(pdf)

Introduction

Over time, navigating through harbors and waterways tend to become increasingly difficult due to the natural accumulation of sediment and earth washed up from the ocean over time. This process is an ongoing, natural phenomenon exacerbated by the increased usage of shipping lanes by large cargo vessels. The vessels enter the port from the ocean, bringing with them large displacements of water leading to accumulation of sediment in the base of the harbor. As ships exit from ports, the earth and sand moved by the displacement of water remain, building up sediment into large embankments that make navigating harbors and waterways increasingly difficult.

Harbors, shipyards, and other critical commercial waterways must be regularly dredged to mitigate the steady accumulation of silt. This dredging process is time-consuming and expensive, but without it, many waterways and harbors will become unusable, with costly implications for trade, supply chains, and economic growth. Continued failure to address the building problem of restricted waterways will drive up costs for businesses and consumers, harming economic growth. New vigor must be applied to dredging policy, while outdated laws and restrictions should be reexamined to enable renewal and growth for America’s harbors, ports, and riverways.

Slowly Stockpiling Sediment

The United States Army Corps of Engineers (USACE) takes the lead on dredging efforts throughout the ports and waterways administered by the federal government, maintaining waterways and ports throughout the United States.

Despite the general trend of higher annual spending on dredging, by some measurements efficiency and productivity have lagged expenditures. There remains relatively little political action around the issue of dredging as it doesn’t occupy the top of Congress’s list of priorities. But those immediately impacted by the continued accumulation of sediment within American waterways have long been petitioning their representatives as well as the Army Corps of Engineers for relief. The latter entity has been active in attempting to develop responses for this creeping problem, all while addressing critical issues with the cost of dredging in the United States.

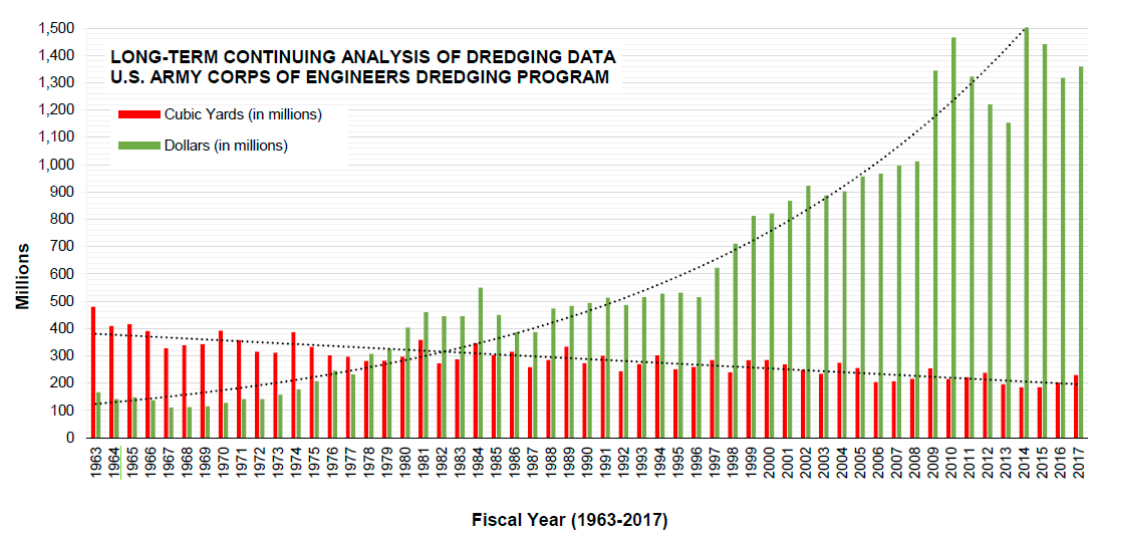

But this price tag continues to increase the longer the waterways remain un-dredged. Currently, USACE-led contracts move between 200 and 300 million cubic yards of sediment each year, and as such require a substantial amount of manpower and financial resources.[1] USACE has developed the Dredging Operations Technical Support Program (DOTS) to create accurate cost estimates, provide logistical support, offer resources relating to navigation within America’s waterways, and ensure safe and environmentally conscious dredging activities within the United States. The longer dredging is not updated or improved with technology, the greater costs will be over time. The below chart illustrates the problem the United States will encounter in the long run.

The above table was published by USACE in a 2018 release.

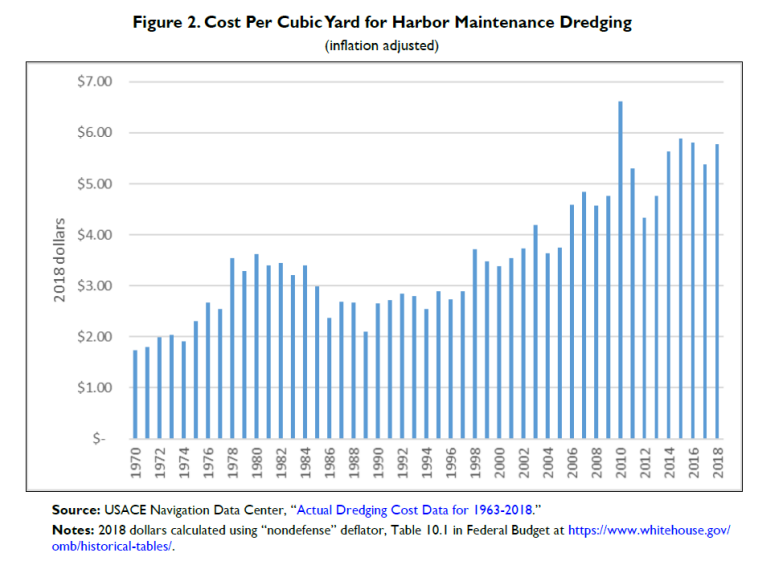

As evidenced from the above graph, since the early 1980s the efficiency of dredging has continued to fall. The number of cubic yards removed has decreased, while the cost to move each cubic yard has continued to rise year-over-year. Meanwhile, a study comparing international dredging costs, found that there have been massive expansions of dredging work in the Middle East, Asia, and Africa, without the huge increases in cost per cubic yard seen in the U.S.[2] Instead these newly-built or renovated fleets have allowed for consistent and efficient dredging projects at reduced cost to foreign governments.

Not all experience abroad can be directly translated to dredging challenges here at home. For example, the study conducted to aid Louisiana’s Office of Coastal Protection and Restoration noted that marsh depths in some areas of the state cannot support some of the deeper-draft, large capacity dredges that have been employed in foreign countries.

Nonetheless, increasing costs could have a wider impact on the economy given the critical importance of waterways and harbors to trade and commerce. A U.S. Department of Agriculture report on the value of inland waterways to the agricultural industry notes that over the next 25 years, clear and open rivers and canals will contribute $51.8 billion to GDP. Without sufficient investment, that figure falls to $44.4 billion in 2045.[3]

Global Innovation and Domestic Stagnation

The development of new dredging technologies has been slow in the United States while China has improved by leaps and bounds in order to fuel its aggressive stance in the South China Sea. It is no secret that the Chinese government has been aggregating sand dredged up from the seabed in order to create artificial islands where coral reefs had previously been. This has allowed the expansion of China’s territorial waters into what were previously neutral international waters, much to the chagrin of the U.S. and many other East and Southeast Asian states.

The Asia Maritime Transparency Initiative has worked to track the development of new land masses in the South China Sea, much of which has been made possible by China’s fleet of dredging vessels.[4] Currently, the U.S. operates four dredging ships. The Chinese have built more than 200 such vessels.[5] While this advancement is notable, much of it has been fueled by the Chinese government ignoring environmental concerns and commandeering resources from the private sector at will, allowing cheaper and faster production.

In contrast to China’s dredging activities, the United States relies on the stability of critical sandbars and islands to maintain shipping lanes. Of primary importance in this arena is a collapsed sandbar south of the Port of New Orleans destroyed by Hurricane Katrina over a decade ago. The state of Louisiana will invest $50 billion over the next 50 years into rebuilding and maintaining sand structures along the southern banks of Louisiana, but at a much less efficient rate than other coastal communities around the globe.[6]

The Dutch government spends a substantial amount of resources maintaining coastlines throughout the Netherlands, ensuring large stretches of land are not awash with seawater. This initiative requires the movement of over 28 million cubic yards of sand by the Dutch government at a price tag of $55 million (USD).[7] In contrast, Louisiana’s coastal investment projects required the movement of slightly less material (24.6 million cubic yards of sand for projects reaching completion in 2018), but for a much higher cost totaling $334 million. Despite moving 4 million fewer cubic yards, the Louisiana project will cost nearly $280 million more than the work done by the Dutch government. As Congress evaluates America’s dredging challenges, it should explore appropriate policy responses that can address this disparity.

These international examples serve to illustrate the United States must catch up to the developed world in domestic dredging capacity if it wishes to source dredging projects domestically. If foreign firms are allowed to compete in certain elements of the U.S. market at a larger scale while carefully managing any national security concerns, taxpayers stand to save millions while averting the economic decay from diminished capacity at America’s harbors and ports.

Impacts Beyond Industry

The Mississippi River is of critical importance to the U.S., with an estimated $ 735.7 billion annual impact on the nation’s economy that supports approximately 2.4 million jobs.[8] Without proper access to the Gulf of Mexico, the economy of the American South and heartland could face severe contractions, beyond those already experienced from the global and national economic contraction due to the COVID-19 outbreak.

A coalition report argues that six dredging platforms are necessary to perform basic tasks to keep the Mississippi open and flowing, yet the Trump administration’s budget has set out funds to cover the cost of only five dredging platforms.[9] This insufficient capacity endangers those operating within the large inland waterways and in doing so endangers the economic capacity of the channel. In FY 2016, there were channel restrictions due to insufficient dredging on the Mississippi River for a total of 182 days, with a minimum estimated economic loss of $96,410,932.[10]

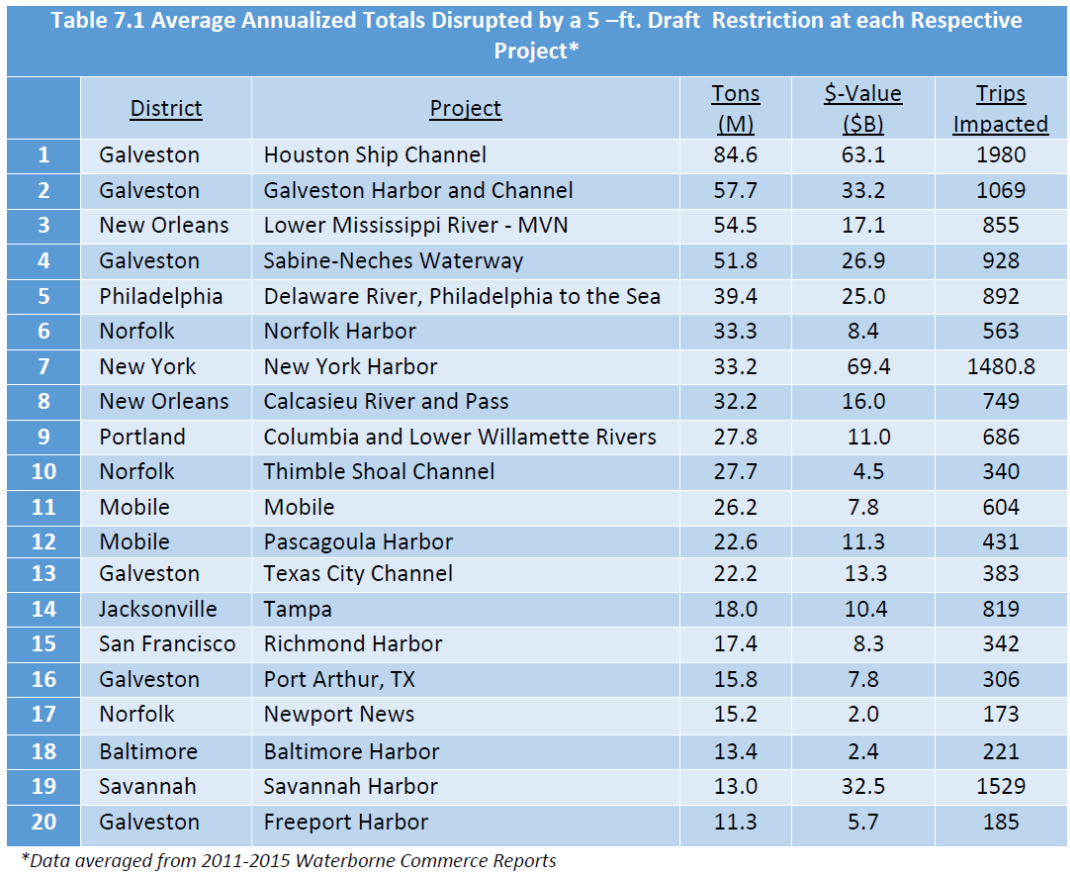

This table from the USACE Hopper Dredge Recapitalization Analysis illustrates the tremendous economic impact from restrictions created by insufficient dredge work for these critical waterways throughout the United States.[11] Millions of tons of goods totaling $376.1 billion in value are slowed or delayed due to insufficient infrastructure to mitigate the natural and expected accumulation of channel obstructing sediment.

Jones Act Protectionism Increases U.S. Costs

One contribution to this increase in cost are laws requiring U.S. dredging projects to be performed exclusively by U.S.-built heavy-lift ships to transport dredging equipment.[12] The Jones Act, a 1920 law that prohibits the use of non-U.S. vessels for shipping between U.S. ports, continues to erect protectionist barriers around the United States in the name of national security, driving up costs for transportation, labor, and innovation.[13] The century-old law should be reevaluated to determine whether it continues to serve American interests properly, as many experts argue it has harmed the American maritime industry it was intended to protect while increasing the cost to taxpayers thanks to a lack of competition in the marketplace.[14]

Interacting with the Jones Act is the Dredging Act of 1906 which requires that vessels engaged in dredging in U.S. waters be U.S. built, operated, and crewed. In 1988 the Jones Act was expanded by Congress to define dredged material (sand, silt, and mud) as “Merchandise”, forcing all vessels that transport dredge products to meet Jones Act requirements. This presents yet another compounding barrier to innovation and development in the dredging industry.

Thanks in part to policies that have impeded competition and innovation (including others described below), a large disparity has opened between the United States and European dredging programs. When comparing U.S. dredging capacity to the four largest European dredging firms, the U.S. fleet is substantially older.

According to the Congressional Research Service (CRS), the fleet of hopper ships used most often for harbor dredging is aging and losing efficiency with each passing year. Eleven of the 15 hopper ships have been in service for more than 20 years. The US Army Corps of Engineers has sometimes been forced to use its small and inefficient fleet to keep up with requests for dredging, positing a greater expansion of U.S. dredging capacity is needed to keep up with demand.[15]

The U.S. fleet also tends to be smaller than those in Europe. As noted by Dutch, Belgian and other European dredging companies’ comments on a White House Office of Management and Budget notice regarding maritime competition, each of the four European dredging firms have a fleet triple or quadruple the size of the U.S. fleet.[16]

Standing restrictions on the level of international competition for dredging certainly contribute to the overall increase in cost for dredging projects in the United States. Yet, “competition” can be affected by many factors, not just one law. For their part, U.S. dredging firms have disputed several points raised in the CRS report, particularly regarding the condition of domestic fleets and the impact of Jones Act restrictions. Yet, despite controversy over these particulars, other government burdens on the private sector seem to have contributed toward limiting the expansion described above, and would likely be acknowledged by all stakeholders.

For example, the burden of environmental regulations, cost of materials, movement and disposal of dredged material, and labor overhead all steadily drive up the cost of dredging. Furthermore, U.S. dredging companies, like many other firms across the economy that make major capital investments, have been hampered by uncompetitive tax policy at the federal level. This inhospitable climate changed for the better with the Tax Cuts and Jobs Act, which not only lowered business tax rates to levels more in line with those of U.S. trading partners, but also largely replaced complex asset depreciation with full and immediate expensing. The goal ahead is to ensure that the expensing provision is made permanent.[17]

Harbor Funding

A sizable portion of dredging operations are financed through the Harbor Maintenance Trust Fund (HMTF). For several years, lawmakers have sought to massively increase spending through the HMTF. One proposal, blocked in 2016, would have made spending from the Fund mandatory, or direct, spending.[18] This would mean less congressional oversight through the regular appropriation process. More recently, lawmakers have pushed a bill to create a loophole that would exempt the HMTF from discretionary spending limits. This would increase outlays by billions over the decade.

As noted above, taxpayers are not getting an ideal return on dredging investments. Rather than dramatically increasing HMTF spending, lawmakers should examine the current allocations to ensure that taxpayer funds are being spent and distributed fairly and efficiently. The distribution of these dollars to support dredging efforts has not always followed the highest traffic ports. Taxpayers for Common Sense points out that despite only performing 8 percent more harbor traffic than Rhode Island ports, North Carolina’s harbors have received 20 times the funding.[19]

As shipping traffic increases in the ports of Long Beach and Los Angeles, Congress should make certain to oversee proper distribution of funds to economically critical ports. Despite generating a large portion of the total input to the HMTF, the ports of Long Beach and Los Angeles receive less than a penny of funding for each dollar they put in. In an era of ballooning deficits and rapid spending with little in the way of cost offsetting, Congress should look to make certain existing and future investments are made with financially prudent policy.[20]

Lawmakers Should Boost Competition in U.S. Dredging

There remains a tremendous need for progress, both public and private, in the U.S. dredging sector. The accumulation of sediment throughout U.S. waterways and harbors is an expected and predictable yearly occurrence, yet each year billions of dollars of goods are impacted by needless delays in shipping due to insufficient dredging infrastructure. Companies from beyond the United States have long petitioned to provide dredging services in the United States, at cost-saving rates that could reduce the burden on U.S. taxpayers. At the same time, U.S. companies remain disadvantaged by numerous government restrictions on how they conduct their operations. It remains a testament to these companies’ resilience that any of them are able to engage in dredging projects abroad.[21] But this testament is also an indication that additional pro-market reforms would enable firms based in the U.S. to become far more competitive with foreign-owned concerns. Regardless if European companies are allowed to begin dredging operations in the United States, public and private dredging fleets in the United States should prioritize developing new and innovative solutions to the dredging problems facing our waterways and harbors. Thousands of jobs and billions of dollars of trade are on the line, and the U.S. dredging fleet can, with proper government policy, answer the call.

Innovation and competition should be encouraged in all sectors of the economy, particularly in the maintenance of our waterways and harbors that provide avenues of trade for small businesses, multinational corporations, and consumers alike. This public-private space deserves the attention of Congress and the White House, making certain to prioritize lighter touch tax and regulatory policies where prudent. Some have suggested, for example, that policymakers examine whether there are opportunities for allowing certain U.S. ports to be transitioned to private ownership. Combined with other prudent regulatory and tax changes, this approach could, in some cases, help to move dredging projects of the greatest commercial promise to a higher priority level. Permit-process reforms of the National Environmental Policy Act could also be helpful.[22]

Conclusion

America’s waterways and harbors have served as lifegiving arteries for the free flow of commerce, people, and ideas throughout the history of our country. Reforms to enhance innovation and competition in the dredging industry would spur efficiencies to drive down the costs involved in keeping waterways open for commerce. This, in turn, will promote the continued growth of trade and the economy, while reducing costs for taxpayers.

[1] Environmental Protection Agency & U.S. Army Corps of Engineers. (2007). “Identifying, Planning, and Financing Beneficial Use Projects Using Dredged Material.” Retrieved from: https://www.epa.gov/sites/production/files/2015-08/documents/identifying_planning_and_financing_beneficial_use_projects.pdf.

[2] Cohen, Brianne et al. “Proceedings, WEDA XXXI Technical Conference and TAMU 42 Dredging Seminar, 2011,” Environmental Protection Agency & U.S. Army Corps of Engineers. Retrieved from: https://www.westerndredging.org/phocadownload/ConferencePresentations/2011_Nashville/Session2B-DredgingCaseStudies/2%20-%20CohenEscudeGarbaciakHassanLawtonSimoneausSpadaroNewman%20-%20Efficiency%20Cost%20Inland%20Marsh%20Restore.pdf#page=3.

[3] Agribusiness Consulting. (2019). “Importance of Inland Waterways to U.S. Agriculture.” https://www.ams.usda.gov/sites/default/files/media/ImportanceofInlandWaterwaystoUSAgricultureFullReport.pdf.

[4] Center for Strategic and International Studies. Asian Maritime Transparency Initiative: Occupation and Island Building. Accessed August 19, 2020 at https://amti.csis.org/island-tracker/.

[5] Beiser, Vince, “Aboard the Giant Sand-Sucking Ships That China Uses to Reshape the World,” MIT Technology Review, December 19, 2018. https://pulitzercenter.org/reporting/aboard-giant-sand-sucking-ships-china-uses-reshape-world.

[6] Snadowsky, Leslie T. “50 Billion Reasons To Attend ‘Restoration On The Half Shell.” Biz New Orleans, May 31, 2018. https://www.bizneworleans.com/50-billion-reasons-to-attend-restoration-on-the-half-shell/.

[7] Baurick, Tristan. “Water Ways: How the Dutch Are Building Coastal Protection for Less — with Nature’s Help.” Times-Picayune and Advocate, March 6, 2020. https://www.nola.com/news/environment/water_ways/article_0a50735a-5e56-11ea-a7ee-eb8087416f63.html.

[8] Duffy, Sean M. Sr. “Letter to Mr. Thomas Smith Chief, Operations and Regulatory Division Directorate of Civil Works: National Dredging and Industry Corps Hopper Dredge Management Group (ICHDMG) Meeting Notes 61319.” Big River Coalition, June 28, 2019. Retrieved from: https://online.louisianamaritime.org/Files/publicFileStore/bigriver/National%20Dredging%20Meetings%20Response%2062819[5].pdf.

[9] U.S. Army Corps of Engineers. (2017). “Hopper Dredge Recapitalization Analysis.” https://bayplanningcoalition.org/wp-content/uploads/2018/07/HDRecapFinal.pdf.

[10] Ibid.

[11] Ibid.

[12] Fritelli, John. “Shipping Under the Jones Act: Legislative and Regulatory Background.” Congressional Research Service, November 21, 2019. Retrieved from: https://fas.org/sgp/crs/misc/R45725.pdf.

[13] 46 U.S.C. §§ 861-889 (1958). https://www.loc.gov/item/uscode1958-009046024/.

[14] Grabow, Colin. “Rust Buckets: How the Jones Act Undermines U.S. Shipbuilding and National Security.” CATO Institute, November 12, 2019. https://www.cato.org/publications/policy-analysis/rust-buckets-how-jones-act-undermines-us-shipbuilding-national.

[15] U.S. Army Corps of Engineers. (2017). “Hopper Dredge Recapitalization Analysis.” https://bayplanningcoalition.org/wp-content/uploads/2018/07/HDRecapFinal.pdf.

[16] American Association of Footwear and Apparel et al. “Public Submission: Comment on FR Doc # 2018-10539, Comment ID OMB-2018-0002-0113.” September 4, 2018. Accessed on August 19, 2020 at https://beta.regulations.gov/document/OMB-2018-0002-0113; and

Office of Information and Regulatory Affairs, Office of Management and Budget. (2018). “Maritime Regulatory Reform A Notice by the Management and Budget Office on May 17, 2018.” Retrieved from: https://www.federalregister.gov/documents/2018/05/17/2018-10539/maritime-regulatory-reform.

[17] Wilford, Andrew. “Don’t Let Full Expensing Become Another Tax Extender.” National Taxpayers Union Foundation, February 27, 2020. Retrieved from: https://www.ntu.org/foundation/detail/dont-let-full-expensing-become-another-tax-extender.

[18] Swift, Nan. “House Water Resources Bill Lacks Critical Reforms.” National Taxpayers Union, September 28, 2016. Retrieved from: https://www.ntu.org/publications/detail/house-water-resources-bill-lacks-critical-reforms.

[19] Taxpayers for Common Sense. (2012). “The Harbor Maintenance Trust Fund Fact Sheet.” Retrieved from: https://www.taxpayer.net/wp-content/uploads/ported/images/downloads/HMTF%20-%20TCS%20-%20FINAL%202012-01-18.pdf.

[20] Brady, Demian. “CBO's Most Recent Cost Estimates Highlight Congress's Big Spending Agenda.” National Taxpayers Union Foundation, July 2, 2020. Retrieved from: https://www.ntu.org/foundation/detail/cbos-most-recent-cost-estimates-highlight-congresss-big-spending-agenda.

[21] Great Lakes Dredge & Dock Company, LLC. (2019). “International Projects.” Retrieved from: https://www.gldd.com/gldd-international-projects/.

[22] U.S. Senator Ted Cruz. “Press Release: Sens. Cruz, Cotton, Lankford Introduce Reforms to NEPA to Roll Back Burdensome Regulations, Cut Red Tape.” June 10, 2020. Retrieved from: https://www.cruz.senate.gov/?p=press_release&id=5167.