(pdf)

The final Economic Report of the President from President Trump's Council of Economic Advisers shows that the administration never learned from its costly trade policy mistakes.[1] Specifically, the report:

- Fails to accurately describe how trade agreements work

- Misstates academic findings on the impact of U.S.-China trade

- Endorses trade policies that harm American consumers

Failure to accurately assess the impact of trade agreements

The report’s chapter on trade policy begins: “...the Trump Administration inherited a legacy of asymmetric trading arrangements that had imposed steep costs on U.S. manufacturing and segments of the labor market.”

In fact, U.S. trade agreements are generally symmetric and fair. They embody the very “free, fair, and reciprocal” goals the Trump administration claimed to be pursuing.

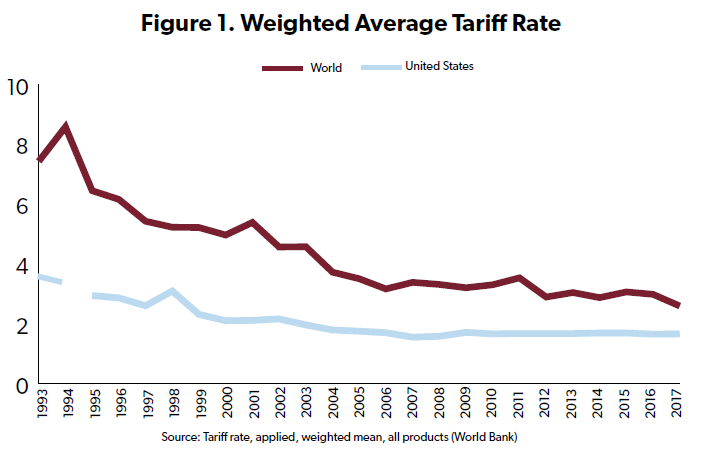

With a handful of exceptions on both sides, all U.S. trade agreements required each trading partner to treat foreign and imported goods equally. In addition to being free, fair, and reciprocal, most trade agreements negotiated prior to President Trump successfully reduced foreign tariffs by more than U.S. tariffs.[2] That’s part of the reason that while U.S. tariffs have declined, foreign tariffs have declined by even more.

The Economic Report adds, "...unfair trading arrangements...have harmed, in particular, U.S. manufacturing and manufacturing employment." In fact, real manufacturing output increased by more than 50 percent from 1997 to 2019 as U.S. and global trade barriers fell.[3] Manufacturing employment fell because manufacturing workers became more productive,[4] and manufacturing job losses were typically not due to layoffs but instead resulted from workers finding better jobs.[5]

According to the Economic Report, "...the benefits of the global trading system have at times come at the cost of America's own national interest."

That is backwards. President Ronald Reagan was closer to the truth when he said "[t]he expansion of the international economy is not a foreign invasion; it is an American triumph, one we worked hard to achieve, and something central to our vision of a peaceful and prosperous world of freedom.”

Trade has promoted economic prosperity for American workers and families while encouraging a more peaceful and freer world.

Misstates academic research on U.S.-China trade

The Economic Report blames trade with China for a broad range of eye-popping maladies including drug overdoses, suicides, liver disease, and even a reduction in young males’ marriage prospects.

While China has committed innumerable bad deeds for which it richly deserves scorn, the mere fact of American trade with Chinese entities is not to blame for every domestic malady. None of the studies cited in the report actually find that imports from China had any of these effects on the country as a whole. (Abraham and Kearney 2020, Autor, Dorn, and Hanson 2019; Case and Deaton 2017; Pierce and Schott 2020). What they found is that trade with China caused job losses in import-sensitive sectors, which led to a variety of negative outcomes in those sectors.

This isn’t a surprising result if only looking at industries harmed by imports from China. But the big picture, including sectors of the economy that benefited from trade with China, shows a different story.

For example, during the “China shock” era of 1999 to 2011, the United States exported nearly $800 billion worth of goods to China, while China’s holdings of U.S. treasury securities increased by more than $1.3 trillion. None of the studies cited by the Economic Report attempt to account for any economic benefit resulting from these transactions.

According to a 2009 analysis, purchases of government bonds by China and other countries reduced the 10-year U.S. Treasury yield by 80 basis points.[6] The impact was described as “economically large and statistically significant.” Cato Institute Senior Fellow Scott Lincicome lists several other studies showing that trade with China generated over $202 billion in consumer benefits via lower prices, significantly reduced inflation, and “generated overall gains in social welfare.”[7] Moreover, during the China shock era, U.S. manufacturing output, real wages, and U.S. employment all increased.

With respect to the U.S.-China “Phase One” agreement negotiated by the Trump administration, the Economic Report says, “Chapters 1 and 2 of the Phase One Agreement address U.S. concerns relating to intellectual property theft and forced foreign technology transfer and should help create a fair market and protect U.S. companies operating in China [emphasis added].” If successful, this obviously would encourage more companies to produce in China instead of in the United States or elsewhere.

China is a significant problem on the world stage, but that’s largely a result of their domestic repression and foreign policy aggression.

Costly Auto Policies

The Economic Report notes that the U.S.-Mexico-Canada Agreement (USMCA) increases the regional value requirements for automobiles from 62.5 percent to 75 percent. This is a downgrade from the North American Free Trade Agreement (NAFTA), and it will increase the cost of making cars in the United States relative to Asia or Europe by increasing the cost of components.

According to the Congressional Budget Office (CBO), in some cases carmakers will find it cheaper to pay the general tariff rate of 2.5 percent on cars imported from Canada and Mexico rather than comply with the new North American content rules. CBO estimates this will cost $3 billion in tariffs over the next decade.[8]

The Economic Report also points out that the United States will maintain its 25 percent tariffs on Korean trucks through 2041. This tariff is a costly exception to the U.S.-Korea Free Trade Agreement’s general elimination of U.S.-Korea trade barriers. The 25 percent tariff on trucks was supposed to be a “temporary” measure aimed at European imports that took effect in 1964, not a 77-year tariff affecting Korea and other trading partners.[9]

It is interesting that the Economic Report doesn’t contain a single reference to “national security” tariffs imposed on steel and aluminum under Section 232 of the Trade Act of 1962. These tariffs, undertaken by the Trump Administration, have harmed American industries across the country that rely on steel and aluminum, including automobile manufacturing. In 2018, Section 232 tariffs slashed the profit-sharing check for each of Ford’s United Autoworkers employees by $750 on average.[10]

Fortunately, none of these perspectives are set in stone. President Biden and his successors should use the Trump administration’s efforts as a valuable lesson on what not to do with respect to trade policy.[11]

[1] “Economic Report of the President,” accessed March 4, 2021, https%3A%2F%2Fwww.govinfo.gov%2Fapp%2Fcollection%2Ferp%2F2021.

[2] Riley, Bryan, “Trump Is Still Wrong About ‘Disastrous’ Trade Deals,” National Taxpayers Union, accessed March 4, 2021, https://www.ntu.org/foundation/detail/trump-is-still-wrong-about-disastrous-trade-deals.

[3] Bureau of Economic Analysis, “GDP by Industry,” accessed March https://apps.bea.gov/iTable/index_industry_gdpIndy.cfm.

[4] Hicks, Michael, “Commentaries - Weekly Commentary with Michael Hicks,” accessed March 4, 2021, https://commentaries.cberdata.org/1026/automation-risk-trade-risk-and-public-policy.

[5] Bryan Riley, “U.S. Manufacturing Layoffs Declined After China Joined the WTO,” National Taxpayers Union Foundation, accessed March 4, 2021, https://www.ntu.org/foundation/detail/us-manufacturing-layoffs-declined-after-china-joined-the-wto.

[6] Warnock, Francis E., and Warnock, Veronica Cacdac, “International Capital Flows and U.S. Interest Rates,” Journal of International Money and Finance 28, no. 6 (October 1, 2009): 903–19, https://doi.org/10.1016/j.jimonfin.2009.03.002.

[7] Lincicome, Scott, “Testing the ‘China Shock’: Was Normalizing Trade with China a Mistake?,” Cato Institute, July 8, 2020, https://www.cato.org/policy-analysis/testing-china-shock-was-normalizing-trade-china-mistake.

[8] Lawder, David and Shepardson, David, “Automakers to Pay $3 Billion in New U.S. Tariffs under USMCA: Budget Estimate,” Reuters, accessed March 4, 2021, https://www.reuters.com/article/us-usa-trade-usmca-autos-idUSKBN1YM294.

[9] “Proclamation 3564—Proclamation Increasing Rates of Duty on Specified Articles | The American Presidency Project,” accessed March 4, 2021, https://www.presidency.ucsb.edu/documents/proclamation-3564-proclamation-increasing-rates-duty-specified-articles.

[10] Howard, Phoebe Wall, “Trump Tariffs Cut Each Ford UAW Worker’s Profit-Sharing Check by $750,” Detroit Free Press, accessed March 4, 2021, https://www.freep.com/story/money/cars/2019/01/24/trump-tariffs-ford-uaw-profit-sharing/2663063002/.

[11] “The Trump/Lighthizer Legacy on Trade,” International Economic Law and Policy Blog, accessed March 4, 2021, https://ielp.worldtradelaw.net/2021/01/the-trumplighthizer-legacy-on-trade.html.