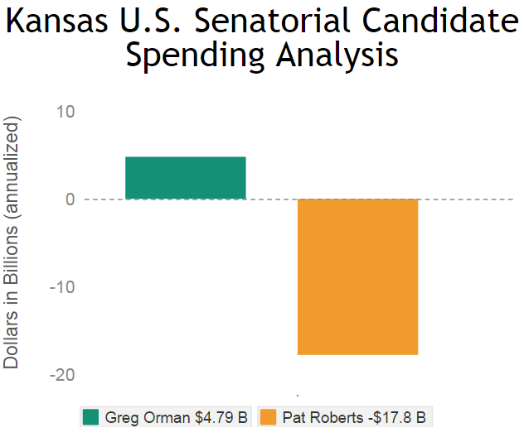

With Election Day on the horizon, National Taxpayers Union Foundation (NTUF) has released another special candidate spending analysis covering the Kansas Senate race. The campaigns of businessman Greg Orman and incumbent Senator Pat Roberts represents a $23 billion difference in proposed spending. Over the course of the past year, the two have made many speeches and appearances but neither has presented taxpayers with many budgetary details behind the measures they might support if elected as one of Kansas’ Senators in the 114th Congress.

The lack of fiscal transparency has marked many other races across the country. Candidates need to offer citizens more insights regarding their planned fiscal agendas, not only to ensure a more well- informed electorate but also to better show where their policies might take the nation’s budget. To help taxpayers in Kansas more fully understand their options, NTUF offers new details into the budgetary aims of Greg Orman and Pat Roberts.

How did NTU Foundation determine the candidates’ agendas? We have been scoring political agendas, including Presidential primaries and general elections, Senatorial races, and special House campaigns, for over ten years. Recording direct quotes from debates, interviews, and the candidates’ own websites, researchers match proposals with introduced legislation, cost estimates from third-party sources (like the Congressional Budget Office), and budgetary documents.

Below are the top- and bottom-line findings of our special Kansas Senate election coverage.

Businessman Greg Orman (I)

NTUF found that Greg Orman directly supports 25 policies that could change current spending. Four items would increase spending and the remaining 21 proposals had uncertain budgetary impacts. Since he is not a current Member of Congress, we compared his quotes and campaign materials to relevant legislation already before Congress as well as budgetary data. Taking Orman’s four scorable proposals into account, NTUF determined that his platform would increase spending by a net $4.8 billion each year.

Largest Increase: Border Security. On multiple occasions, Orman has said that improving the security of the southern border is the first step in immigration reform. He would seek to continue the buildup of Border Patrol agents and to further fund infrastructure development associated with those agents and monitoring the border. NTUF matched his statements with provisions of a bill that passed the Senate last year in which double the number of agents would be employed and additional administrative spending would be authorized. In the first five years, spending would increase by $3.7 billion per year.

Largest Unknown: Reducing Improper Social Security Payments. Citing the pending insolvency of the Social Security Disability Program, Orman would seek to cut down on improper payments within the Social Security system. This is a point made in many campaigns but its costs are hardly ever addressed. When considering efforts by the government to cut down on waste, fraud, and abuse, there are not only potential savings from correcting the program at hand (in this case, Social Security) but costs as well. Currently, many agencies have dedicated funding and programs to weed out ill-spent tax dollars and going further would likely require more funding for Inspectors General offices and government watchdogs like the Government Accountability Office.

As NTUF notes in our analysis, a bill that was signed into law in 2013 would formalize some efforts already in effect to identify, prevent, and recover spending errors. Since it was simply codifying ongoing activities, CBO scored the bill as having no significant budgetary effects. Another bill would require more coordination between federal benefits programs on data related to deceased beneficiaries, who sometimes continue to receive payments. This bill would also not likely affect spending in a significant way.

It is unclear which, if any, of these actions Orman would advocate for if elected to the Senate. For context, NTUF highlighted the issue of Social Security system abuse in a recent issue of The Taxpayer’s Tab. According to the Congressional Research Service, the government made at least $108 billion in improper payments in FY 2012.

Senator Pat Roberts (R)

On the other side of the debate, NTUF found 15 fiscal policies that are directly supported by the incumbent, Senator Roberts. Three would increase spending, three would decrease outlays, and nine were not quantifiable. Though at least one of his measures could cut the budget, none of them could be matched with bills that he has sponsored and cosponsored. On net, spending would decrease by $17.8 billion each year if Sen. Roberts’ scorable proposals were enacted.

Largest Increase: Exempt Military Spending from the Sequester. The Senator said that exempting the military from the across-the-board budget cuts, known as sequestration, would be the best way to support national defense. This action would require additional spending for the Department of Defense in the amount of $52.1 billion for each of the next five years. Sequestration was adopted after the so-called “Supper Committee” failed to agree on $1.5 trillion in cuts to the deficit over ten years. As a result, $1.2 trillion in automatic sequestration cuts came into effect. These cuts are more or less split evenly between defense and domestic discretionary programs. The sequester will continue as long as the President and Congress exceed the original 2011 budget caps.

Largest Decrease: Repeal the Affordable Care Act. Sen. Roberts has said that he is “fighting to repeal Obamacare,” which NTUF scored in 2012 as a $36.9 billion annual spending cut. As opposed to how CBO scored similar repeal measures, NTUF tracked only the changes in spending outlays and did not account for gains or losses in revenues (this is one of the primary features of BillTally). As implementation continues, it is likely that a full repeal would result in additional reductions.

Largest Unknown: Dedicate New Funds to the Highway Trust Fund. The Fund is the primary mechanism for financing surface transportation projects. It receives tax dollars from gasoline and vehicle sales and is used to maintain the nation’s highways, bridges, and tunnels. Yet, as cars become more fuel-efficient, less revenue has been available to finance those projects. Since 2008, Congress has transferred $54 billion from the general fund to cover shortfalls. Federal legislators are currently considering how to keep the Fund afloat but no agreements have been reached.

If Senator Roberts would offer specific ideas to fix the Highway Trust Fund’s money problems, taxpayers would better understand his fiscal intentions. Some have called for increasing the gas tax and dedicating a greater amount of the repatriation tax (when corporate money is brought into the country, the government takes a percentage), while others see dedicating royalties from oil exploration and production as a means to at least partially fill the budget gaps, which are projected to total $167 billion over the next ten years.

Agreement

The two frontrunners have proposed similar policies, at least in principle, that they would support in the 114th Congress, including:

- Cutting Regulations: Both have cited how regulations are hurting economic recovery and job growth. Roberts has identified red tape as a mounting problem whereas Orman has said that a ten-year review process is in order. Both of their quotes were too broad to match with legislation but two bills, the REINS Act and the Regulatory Sunset and Review Act, would attempt to address the issue.

- Support Energy: To a vague degree, Orman and Roberts have said that promoting both traditional and renewable energy sources will be a priority. There are a variety of Republican and Democratic proposals to support the many sectors within the energy industry and, as a result, NTUF could not identify a cost associated with their quotes.

- Tax Simplification: The candidates both wish to see a simpler Tax Code. Orman proposes to reform within the current system and to reduce overall rates, including adjusting corporate taxes. Roberts would seek to enact the Fair Tax Act, which would replace the current system with a national consumption tax on all new goods and services. Though NTUF could not determine what spending changes would result from Orman’s platform, we did find that Roberts’ proposal would cut spending by $19.3 billion annually.

- Border Security: Both would seek to better secure the border. To see exactly how they would do that, check out their reports.

- Military Spending: Orman and Roberts would attempt to address defense spending cuts made through sequestration. Roberts said that he would outright exempt the military from the cuts (read: Largest Increase) whereas Orman has said that he would broadly address the issue, to which NTUF could not assign an impact.

For taxpayers, particularly in the Sunflower State, the race between Orman and Roberts reflects other campaigns. They have provided some concrete details as to exactly how they would change federal spending and, by effect, your economic freedom. However, both candidates need to do a better job of offering specific information concerning their proposals. Taking all of the budget-influencing items into account, 75 percent of all proposals in the Kansas Senate race could not be quantified with existing budget data, third-party estimates, or the campaign’s own provided materials. This matters a great deal because no matter who is elected to represent Kansas in the 114th Congress, they will have a direct say in how the entire country’s budget is decided. The best thing that Orman and Roberts can do in the waning days of Election 2014 is to tell Kansans their top-line budget targets and the major proposals that they would use to reach those goals. The time of keeping citizens in the dark about spending plans is over. It’s time for some real answers.

Check out Greg Orman’s and Pat Roberts’ line-by-line reports.