(pdf)

Biden administration officials have pledged to pursue a “worker-centric” or “worker-centered” trade policy.[1] The following four policies would allow President Biden to achieve that goal.

Eliminate taxes on imports used by U.S. workers

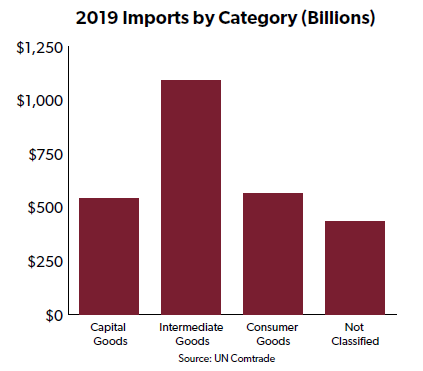

In 2019, 62.1 percent of imports were either intermediate goods like motor vehicle parts or capital goods like machinery that are used by U.S. workers to produce goods.[2] Eliminating taxes on these imports would support American manufacturing jobs, encourage companies to locate in the United States instead of abroad, and boost exports.

For example, in 2019 the United States collected more than $2.1 billion in taxes on imported motor vehicles parts.[3] Eliminating tariffs on motor vehicle parts would make the United States more attractive to car manufacturers looking for the best location to assemble vehicles.

Figure 1: 2019 Imports by Category

Eliminate taxes on imported shoes and clothing worn by U.S. workers

The Biden administration has pointed out that every consumer is also a worker: “The President knows that trade policy should respect the dignity of work and value Americans as workers and wage-earners, not only as consumers.”[4]

The inverse is also true: every worker is a consumer, and in 2019 American workers paid an average 14 percent tax on imported shoes and clothing.[5]

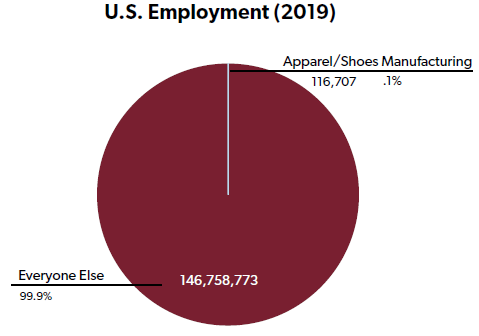

Shoe and clothing tariffs pit a small number of workers who benefit from tariffs against the vast majority of the American workforce. For every worker in the apparel and footwear manufacturing industry, 1,258 Americans working in other industries pay inflated prices for shoes and clothing as a result of double-digit import taxes.[6]

Figure 2: Number of U.S. Jobs

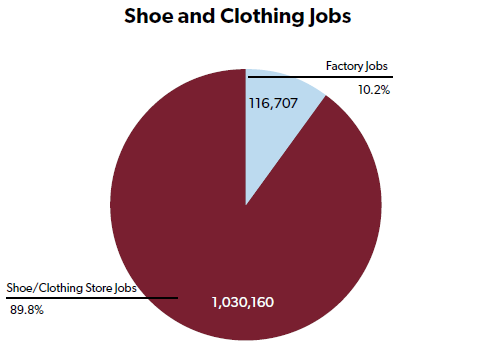

Tariffs pit workers against one another even within the shoe and clothing industry. Jobs in shoe and clothing stores outnumber jobs in shoe and clothing factories by nearly 9-to-1.[7] That doesn’t even count the millions of Americans who sell clothing and shoes at large department stores and sporting good stores.

Figure 3: U.S. Shoe and Clothing Jobs

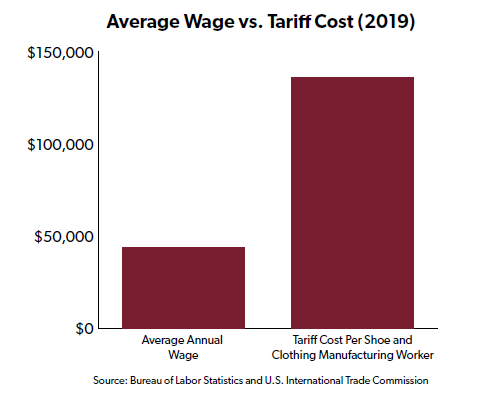

The federal government collected $15.8 billion from taxes on imported shoes and clothing in 2019, the equivalent of $135,776 for every production worker in the apparel and footwear industry. On average, apparel and footwear manufacturing workers earned less than $44,000.[8] Compared to the $15.8 billion cost of tariffs, it would cost taxpayers less to pay every person in the industry three times their current salary.

Figure 4: Average Annual Wage vs. Tariff Cost Per Shoe and Clothing Manufacturing Worker

The shoe and footwear industry includes more than just manufacturing and retail workers. More than 28,000 American fashion designers earned an average of $73,790 in 2019 creating new clothing and footwear. Millions more work in the transportation and logistics industries that help deliver such items to consumers.[9] Eliminating tariffs on shoes and clothing would directly boost employment in these sectors. Nationwide, additional jobs would be created indirectly as the dollars American workers save as a result of lower-cost shoes and clothing were spent on other goods and services or invested in the U.S. economy.

Negotiate job-creating trade agreements

The United States has been falling behind the rest of the world in negotiating trade agreements, and as a result U.S. exporters face higher tariffs than do most of their foreign competitors. As of 2016, U.S. exporters faced an average foreign tariff of 4.9 percent, ranking in the bottom ten of 136 countries ranked by the World Economic Forum.[10]

The United States has failed to implement a single new market-opening trade agreement since 2012. Since our last trade agreement took effect, other countries have signed 70 regional trade agreements, notably including the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP).[11] The Trump administration’s U.S.-Mexico-Canada Agreement (USMCA) is not included, since the North American Free Trade Agreement (NAFTA) had already eliminated most tariffs between the three countries.

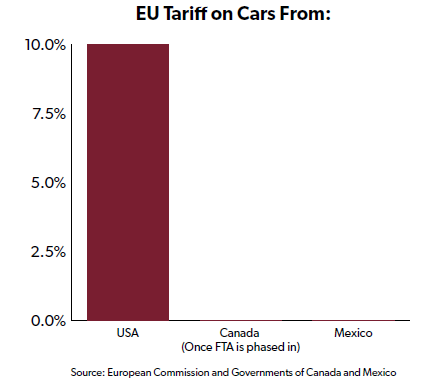

To illustrate why the failure to negotiate new trade agreements has been costly for American workers, consider the automobile industry. Cars exported from the United States to the European Union (EU) face a 10 percent tariff. But because Canada and Mexico have managed to negotiate trade agreements with the EU, cars exported from Canada and Mexico will enter tariff-free once those agreements are fully phased in.[12]

Figure 5: EU Automobile Tariffs

This gives Canada and Mexico a big advantage over the United States in attracting investment from carmakers that want to export to the EU. For example, when BMW announced a new factory in Mexico in 2014, the company said, “The large number of international free trade agreements – within the NAFTA area, with the European Union and the MERCOSUR member states, for example – was a decisive factor in the choice of location.” When Audi chose to locate a new factory in Mexico instead of Tennessee in 2012, the company’s chairman said, “Good infrastructure, competitive cost structures and existing free trade agreements played a significant role in the choice of Mexico.”[13]

If trade negotiators from Canada and Mexico have been able to negotiate tariff-free access to the EU (or close to it), what’s keeping U.S. negotiators from doing the same thing? Unfortunately, the Biden administration has suggested it will put trade negotiations on the back burner. According to Treasury Secretary Janet Yellen, “President Biden has been clear that he will not sign any new free trade agreements before the U.S. makes major investments in American workers and our infrastructure. Our economic recovery at home must be our top priority.”[14]

This is the wrong approach. Negotiating good trade agreements and making economic recovery the top priority is not an either-or proposition. Pursuit of good trade agreements would create good new jobs for American workers and boost the U.S. economy.

Follow a trade policy designed to benefit more than just unionized workers

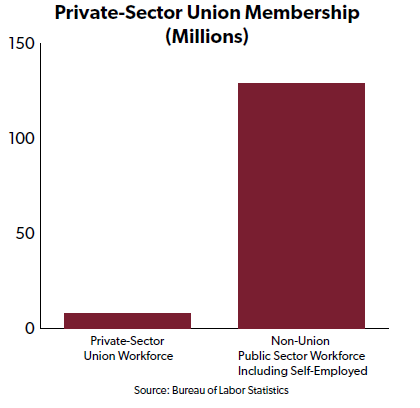

According to the Biden administration, “President Biden’s trade agenda will support all workers.”[15]

That is much better than pursuing a trade agenda that focuses on the 5.5 percent of the private-sector workforce who belong to labor unions without regard to the other 94.5 percent.[16]

Figure 6: Union Membership (Millions)

The goal of trade agreements should be to benefit workers by reducing barriers to international trade and investment, as opposed to imposing new multinational labor regulations or minimum wage provisions.

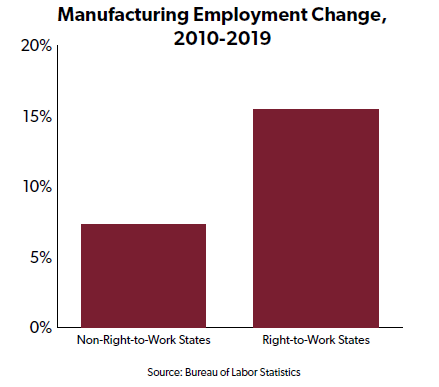

However, if labor provisions are to be included in future trade agreements, the Biden administration should consider guaranteeing every worker’s right to work without joining a labor union. Manufacturing workers in particular could benefit from this labor policy. In recent years, manufacturing employment in states with right-to-work laws has increased more than twice as much as in states that do not have such laws.[17]

Figure 7: Manufacturing Employment Change, 2010-2019

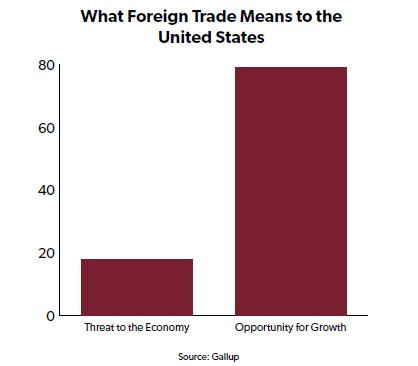

The White House has said that our trade and international economic policies must serve all Americans.[18] If the Biden administration is serious about that, a good start would be for it to listen to Americans, who believe trade is more of an opportunity than a threat by a 4.4-to-1 margin.[19]

Figure 8: What Foreign Trade Means to the United States

According to U.S. Trade Representative Katherine Tai, “i think that for a very long time our trade policies were based on an assumption that the more we traded with each other and the more liberalized our trade, the more peace and prosperity there would be.”[20] For the most part, that’s exactly what happened.

The problem facing American workers is too little trade liberalization, not too much. Workers continue to be harmed by U.S. taxes on imported inputs that they need to do their jobs, by import taxes that increase the cost of their shoes and clothing, and by the government’s failure to implement new market-opening trade agreements. A truly worker-centered trade policy should correct these shortcomings.

[1] Office of the U.S. Trade Representative. (2021). “Fact Sheet: 2021 Trade Agenda and 2020 Annual Report.”(Accessed March 21, 2021) https://ustr.gov/about-us/policy-offices/press-office/fact-sheets/2021/march/fact-sheet-2021-trade-agenda-and-2020-annual-report.

[2] Author’s calculations from United Nations Comtrade database, accessed March 21, 2021, comtrade.un.org/data.

[3] Imports for Consumption, U.S. International Trade Commission, accessed March 21, 2021 dataweb.usitc.gov.

[4] Office of the U.S. Trade Representative. (March 2021.) “2021 Trade Policy Agenda and 2020 Annual Report,” (Accessed March 21, 2021.) https://ustr.gov/sites/default/files/files/reports/2021/2021%20Trade%20Agenda/Online%20PDF%202021%20Trade%20Policy%20Agenda%20and%202020%20Annual%20Report.pdf.

[5] U.S. International Trade Commission. “Imports for Consumption.” Accessed March 21, 2021, dataweb.usitc.gov.

[6] Author’s calculation from “May 2019 National Industry-Specific Occupational Employment and Wage Estimates,” Bureau of Labor Statistics, accessed March 21, 2021, https://www.bls.gov/data/#employment.

[7] Author’s calculation from “May 2019 National Industry-Specific Occupational Employment and Wage Estimates,” Bureau of Labor Statistics, accessed March 21, 2021, https://www.bls.gov/data/#employment.

[8] Author’s calculation from “May 2019 National Industry-Specific Occupational Employment and Wage Estimates,” Bureau of Labor Statistics, accessed March 21, 2012, https://www.bls.gov/data/#employment.

[9] Bureau of Labor Statistics. (2019.) “May 2019 National Industry-Specific Occupational Employment and Wage Estimates,” (Accessed March 21, 2021.) https://www.bls.gov/data/#employment.

[10] World Economic Forum. (2016.) “The Global Enabling Trade Report.” Retrieved from: https://reports.weforum.org/global-enabling-trade-report-2016/enabling-trade-rankings/#series=TARIFACED.

[11] World Trade Organization. “Regional Trade Agreements Database”. (Accessed March 21, 2021.) https://rtais.wto.org/UI/PublicMaintainRTAHome.aspx. Note: Recent UK trade agreements are not included in this count.

[12] Government of Canada. (2021.) “Opportunities and Benefits of CETA for Canada’s Automotive Exporters,” (Accessed March 21, 2021.) https://www.international.gc.ca/trade-commerce/trade-agreements-accords-commerciaux/agr-acc/ceta-aecg/business-entreprise/sectors-secteurs/auto.aspx?lang=eng; and the Government of Mexico (2021). “The Automobile Sector in Mexico,” (Accessed March 21, 2021). https://www.economia-snci.gob.mx/sic_php/pages/bruselas/pdfs/FS02AUT.pdf.

[13] Thomson, Adam, and Reed, John. “Audi to open Mexico production plant.” Financial Times, April 8, 2012. https://www.ft.com/content/ab3abae8-8987-11e1-85b6-00144feab49a.

[14] Shalal, Andrea, and Lawder, David. “Domestic investment needed before new trade deals: U.S. Treasury pick Yellen.” Reuters, January 21, 2021. https://www.reuters.com/article/us-usa-biden-yellen-trade/domestic-investment-needed-before-new-trade-deals-u-s-treasury-pick-yellen-idUSKBN29Q2RZ.

[15] Office of the U.S. Trade Representative. (2021.) “Fact Sheet: 2021 Trade Agenda and 2020 Annual Report,” Accessed March 21, 2021. https://ustr.gov/about-us/policy-offices/press-office/fact-sheets/2021/march/fact-sheet-2021-trade-agenda-and-2020-annual-report.

[16] Author’s calculation based on “Union affiliation of employed wage and salary workers by occupation and industry,” Bureau of Labor Statistics, accessed March 21, 2021, https://www.bls.gov/news.release/union2.t03.htm, and “Labor Force Statistics from the Current Population Survey,” Bureau of Labor Statistics, accessed March 21, 2021, https://www.bls.gov/webapps/legacy/cpsatab9.htm. Private-sector workforce includes self-employed Americans.

[17] Author’s calculation from “Employment by State,” Bureau of Economic Analysis, accessed March 21, 2021, https://www.bea.gov/data/employment/employment-by-state.

[18] The White House. (2021). “Interim National Security Strategic Guidance,” (Accessed March 21, 2021.) https://www.whitehouse.gov/wp-content/uploads/2021/03/NSC-1v2.pdf

[19] Saad, Lydia. “Americans' Vanishing Fear of Foreign Trade.” Gallup, February 26, 2020. https://news.gallup.com/poll/286730/americans-vanishing-fear-foreign-trade.aspx.

[20] “Senate Finance Committee Hearing on Nomination of Katherine Tai to be U.S. Trade Representative,” YouTube, February 25, 2021, accessed March 22, 2021, https://www.youtube.com/watch?v=Rm3QlkYL9Es.