf.

[13]U.S. Department of the Treasury. “Major Foreign Holders of Treasury Securities,” https://ticdata.treasury.gov/Publish/mfh.txt, and “Monthly Statement of the Public Debt of the United States,” November 30, 2019. https://www.treasurydirect.gov/govt/reports/pd/mspd/2019/opds112019.pdf.

[14]U.S. Bureau of Economic Analysis, “U.S. International Financial Transactions for Portfolio Investment, https://apps.bea.gov/iTable/iTable.cfm?ReqID=62&step=1.”

[15]World Bank (2020). “Market capitalization of listed domestic companies (current US$),” Retrieved from: https://data.worldbank.org/indicator/CM.MKT.LCAP.CD(Accessed 1/28/2020); and U.S. Department of the Treasury, “Foreign holdings of U.S. securities,” Retrieved from: https://ticdata.treasury.gov/Publish/shlhistdat.html(Accessed 1/28/2020).

[16]Hayward, John. “Peter Navarro on ‘Conquest by Purchase’: Trade Deficits Are ‘Turning Over Our Country to the Rest of the World,’” Breitbart News, April 21, 2017.